Benefits of Contactless Payments for Business

- Reduces Physical Interaction. Though obvious, this remains a primary driver of contactless payment adoption as we...

- Increased Security. Beyond public health concerns, contactless payments are also less risky from a fraud perspective.

- Efficiency. The ability to seamlessly pay not only saves your customers time during...

- Ease of use. Quicker transactions and shorter queues at the checkout are the most significant advantages of contactless payment. Handling cash is not a concern at the checkout. ...

- Safer transactions. Tap-to-pay technology is more reliable and secure than other forms of payment.

What do you need to know about contactless payments?

Some include:

- Speed: Contactless payments are fast. ...

- Security: Contactless payments use nearly the same technology that powers EMV chip cards. ...

- Convenience: Contactless payments are a convenient way for banks, merchants and consumers to conduct swift transactions.

Is contactless more secure?

It’s incredibly difficult for a hacker to recreate the one-time code that contactless credit cards create for each transaction. Compared to magnetic strips that are more easily duplicated, contactless credit cards are much more secure. The easiest way for a thief to leverage contactless payment technology is to steal your physical credit card.

How safe are contactless cards?

You can minimise the chances of becoming a victim of contactless fraud by following these steps:

- Don't keep your cards in easily accessible pockets or bags which will draw pickpockets' attention

- Line your wallet or cardholder with tin foil to block scamming devices from reading your card. ...

- Don't let anyone take your card out of sight while taking a payment – even for just a few seconds. ...

How to use contactless payment?

- Think about placement. Put your payment terminal on the customer's side of the register, so they don't have to reach over and get too close to your cashier. ...

- Encourage customers to make contactless payments. ...

- Train your staff. ...

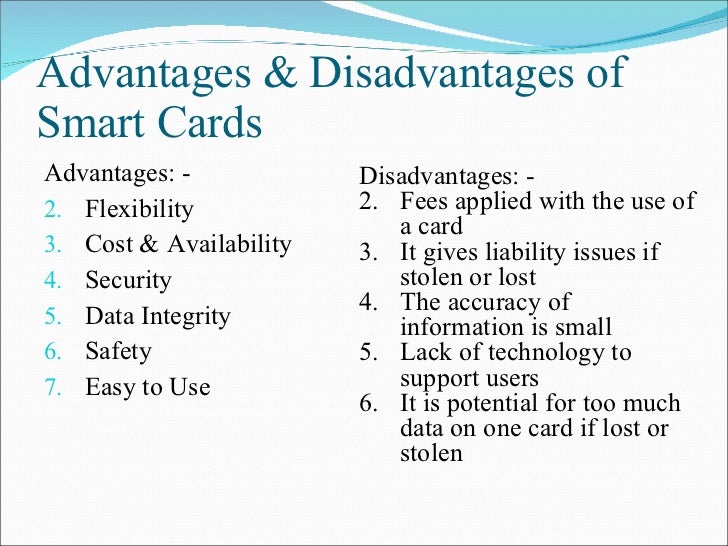

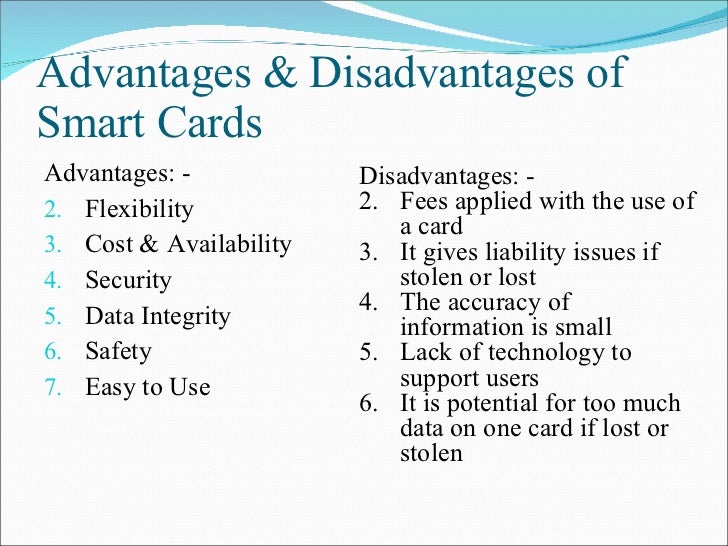

What are the pros and cons of contactless payment?

Advantages of contactless payment for both consumers and merchants include:fast and efficient payment.convenience as customers can use their smartphone in lieu of their payment card.less likelihood of long queues during busy times.Covid-safe and hygienic.easier payments may result in more unplanned/impulse purchases.More items...

Is contactless payment better?

