Reasons to File Separately

- You earn the same level of income as your spouse. There are some situations where married couples filing separately can come out ahead. ...

- You have hefty medical bills. Filing separately may help you qualify for some tax breaks. ...

- Your income determines your student loans. ...

- You don’t want to be responsible for each other’s tax liabilities.

When should you file your taxes as Married, Filing Separately?

- These partners reported individual income and expenses on individual tax returns.

- They had to agree on either itemizing expenses or using the standard deduction.

- By filing separately, their similar incomes, miscellaneous deductions or medical expenses likely helped them save taxes.

Can we switch between Married Filing Jointly and separate?

You can change your filing status from married filing jointly to married filing separately in any year, but just make sure the change benefits you. Filing Taxes Separately After Filing Jointly

What are the benefits of filing married separate?

- Earned income credit

- Child tax credit (half the married filing joint rate is available)

- Child and dependent care credit (a partial credit may be possible if the spouses are living separately)

- Adoption credit

Is it better to file married jointly or married separately?

When it comes to being married filing jointly or married filing separately, you’re almost always better off married filing jointly (MFJ), as many tax benefits aren’t available if you file separate returns. Ex: The most common credits and deductions are unavailable on separate returns, like: Earned Income Credit (EIC)

When should married couples file separately?

Though most married couples file joint tax returns, filing separately may be better in certain situations. Couples can benefit from filing separately if there's a big disparity in their respective incomes, and the lower-paid spouse is eligible for substantial itemizable deductions.

What are the disadvantages of filing married filing separately?

As a result, filing separately does have some drawbacks, including:Fewer tax considerations and deductions from the IRS.Loss of access to certain tax credits.Higher tax rates with more tax due.Lower retirement plan contribution limits.

Why would you file married filing separately?

Married filing separately is a tax status used by married couples who choose to record their incomes, exemptions, and deductions on separate tax returns. Some couples might benefit from filing separately, especially when one spouse has significant medical expenses or miscellaneous itemized deductions.

Is it better to file separately or jointly?

When it comes to being married filing jointly or married filing separately, you're almost always better off married filing jointly (MFJ), as many tax benefits aren't available if you file separate returns. Ex: The most common credits and deductions are unavailable on separate returns, like: Earned Income Credit (EIC)

What are the rules for married filing separately?

Eligibility requirements for married filing separately If you're considered married on Dec. 31 of the tax year, then you may choose the married filing separately status for that entire tax year. If two spouses can't agree to file a joint return, then they'll generally have to use the married filing separately status.

Am I responsible for my spouse's tax debt if we file separately?

Debt Incurred Before, During, and After Marriage You may be liable for tax debt incurred during your marriage – unless you take steps to limit your liability. You can protect yourself by filing separately or applying for Innocent Spouse Status. Divorce frees you from tax debt your spouse incurs after your marriage.

Do you get more taxes back if you file separately?

Separate tax returns may give you a higher tax with a higher tax rate. The standard deduction for separate filers is far lower than that offered to joint filers. In 2021, married filing separately taxpayers only receive a standard deduction of $12,550 compared to the $25,100 offered to those who filed jointly.

Who takes deductions when married filing separately?

You may be able to claim itemized deductions on a separate return for certain expenses that you paid separately or jointly with your spouse. When paid from separate funds, expenses are deductible only by the spouse who pays them.

Can married filing separately get stimulus check?

You are eligible for the $1,200 payment if: Your income is under $75,000 (single, or married filing separately) or $150,000 (married filing jointly). You also qualify if you have no income. 2. You and your spouse, if filing jointly, each have a valid Social Security number (one if military).

Do married couples get bigger tax refunds?

Generally, married filing jointly provides the most beneficial tax outcome for most couples because some deductions and credits are reduced or not available to married couples filing separate returns.

Which filing status withholds the most?

Your 2020 W-4 filing status choices are: Head of Household: This status should be used if you are filing your tax return as head of household. Historically this status will have more withholding than Married Filing Jointly.

Can I claim head of household married filing separately?

No, you may not file as head of household because you weren't legally separated from your spouse or considered unmarried at the end of the tax year.

Why do you file separately?

Below are eight reasons to file separately; 1. You have a large amount of Medical Expenses: In order to qualify to deduct medical expenses, they have to total more than 10% of your Adjusted Gross Income (AGI). That means, if your filing jointly and ...

How much medical expenses can I deduct if I file jointly?

That means, if your filing jointly and your Adjusted Gross Income as a couple is $110,000, then the total of your medical expenses has to be at least $11,000. However, if your AGI is $40,000, and your spouse’s is $70,000, then when married filing separately, you could deduct your medical expenses as long as they are at least $4000. 2.

What happens if my spouse doesn't pay his/her student loans?

