Advantages of a Testamentary Trust

- Flexibility. One of the big advantages of using a testamentary trust is the flexibility that you will have regarding the trustee.

- Taxation. With the testamentary trust, you will also be able to take advantage of certain tax benefits. ...

- Protection from Creditors. Another advantage of a testamentary trust is that you can protect your money from creditors. ...

- Taking Care of a Beneficiary. This type of trust structure also provides a great way for you to take care of beneficiaries. ...

What is a testamentary trust and should I have one?

What is a Testamentary Trust and should I have one Incorporating a Testamentary Trust within your will can provide significant flexibility along with asset protection and tax minimisation for those who benefit from your estate What is a Testamentary Trust? It is a Trust established under a will but it does not come into effect until after the death of the person making the will.

Should you consider a testamentary trust?

You should consider whether the income generated by your estate will be sufficient to warrant a testamentary trust. If, for example, all your assets are owned jointly with another person or by a family trust, there may be insufficient assets in your estate to make the establishment of a testamentary trust worthwhile.

What is a testamentary trust and how are they used?

The trust is created after the will goes through probate. Like all trusts, a testamentary trust allows the creator to stipulate how the assets contained in the trust will be disbursed. People often use testamentary trusts if they want to be able to specify when they leave their assets to a beneficiary.

When is a testamentary trust the best option?

The only time a testamentary trust may have an advantage over a living trust is if someone involved in the estate is prone to taking legal action, in which case court management may be preferable. [

What are the disadvantages of a testamentary trust?

Some possible disadvantages are: There is no actual benefit for you, the will maker, although there may be benefits for your beneficiaries. Cost – testamentary trusts are often more complex, they generally cost more to produce and they generally involve ongoing accountancy and other fees during their operation.

Do testamentary trusts pay taxes?

Testamentary Trusts are taxed as a whole, though beneficiaries will not be forced to pay taxes on distributions from the Trust. Note that you could be responsible for the capital gains tax, depending on your state.

What are the disadvantages of a trust?

What are the Disadvantages of a Trust?Costs. When a decedent passes with only a will in place, the decedent's estate is subject to probate. ... Record Keeping. It is essential to maintain detailed records of property transferred into and out of a trust. ... No Protection from Creditors.

Is a testamentary trust an inheritance?

Generally, testamentary trusts are created for young children, relatives with disabilities, or others who may inherit a large sum of money that enters the estate upon the testator's death.

What does it cost to set up a testamentary trust?

The average cost for a basic will these days varies from $200 to $500. For a full testamentary trust depending on complexities and number of devises and gifts and trust instructions the costs could be from $1,200 to $4,300.

When would a testamentary trust be used?

According to Marie-Ève Ferland, a financial planner at National Bank, a testamentary trust is particularly useful in two situations: when the beneficiaries are bad at managing money or they have debts. In such instances, a trust will ensure healthier inheritance management.

What are the 3 types of trust?

To help you get started on understanding the options available, here's an overview the three primary classes of trusts.Revocable Trusts.Irrevocable Trusts.Testamentary Trusts.More items...•

What is better a will or a trust?

For example, a Trust can be used to avoid probate and reduce Estate Taxes, whereas a Will cannot. On the flipside, a Will can help you to provide financial security for your loved ones and enable you to pay less Inheritance Tax.

What happens when you inherit money from a trust?

The trust itself must report income to the IRS and pay capital gains taxes on earnings. It must distribute income earned on trust assets to beneficiaries annually. If you receive assets from a simple trust, it is considered taxable income and you must report it as such and pay the appropriate taxes.

Who owns the assets of a testamentary trust?

the trusteeAdvantages of a Trust. The significant advantage of a testamentary trust is that the assets are owned by one person(s), the trustee, and the benefit of the income and capital of the trust passes to another person/s, the beneficiaries.

Who pays tax in a testamentary trust?

Generally speaking, provided there is a beneficiary who is “present entitled” to the net income of a trust under s 97 of the ITAA 1936, it is the beneficiary who pays the tax, not the trustee.

What happens when the beneficiary of a testamentary trust dies?

If the beneficiary of a revocable trust dies before the settlor does, the settlor can simply rewrite his trust instrument to address the change. If the beneficiary dies after the settlor dies and the trust still holds property on behalf of the beneficiary, the property often passes to the beneficiary's estate.

What are the benefits of a testamentary trust?

One of the primary benefits of a trust is that the assets you include in the trust will likely avoid the probate process. There are different types of trusts, so you should discuss your options with your estate planning attorney first. A testamentary trust is a very common type of trust that is included in a will and does not go into effect until the person who created it dies. Here is what you need to know.

What is the court's duty to a trust?

It is the court’s duty to ensure that the trust property is being handled properly. Court supervision also means that, depending on how long the trust remains in effect, the legal fees could be substantial. This is something that should be considered when deciding whether to include a testamentary trust in your will.

Can a minor inherit money?

