Medicare Advantage vs. Medicare Supplement

| Medicare Advantage | Medicare Supplement | |

| Overall | Private health plans. Bundled coverage i ... | Private health plans. Supplemental cover ... |

| Drug coverage | Yes, usually included. | No, not part of plans. Must be purchased ... |

| Out-of-pocket costs | Usually low monthly premiums. Often, hig ... | Higher monthly premiums but lower costs ... |

| Provider networks | Yes, with most plans. | No. Beneficiaries can see any provider i ... |

What are the pros and cons of Medicare Advantage plan?

Pros and Cons of Medicare Advantage. Medicare Advantage plans provide expanded coverage beyond what Original Medicare covers, including vision and dental. But there are some limitations that come with opting for a Medicare Advantage plan, so it’s important to figure out if it’s a right fit for your needs. Get a Free 2022 Open Enrollment Guide.

Does Medicare Advantage offer much advantage?

Medicare Advantage plans must offer everything Original Medicare covers except hospice care, which is still covered by Medicare Part A. Some Medicare Advantages plans offer extra benefits, such as prescription drug coverage, routine dental, routine vision, and wellness programs.

What are disadvantages of Medicare Advantage?

For example, Aetna recently began requiring prior authorization for cataract surgeries across all its health plans — including Medicare Advantage. Tens of thousands of Americans covered by Aetna ...

What is the difference between Medicare Supplement and Medicare Advantage?

With most Medicare Supplement plans, you can see any doctor who accepts Medicare assignment. Some Medicare Supplement plans may cover emergency medical care when you’re out of the country. Medicare Advantage plans can include prescription drug coverage, while Medicare Supplement plans sold today can’t.

What are the advantages of having a Medicare Advantage plan?

Medicare Advantage plans can serve as your “one-stop” center for all your health and prescription drug coverage needs. Most Medicare Advantage plans combine medical and Part D prescription drug coverage. Many also coordinate the delivery of added benefits, such as vision, dental, and hearing care.

What are the advantages and disadvantages of Medicare Advantage Plans?

Medicare Advantage offers many benefits to original Medicare, including convenient coverage, multiple plan options, and long-term savings. There are some disadvantages as well, including provider limitations, additional costs, and lack of coverage while traveling.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

What is not covered by Medicare Advantage Plans?

Most Medicare Advantage Plans offer coverage for things Original Medicare doesn't cover, like fitness programs (like gym memberships or discounts) and some vision, hearing, and dental services. Plans can also choose to cover even more benefits.

Can you switch back to Medicare from Medicare Advantage?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

What is the difference between Original Medicare and Medicare Advantage?

Original Medicare covers inpatient hospital and skilled nursing services – Part A - and doctor visits, outpatient services and some preventative care – Part B. Medicare Advantage plans cover all the above (Part A and Part B), and most plans also cover prescription drugs (Part D).

What are the top 3 Medicare Advantage plans?

The Best Medicare Advantage Provider by State Local plans can be high-quality and reasonably priced. Blue Cross Blue Shield, Humana and United Healthcare earn the highest rankings among the national carriers in many states.

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

Do Medicare Advantage plans have deductibles?

Medicare plans have deductibles just like individual or employer health insurance plans do. Both Original Medicare and, typically, Medicare Advantage Plans, require you to meet a deductible—an amount you pay for healthcare or for prescriptions—before your healthcare plan begins to pay.

Does Medicare cover eye exams?

Medicare doesn't cover eye exams (sometimes called “eye refractions”) for eyeglasses or contact lenses. You pay 100% for eye exams for eyeglasses or contact lenses.

Do you still pay Medicare Part B with an Advantage plan?

You continue to pay premiums for your Medicare Part B (medical insurance) benefits when you enroll in a Medicare Advantage plan (Medicare Part C). Medicare decides the Part B premium rate. The standard 2022 Part B premium is estimated to be $158.50, but it can be higher depending on your income.

Is there a Medicare plan that covers everything?

Plan F has the most comprehensive coverage you can buy. If you choose Plan F, you essentially pay nothing out-of-pocket for Medicare-covered services. Plan F pays 100 percent of your Part A and Part B deductibles, coinsurance amounts, and excess charges.

What is Medicare Advantage Fitness?

