What are the benefits of renters insurance for landlords?

- Mitigates the risk of conflict. If a tenant’s belongings are stolen or damaged, their renters insurance will generally cover the loss, whereas a tenant without renters insurance may look to ...

- Reduces the risk of damage caused by a tenant’s pets. A renters insurance policy should cover any damage done by a tenant’s pet.

- Provides peace of mind. ...

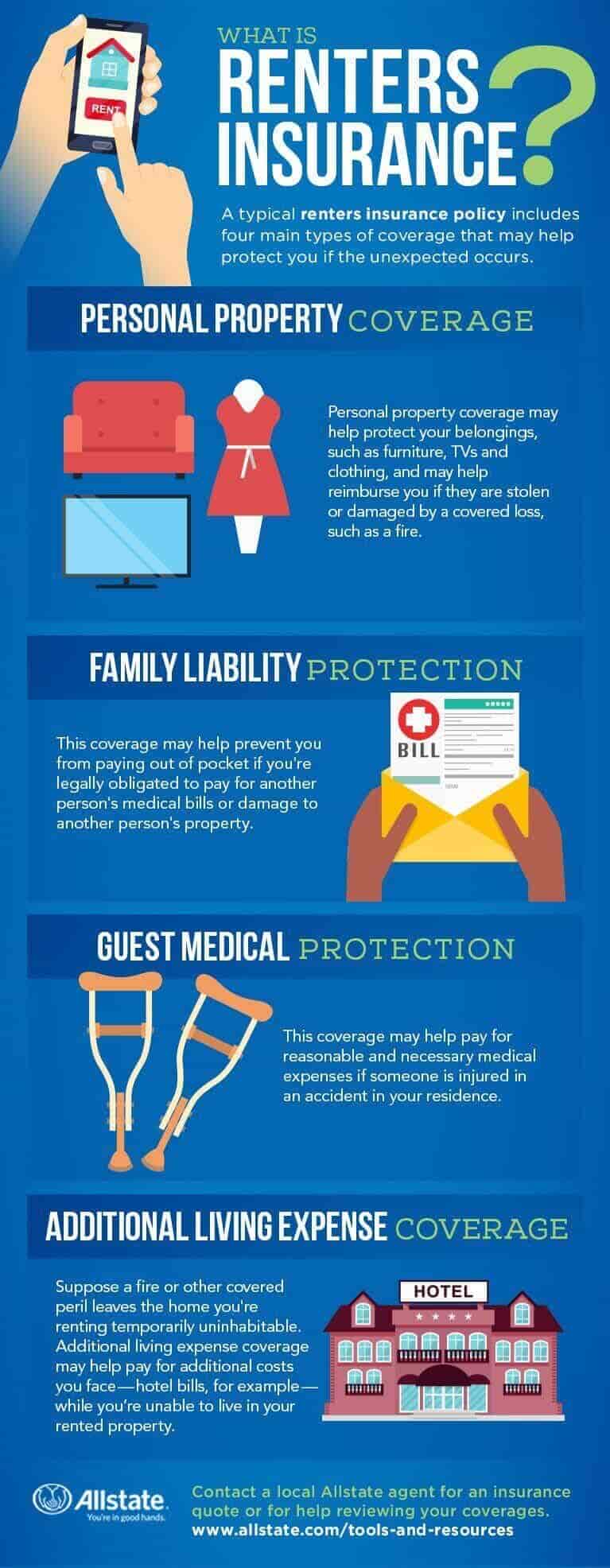

What is renters insurance and what does it cover?

What Is Renters Insurance? Renters insurance is a type of property insurance that protects your possessions if they’re damaged, vandalized or stolen while you’re renting. It covers you from unexpected catastrophes like fires, electrical surges, sewer backups and explosions.

Is it worth getting renters insurance?

Yes, renters insurance is worth it. Given its relatively low cost, the protection it offers makes it a smart investment for any tenant. Find out more about what coverage it gives you and how you can get the most out of your policy. Why is renters insurance worth it? Why is renters insurance important for both landlords and tenants?

Why do landlords require renters insurance?

- Tenants File Liability Claims on Their Policy, Not Yours. ...

- Additional Insured. ...

- Keeps Your Landlord Insurance Premiums Low. ...

- Tenants File Property Claims on Their Policy, Not Yours. ...

- Avoid Costly Lawsuits. ...

- Pays Tenants to Live Elsewhere After a Disaster. ...

Why is it important to get renters insurance?

- Geico: Renters who want to handle their policies digitally may want to consider Geico. ...

- Progressive: If you are looking for a highly customizable policy, Progressive could be a good choice. ...

