Benefits of Filing Chapter 7 Bankruptcy

- Get rid of your debt. With Chapter 7 bankruptcy, you can quickly eliminate your debt by paying off your bills or having...

- Prevent creditors from harassing you. Are creditors hounding you to repay your debts? This can include countless phone...

- Avoid having to sell off all your possessions. While Chapter 7 bankruptcy can require...

- You Receive a "Fresh Start" ...

- You Will Keep Future Income. ...

- No Limitations on Your Amount of Debt. ...

- No Debt Repayment Plan. ...

- The Discharge of Debts Occurs Quickly. ...

- Only Individuals Are Eligible (Even for Business Debts) ...

- You Must Repay Creditors.

What are the pros and cons of Chapter 7 bankruptcy?

What are the Upsides of Filing Chapter 7 bankruptcy?

- Immediate relief in the form of a much-needed breathing spell. ...

- Permanent debt relief in the form of a bankruptcy discharge. ...

- Getting your bankruptcy discharge is virtually guaranteed. ...

- You’ll probably get to keep all of your stuff. ...

- If you want, you can even keep your car after filing bankruptcy. ...

What are the benefits of Chapter 7 bankruptcy?

- Up to $150,000 of equity value* for your home;

- Furniture up to $6,000 ($12,000 couples) with some exceptions;

- Up to $300 cash;

- Up to $6,000 ($12,000 for physically disabled) for a vehicle, and couples are allowed two (2) vehicles;

- Various limits for other types of personal property;

- Retirement benefits; and

What Chapter 7 bankruptcy can do for You?

Those who qualify for a Chapter 7 bankruptcy can reduce their financial obligations, allowing them to pay their mortgage or rent, pay medical expenses, buy groceries and pay for any other crucial monthly expenses. Those who are considering Chapter 7 bankruptcy should explore their other available options before making the final decision.

What are the alternatives to Chapter 7 bankruptcy?

Other non-bankruptcy alternatives to bankruptcy Chapter 7 may include:

- Contacting Consumer Credit Counselors. They can help you make a budget and negotiate a repayment plan with credit card companies to obtain a reduced interest rate on your debt

- Entering into a workout arrangement

- Compositions and extensions

- Assignments for the benefit of creditors

What do you lose when you file Chapter 7?

A Chapter 7 bankruptcy will generally discharge your unsecured debts, such as credit card debt, medical bills and unsecured personal loans. The court will discharge these debts at the end of the process, generally about four to six months after you start.

What is the major advantage of Chapter 7 bankruptcy?

When you file for Chapter 7 bankruptcy, there's no obligation that you repay qualifying debts. Those debts are wiped fully clean. You can get rid of debts like credit card balances, personal loans, and other forms of unsecured debt.

What can be forgiven under Chapter 7 bankruptcy?

Chapter 7 Bankruptcy Discharge Wipes Out Most Debts Forevercredit card debt.medical bills.personal loans and other unsecured debt.unpaid utilities.phone bills.your personal liability on secured debts, like car loans (if there's no reaffirmation agreement)deficiency balances after a repossession or foreclosure.More items...•

What is the downside of Chapter 7?

Not all debts are discharged – While many types of debts are dischargeable, other major debts, such as student loans, certain taxes, alimony and child support, will not be discharged. Affects credit score – A Chapter 7 bankruptcy will negatively affect your credit score and stay on your record for up to 10 years.

Does Chapter 7 Get rid of all debt?

If you file a bankruptcy case under Chapter 7, not all debts are eliminated (or "discharged") once the bankruptcy process is complete. Generally speaking, in a Chapter 7 proceeding, the following types of debts are not discharged: Debts that were not listed at the start of the case (or debts for unlisted creditors).

What can you not do after filing bankruptcies?

After you file for bankruptcy protection, your creditors can't call you, or try to collect payment from you for medical bills, credit card debts, personal loans, unsecured debts, or other types of debt.

What debt is not covered by bankruptcy?

Other Non-Dischargeable Debts in Bankruptcy 401k loans. Other government debt such as fines and penalties. Restitution for criminal acts. Debt arising from fraud or false pretenses.

How much do you have to be in debt to file Chapter 7?

Again, there's no minimum or maximum amount of unsecured debt required to file Chapter 7 bankruptcy. In fact, your amount of debt doesn't affect your eligibility at all. You can file as long as you pass the means test. One thing that does matter is when you incurred your unsecured debt.