One Medicare Advantage fitness program is called SilverSneakers. which may provide you with unlimited access to gyms in your area as well as fitness classes. According to the U.S. National Library of Medicine, exercise for seniors can help you build strength, avoid falls, and keep your body limber.

What is copayment in Medicare?

A copayment is a set dollar amount, for example $10, that you pay to visit your primary care physician. On the other hand, the cost sharing structure of Original Medicare is coinsurance, making you responsible for example of 20% of the Medicare approved amount for a service.

Does Medicare cover hearing loss?

Despite this, Original Medicare generally doesn’t cover routine hearing coverage.

Does Medicare cover dental care?

Original Medicare generally doesn’t cover dental care, except in certain extreme and emergency situations. However, you may be able to find a Medicare Advantage plan that covers routine dental care such as cleanings, x-rays, fillings, and dentures. A Medicare Advantage plan is the only way to get routine dental care through Medicare.

Does Medicare Advantage cover prescriptions?

There is no separate premium for your Medicare Advantage prescription drug coverage; you pay for it in your general monthly Medicare Advantage premium. You may pay a separate prescription drug deductible, for example, $250 a year. You also will generally pay something when you fill a prescription, for example a $15 copayment for a generic ...

Does Medicare cover prescription drugs?

Original Medicare generally doesn’t cover most prescription drugs you take at home. However, most Medicare Advantage plans include coverage for prescription drugs you take as an inpatient, outpatient, and at home. There is no separate premium for your Medicare Advantage prescription drug coverage; you pay for it in your general monthly Medicare ...

Does Medicare have an out of pocket maximum?

Medicare Advantage out of pocket maximums. Original Medicare has no out of pocket maximum. That means that if you get a complicated surgery, have a prolonged hospital stay, or need frequent outpatient procedures or doctor visits, you may be billed for tens of thousands of dollars.

Medicare Advantage coverage

A key benefit is that Medicare Advantage plans are simpler, serving as "all in one" alternatives to Original Medicare. These bundled policies encompass Medicare Part A (inpatient and hospitalization), Part B (outpatient care) and usually Part D (prescription drug coverage) within the same plans.

Medicare Advantage costs

Medicare Advantage plans often charge little or nothing in monthly premiums. But like Original Medicare, Medicare Advantage requires that beneficiaries pay Part B premiums, $148.50 a month per beneficiary in 2021. Some of the plans, however, provide financial assistance to help beneficiaries meet the Part B premium.

Medicare Advantage access to care

Another downside is that policyholders can be limited to fewer doctors and hospitals. Most Medicare Advantage plans have financial incentives encouraging beneficiaries to use providers within their network, except in emergency situations. In contrast, Original Medicare provides access to any provider that accepts Medicare.

Medicare Advantage plan types

There are generally five types of Medicare Advantage plans, though health maintenance organizations (HMOs) and preferred provider organizations (PPOs) are the most prevalent:

Medicare Advantage vs. Original Medicare

The Medicare program covers 62 million disabled individuals and seniors 65 and older, nearly 42% of whom are enrolled in Medicare Advantage plans, policies provided by private insurance companies that contract with the Medicare program.

Medicare Advantage vs. Medicare Supplement

Medicare Advantage and Medicare Supplement (Medigap) plans are both provided through private insurance companies.

Medicare Advantage and employer health insurance

Beneficiaries can have both Medicare and employer-sponsored health insurance at the same time. But the size of the employer determines primary and secondary coverage.

What are the advantages and disadvantages of Medicare?

The Advantages and Disadvantages of Medicare. The advantages of Medicare include cost savings and provider flexibility. Among the disadvantages are potentially high out-of-pocket costs. Once you qualify for Medicare, you have several options when it comes to enrolling in a plan. You can enroll in Original Medicare, ...

What are the advantages of Medicare Part C?

Although Medicare Advantage plans must provide the same benefits as Original Medicare , some of them provide additional benefits such as dental, vision and prescription drug coverage.

