How to make money with Cash App?

- TikTok has exploded in popularity and some users are looking for ways to cash in.

- Creators turn to TikTok's built-in monetization tools, brand deals, and song promos to make money.

- Users with as few as a hundred followers can still earn on the app by joining marketing contests.

What is Cash App and how does it work?

That’s because, despite the burgeoning volume of digital transactions since, low-value payments continue to be made in cash. The cure for this ... to all content on any device through browser or app. Exclusive content, features, opinions and comment ...

What are the best cash apps to use?

Select’s picks for the top apps to send money

- Best between friends: Venmo

- Best for bank-to-bank transfers: Zelle

- Best for flexible payments: PayPal

- Best for budding investors: CashApp

- Best for sending money internationally: Remitly

How much money can I send through Cash App?

To send a payment:

- Open the Cash App

- Enter the amount

- Tap Pay

- Enter an email address, phone number, or $Cashtag

- Enter what the payment is for

- Tap Pay

What are the disadvantages of using Cash App?

Drawbacks: There's a fee to send money via credit card. Cash App charges a 3% fee to people who use a credit card to send money. A fee for instant deposits.

What are the pros and cons of using Cash App?

With Cash App, you can also buy and sell stocks with no commission. This saves you the time of having to open up a second app in order to perform your stock transactions. One of the biggest disadvantages of Cash App is that you are limited to sending and receiving up to $1,000 during the first 30 days on the app.

Why you shouldn't use Cash App?

Although the app is legitimate, you should use it cautiously. Scammers have found ways to defraud people using the app, so only send and accept money from people you trust.

What is the point of Cash App?

Cash App allows individuals to quickly receive and send money to other people from their mobile devices. In addition to mobile banking, Cash App also offers the option to purchase stock and Bitcoin through its platform. The company has even made it possible to file your taxes through its Cash App Taxes feature.

Can you get hacked on Cash App?

No, it is not possible to hack your account with just your username; your username is only used to send money or request payments. However, it is still possible to fall into a scam. If you want to know more about this specific topic, we recommend reading: What To Do If a Random Person Sends Me Money on Cash App?

Do I need a bank account for Cash App?

You can set up Cash App without a Bank Account, but you will face some drawbacks. Users can get money off Cash App without a typical credit or debit card by using a Cash App Card. Cash app allows for money withdrawal and other services without a bank account or card.

How long can money sit in Cash App?

When you request money, the person you requested money from will have 14 days to accept or decline the request. If they do not respond within 14 days, the request will automatically expire. When you receive a Cash App payment, it will be available instantly in your balance.

Is it safe to leave money in Cash App?

Cash App uses cutting-edge encryption and fraud detection technology to make sure your data and money is secure. Any information you submit is encrypted and sent to our servers securely, regardless of whether you're using a public or private Wi-Fi connection or data service (3G, 4G, or EDGE).

What is better PayPal or Cash App?

The main difference between Cash App and Paypal is that Cash App is a fee-free service while PayPal offers a range of diverse services which means the fee structure is also diverse. Cash App and PayPal are two of the most popular financial service providers in the United States.

How do you make money on App cash?

Cash Out InstructionsTap the Banking/Money tab on your Cash App home screen.Press Cash Out.Choose an amount and press Cash Out.Select a deposit speed.Confirm with your PIN or Touch ID.

How do I deposit money on Cash App?

After you've arrived at the store, tell the cashier you want to load funds to your Cash App using your barcode. If they're not sure how to help, you can show them the instructions by tapping the ? on your map. Once the cashier scans the barcode within your Cash App, hand them the money you'd like to deposit.

Is there a fee for Cash App?

Cash App charges a 3 percent fee if you use a credit card to send money, but making payments with a debit card or bank account is free. Cash App also charges a 1.5 percent fee if you request an Instant Transfer of funds from your Cash App account to your linked debit card.

What is Cash App?

Cash App also makes it easy for you to simplify reimbursements with your friends. Let’s say you and three other friends decide to split the bill at a restaurant. You or one of your friends can pay the restaurant bill and have the other reimburse you. Cash App makes it easy to see who has reimbursed you and when.

How long does it take to pay cash app fees?

If you would like to forgo the option to pay the Cash App fee, you have the option to have the transaction completed in one to three days. This can come in handy if you are short on cash or if you simply prefer not to pay the 1.5% transfer fee.

When was CashApp created?

Founded in 2013, Cash App has become one of the most popular mobile payment systems in the United States and UK. The rise in the popularity of CashApp is due to its ease of use in transferring money from one person to another.

Can you buy stocks with cash app?

