The Advantages of a Horizontal Merger

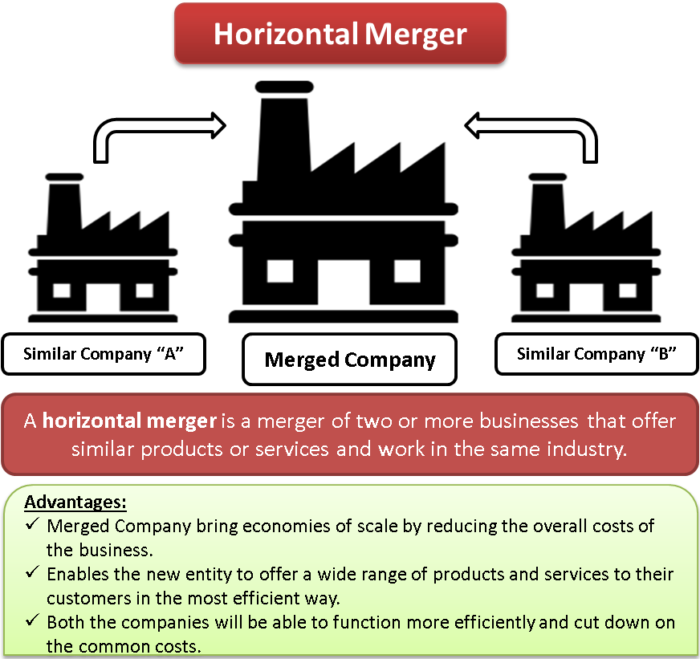

- Economies of Scope. Economies of scope refer to the merged company's potential to cross-promote products or bundle...

- Dominating the Market. Although criticized for being monopolistic, horizontal mergers can help companies corner a...

- Increased Investment. The greater a company's profits become from reduced overhead and...

- Increase market share and reduce competition in the industry.

- Further utilize economies of scale (thus reducing costs)

- Increase diversification.

- Reshape the company's competitive scope by reducing intense rivalry.

- Realize economies of scope.

- Share complementary skills and resources.

What are advantages and disadvantages of horizontal merger?

Disadvantages of Horizontal Merger

- Creation of Monopoly. The biggest disadvantage of this type of merger is that it increases the chances of the merged company having monopoly powers due to the sheer big size ...

- Difficulty in Integration. ...

- Lack of Diversification. ...

Are vertical mergers healthy for consumers?

Vertical integration might improve care coordination, but it could also reduce provider competition and drive up out-of-pocket costs for consumers ... Cost of Care Model, health systems are ...

What is a horizontal merger and a vertical merger?

Horizontal merger: A merger between companies that are in direct competition with each other in terms of product lines and markets; Vertical merger: A merger between companies that are along the same supply chain (e.g., a retail company in the auto parts industry merges with a company that supplies raw materials for auto parts.)

What are the subtle benefits of a merger?

Why do Mergers Happen?

- After the merger, companies will secure more resources and the scale of operations will increase.

- Companies may undergo a merger to benefit their shareholders. ...

- Companies may agree for a merger to enter new markets or diversify their offering of products and services Products and Services A product is a tangible item that is put ...

What is an advantage of a horizontal merger?

The advantages include increasing market share, reducing competition, and creating economies of scale. Disadvantages include regulatory scrutiny, less flexibility, and the potential to destroy value rather than create it.

What are the benefits of a vertical merger?

Benefits of a Vertical Merger Vertical mergers are helpful because they can help improve operational efficiency, increase revenue, and reduce production costs. Synergies can be created with vertical mergers since the combined entity typically has a higher value than the two individual companies.

How do companies benefit from horizontal and vertical mergers?

Key Takeaways Horizontal integrations help companies expand in size, diversify product offerings, reduce competition, and expand into new markets. Vertical integrations can help boost profit and allow companies more immediate access to consumers.

What is horizontal mergers?

A Horizontal merger is a merger between firms that produce and sell the same products, i.e., between competing firms.

What is horizontal merger examples?

A merger between Coca-Cola and the Pepsi beverage division, for example, would be horizontal in nature. The goal of a horizontal merger is to create a new, larger organization with more market share.

How did horizontal integration help businesses?

Key Takeaways. Horizontal integration is a business strategy in which one company acquires or merges with another that operates at the same level in an industry. Horizontal integrations help companies grow in size and revenue, expand into new markets, diversify product offerings, and reduce competition.