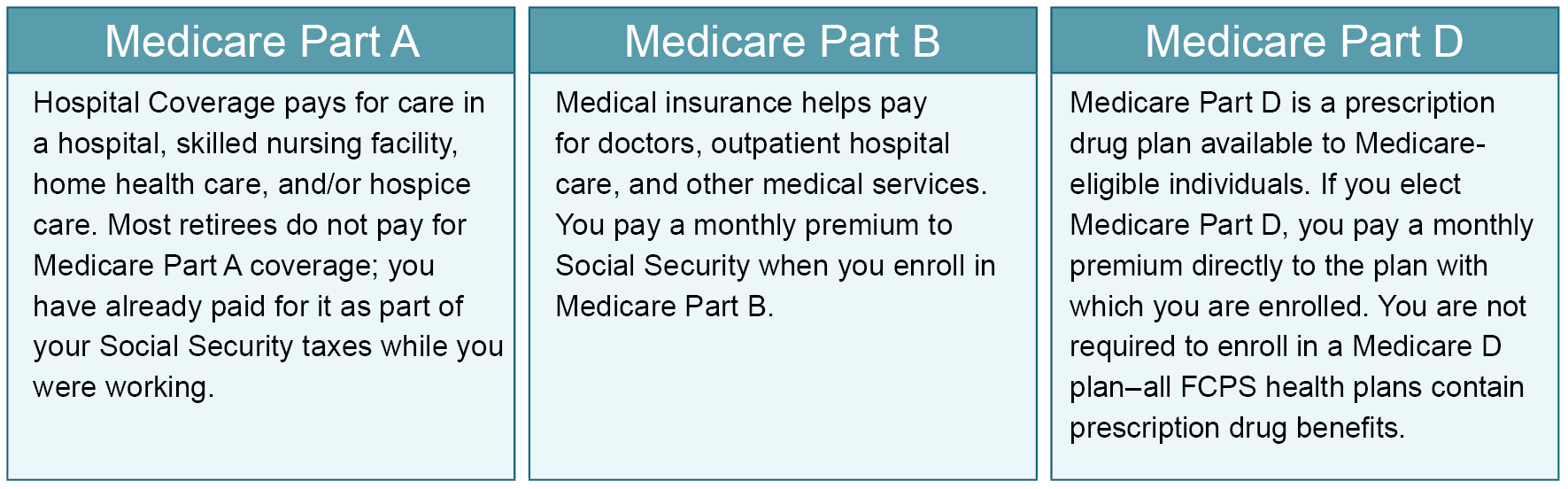

What is Medicare Part A?

Medicare Part A (hospital insurance) covers inpatient care, including care received in a hospital and skilled nursing facility.