What assets can you keep in Chapter 7?

Bankruptcy Exemptions: What Property Can you Keep In Chapter 7 Bankruptcy?Houses, Cars, and Property Encumbered By a Secured Loan. ... Household Goods and Clothing. ... Retirement Accounts. ... Money, Jewelry, and Other Property.

Will I lose my car in Chapter 7?

If you file for Chapter 7 bankruptcy and local bankruptcy laws allow you to exempt all of the equity you have in your car, you can keep the vehicle—as long as you're current on your loan payments. And if the market value of a vehicle you own outright is less than the exemption amount, you're in the clear.

Will I lose my car and house in Chapter 7?

Filing for bankruptcy does not relieve you of secured debts unless you agree to surrender the property that serves as collateral for the loan. Consequently, victims of bankruptcy can only keep their house and car if they can still afford to make the monthly payments on the loans.

Can you buy a car after filing Chapter 7?

The bottom line. While you can purchase a car after bankruptcy, you should expect to pay a higher interest rate if you take out a loan. Although waiting for your credit score to improve can lower your rate, it's not always possible.

What debts are eliminated in Chapter 7 bankruptcy?

Filing Chapter 7 bankruptcy wipes out most types of debt, including credit card debt, medical bills, and personal loans. Your obligation to pay these types of unsecured debt is eliminated when the bankruptcy court grants you a bankruptcy discharge .

What happens if you don't pay bankruptcy court fees?

But, if you don’t pay it in full, your case will be thrown out by the court . If you hire a law firm or bankruptcy lawyer to help you, you’ll have to pay their attorney fees in addition to the court filing fees. That usually comes out to an average of about $1,500 that has to be paid before your case is filed.

How much does it cost to file for bankruptcy?

Filing Bankruptcy Can Be Expensive. The bankruptcy court charges a $338 filing fee for Chapter 7 cases. If you earn more than 150% of the federal poverty guideline, you have to pay this filing fee. It’s possible to file your case and pay the fee in up to 4 payments if you can’t pay it all at once.

What is Chapter 7 bankruptcy?

Let's Summarize... Chapter 7 bankruptcy is one of the most powerful debt relief options available in the United States. It can help filers get out of poverty and provides them with a clean slate. It gives you a fresh start by erasing your debts.

How long does it take to get discharged from bankruptcy?

If you’ve never filed bankruptcy before, pass the means test, and are honest in your dealings with the bankruptcy court and the bankruptcy trustee, you can get your bankruptcy discharge in as little as 3 months.

Is Chapter 7 bankruptcy the same as Chapter 13 bankruptcy?

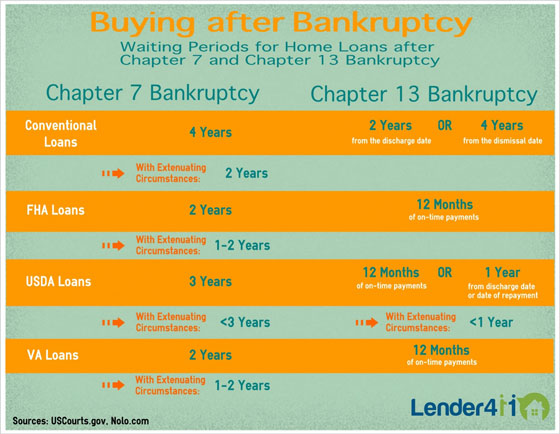

Chapter 7 and Chapter 13 bankruptcy are both powerful debt relief options for folks in need of a fresh start. But the pros and cons of filing Chapter 13 bankruptcy are quite different than for Chapter 7. If you have a high disposable income or non-exempt assets you want to protect, Chapter 13 may be right for you.

Is Chapter 7 bankruptcy a personal decision?

But, filing bankruptcy is a personal decision and it’s important to fully consider whether it’s the right option for you. This article explores the pros and cons of filing Chapter 7 bankruptcy.

How long does it take for a bankruptcy to stop harassing calls?

A permanent injunction is issued once the judge issues the discharge order at the end of the Chapter 7 bankruptcy process. Once you have paid the required fees, completed your credit counseling class and workbook, and compiled the necessary documents, Attorney Trezza can file your petition in less than 48 hours. This means once you have paid the required fees and completed the necessary items, the harassing calls can stop within 48 hours.