In many cases, testamentary trusts are created for young children, relatives with disabilities or special needs, or others who may inherit a large sum of money and need assistance managing that money. Minors, for example cannot receive inherit gifts directly, because of their lack of maturity. As such, those assets need to be managed by an adult. Including a testamentary trust in a will, however, allows you to leave a gift to a child, as well as identify your selected guardian as trustee of that property. The trustee will then manage the trust until the minor reaches an age when they can manage the property themselves.

What are the advantages of a testamentary trust?

One of the big advantages of using a testamentary trust is the flexibility that you will have regarding the trustee. With this type of arrangement, you can name any individual as the trustee to your trust. This means that if you want to name a family member whom you trust as the trustee, you could potentially do so. With this type of arrangement, you will want to make sure that you choose someone whom you can trust at all times. They will be making important decisions for your estate once you are gone, so it is important to choose the right trustee for your needs.

What is a testamentary trust?

A testamentary trust is a popular tool commonly used in estate planning. Although it is similar to a family trust, there are some key differences that many people would consider to be advantages. Here are some of the advantages of using a testamentary trust.

How much can you distribute with a testamentary trust?

When you use a family trust to distribute assets to minors, they will have to pay penalty tax rates for receiving anything over $1100. With a testamentary trust, the minors can receive up to $10,000 per year without paying any taxes on it. In addition to that, if they receive more than $10,000, they will simply be taxed at the regular income tax rate for adults. You can even distribute money to multiple beneficiaries if you choose, and they will receive the same tax benefits. This means that you can distribute much more tax-free money with this type of trust than you could with a family trust.

What is a testamentary trust?

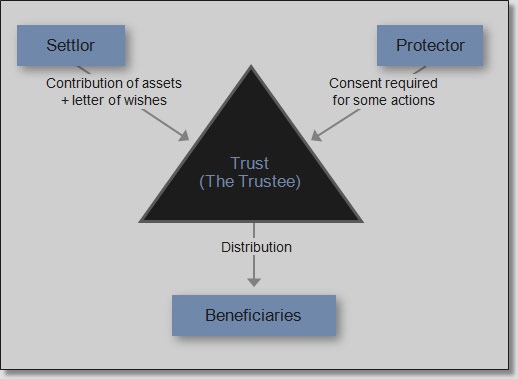

A Testamentary Trust is created in accordance with the instructions in a person’s Last Will and Testament and outlines when assets will be given to certain named beneficiaries. Unlike a Living Trust, a Testamentary Trust goes into effect after one’s death. The Testamentary Trust definition outlines three main parties: a grantor, a trustee, ...

Why are trusts important?

Trusts are a crucial element to Estate Planning as they help provide more control over asset distribution after death. Among the various types available, a Testamentary Trust can be one of the best options for those thinking of their young children or grandchildren.

What is a pot trust?

The other type of Testamentary Trusts are considered “pot” Trusts, essentially meaning all of one’s assets are managed together. Family Testamentary Trusts allow parents to distribute assets based on each child’s needs. These Trusts are typically used by parents who need or want to leave more funds to one child.

Why do we need estate planning?

Estate planning is a necessary, but oftentimes confusing, way to ensure your loved ones are taken care of following your death. Trusts can work in tandem with a Last Will and Testament to ensure your assets are distributed according to your wishes. The creation of a Trust can also help guarantee your assets remain in good hands ...

Is there a limit on beneficiaries in Testamentary Trusts?

There are, however, income taxes to consider on undistributed income. No Limit On Beneficiaries: There is not a limit to the number of acceptable beneficiaries when creating Testamentary Trusts. Additionally, with separate Trusts these accounts can be personalized.

Do Testamentary Trusts require beneficiaries to pay taxes?

Income Tax Perks: Testamentary Trusts do not require beneficiaries to pay taxes on income distributed from the trust. There are, however, income taxes to consider on undistributed income.

Does a testamentary trust avoid probate?

A Testamentary Trust does not avoid probate — as the court will typically determine the Trusts authenticity and supervise the distribution of assets. For this reason, Testamentary Trusts may not offer the same level of privacy when compared to alternatives.

What is a testamentary trust?

A testamentary trust is a trust established under a valid will. A testamentary trust functions in a similar way to a discretionary family trust, with certain provisions of the will operating like a trust deed. You can read a Clearlaw article on the testamentary trust structure generally and its benefits here .

How much tax free income can a beneficiary receive from a testamentary trust?

With the current tax free threshold of $18,200, beneficiaries are potentially able to receive up to $18,200 of tax free income from the testamentary trust each year.

What happens if a trust passes to a beneficiary?

This means that any capital gain made by a trustee of a testamentary trust from a CGT asset passing to a beneficiary of the trust will be disregarded. For example, if land held in a testamentary trust passes to a beneficiary of the trust, the capital gain that arises on the disposal of that land by the trustee is disre garded as a result ...

Who decides who receives trust income?