Which of the following is most likely to be an advantage of horizontal integration?

An advantage of horizontal integration is that by staying in one industry, a firm can focus its resources and capabilities on competing successfully in just one area.

Are horizontal and vertical mergers good?

Unlike horizontal mergers, vertical mergers never involve one business directly acquiring its competition. However, just like horizontal mergers, vertical mergers can result in anti-trust problems in the marketplace.

What are the advantages of horizontal integration?

Here are a few other advantages of horizontal integration: 1 Reducing competition 2 Increasing other synergies such as marketing 3 Creating economies of scale and economies of scope 4 Reducing other production costs

What are the benefits of merging two companies?

The most obvious benefit is an increased market share or market power. When the two companies merge, they also combine the product base, technology, and services that are available on the market. With more products under one name, the new company can increase its foothold among consumers.

Why is horizontal integration important?

When undergoing a horizontal integration, however, it is important to look out for the disadvantages, such as increased regulatory scrutiny, failure to combine synergies, and destroying value, which would make the entire process worthless and costly.

What are the disadvantages of horizontal merger?

The biggest disadvantage of this type of merger is that it increases the chances of merged company having monopoly powers due to sheer big size of merged company and we all know that a company having monopoly powers will tend to exploit customers by charging higher price than normal from its customers ...

What are the disadvantages of merging two companies?

Another disadvantage of this type of merger is that it is difficult to integrate the culture, employee behavior and other such things of two companies which are merged and if company is unable to achieve the integration then the whole idea of merging two businesses will go out of window and it will result in failure of the merged entity.

What is horizontal line?

When you study mathematics you come across the concept of horizontal line, it refers to joining two points and making a straight line.

What are the consequences of horizontal mergers?

Bureaucratic controls: There may be legal repercussions if the horizontal merger creates a company that may be considered a monopoly.

What is horizontal merger?

A horizontal merger occurs when companies operating in the same or similar industry combine together. The purpose of a horizontal merger is to more efficiently utilize economies of scale. Economies of Scale Economies of scale refer to the cost advantage experienced by a firm when it increases its level of output.The advantage arises due to the.

What is a statutory merger?

Statutory Merger In a statutory merger between two companies (where company A merges with company B), one of the two companies will continue to survive after the transaction has completed. This is a common form of combination in the mergers and acquisitions process. How to Build A Merger Model.

What is the difference between horizontal and vertical merger?

Though one is often confused with the other, there is a distinct difference between the two types of mergers. Horizontal merger: When companies that sell similar products merge together. Vertical merger: Occurs between companies at different stages in the production process (between companies where one buys or sells something from or to ...

Why do companies merge horizontally?

Reasons for a Horizontal Merger. When companies undergo a horizontal merger, the underlying principle is to create value. A successful merger should create value in which combining the companies would be worth more than if each company were under independent ownership. In a horizontal merger, 1 + 1 (referring to two independent companies) ...

How much did HP merge with HP?

The merger created a US$87 billion global technology leader offering the most comprehensive set of IT products and services for businesses and consumers. The new HP became the top global player in IT services, imaging and printers, and access devices.

Horizontal Merger

Horizontal merger happens when two companies essentially involve in the same service or product merge to enhance their combined value. In this case, a company decides to integrate or take over another company at the same production stage or in the same industry for instance the merger of Mobil and Exxon or the acquisition of Pixar by Disney.

Benefits of Horizontal Merger

There are various benefits associated with horizontal integration.

How does a horizontal merger help a company?

A horizontal merger can help a company gain competitive advantages. For example, if one company sells products similar to the other, the combined sales of a horizontal merger will give the new company a greater share of the market. If one company manufactures products complementary to the other, the newly merged company may offer a wider range ...

What is horizontal merger?

A horizontal merger is when companies of the same industry merge. Horizontal mergers often result in a way to eliminate competition by creating one powerful company instead of two competitors. Horizontal mergers can greatly increase revenues, as the combined companies have access to a greater variety of products or services.

How does a vertical merger help?

A vertical merger can help secure access to important supplies and reduce overall costs by eliminating the need for finding suppliers, negotiating deals and paying full market prices. A vertical merger can improve efficiency by synchronizing production and supply between the two companies and assuring the availability of needed items.

How does a horizontal merger increase revenue?

A horizontal merger can increase a company’s revenue by offering an additional range of products to existing customers. The business may be able to sell to different geographical territories if one of the pre-merger companies has distribution facilities or customers in areas not covered by the other company.