Increased payment security and a reduced risk of fraud Contactless payment methods are as safe as EMV chip and PIN (Personal Identification Numbers) transactions. Also, your customer's credit card information can't be used fraudulently in case of a data breach.

Why contactless payments are safer?

Contactless payments are actually safer than regular ones. The reason for this is because consumers identify themselves through a biometric systems or a PIN number, and the mobile payment system generates an individual security code for each transaction.

Can contactless cards be hacked?

By removing the need for a PIN code, contactless cards do offer a fast and convenient way to pay - however, they may also offer criminals the opportunity to commit fraud.

How secure is contactless payment?

Contactless payments are secure. You enjoy the same 100% fraud protection on contactless payments as your normal Chip & PIN transactions. For security purposes, you'll occasionally be asked to enter your PIN when making a contactless payment.

What if my contactless card is stolen?

You need to send an email from registered id to the bank with card details, account number, date of loss along with a copy of the FIR. You need to report the loss of card/fraudulent transactions in the stipulated time frame of the banks to be entitled to lost card liability cover.

Is contactless more secure than chip?

Contactless credit cards are as secure as EMV chip credit cards because they both use the same security standards for transactions. Whether you're using a tap-to-pay card or inserting your EMV chip card, the sensitive information sent is encrypted.

What is Flex Payment Solutions?

Flex Payment Solutions offers electronic invoicing that can help your business start taking payments without your customer being physically present (ACH, RCC, and card payment if stored). We can also help your business to start taking contactless payments such as ‘tap and go’ and Apple Pay.

Is contactless payment safe?

Contactless payment methods are as safe as EMV chip and PIN (Personal Identification Numbers) transactions. Also, your customer’s credit card information can’t be used fraudulently in case of a data breach.

What are the advantages of contactless payment?

Quicker transactions and shorter queues at the checkout are the most significant advantages of contactless payment. Handling cash is not a concern at the checkout. You also don’t have the hassle of punching in your PIN. Safer transactions. Tap-to-pay technology is more reliable and secure than other forms of payment.

Why is contactless payment important?

Contactless payments play a vital role in making the buying experience a pleasurable one due to the speed and ease of transaction. Contactless cards are great facilitators for your everyday purchases and are fast being adopted by both consumers and businesses. You can swipe your card or digital device at the point of sale to complete your payment.

Why do businesses use contactless payment?

Studies have shown that businesses offering contactless payment facilities provide a smoother and quicker checkout experience to the customers, hence earning their loyalty. Stores can also optimise their loyalty programs and improve customer relationships. No extra cost.

What is NFC enabled?

Your NFC-enabled smartphone is all you need to make your payments. Loyalty benefits. Most loyalty programs offered by stores are in sync with the tap-to-pay smartphone that you use for payments. They automatically confer discounts and loyalty points at the time of payment.

Do contactless cards need a pin?

Security concerns. Since the transaction with a contactless card does not need any PIN authorisation, there is a fear of fraudulent purchases in the event of it being lost or stolen . In such a case, it is always a good idea to let the issuing bank know about this.

Does contactless payment attract additional processing fees?

Providing a contactless payment facility does not attract any additional processing fee. Businesses pay the same fee applicable for a transaction with a regular credit card. Fraud protection. Contactless payment technology is secure and encrypted to discourage any hacking attempts.

What is contactless payment system?

Contactless payment systems are based on RFID or NFC (Near Field Communication) technology. They come in different forms including credit and debit cards, smartphones, smart cards, key fobs or other devices, including wearables (watches, rings...).

How fast can contactless payments be completed?

1. Speed. It is estimated that contactless payments can be completed within 15 seconds and work twice as fast as normal cards. With less processing and handling of cash occurring, transactions are completed at a faster rate, turnover is likely to improve and queues are less likely to build up. As pin numbers are no longer needed and ...

What happens if you lose your credit card?

Secure. If you lose your card or it is stolen you are able to freeze the account or contact your bank who will disregard and amend fraudulent payments. As the user only needs to tap the card onto the reader, the risk of fraudulent activity or theft seems a lot higher.

Why are contactless payments less risky?

dollars that returned from overseas. 2. Increased Security. Beyond public health concerns, contactless payments are also less risky from a fraud perspective.

What is contactless payment?

Most contactless payments rely either on chips in credit cards, allowing consumers to simply wave their cards, or purely mobile wallets. Unlike the magnetic strips in credit cards, these payments don’t transmit the customer’s name and card number along with the transaction. Instead, the RFID chip in the card transmits a one-time code to ...

Will contactless payments increase in 2020?

While retailers have been moving toward low-touch and no-touch payments for years, the pandemic has appeared to dramatically accelerate contactless payment adoption. For example, from January through July 2020, contactless payments as a percentage of overall payments more than doubled, according to research from Appriss Retail.

