Reasons to File Jointly

- You may get a lower tax rate. In most cases, a married couple will come out ahead by filing jointly. ...

- You earn more credits and deductions. If you’re married, you’re only eligible for certain tax breaks if you file a joint return. ...

- You can contribute to a Roth IRA.

How long must you be married before filing jointly?

The Internal Revenue Service has no official "waiting period" between when you get married and when you're allowed to begin filing joint tax returns. Instead, it all depends on the timing of your wedding compared with the end of the tax year. Depending on when you get married, you might have to wait a year before filing jointly.

What happens if I file taxes married jointly?

- Employment income Remuneration Remuneration is any type of compensation or payment that an individual or employee receives as payment for their services or the work that they do for an ...

- Commission income

- Property income (rent, interest, dividends, and royalties)

- Capital gains income (sale of a property, sale of financial assets)

What credits do I Lose when filing Married Filing Separately?

What Credits Do I Lose When Filing Married Filing Separately?

- Identify Credits You'll Lose. The married filing separately earned income credit is non-existent. ...

- Justify Some Lost Credits. If you're married, the IRS recommends calculating your tax return by using married filing jointly and married filing separately statuses to determine your highest tax benefit.

- 2018 Tax Law. ...

- 2017 Tax Law. ...

What is the standard deduction for Married Filing Jointly?

- If you are age 65 or older, your standard deduction increases by $1,750 if you file as Single or Head of Household. ...

- If you are Married Filing Jointly and you OR your spouse is 65 or older, your standard deduction increases by $1,400. ...

- As Qualifying Widow (er) it increases by $1,400 if you are 65 or older. ...

What are the tax benefits of married filing jointly?

What are the advantages of married filing jointly?You have a higher standard deduction. If you file separately, you only get a $12,000 standard deduction. ... You get more tax credits. ... You can save time. ... Filing jointly is less complicated.

Is it better to file separately or jointly?

When it comes to being married filing jointly or married filing separately, you're almost always better off married filing jointly (MFJ), as many tax benefits aren't available if you file separate returns. Ex: The most common credits and deductions are unavailable on separate returns, like: Earned Income Credit (EIC)

Do you get a bigger refund filing jointly or separately?

A joint return will usually result in a lower tax liability (owed federal taxes) or a bigger tax refund than two separate returns. However, there are a few reasons or benefits as to why you (and your spouse) might want to file separate tax returns: You will be responsible for only your tax return.

When should married couples file separately?

Though most married couples file joint tax returns, filing separately may be better in certain situations. Couples can benefit from filing separately if there's a big disparity in their respective incomes, and the lower-paid spouse is eligible for substantial itemizable deductions.

Do married couples get bigger tax refunds?

Advantages of filing jointly The IRS gives joint filers one of the largest standard deductions each year, allowing them to deduct a significant amount of their income immediately. Couples who file together can usually qualify for multiple tax credits such as the: Earned Income Tax Credit.

Does married couple get more tax return?

Generally, married filing jointly provides the most beneficial tax outcome for most couples because some deductions and credits are reduced or not available to married couples filing separate returns.

How do I get the biggest tax refund?

Maximize your tax refund in 2021 with these strategies:Properly claim children, friends or relatives you're supporting.Don't take the standard deduction if you can itemize.Deduct charitable contributions, even if you don't itemize.Claim the recovery rebate if you missed a stimulus payment.More items...•

How do you get a higher tax refund?

5 Hidden Ways to Boost Your Tax Refund: Rethink Your Filing Status (Part 1)Rethink your filing status. ... Embrace tax deductions. ... Maximize your IRA and HSA contributions. ... Remember, timing can boost your tax refund. ... Become tax credit savvy.

What is the best filing status for married couples?

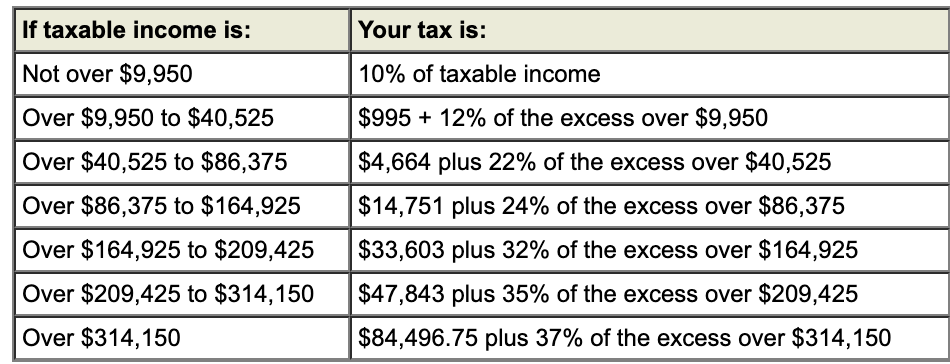

Filing joint typically provides married couples with the most tax breaks. Tax brackets for 2020 show that married couples filing jointly are only taxed 10% on their first $19,750 of taxable income, compared to those who file separately, who only receive this 10% rate on taxable income up to $9,875.