With Cash App, you can also buy and sell stocks with no commission. This saves you the time of having to open up a second app in order to perform your stock transactions.

Pros: Where Cash App stands out

Cash App is so easy to sign up for that you’ll be in your account before you even realize you have one. Give your name, add either an email or phone number, pick your username (your cashtag, as it’s called) and you’re ready to roll, even without linking your bank account to transfer funds.

Cons: Where Cash App could improve

If you’re expecting to buy deep-in-the-weeds stocks (as at other major brokers), you’re not likely to find what you’re looking for. But you’ll likely find all the major stocks, with Cash App offering about 1,000 stocks on its platform, which meets the bulk of demand, says the company.

What is cash app?

Cash App allows users to buy stock in specific companies with as little or as much money as they want to invest. Stocks can be purchased with the funds in your Cash App account; if you don’t have enough funds in the app, then the remaining amount will be taken from your linked bank account.

How much can you spend on a cash card?

The maximum that can be spent on your Cash Card is $7,000 per transaction and per day and $10,000 per week. The maximum that can be spent per month is $25,000. There are withdrawal limits on the Cash Card.

Cash App Overview

The Cash App is a peer-to-peer payment app created by Square, Inc. in 2013. The mobile app is available for iOS and Android and has grown in popularity since its launch. In June 2018, more than 30 million people used the Cash App to make payments. With that, it was ranked as the No. 1 finance app in the Apple App Store.

What are some Cash App uses?

The main benefits of using the Cash App are: Sending money, receiving money, mobile banking, and investing are all features of the Cash App. Here’s how each one works:

Who can use Cash App?

The Cash App is one of the finest cash apps for person-to-person interactions between friends and people you can trust. There’s no need to remind your roommate to pay their portion of the rent or utilities every month. Instead, you may send them a payment request via the Cash App.

Is it safe to send money with Cash App?

According to the Cash App website, payment information is secured and transmitted via secure servers. You should take additional measures to ensure no one can utilize your phone without your agreement. Cash App suggests password-protecting your phone and enabling the in-app security lock, which will need a PIN or touch I.D. for each transaction.

How to Get Started with Cash App

Download the app from Google Play or the App Store. To download it for free, go to the Apple or Google Play store.

How to avoid scams

Square advises its customers to set complicated passwords on devices and online accounts to protect their information from fraud. The Square company also has a risk and fraud team that monitors activity in the network to protect customers.

Conclusion

Cash app has made it simpler to handle this scenario by allowing you to pay with your credit cards, earn the points, and have everyone else send you money through Cash App. Cash App also offers a banking product and an investing service that allows you to invest in stocks online for free.

What is Cash App?

Cash App is one such service that has made it extremely easy to transfer funds and also provides other unique functions such as investing stocks or buying/selling bitcoins. However, the real benefits of the Cash App and how it works is still unknown to many. So let’s first answer one basic question.

How much money do you get from referring an app to a friend?

If you refer the app to a friend and they sign up you will get $5. This can be done with as many friends as possible and you will win the same amount every time.

Can you use Cash App card on all accounts?

Cash App Card is also open for all account holders and it can be used to enjoy a specific boost with a chosen vendor. This means you can select a retailer of your choice and then earn a discount when you shop there using the Cash App card. You can only choose one vendor at a time but it can be changed whenever you want to.

Is Cash App legit?

Cash App refer-a-friend program is legit and it lets you make some dollars without putting in much effort. However, keep in mind that this is the only method to make some money with Cash App as the application does not carry out any giveaways or contests.

What is CashApp?

Cash App is one of several popular peer-to-peer transaction services, similar in many ways to PayPal, Venmo, and others. Cash App tries to differentiate itself from other apps by serving as a potential alternative to a traditional bank account; it can even receive direct deposits, for example.