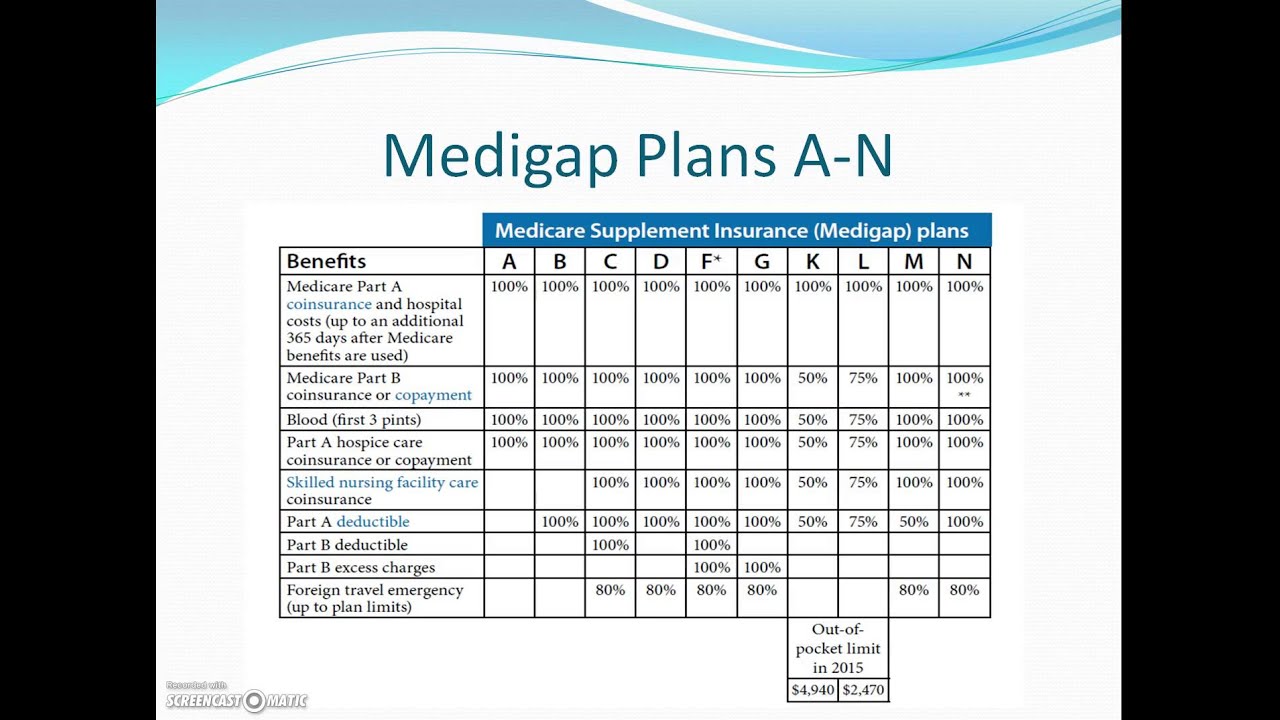

How many Medigap plans are there?

Numerous plan options. In most states, there are 10 standardized Medigap plans to choose from, each providing a different level of basic benefits. This means there are plenty of options to ensure you find a Medigap plan that provides the level of coverage you need.

How much is the deductible for Medicare 2021?

If you became eligible for Medicare. + Read more. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

How much is Medicare Part A in 2021?

Medicare Part A is usually premium free for most people, and the standard premium for Part B starts at $148.50 per month in 2021 (but can be higher based on your income). Medicare offers a wide range of flexibility when it comes to choosing a healthcare provider.

When will Medicare plan F and C be available?

* Plan F and Plan C are not available to Medicare beneficiaries who became eligible for Medicare on or after January 1, 2020. If you became eligible for Medicare.

What Is Medicare Advantage?

Medicare Advantage is also known as Medicare Part C. This program was created in the 1990s to allow people to choose a private insurer for their Medicare coverage. A Part C plan is a contract between the Medicare program and a private insurance company.

How Do Medicare Advantage Plans Work?

Medicare Advantage plans close the gaps in Original Medicare with small copays and coinsurance. For example, instead of paying the Part A deductible ($1,408 for 2020), you would pay a smaller daily copay for each day that you are in the hospital.

What Are the Advantages of Medicare Advantage Over Original Medicare?

Part C plans have a number of advantages over Original Medicare, the most important one being the out-of-pocket maximum protection provided. With this benefit, people can have peace of mind knowing that they won’t be faced with out of control medical bills.

What Are the Advantages of Medicare Advantage Over Medicare Supplement Insurance?

The biggest advantage of Part C plans over Medicare Supplement insurance (or Medigap, as it’s also called) is cost. Every Medigap plan has a monthly premium. This premium will tend to rise over time. Medicare Advantage plans have lower premiums. In fact, they often have no premium requirement at all.

What Are the Disadvantages of Medicare Advantage Compared to Medigap?

There are two potential drawbacks to Medicare Advantage when compared to Medigap. First, Medigap plans do not require you to see a specific network of doctors. Instead, they give you the same flexibility as Original Medicare. You won’t need to get referrals either, which means that Medigap plans offer more freedom than Medicare Advantage plans.

How to Know What Type of Plan Is Right for You

How much Medicare coverage will be depends on a number of factors. This guide covers costs from 2022. Read More

Why do people choose Medicare Advantage?

1. Benefits. According to laws in the United States, all Medicare Advantage plans are required to provide the same benefits as Original Medicare Parts A and B – at least.

What is Medicare Advantage Plan?

A Medicare Advantage plan, or Medicare Part C, is a plan that private insurance companies sell to those who are eligible for Medicare coverage and already enrolled in Original Medicare Parts A and B.

Is Medicare Part C private or public?

Convenience. Medicare Part C insurance plans are sold by private insurance providers across the country. All Medicare Advantage plans bundle your benefits into one plan which includes hospital, medical care, extra benefits, and prescription drug coverage, if applicable.

Does Medicare Advantage cover urgent care?

Even if your plan requires that you use health care providers and suppliers that are within your plan’s network, Medicare Advantage plans must provide coverage for any emergency or urgent care you need anywhere in the United States. 4.