4 Advantages of Term Life Insurance

- Less expensive. On average, life insurance rates are more affordable for term than whole life insurance because term policies offer coverage for a predetermined time.

- More flexible. You have many options when choosing how long your term life insurance should last. ...

- Good for young families. ...

- Simplicity. ...

Why buying term life insurance may be beneficial?

One reason to buy term life insurance is because the premiums tend to be less expensive than permanent/whole life insurance and so, they are more affordable. Also, term life insurance is a good option if you believe you only need protection for a specific amount of time.

What are the advantages of term insurance?

What Advantages Does Your Term Insurance Policy Have Over Other Types of Insurance?

- Overview of Term Insurance. Term insurance is insurance for a fixed tenure that assures guaranteed benefits on the policyholder’s death.

- Features of Term Insurance. The functioning of term insurance is almost identical to the functioning of any different kind of insurance.

- Advantages of term insurance over other types of insurance. ...

- Summing Up. ...

- FAQ's. ...

Why buy term life?

With the reinsurers forcing the primary life insurers to put their skin in the game, the latter have turned cautious while accepting lives for insurance under their term policies. The waiting period will be counted from the date on which the prospective ...

What are the advantages of life insurance?

“There are really only two reasons to have life insurance: One is to create an estate, and the second is to conserve the estate you’ve created,” says Mr. Diamond, a certified financial planner and author of Retirement for the Record. With permanent life insurance, people pay a premium and the benefit is paid to beneficiaries when they pass away.

What are some advantages of term life insurance?

Less expensive. On average, life insurance rates are more affordable for term than whole life insurance because term policies offer coverage for a predetermined time. ... More flexible. You have many options when choosing how long your term life insurance should last. ... Good for young families. ... Simplicity.

What happens to a term life insurance policy at the end of the term?

Generally, when term life insurance expires, the policy simply expires, and no action needs to be taken by the policyholder. A notice is sent by the insurance carrier that the policy is no longer in effect, the policyholder stops paying the premiums, and there is no longer any potential death benefit.

Is a term life insurance policy worth anything?

Term life is typically less expensive than a permanent whole life policy – but unlike permanent life insurance, term policies have no cash value, no payout after the term expires, and no value other than a death benefit.

What is the biggest disadvantage of term life insurance?

One of the major disadvantages of term insurance is that your premiums will increase as you get older. When you buy term life in your 20s or 30s, it will be much cheaper compared to when you need to renew your policy later on in your 50s or 60s.

At what age should you stop term life insurance?

Most life insurance policies have an upper age limit for applications. Many insurers stop taking life insurance applications from shoppers who are over 75 or 80, while some have much lower age limits and a few have higher limits.

Can you cash out term life insurance?

Term life is designed to cover you for a specified period (say 10, 15 or 20 years) and then end. Because the number of years it covers are limited, it generally costs less than whole life policies. But term life policies typically don't build cash value. So, you can't cash out term life insurance.

Which is better term life or whole life insurance?

Term coverage only protects you for a limited number of years, while whole life provides lifelong protection—if you can keep up with the premium payments. Whole life premiums can cost five to 15 times more than term policies with the same death benefit, so they may not be an option for budget-conscious consumers.

What are the pros and cons of term life insurance?

Term Life Pros & ConsProsConsBeneficiaries will receive larger death payoutsMust re-qualify at the end of the termCan be converted to whole life insuranceDifficult to qualify if there is a significant health issue–Premiums can go up every time you take out a new term–Policy accumulates no cash value1 more row

What is the cash value of a $25000 life insurance policy?

Upon the death of the policyholder, the insurance company pays the full death benefit of $25,000. Money collected into the cash value is now the property of the insurer. Because the cash value is $5,000, the real liability cost to the insurance company is $20,000 ($25,000 – $5,000).

Is it worth getting life insurance at 60?

If you are over 60, you may want life insurance to cover the income you would have contributed to your family, to pay-off remaining mortgage payments, to help towards care costs or any other costs of living when you're no longer around. That's not the only reason people opt for this type of insurance though.

Is life insurance worth it after 50?

At age 50 or older, term life will generally be the most affordable option for getting the death benefit needed to help ensure your family is provided for. 2. Coverage for final expenses. These policies are designed specifically to cover funeral and death-related costs, but nothing more.

Why life insurance is a waste of money?

Basic life insurance policies are designed to provide replacement funds that can approximately match what the policy owner was making or a percentage of it. A life insurance policy on someone with no earnings or someone with no dependent beneficiaries can be a waste of money.