- State Farm: Renters looking for an in-person agency experience might want to get a quote from State Farm. ...

What are the three things covered by renters insurance?

Renters insurance typically includes three types of coverage: Personal property, liability and additional living expenses.

Is renters insurance really worth?

If you're a tenant, purchasing a renters insurance policy is almost always worth it, even if it's not required by your landlord. For an affordable price, renters insurance will protect you against catastrophic damage to your property and potential legal liabilities.

What are five things that renter's insurance covers?

Renters insurance covers personal property against specific perilsFire and lightning.Wind and hail.Explosions.Smoke damage.Theft (for property in our outside your home)Vandalism.Water damage from freezing or leaking plumbing and appliances.Mold.More items...•

What are 3 things that renters insurance typically does not cover?

For example, fire, theft, wind, hail, lightning and even volcanic eruption are typically covered. However, renters insurance does not cover floods, earthquakes, sinkholes or other earth movements. Instead, you have to purchase separate or additional coverage to protect your belongings from these threats.

What's a scenario where renters insurance would come in handy?

If your rental property suffers damage from a wildfire, hail, or tornado, the landlord may or may not repair the home damages, but you would need renters insurance to replace your damaged personal property. Keep in mind, as is the case for home insurance, there are exceptions, like flood damage and earthquakes.

What are the average monthly costs for homeowners and renters insurance across the US?

Renters insurance costs by stateStateAverage annual premiumAverage monthly premiumAlaska$125$10Arizona$238$20Arkansas$294$25California$222$1947 more rows•Feb 22, 2022

What are 4 disasters that renters insurance cover?

Tornadoes, fires, hail, and rain and snow damage (non-flooding) are covered by most renters insurance policies. Floods and earth movement (earthquakes and sinkholes) aren't covered by renters insurance. Consider including loss-of-use coverage in your renters policy if you're in a disaster-prone area.

Does renters insurance cover natural disasters?

Property Damage and Loss A natural disaster, such as hail, fire, rain, hail, or wind storm. Standard renters' insurance does not, however, cover all natural disasters. Typical exceptions include earthquakes and floods (in which case you will need to purchase additional coverage, if necessary).

Does Geico renters insurance cover dog bites?

Unfortunately, GEICO renters insurance doesn't cover pet damage to your property. However, if your dog bites someone and causes an injury, your renters insurance liability coverage may help you cover ensuing legal fees.

Does renters insurance cover mice damage?

In almost every home and renters insurance policy, rodents, insects, and vermin are excluded from coverage. Insurance companies consider damage and infestations from these pests as preventable. Beyond that, renters insurance only covers your personal property, not the building or structure you live in.

Does insurance cover lost and stolen phones?

Similar to a warranty, cell phone insurance covers electrical and mechanical failures – but that's where the similarities end. Cell phone insurance also covers if your phone is lost, stolen or damaged — even liquid damage.

How often should you shop around for renters insurance?

every six monthsYou should shop around for renters insurance about two weeks or so before your current policy is set to end or renew to give yourself time to make an informed decision. In general, it's recommended that you shop for insurance quotes every six months for long-lasting policies like car and home insurance.

What is renters insurance?

A renters insurance policy is basically a form of monetary protection for you and your belongings. It includes protection for your personal property, liability coverage, and coverage for additional living expenses (we’ll dive into the details a few scrolls from now). During your apartment search, you’ll discover that many landlords ...

How much does renters insurance cost?

How Much Is Renters Insurance? Don’t get yourself into a tizzy over the cost of renters insurance – it’s quite reasonable! In fact, most renters insurance plans cost an average of $10-$15 a month or a $120-$180 one-time annual payment.

What is personal liability insurance?

Personal liability coverage protects you (the renter) against liability claims and lawsuits by others for injuries acquired in your apartment or damage to other’s property (their apartment).

Does renters insurance cover dogs?

Or say your dog snaps at your neighbor or guest while in your apartment – your renters insurance will likely cover you here, unless they have a specific clause that does not cover injuries caused by your pets (or the policy is breed restrictive – a bummer, I know).

Is renters insurance affordable?

Renters insurance comes at a very affordable cost , and it will give you the coverage and peace of mind that you so desire. Though the cost is minimal, make sure to add this to your monthly rent budget or just pay it in full and consider it a move-in fee. Get with it and get covered, my fellow renters!

Is one insurance company better than another?

One insurance company may be offering you a better deal than another. For instance, you may find that Insurance Company A is offering you a sweet deal with $500,000 in liability coverage for just a tad more money – let’s say for $40 more.

Does landlord insurance cover tenant?