Your Spouse Owes the Government Money: If your spouse hasn’t paid his/her student loans, have unpaid government loans or overdue tax returns, then the government may hold onto your tax refund if filing jointly. 7.

What do you share with your spouse?

Whether you’ve been married for decades or recently tied the knot, you probably share just about everything with your spouse. Bills, chores, children (or maybe just a pet), a house, the list of what couples share goes on and on.

How much of your income do you need to deduct for employee business expenses?

To deduct employee business expenses, they must total at least 2% of your income. In other words, this 2% will be a much larger number when taking into account your spouse’s income in addition to your own. 3.

Income Tax Filing Status Options

There are actually five different filing status options that tax filers can choose from. You can choose whichever option fits your situation, and you can even change it from one tax year to the next. Here are the different options and some details about each.

Advantages Of Married Filing Separately

Many people wonder when should married couples file taxes separately? What are the benefits of married filing separately? First, this status allows you to file a separate return from your spouse if you are legally separated.

Drawbacks Of Married Filing Separately

When a couple files separate returns, they miss out on many important tax breaks and deductions that joint filers receive. Not only that, but you will also have to report your spouse’s information, including their Social Security number and adjusted gross income (AGI), on your return.

How To Choose The Proper Filing Status For Your Tax Return

Obviously, choosing a filing status is an easy decision in some cases. If you are unmarried and do not provide care or living expenses for anyone else, then you will use the single filing status. You will want to use the head of household status if you are unmarried and provide care or living expenses for a legal dependent or parent.

The Bottom Line

The IRS offers five different filing status options, and choosing between them can sometimes be difficult. If you are married, then you can choose to file jointly or separately. Filing jointly almost always provides the bigger tax benefit, although there are a few specific circumstances that might make you consider filing separately.

When should married couples file separately?

Generally, married couples should only file separately in a few limited situations. When one spouse has much lower income, but high itemized deductions, this is when it usually makes the most sense to file separately. By filing jointly, the couple’s gross income might be too high to claim those deductions.

Are you penalized for married filing separately?

So, is it better to file jointly or separately? Do you get a tax penalty for filing separately? Technically, no, you are not penalized for filing separately. However, in practice, you are penalized in a way. You are not allowed to take advantage of many tax credits available to those filers who choose to file jointly.

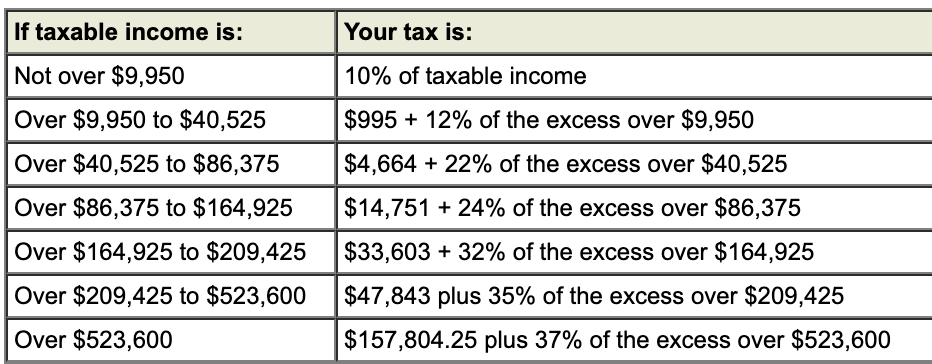

What is the MFS bracket for singles?

These MFS brackets are the same as those that apply to single taxpayers with one major exception. The 35% tax bracket covers income up to $518,400 for single taxpayers, but those who are married and file separately hit the highest tax bracket of 37% at incomes of just $311,025—a difference of over $200,000.

Can you claim one child if you have two children?

Each of you can claim one child if you have two children, or one of you could claim two or three if you have four children, leaving the other dependents for the other spouse. The IRS will award the dependent to the parent with whom the child lived most often during the tax year if the agency must decide the issue.

Can married filing separately be filed separately?

Married taxpayers can file joint tax returns together, or they can file separate returns, but the "married filing separately" (MFS) status provides fewer tax benefits and is considered to be the least beneficial. But there are some advantages to this filing status, too, depending on your personal situation and where you live.

Can you claim standard deductions if you file separately?

Some tax deductions can become out of reach simply because both spouses must claim the standard deduction when they file separately, or they must both itemize their deductions unless one of them is eligible to file as head of household. 4

Is the IRS jointly and severally liable for taxes?

Both spouses are "jointly and severally liable" for the accuracy of a jointly filed tax return, and they're also jointly and severally liable for any resulting taxes on that return. This means the IRS can collect tax debts and penalties from each of you, and both of you are equally responsible for any errors or omissions on the return. 2

Can you claim dependents on taxes if you are married?