What are the benefits of term life insurance?

Although the death benefit of a term life insurance policy can be used any way the beneficiary chooses, the funds are commonly used for: 1 Funeral and Burial Expenses 2 Loss of Income 3 Medical Bills 4 College Loans 5 Mortgages 6 Rent 7 Business Expenses 8 Others

What is the death benefit of a term life insurance policy?

Although the death benefit of a term life insurance policy can be used any way the beneficiary chooses, the funds are commonly used for: 3. Flexibility . Term life policies enable you to choose how long you want your policy to last.

Why is term life insurance more affordable than permanent life insurance?

1. Cost. Term life insurance is typically more affordable than permanent life insurance because it only provides protection for a set amount of time. Policy premiums are determined by your insurance carrier. Factors include age, health, occupation and others.

What factors determine the eligibility for term life insurance?

Factors include age, health, occupation and others. Traditional term life insurance policies usually require a medical exam and a health questionnaire to determine eligibility. In general, a healthy, non-smoking person in their 20s will pay much less than a 60 year-old smoker, for example. 2. Versatility.

How to speak to a licensed life insurance agent?

A licensed life insurance agent can help you better understand life insurance. Speak with a licensed agent at 1-855-303-4640. ----------.

What is term insurance?

Term Insurance. Term Insurance Benefits. Term insurance plans secure your family’s financial future even when you are not around. These plans are considered by many as one of the basic financial necessities of life, especially in today’s times. Term insurance plans also have multiple features and benefits, right from affordable premiums ...

How long does it take to die from a life assured?

2 A Life Assured shall be regarded as Terminally Ill only if that Life Assured is diagnosed as suffering from a condition which, in the opinion of two independent medical practitioners’ specializing in treatment of such illness, is highly likely to lead to death within 6 months.

What is Critical Illness Coverage 1?

Critical Illness Coverage - In case optional Critical Illness Coverage 1 is included in your term insurance plan, you will get a lump-sum payout upon diagnosis of any critical illness 1 that is covered in the plan. Accidental Death Benefit - You can add the Accidental Death Benefit benefit 3 to your term insurance plan.

What happens if a CI benefit is equal to a death benefit?

If CI Benefit paid is equal to the Death Benefit, the policy will terminate on payment of the CI Benefit. To know more in detail about CI Benefit, terms & conditions governing it, kindly refer to sales brochure.

Can you add Accidental Death Benefit 3 to your term insurance?

Accidental Death Benefit - You can add the Accidental Death Benefit benefit 3 to your term insurance plan. This will offer protection against any mishaps in the future. Coverage for Terminal Illnesses - Term insurance plans can give you lump-sum payouts in case of diagnosis of terminal illnesses 2 such as AIDS.

Is ADB available in Life Plus?

ADB is available in Life Plus and All in One options. In case of death due to an accident Accidental Death Benefit will be paid out in addition to Death Benefit. Accidental Death Benefit will be equal to the policy term or (80-Age at entry), whichever is lower.

What are the advantages of term life insurance?

Advantages of Term Life Insurance. Term insurance allows a person to acquire the greatest death benefit for the lowest premium outlay when the policy is first issued. However, this does not mean that term insurance is necessarily the least expensive form of insurance over the full duration of needed coverage.

Why is term insurance the best alternative for temporary life insurance needs?

Because term premiums increase at each renewal, at the later ages the premium cost will far exceed the level premium that would have been charged for an ordinary whole life policy issued at the same age as the original term policy. Term insurance is the best alternative for temporary life insurance needs.

How long does cash value life insurance last?

Conversely, some form of cash value life insurance will generally be the best alternative if protection must continue for 15 or more years . If the duration of the needed protection is between 10 and 15 years, the best alternative depends upon the facts and circumstances of the case. As a general rule of thumb, term insurance will tend ...

Can life insurance be used as collateral?

Life insurance policies can be used as collateral or security for personal loans . Although lenders generally prefer permanent types of policies because of the cash values, a term policy is often sufficient if the borrower is a good credit risk and the loan is very likely to be repaid unless he or she dies.

Can you use life insurance as collateral for a loan?

See also: The 10 best & worst states to pay taxes. Policies Can Be Used as Collateral for Loans: Life insurance policies can be used as collateral or security for personal loans.

Can term insurance be combined with permanent insurance?

Various types of term insurance — level, decreasing, and increasing — can be combined as riders with other types of permanent insurance to create a package that meets a person’s special death protection, savings, and affordability needs. See also: How more regulation can help the insurance industry.