Typically, a property manager or landlord’s insurance policy covers the structure (the apartment building and any additional amenity structures) and the physical property, but it does not cover the tenant or any of the tenant’s belongings. Because of this, it’s best to get your own renters insurance policy in the case of theft, disaster, ...

What does renters insurance cover?

Renter's insurance covers your personal belongings, whether they are in your home, car, or with you while you travel. Your possessions are covered from loss due to theft and other covered losses anywhere you travel in the world.

Why don't renters need renters insurance?

The majority of renters don't purchase renter's insurance, either because they don't think it is necessary or believe they are covered under the landlord's policy. Reasons to purchase renter's insurance include its affordability, the coverage of losses to personal property, it might be required, it provides liability coverage, ...

What is liability coverage?

Liability coverage is also included in standard renter’s insurance policies. This provides protection if someone is injured while in your home or if you (or another covered person) accidentally injure someone. It pays any court judgments as well as legal expenses, up to the policy limit.

What are the perils of a renter's policy?

Renter's policies protect against a surprisingly long list of perils. A standard HO-4 policy designed for renters, for example, covers losses to personal property from perils including: 1 Damage caused by aircraft 2 Damage caused by vehicles 3 Explosion 4 Falling objects 5 Fire or lightning 6 Riot or civil commotion 7 Smoke 8 Theft 9 Vandalism or malicious mischief 10 Volcanic eruption 11 Weight of ice, snow, or sleet 12 Windstorm or hail 13 Damage from water or steam from sources including household appliances, plumbing, heating, air conditioning, or fire-protective sprinkler systems

Do I need insurance for my apartment in 2021?

Updated Jan 7, 2021. If you're renting an apartment or home, you'll need an insurance policy to cover your belongings. Your landlord 's property insurance policy covers losses to the building itself; whether it's an apartment, a house, or a duplex. Your personal property and certain liabilities, however, are covered only through a renter's ...

Do renters insurance policies cover hurricanes?

And renter’s insurance policies don't cover losses caused by your own negligence or intentional acts.

Does landlord insurance cover the grounds?

Your landlord's insurance covers the structure itself and the grounds, but not your belongings. A growing number of landlords require tenants to purchase their own renter's insurance policies and they'll expect to see proof. This could be the landlord's idea, or it could be an "order" from the landlord's insurance company.

What Is Renters Insurance

Renters insurance is a type of insurance policy taken out by tenants who are renting Their living space from a landlord or property management company. Usual living arrangements include apartment complexes, rental homes, or even rental condominiums.

Bundle Savings

Many insurance providers offer discounts for carrying multiple policies through their insurance program. Renters insurance policies generally fall under bundle savings, dramatically reducing monthly and overall premiums depending on how much coverage you need and if your provider offers bundle discounts.

Auto Insurance Discounts

Like bundling, many auto insurance providers offer rental insurance and discounts to policyholders who combine their auto insurance with their renters’ insurance.

Coverage For Your Entire Household

Many renters’ insurance policies extend to the primary policyholder and roommates as long as the stated value of property in the house or apartment matches that of the policy coverage limits.

Off-Premises And Travel Coverage

Traveling is a fun and rewarding way to see the world and experience new food, cultures, and landscapes. Regardless of how you travel, there is always the risk of losing something important such as a camera, misplacing your luggage, or even having your personal property stolen.

Peace Of Mind

Renter’s insurance provides numerous benefits for renters ranging from the reimbursement for losses to pay for temporary housing if they are just placed due to a natural disaster or damage to their principal residence.

Final Thoughts

Although there are many obvious benefits of renter’s insurance policies, hopefully, you can see there are some supplementary benefits that make renters insurance even more attractive to tenants of rental properties.

Why do landlords need renters insurance?

The sixth reason to require renters insurance is that landlords are potentially protected when a tenant’s pets cause property damage to the property of others, or if a pet belonging to a tenant causes an injury to someone else . The last reason for the rental insurance is that it may help to reduce the possibility of a lawsuit if an injury ...

When to mention landlord insurance?

Landlords may mention the landlord rental insurance requirement at the time when landlords and prospective tenants discuss the tenant screening report. The landlord may also decide to wait until the prospective tenant passes the tenant background check.

What is the fifth reason for liability?

Liability also goes along with the fifth reason, which is consistent compliance. Landlords that require tenants to purchase the renters insurance must be consistently compliant. Otherwise, the policy that never happened, or the lapsed policy, whether a renters insurance policy or landlord insurance for rental property, ...

Why is the landlord responsible for replacing the tenant's belongings?

The first reason is that they believe that the landlord is responsible for replacing tenant’s belongings if their possessions are damaged while the tenant resides at the rental property or if their belongings are stolen from the property. Landlords may want to include important information to tenants from sources such as ...