The trustee may decide which beneficiaries receive trust income. The beneficiaries that receive the trust income then include this income in their own assessable income which is taxed at that individual's marginal tax rates.

What are the benefits of a testamentary trust?

One of the most beneficial aspects of a testamentary trust is that it can be completely tailored to your needs. It is extremely flexible and can be as simple or complex as you would like.

Why are trusts called testamentary trusts?

Trusts that are created after your lifetime are called testamentary trusts because they are established in your “last will and testament.”. The trust is described in the will and all of the terms are often found in the will.

How is a testamentary trust created?

In other situations, a testamentary trust can sometimes be created by referring to another document that actually creates the trust. Like living trusts, testamentary trusts are overseen by a trustee and have specified beneficiaries. The trustee is bound by the terms of the trust and will distribute funds or property according to your specific ...

Who is bound by the terms of a trust?

The trustee is bound by the terms of the trust and will distribute funds or property according to your specific instructions. This type of trust is often used by someone who is expecting a large life insurance payment or for those who have minor or disabled children.

Can a trustee be a stranger?

The trustee could end up being a complete stranger in some cases. It is important to discuss your plans with your prospective trustee to avoid this type of situation. There may be other drawbacks to a testamentary trust that vary depending on your particular situation as well.

What is testamentary trust?

Key Takeaways. A testamentary trust is a provision in a will that appoints a trustee to manage the assets of the deceased. It is frequently used when the beneficiary or beneficiaries are children or disabled people. The trust is also used to reduce estate tax liabilities and ensure professional management of the assets.

How long does a testamentary trust last?

A testamentary trust remains in effect until a triggering event named in the will, such as a surviving child reaching the age of 21. Once a testamentary trust is in place, the trustee manages the assets until the trust expires and the beneficiary receives control of them.

What happens when a trust expires?

Until the trust expires, the probate court checks in periodically to ensure that the trust is managed properly. The trustor can choose anyone to act as a trustee.

When does a living trust go into effect?

A living trust, as the name implies, goes into effect during the trustor’s lifetime. A testamentary trust goes into effect immediately upon the death of the trustor. The testamentary trust is a provision in the will that both names the executor of the estate and instructs that person to create the trust. After the person's death, the will must go ...

Can a trustee choose anyone?

The trustor can choose anyone to act as a trustee. However, the trustee appointed is not obligated to take on this role and may decline the request. If this happens, the court may appoint a trustee or a relative or friend of the beneficiaries involved may volunteer to act as the trustee. Take the Next Step to Invest.

Can a will have more than one trust?

A will could have more than one testamentary trust . The trustee named is responsible for managing and distributing the trustor's assets to the beneficiaries as directed in the will. Sometimes called a will trust, the testamentary trust is irrevocable.

What is a testamentary trust?

Testamentary Trust Defined. A testamentary trust is a type of trust that is created in a last will and testament. The terms of the trust are specified in the will. Unlike a living trust, a testamentary trust comes into existence only after the settlor dies. Because a testamentary trust doesn’t take effect until after the settlor dies, ...

Why is a trust important?

The major benefit of a trust is that it gives the settlor control over when and how his or her assets are disbursed. This is especially important for settlors who have young children or grandchildren. With a testamentary trust, assets can remain protected until the child is old enough to be financially responsible.

What happens to a trust after a settlor dies?

Upon the settlor’s death, the will goes through the probate process. Once this is complete, the trust is created and funds can begin to be disbursed.

What happens to a testamentary trust when the beneficiary turns 18?

Once the settlor’s daughter, who is the beneficiary, turns 18, she will receive the assets and the trust will terminate. Since a testamentary trust is formed within a will, the probate court is also an involved party. The probate court must first determine the authenticity of the will. Only once that’s established will the trust be created.

How to do estate planning?

Tips for Estate Planning 1 While you can do it yourself, there are numerous pitfalls to DIY estate planning. You may want to work with an attorney and a financial advisor, particularly if your situation is complex. A matching tool like SmartAsset’s can help you find a financial advisor to work with who suits your needs. You’ll first answer a series of questions about your needs and preferences. Then, the program will pair with up to three suitable fiduciaries near you. You can then interview your matches and read their profiles to narrow it down. 2 Once you decide choose your beneficiaries, don’t forget to update your retirement accounts, pensions, life insurance and brokerage accounts. Aside from choosing your beneficiaries, you’ll also need to designate power of attorney. If you have minor children, you’ll need to determine a guardianship plan. 3 Take steps to minimize estate taxes. Your beneficiaries could lose a significant chunk of their inheritance to taxes. There are a number of steps you can take to prevent this from happening though. For example, you can give portions of your assets to family members through gifts or set up an irrevocable life insurance trust.

How often do you have to go to probate court?

The probate court is also there to ensure that the trustee is correctly handling the trust per the will for the duration of the trust. The trustee may have to go to probate court once a year.

When do testamentary trusts terminate?

The trust terminates when the beneficiary receives the specified assets.