Do payment terminals have contactless?

For the latter, most newer payment terminals have contactless payment capabilities built-in. If yours is older, though, then you may need to update some of your equipment. In addition, depending on the payment method, you may end up paying added fees to accept contactless payments.

What are the benefits of contactless payments?

Benefits of contactless payments. 1. More hygienic. The pandemic means that hygiene is the number one concern on everyone’s minds. Attractions of all types are bringing in new safety measures to prevent the virus from spreading. For example, stricter cleaning protocols and guest screening.

Why is contactless technology important?

While many FECs and entertainment venues are currently closed, using contactless technology will help make them safer places once they reopen. 2. More efficient. FACE Amusement, which operates a variety of venues in the US, uses Embed to provide cashless technology:

What are the benefits of cashless technology?

A key benefit of cashless technology is that it can help operators to increase their revenue. “We’ve seen time and time again, around the world: FECs open and close due to the virus ,” says Welsh. “When they open, they are 95% below last year’s revenue. Embed wants to help them accelerate their recovery.”.

Why do we wash our hands after paying?

The World Health Organisation (WHO) is advising the public to wash their hands after handling money, to help stop the spread of the virus; some governments outlawed the usage of paper currency and credit card swipe machines, only allowing contactless payments.

What happens after a long lockdown?

After a long-lockdown period, the surge of consumers will emerge and only go to businesses they perceive as safe (businesses that have taken steps to mitigate risk and have pervasively communicated the measures they are taking to provide safe, clean fun).

What are the advantages of contactless payment?

Quicker transactions and shorter queues at the checkout are the most significant advantages of contactless payment. Handling cash is not a concern at the checkout. You also don’t have the hassle of punching in your PIN.

Why do businesses use contactless payment?

Studies have shown that businesses offering contactless payment facilities provide a smoother and quicker checkout experience to the customers, hence earning their loyalty. Stores can also optimise their loyalty programs and improve customer relationships.

Do contactless cards need a pin?

- Security concerns. Since the transaction with a contactless card does not need any PIN authorisation, there is a fear of fraudulent purchases in the event of it being lost or stolen.

Is contactless payment more secure than magnetic stripe?

Contactless technologies are more secure than other payment modes such as magnetic stripes. When all your bank information is stored on a magnetic stripe, it makes it easy for hackers to steal your bank information and make fraudulent charges. - Better customer experience.

Can POS systems be integrated with current payment systems?

If retailers or POS systems do not have the solution integrated with current payment systems, end-users won’t be able to use the facility even if they have their part set up. Spotty network coverage at the time of payment can also turn out to be deterrent, especially in urgent or critical situations.

Is contactless payment good?

There are many contactless payment benefits, whether you’re a customer or a business trying to make payments easier for your customers. Despite the above-mentioned issues, more and more businesses have started accepting contactless payments and millennials are heavily relying on contactless payments through wallet apps. Due to the convenience and speed offered, contactless payments seem to be the norm for both current and future payment systems.

What is contactless payment?

Security – Contactless payments provide a level of protection that traditional magnetic stripe cards can’t achieve.

How many people will use contactless payment in 2020?

According to Visa, 31 million Americans tapped a card or used a mobile device for payment in March 2020, nearly 50% more than had done so six months earlier.

What is tap to go payment?

In technical terms, tap-to-go payments use a technology called Near-Field-Communication or NFC. This chip technology enables card readers to read information from a customer’s credit/debit card or enabled device. NFC isn’t necessarily a new technology – it’s a form of RFID.

What is a one time encrypted credit card?

Instead of transmitting the cardholder’s name, security code, and billing information from data contained in a magnetic stripe that can be copied, a one-time encrypted code transmits from the credit card or phone to the reader.

Is tap to go secure?

In comparison, contactless payments are one of the most secure forms of payment. Since tap-to-go is a relatively new concept in the payment industry, some consumers question whether it is as secure as claimed.

Is contactless payment a transition?

U.S. businesses have been hesitant to transition to contactless payments, but many of their customers have already made the switch. To serve your customers most effectively, you need to provide them with the payment method options they are most comfortable with. YouTube. Chargent.

The definition of contactless payments

First, it is important to define what contactless or touchless transactions are. They can be made using either a credit card or device that contains a smart chip or special communications technology that interfaces with your contactless reader.

The benefits of contactless payments

In many respects, touchless transactions give customers and merchants the best possible results: Efficiency at the checkout counter without sacrificing security. Advantages include the following:

How touchless payments can enhance your brand during the pandemic and beyond

It’s no accident that customers truly began to embrace touchless payments as the coronavirus pandemic raged in 2020 and 2021. Touchless payments continue to provide buyers and sellers alike with peace of mind.