Does landlord insurance cover tenant losses?

Many tenants likely understand the importance of a requirement by landlords that they purchase tenants insurance, that a landlord insurance policy will not cover tenant losses or damage to their possessions. Landlords may, unfortunately, experience some pushback from tenants that believe that a landlord should accept their verbal agreement ...

Does renters insurance cover landlords?

Landlords and tenants are bound by the landlord-tenant laws of their specific state. Landlords have some discretion regarding the terms that they can include in a lease, including a requirement that tenants purchase renters insurance.

Do landlords require tenants to have insurance?

Can Landlords Require Tenants to Comply with Landlord Renters Insurance Requirement? Many states have laws governing the signing of the lease, renting a property, pay rent or quit notices and evictions, but do not specifically require that tenants purchase insurance.

How to Talk to Tenants About Renters Insurance

The best time to discuss the benefits of renters insurance is during the tenant interview process. It is very common for a landlord to build a requirement for renters insurance into a new lease agreement. Feel free to use our resource How to Talk to Tenants About Renters Insurance to help you open up that conversation with tenants.

A Benefit to Tenants (Not Just Landlords)

Many renters forego the added expense of renters insurance as they believe their personal belongings are protected by a landlord’s property and liability insurer. However, a landlord’s insurance policy only covers the building, and it won’t protect the tenants if something happens.

What Does Renters Insurance Cover?

Items stored in a renter’s home including furniture, clothing, electronics, jewelry, and small appliances that aren’t built into the unit.

How to speak with a licensed insurance agent?

Call us at 1-800-841-2964 to speak with a licensed insurance agent or get an online renters insurance quote. The above is meant as general information and as general policy descriptions to help you understand the different types of coverages.

Does replacement cost insurance pay out more?

Replacement cost coverage will cost you more in premiums, but it will also pay out more if you ever need to file a claim.

Does loss of use cover temporary housing?

If necessary, your policy may even pay for your legal defense in these circumstances. Loss of Use/Temporary Housing will cover you if your home or apartment is rendered unlivable by a fire or other disaster. Generally, this coverage provides temporary relocation housing while your residence is repaired or rebuilt.

Can landlords pay for lost possessions?

You can’t assume your landlord will pay for your damaged or lost possessions. In fact, you can probably assume they won’t. You’ll need a renters insurance policy to help recoup your losses. Unfortunately, renters insurance often falls under the radar. Approximately 80% of renters do not carry renters insurance.

Does renters insurance cover car interiors?

Car Interior – Many renters insurance policies also cover possessions that you keep in your car (CDs, books, portable computer equipment). Note that the car’s value itself is not covered, and typically installed stereo equipment (which is often considered “part” of the car’s systems) is not insured either.

Why is renters insurance worth it?

Whether you’re renting a house or an apartment, renters insurance has several benefits that make it well worth getting.

Four major benefits of renters insurance that make it worth it

In addition to the comprehensive coverage listed above, renters insurance offers several other benefits that you might not be aware of:

Why is renters insurance important for both landlords and tenants?

Landlords often require tenants to get renters insurance before they move in. Landlords like it when their tenants have renters insurance for several reasons:

How to make the most of your renters insurance

To make sure that you’re getting the right policy, there are a few things you should bear in mind when you’re buying renters insurance.

When is it not worth it to get renters insurance?

The only time when getting renters insurance isn’t worth it is if you’re already covered under someone else’s policy. Most renters insurance policies automatically cover spouses and immediate relatives, so you probably don’t need renters insurance if you’re married and your spouse already has a policy.

Why should I avoid renters insurance?

One common reason to avoid renters insurance is the cost. “A lot of people are not looking for added expenses these days,” Schneider says. The average cost of renters insurance is $168 a year, or about $14 a month, according to NerdWallet’s rate analysis.

What is the standard renters insurance policy?

A standard renters insurance policy includes liability coverage starting at $100,000, which can pay damages and legal expenses if you’re sued for accidentally injuring someone else or damaging their property. » MORE: The best renters insurance companies. 2. You probably own more than you think.

Does renters insurance cover housing?

Renters insurance can pay for housing after a disaster. “Most policies provide what’s called a ‘loss of use’ or ‘additional living expense’ benefit,” Schneider says. “It pays you if you are forced out of your apartment by a major claim — usually fire or extensive water damage — and you have to stay in a hotel.”.

Does landlord insurance cover you?

1. Your landlord’s insurance won’t cover you. Some landlords require their tenants to have renters insurance, but if yours doesn’t, it’s not because they’ve got you covered. “Many renters [believe] that, since their landlord has insurance, it covers damage to their property. This is not the case,” Wissner-Levy said.