No two taxpayers can claim the same dependent unless they're married and file a joint return. Married taxpayers who are parents and who file separately must decide which of them is going to claim their child as a dependent for various tax breaks. 7

Can you file jointly if you are divorced?

You’re Getting Divorced or Are Separated. Divorce is often complicated and filing jointly may not be in your best interest. In addition to skirting liability issues, by filing separately you avoid a joint tax bill or a joint refund. If you have a refund coming, it will be direct-deposited into an account you specify.

What is the standard deduction for married filing separately?

The standard deduction for the Married Filing Separately is $12400.

What is the form for married filing separately?

Married Filing Separately, Single and Head of Household are considered as separate tax returns and the required tax return form is Form 1040X.

What is 50% of the exemption amount?

Premium Tax Credit, Earned Income Tax Credit, Adoption, Education, Child Care, may be limited or may not be allowed. The deduction on capital losses is just $1500 which is half of the allowable deduction on a Married Filing Joint tax return.

Who can file MFS separately?

Who can File MFS – Married Filing Separately? A married couple can file their tax returns separately by disclosing their income on a separate tax returns, it means both the spouses will show their income and claim their exemptions, deductions credits separately by choosing Married Filing Separately status.

Can I claim medical expenses based on my AGI?

If you could claim standard deduction, your basic standard deduction is 50% on the allowable amount of Married Filing Joint tax return. If your AGI- Adjusted Gross Income is lower to Married Filing Joint tax return, then you can claim your complete eligible medical expenses based on your AGI.

Can I claim my spouse's exemption on my taxes?

You can claim your spouse exemption if she does not have any gross income , not filing her tax returns or she is not being claimed on another person’s tax return.

Can I claim my IRA contributions?

You might not be able to claim your contributions towards IRA – Individual Retirement Account, if you or your spouse were under the cover by your employer provided retirement plan for the tax year. Your deductions can be eliminated or reduced if your income is crossing certain thresholds.

Why do couples file separately?

One of the most common reasons why some couples file separately is to limit their liability for the other spouse's tax errors. "In situations where there is a lack of trust between spouses, typically due to business activities or tax positions being taken on a tax return, ...

Why do people file taxes separately?

Reasons To File Separately. 1. You earn the same income as your spouse. There are some situations where married couples filing separately can come out ahead. The way the tax brackets are calculated, some high-income couples may end up with lower tax rates if they file separately, says Greene-Lewis.

How much is the standard deduction for 2020?

Now that the standard deduction is so high, however – $24,800 for married couples filing joint ly and $12,400 for single taxpayers and married individuals filing separately in 2020 – few people itemize their deductions. If one spouse itemizes their deductions, the other spouse has to itemize, too.

Why do you file jointly?

Reasons to File Jointly. 1. You may get a lower tax rate. In most cases, a married couple will come out ahead by filing jointly. "You typically get lower tax rates when married filing jointly, and you have to file jointly to claim some tax benefits," says Lisa Greene-Lewis, a CPA and tax expert for TurboTax. "You need to consider your tax rate, ...

How much can you deduct for medical expenses?

For example, if you itemize, you can deduct unreimbursed medical expenses that exceed 7.5% of your adjusted gross income. If one spouse has a lot of medical expenses and the lower income, filing separately may make it easier to cross the 7.5% income threshold to deduct the expenses.

When will married couples file taxes in 2021?

Jan. 29, 2021, at 9:21 a.m. There are some situations where married couples filing separately can come out ahead. (Getty Images) Married couples have a choice to make at tax time: They can file their income-tax returns jointly or separately. Most married people automatically file joint returns, but there are some situations where filing separately ...

Can you claim dependent care credit if you are separated?

In most cases you can't claim the dependent-care credit if you file separately, but if you're legally separated or living apart from your spouse, you may still be able to file separately and claim the credit, says Revels. Also, your child tax credit and capital loss deduction limit will be half the amount it would be on a joint return, he says.

Can you file taxes jointly if you are married?

One spouse might be held responsible for all the tax due — even if the other spouse earned all the income. If either spouse doesn’t agree to file jointly, then both spouses must file separately .

Is it better to file married filing jointly or separately?

When it comes to being married filing jointly or married filing separately, you’re almost always better off married filing jointly (MFJ), as many tax benefits aren’t available if you file separate returns. Ex: The most common credits and deductions are unavailable on separate returns, like:

Can I file married filing separately?

Married filing separately (MFS) might benefit you if you have to use the Alternative Minimum Tax (AMT) on a joint return. However, this is only true if only one spouse is liable on a separate return. Some other reasons people file separate returns are: For non-tax reasons, such as maintaining separate finances.

Can a spouse with lower income file a separate tax return?

Because the spouse with the lower income can qualify for tax deductions like a medical expense deduction only by filing a separate return. For state tax reasons. Ex: Filing separate state returns will significantly cut your state tax bill, and your state makes you file using your federal filing status.