What is the purpose of vertical merger?

The main objective of a vertical merger is to improve a company’s efficiency or reducing costs. A vertical merger occurs when two companies previously selling to or buying from each other combine under one ownership. The businesses are typically at different stages of production.

Why do vertical mergers occur?

This type of merger occurs frequently because of larger companies attempting to create more efficient economies of scale. Conversely, a vertical merger takes place when firms from different parts of the supply chain consolidate to make the production process more efficient or cost-effective. 1:06.

What are the advantages of horizontal mergers?

They include, but are not limited to: Bulk discounts from suppliers. Lower manufacturing costs per unit. Improved access to human capital. Improved access to financial capital (lower cost of capital, etc.)

What is horizontal merger?

In simple terms, a horizontal merger is when two companies in the same industry (meaning they sell similar products/services in the market) come together. The larger thinking behind this type of merger is that the companies together are worth more than they are separate; some practitioners like to express this added value by saying in these cases 1 ...

Why are horizontal mergers closely watched?

Horizontal mergers are closely watched by the Government in order to avoid oligopoly (where the market is highly concentrated and dominated by a few - not to be confused with a monopoly).

What is vertical merger?

While a horizontal merger occurs when two companies in the same industry come together, a vertical merger occurs when companies that provide different supply chain functions/products/services combine. Oftentimes, the goals behind this type of vertical merger are to capture synergies and improve productivity by creating a business ...

What are the different types of mergers?

There are multiple types of mergers including horizontal, vertical, conglomerate, and concentric. Here we deep dive into horizontal mergers - one of the most popular, yet often scrutinized, types - from what they are, why they are beneficial, and which companies have utilized them. So, let's start with definition and meaning.

Why did HP merge with Compaq?

HP & Compaq -This horizontal merger allowed HP to better fight off the heavy competition in its industry. More specifically, thanks to the combining of resources and information, the newly formed company believed it would be better able to innovate and face the ever-changing demands of its industry.

Do horizontal mergers happen at the top?

Horizontal mergers don’t just happen at the top end of the market: The best way for many smaller players in any industry to scale up is through horizontal mergers with companies that you’re competing with on a regular basis.

What does horizontal integration mean?

Horizontal integration is a process where one company takes over, acquires, or merges with some other company in the same value chain.

What are the different benefits of horizontal integration?

The laws of different countries and governments are different. For a business looking to enter international waters, it would take a lot of resources and time to start their businesses from scratch.

What are some of the horizontal integration disadvantages?

Generally, acquisition and merger tend to eliminate competition from the market that leads to one player dominating it. The concept in itself goes against the idea of a free market. This is one of the primary reasons why horizontal integration teends to attract givernment laws, regulations, and scrutiny.

Real-world horizontal integration examples

The social media giant merged its business with Instagram in 2012 for a whopping $1 billion. Since both the companies were in social media division, Facebook saw the acquisition as the perfect strategy to increase its dominance in the market.

Reasons For A Horizontal Merger

- When companies undergo a horizontal merger, the underlying principle is to create value. A successful merger should create value in which combining the companies would be worth more than if each company were under independent ownership. In a horizontal merger, 1 + 1 (referring to two independent companies) should be greater than 2 (the merged compa...

Problems in Achieving Merger Success

- Although there are many benefits to a horizontal merger, they may not be fully realized and the merger may not actually create added value. Merging companies face problems such as: 1. Integration difficulties:Merging two different corporate cultures can be difficult. 2. Difficulty in building a working relationship:Due to differing management styles, it may be difficult to build a …

Horizontal Merger vs. Vertical Merger

- Though one is often confused with the other, there is a distinct difference between the two types of mergers. 1. Horizontal merger: When companies that sell similar products merge together. 2. Vertical merger:Occurs between companies at different stages in the production process (between companies where one buys or sells something from or to the company). The diagram …

Example of A Horizontal Merger

- Consider a famous horizontal merger: HP (Hewlett-Packard)and Compaq in 2011. The structure was a stock-for-stock merger with an exchange ratio of 0.63 HP share per Compaq share, valued at approximately US$25 billion. The new company would be held 64% by HP and 36% by Compaq shareholders. The rationale behind the horizontal merger of HP and Compaq was based on the f…

Other Resources

- Learn more about mergers and acquisitions by seeing the following CFI resources: 1. Statutory Merger 2. How to Build A Merger Model 3. M&A Considerations and Implications 4. Monopoly