Is term insurance better than cash value?

As a general rule of thumb, term insurance will tend to be better than cash value insurance at issue ages below age 45, and worse at older issue ages if the length of the need for protection is between 10 and 15 years. See also: Planning for the modern family: 3 life insurance scenarios. Younger Clients May Acquire More Coverage at Lower Immediate ...

What is term life insurance?

Term life insurance, also known as pure life insurance, is a type of life insurance that guarantees payment of a stated death benefit if the covered person dies during a specified term. Once the term expires, the policyholder can either renew it for another term, convert the policy to permanent coverage, or allow the term life insurance policy ...

How long does term life insurance last?

Term life insurance occurs over a predetermined period of time, typically between 10 and 30 years. Term policies may be renewed after they end, with premiums recalculated according to the holder’s age, life expectancy, and health. By contrast, whole life insurance covers the entire life of the holder.

What happens to George's life insurance policy?

Thirty-year-old George wants to protect his family in the unlikely event of his early death. He buys a $500,000 10-year term life insurance policy with a premium of $50 per month. If George dies within the 10-year term, the policy will pay George’s beneficiary $500,000. If he dies after he turns 40, when the policy has expired, his beneficiary will receive no benefit. If he renews the policy, the premiums will be higher than with his initial policy because they will be based on his age of 40 instead of 30.

What happens to your insurance if you die?

If you die during the term of the policy, the insurer will pay the face value of the policy to your beneficiaries.

Why do term life insurance policies expire?

Because most term life insurance policies expire before paying a death benefit, the overall risk to the insurer is lower than that of a permanent life policy. The reduced risk allows insurers to pass cost savings to the customers in the form of lowering premiums.

What is the insurance company's policy based on?

When you buy a term life insurance policy, the insurance company determines the premiums based on the value of the policy (the payout amount) as well as your age, gender, and health. In some cases, a medical exam may be required. The insurance company may also inquire about your driving record, current medications, smoking status, occupation, ...

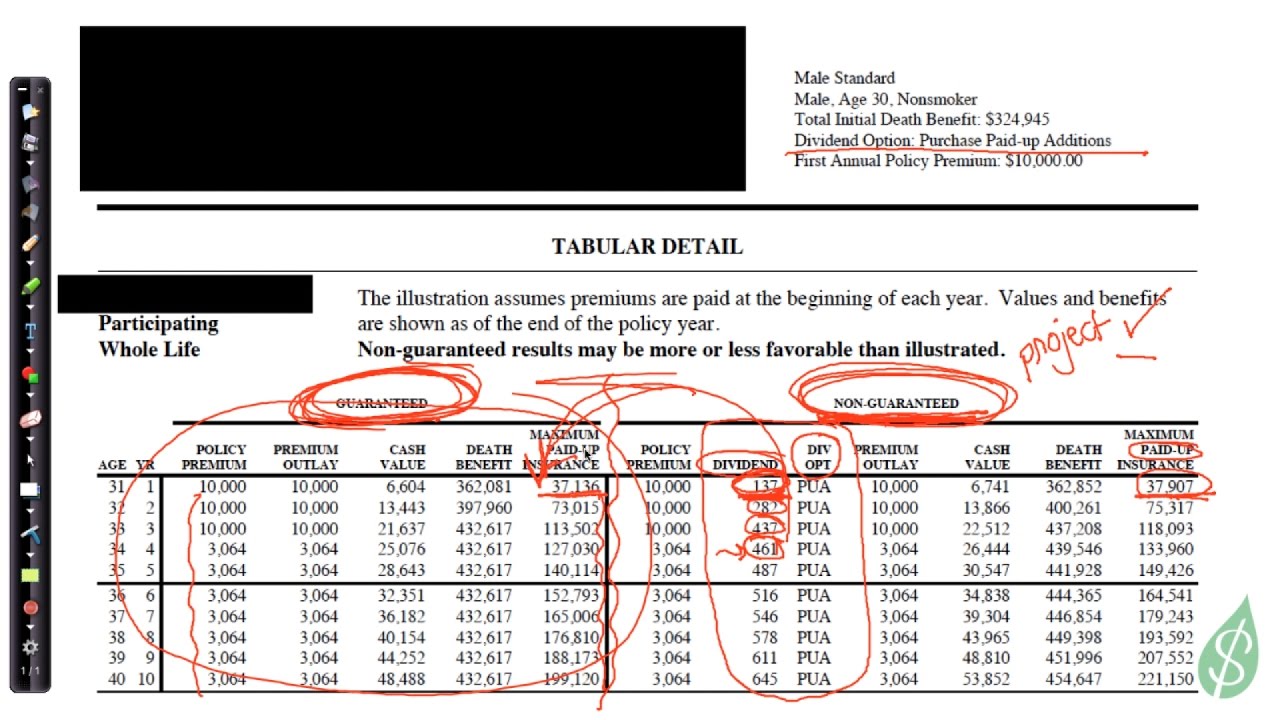

Why do people prefer permanent life insurance?