What are the disadvantages of married filing separately?

As a result, filing separately does have some drawbacks, including:Fewer tax considerations and deductions from the IRS.Loss of access to certain tax credits.Higher tax rates with more tax due.Lower retirement plan contribution limits.

Can I pay my wife to avoid tax?

Hiring your spouse can result in substantial tax savings, but only if you pay your spouse solely, or mainly, with tax-free employee fringe benefits instead of taxable wages. The IRS doesn't require you to pay your spouse any W-2 wages.

What is the 2021 standard deduction?

$12,5502021 Standard Deductions $12,550 for single filers. $12,550 for married couples filing separately. $18,800 for heads of households. $25,100 for married couples filing jointly.

What is married filing jointly?

Married filing jointly for tax purposes refers to the filing status in the U.S. for a married couple that is married as of the end of a tax year. Married couples can access distinct tax treatment that can be beneficial when filing under married filing jointly status. Married couples can record each of their respective incomes, benefits, deductions, ...

What is the role of the IRS in Canada?

In the United States, the Internal Revenue Service (IRS) is responsible for the collection of taxes and for enforcing tax laws. The Canadian counterpart is known as Canada Revenue ...

Why is Schedule A attached to Form 1040?

The reason is that there are additional tax benefits and deductions. Schedule A Schedule A is an income tax form that is used in the United States to declare itemized deductions.It is attached to Form 1040 for taxpayers that pay annual income taxes.

Can a spouse file a joint tax return?

Both spouses agree to file a joint tax return. The definition of either being married, legally separated, or divorced depends on other factors as well. For example, a couple is considered unmarried if they’ve lived apart for a period longer than six months.

Is it better to file jointly or separately?

However, if both spouses earn a significant amount of income, the advantages of filing jointly as a married couple are minimized, and it is more advantageous to file separately.

Can married couples file as single individuals?

that married couples can qualify for that do not apply to taxpayers who file as a single individual. Joint tax returns can provide benefits of a larger tax refund or a lower total tax liability.

Can a married couple file jointly?

A married couple can file jointly if the following conditions are met: The married couple was married as of the last day of the tax year . Therefore, as of December 31 of the previous year, the married status of the couple applies to the whole year. As an example, if a couple gets married on December 30, under tax law, ...

What happens if my spouse reports false tax returns?

If your spouse has intentionally reported false numbers, the IRS will see you as a partner in crime. 3. You or your spouse want to claim medical debt as a deduction.

How much is the standard deduction if you file separately?

If you file separately, you only get a $12,000 standard deduction. Filing jointly doubles that amount to $24,000. Yeah, that’s right. We said $24,000! Most tax filers can substantially lower their taxable income with that.

Is filing taxes jointly the same as filing as single?

Filing your taxes jointly isn’t that different from filing as single or head of household. You and your spouse still have to report your income and list deductions and credits. The biggest difference is that you’ll choose married filing jointly as your filing status instead of the others.

Do you have to file jointly if you are married?

Married filing jointly (or MFJ for short) means you and your spouse fill out one tax return together. Now, don’t get us wrong: You don’t have to file jointly. You could file separately. But it’s rare (like four-leaf clover rare) to find yourself in a situation in which filing separately is better than jointly.

Can you deduct medical expenses if you file jointly?

Basically, the more income you make, the less you can deduct from your medical expenses. And sometimes you make so much you can’t deduct anything. So if your spouse makes a lot more than you do and you file jointly, your medical deduction will be a lot less than if you file separately.

Can my spouse file taxes?

1. Your spouse isn’t paying their taxes. Your spouse may play “catch me if you can” with the IRS and not pay their taxes. We don’t recommend this but, in that case, you should definitely file your taxes. 2. You don’t know if your spouse is honestly reporting their income or deductions.

Can you file jointly if you are a dependent?

Filing jointly is less complicated. When you file separately, you have to follow certain rules that can make your day a little thornier. For example, only one of you can claim your child as a dependent. On top of that, you’ll have to agree on whether you’ll take the standard deduction or itemize. Yep.

Why do you file jointly?

Reasons to File Jointly. 1. You may get a lower tax rate. In most cases, a married couple will come out ahead by filing jointly. "You typically get lower tax rates when married filing jointly, and you have to file jointly to claim some tax benefits," says Lisa Greene-Lewis, a CPA and tax expert for TurboTax. "You need to consider your tax rate, ...

Why do couples file separately?

One of the most common reasons why some couples file separately is to limit their liability for the other spouse's tax errors. "In situations where there is a lack of trust between spouses, typically due to business activities or tax positions being taken on a tax return, ...

How much is the standard deduction for 2020?

Now that the standard deduction is so high, however – $24,800 for married couples filing joint ly and $12,400 for single taxpayers and married individuals filing separately in 2020 – few people itemize their deductions. If one spouse itemizes their deductions, the other spouse has to itemize, too.