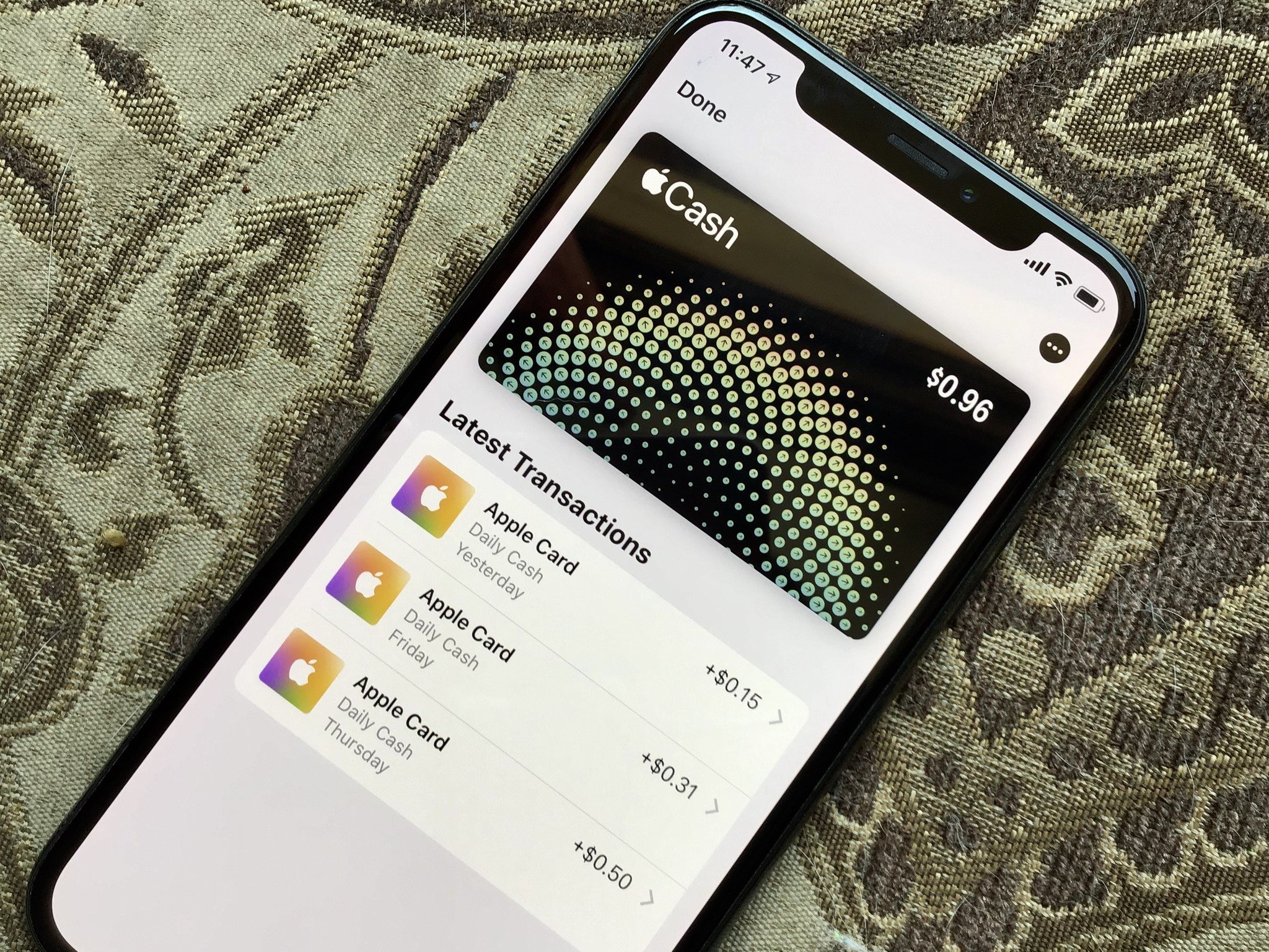

Is the Apple Pay app insured?

Again, your balance in the app is not federally insured, so it's best to not use it as a bank account substitute. Only send money to users you know and trust. Don't send money to accounts you don't know personally, and make sure to verify the account information of your recipients.

Can I use Cash App as a bank account?

SOPA Images/Getty Images. In addition to simple peer-to-peer cash transfers, you can use Cash App as a bank account. Cash App gives you a routing and account number to enable direct deposits, so your paycheck can be sent directly to Cash App. Likewise, you can make payments (such as utilities) from Cash App.

Is CashApp safe?

Cash App is relatively safe due to its encrypted transactions, and the app has certain security features and protections. You should enable the app's security features and be aware of the potential for scams and fraudulent transactions. You should also avoid using Cash App as a replacement for a bank account as your balance is not federally insured.

Can I use a cash app at an ATM?

The Cash App's debit card can be used at ATMs, though there is a $2 transaction fee. There are some limits on Cash App transactions – you can only withdraw up to $310 per transaction from an ATM, for example, and no more than $1,000 in a seven-day period.

Is CashApp FDIC insured?

First and foremost, money held in your Cash App account is not FDIC insured, which means that your entire balance is vulnerable if Cash App were to lose your money or shut down unexpectedly. Unlike traditional bank accounts, Cash App balances do not earn interest.

Does Cash App have a PIN?

Cash App also features security built into the app to prevent unauthorized users from gaining access to the app if they should get physical possession of your phone; these include Touch ID and PIN code security, depending upon which phone you have.