Some customers prefer permanent life insurance because the policies can have an investment or savings vehicle. A portion of each premium payment is allocated to the cash value, which may have a growth guarantee. Some plans pay dividends, which can be paid out or kept on deposit within the policy. Over time, the cash value growth may be sufficient to pay the premiums on the policy. There are also several unique tax benefits, such as tax-deferred cash value growth and tax-free access to the cash portion.

Can you get term insurance at 65?

In many cases, Term insurance is not available for people over the age of 65. However, in certain cases and with certain policies, it can be converted to a Whole Life policy without “evidence of insurability” (a medical exam). This would allow you to retain coverage even if your term policy were to expire. However, even when a Term policy can be converted to a Permanent one, there may be a cut-off age when it can no longer be converted. If you're interested in converting an existing Term policy, it's best to speak with a professional Life Insurance agent about your situation.

Is term life insurance more expensive than permanent life insurance?

For the most part, Term policies are less expensive than Permanent or Whole Life Insurance. The premiums are generally fixed and don't change over the course of the policy. However, the premium can vary from person to person, and depends on a number of factors, including your age, health, and lifestyle. For example: An older person who smokes will generally pay higher premiums than an older person who doesn't.

What is a Term Life Insurance Plan?

A term plan is a life insurance product covering the policyholder's lifetime risk for a fixed period against a fixed premium. In an unfortunate incident resulting in the policyholder's demise during the policy term, the nominee is paid the death sum assured benefit.

Why choose a Term Life Insurance Plan?

The policyholder must explore all the design contours even after grasping the answer to what is term life insurance plan is to make an informed choice. It is pertinent to point out that Indian life insurers offer several term plans in different flavors to suit individual preferences.

Term Insurance Plan - Benefits Explained

The substantially high sum assured offered by a term insurance plan compared to other life insurance products attracts more customers. The term plan is straightforward in paying death benefits on the policyholder’s demise during policy tenure at an affordable premium.

Bottom Line

Term plans have emerged as a life insurance necessity for securing the dependent family’s financial future when the policyholder is not around due to tragic events. High sum assured for a low premium makes the policy a popular financial instrument.

What is term life insurance?

Term life insurance covers you for a set amount of time, or term. It provides funds to your beneficiary (or beneficiaries) if you pass away during that time. Living benefit options for term life include: Accelerated death benefits. This living benefit pays out a portion of your term life policy if you ever face a terminal illness.

What is the benefit of adding a long term care policy to your life insurance?

Long-term care benefits. Adding a long-term care benefit to your permanent life policy lets you tap into the death benefit to cover long-term care expenses that your health insurance doesn’t cover . The death benefit is typically reduced by the amount of the long-term benefit that you use.

What is a surrender policy?

Policy surrender. A policy surrender is when you cancel your permanent life policy to access the cash value portion as a one-time lump sum. The insurer will give you that amount, less any outstanding loans and/or unpaid premiums. Long-term care benefits. Adding a long-term care benefit to your permanent life policy lets you tap into ...

How long does a disability waiver last?

Disability waiver of premium. This living benefit lets you skip your premium payments in the event you suffer from a long-term disability for six months or more.

How long can you be out of work with a disability?

While not a true cash benefit, it nonetheless is a valuable option to have since there’s a three in 10 chance you’ll face a disability that keeps you out of work for 90 days or longer at some point during your working career.

Do you owe taxes on a permanent life policy?

A withdrawal lets you access a portion of the cash value of your permanent life policy. You won’t owe any taxes on this withdrawal if the amount you withdraw is less than or equal to your premium payments. However, you will owe taxes if any portion of the amount you withdraw is from interest, dividends or capital gains.

Can you take out a loan against a permanent life policy?

Policy loan. You’ll be charged interest if you take out a loan against your permanent life policy, but it’s usually lower than the interest charged by other lenders. You also won’t have to undergo a credit check or abide by a long list of restrictions. Policy surrender.