What are the benefits of filing Chapter 7?

Benefits include basic things like stopping harassing phone calls immediately to more complex items like limiting the amount of time your credit is affected by the bankruptcy process. Chapter 7 bankruptcy is the most common and quickest form of bankruptcy filed. Reviewed below are some of the most important benefits of filing Chapter 7 bankruptcy.

What happens if you decide against Chapter 7?

If you decide against Chapter 7 when it may be the right decision for you, your missed debt payments, defaults, repossessions, and lawsuits will also hurt your credit and may be more complicated to explain to a future lender than bankruptcy. You'll lose property that you own that is not exempt from sale by the bankruptcy trustee.

How long does a Chapter 7 bankruptcy stay on your credit report?

Advantages of Chapter 7. A Chapter 7 bankruptcy can remain on your credit report for up to 10 years. Although a bankruptcy stays on your record for years, the time to complete the bankruptcy process under Chapter 7, from filing to relief from debt, takes only about 3-6 months. If you decide against Chapter 7 when it may be ...

How long does it take to get out of Chapter 7 bankruptcy?

If you file for Chapter 7 relief, but you have a certain amount of disposable income, the bankruptcy court could convert your Chapter 7 case to a Chapter 13, thus changing your plan to be free from most debts within four to six months, to a plan requiring you to repay your debts over the course of three to five years.

How does Chapter 7 affect your credit?

It affects your future credit, your reputation, and your self-image. It can also improve your short-term quality of life considerably, as the calls and letters stop. Taken as a whole, it's a difficult process with both advantages and disadvantages. Chapter 7 bankruptcy, in particular, will damage your credit for a little while ...

How long does it take to get new lines of credit after filing bankruptcy?

You may also be able to obtain new lines of credit within one to three years of filing bankruptcy, although at a much higher interest rate.

Can I file for Chapter 7 bankruptcy if I have a Chapter 13 discharge?

If you obtained a Chapter 13 discharge in good faith after paying at least 70% of your unsecured debts, the six-year bar does not apply. You could not file for Chapter 7 bankruptcy if a previous Chapter 7 or Chapter 13 case was dismissed within the past 180 days because: You violated a court order OR.

Can you file for bankruptcy if you have student loans?

Bankruptcy won't get rid of your student loan debt. Bankruptcy will prevent your lenders from aggressive collection action. You can't file for Chapter 7 bankruptcy if you previously went through bankruptcy proceed ings under Chapter 7 or Chapter 13 within the last six years.

Filing Chapter 7 Bankruptcy: What are the Benefits and Drawbacks?

It is not simple to make a choice to file for bankruptcy. However, a bankruptcy filing could be the best approach to your debt and financial problems. Filing bankruptcy has several advantages that other debt-relief options do not offer.

What are the drawbacks of a Chapter 7 bankruptcy declaration?

A bankruptcy proceeding could be a great help for you to pay back your debts. There are a few disadvantages of bankruptcy filing but an experienced bankruptcy lawyer can help you in dealing with these situations.

What happens after Chapter 7 bankruptcy?

After a discharge order, Chapter 7 bankruptcy erases most of your qualifying debt —unlike Chapter 13, which is more focused on developing a realistic monthly payment plan based on your disposable income.

What happens when you file Chapter 7?

However, it’s a misconception that when you file Chapter 7 bankruptcy, you lose everything you have in exchange for wiping your debts clean.

Can I get credit after filing Chapter 7?

It’s totally understandable to think that after filing Chapter 7 bankruptcy, your credit score will be tanked and you’ll never get access to credit again. But this is not the case.

Pros of Chapter 7 Bankruptcy

Bankruptcy falls victim to all sorts of misinterpretations. In truth, it was designed to relieve certain debts and give individuals a fresh start. It should be seen as a way out rather than a punishment.

Cons of Chapter 7 Bankruptcy

The consequences of bankruptcy may not be as severe as they were in the past, but it still comes with risks. Bankruptcy can wipe the slate clean, but there are measures in place to make sure the debtor is still held accountable for falling short on his or her agreement.

Consult With a Professional About Your Options

There’s no reason to make this decision solo. Whether you need an expert to guide you through the whole process, or you’re simply looking for free consultation and advice on the best way forward, speaking with a bankruptcy attorney can help clear things up. These are trained professionals who focus their attention on none other than bankruptcy law.