How much can you deduct for medical expenses?

For example, if you itemize, you can deduct unreimbursed medical expenses that exceed 7.5% of your adjusted gross income. If one spouse has a lot of medical expenses and the lower income, filing separately may make it easier to cross the 7.5% income threshold to deduct the expenses.

Why do people file taxes separately?

Reasons To File Separately. 1. You earn the same income as your spouse. There are some situations where married couples filing separately can come out ahead. The way the tax brackets are calculated, some high-income couples may end up with lower tax rates if they file separately, says Greene-Lewis.

When will married couples file taxes in 2021?

Jan. 29, 2021, at 9:21 a.m. There are some situations where married couples filing separately can come out ahead. (Getty Images) Married couples have a choice to make at tax time: They can file their income-tax returns jointly or separately. Most married people automatically file joint returns, but there are some situations where filing separately ...

Can you claim dependent care credit if you are separated?

In most cases you can't claim the dependent-care credit if you file separately, but if you're legally separated or living apart from your spouse, you may still be able to file separately and claim the credit, says Revels. Also, your child tax credit and capital loss deduction limit will be half the amount it would be on a joint return, he says.

How does marriage determine tax filing status?

How Marital Status Determines Tax Filing Status. Your marriage status for tax purposes is determined by your marriage status on the last day of the Tax Year. If you were married on December 31, then you are considered to have been married all year.

When do you file a joint tax return?

You and your spouse both agree to file a joint tax return. If one spouse is a nonresident alien (or dual-status alien married to a U.S. citizen or resident alien) on December 31, you can choose to file a joint return.

When are 2020 taxes due?

Thus, you and your spouse have the option to e-File your 2020 Tax Return - due on April 15, 2021 - with the filing status of Married Filing Jointly or Married Filing Separately. For the majority of married couples the Married Filing Joint status is more tax advantageous.

Do you have to file taxes jointly if you are married?

Both parties are responsible for each other's tax liability. Therefore, if you choose to file as married filing jointly your spouse will be responsible for any tax, penalties, and interest that arises from that joint tax return, even if you reported no income on the return. Tax Tip: However, if you do not believe you are responsible for some ...

Is married filing joint or married filing separately better?

For the majority of married couples the Married Filing Joint status is more tax advantageous. However, there are good reasons when you should use the Married Filing Separate filing status as it might be more beneficial to your specific tax situation.

Can a spouse file a joint return for a deceased spouse?

There is an exception in the case of a deceased spouse. A representative for the decedent can a mend a joint return (as filed by the surviving spouse) to a separate return for the decedent for up to 1 year after the due date of the return, including any tax extension that was filed.

Do same sex couples file separately?

Legally married same-sex couples are required to file as either Married Filing Jointly or as Married Filing Separately, just as opposite-sex married couples are required to do. Due to a Treasury Department ruling on August 29, 2013, same-sex couples that have been legally married must file as Married Filing Jointly or as Married Filing Separately ...

What is the standard deduction for married filing separately?

In 2020, married filing separately taxpayers only receive a standard deduction of $12,400 compared to the $24,800 offered to those who filed jointly.

What happens if you file taxes separately?

Consequences of filing your tax returns separately 1 In 2020, married filing separately taxpayers only receive a standard deduction of $12,400 compared to the $24,800 offered to those who filed jointly. 2 If you file a separate return from your spouse, you are automatically disqualified from several of the tax deductions and credits mentioned earlier. 3 In addition, separate filers are usually limited to a smaller IRA contribution deduction. 4 They also cannot take the deduction for student loan interest. 5 The capital loss deduction limit is $1,500 each when filing separately, instead of $3,000 on a joint return.

Does the above article give tax advice?

The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Can married couples file separately?

Married couples have the option to file jointly or separately on their federal income tax returns. The IRS strongly encourages most couples to file joint tax returns by extending several tax breaks to those who file together.

Can you file taxes jointly if you are married?

One spouse might be held responsible for all the tax due — even if the other spouse earned all the income. If either spouse doesn’t agree to file jointly, then both spouses must file separately .

Is it better to file married filing jointly or separately?

When it comes to being married filing jointly or married filing separately, you’re almost always better off married filing jointly (MFJ), as many tax benefits aren’t available if you file separate returns. Ex: The most common credits and deductions are unavailable on separate returns, like:

Can I file married filing separately?

Married filing separately (MFS) might benefit you if you have to use the Alternative Minimum Tax (AMT) on a joint return. However, this is only true if only one spouse is liable on a separate return. Some other reasons people file separate returns are: For non-tax reasons, such as maintaining separate finances.

Can a spouse with lower income file a separate tax return?

Because the spouse with the lower income can qualify for tax deductions like a medical expense deduction only by filing a separate return. For state tax reasons. Ex: Filing separate state returns will significantly cut your state tax bill, and your state makes you file using your federal filing status.