Beyond Stimulus Checks: 5 Little Known Benefits Of The CARES Act

- $300 Deduction for Charitable Donations. When it comes to charitable donations, you can only deduct them on your taxes...

- Eliminated Early Withdrawal Penalties. When you contribute to a 401 (k), you are able to take an immediate deduction of...

- 120-Days of Eviction Protection. If you cannot make rent or...

What is the impact of CARES Act on health plans?

The Coronavirus Aid, Relief, and Economic Security Act (the “CARES Act”), the sweeping coronavirus relief package signed into law by President Trump on March 27, 2020, contains a number of provisions impacting employer-sponsored group health plans. These provisions are generally intended to provide individuals with greater access to health care during the coronavirus pandemic, and many will increase employers’ costs under their self-insured group medical plans.

How your small business can benefit from the CARES Act?

To curb the negative economic impact the coronavirus has had on small businesses, the CARES Act provides businesses with fewer than 500 employees access to $350 billion in loans which are commonly being referred to as payroll protection loans.

Is the CARES Act taxable?

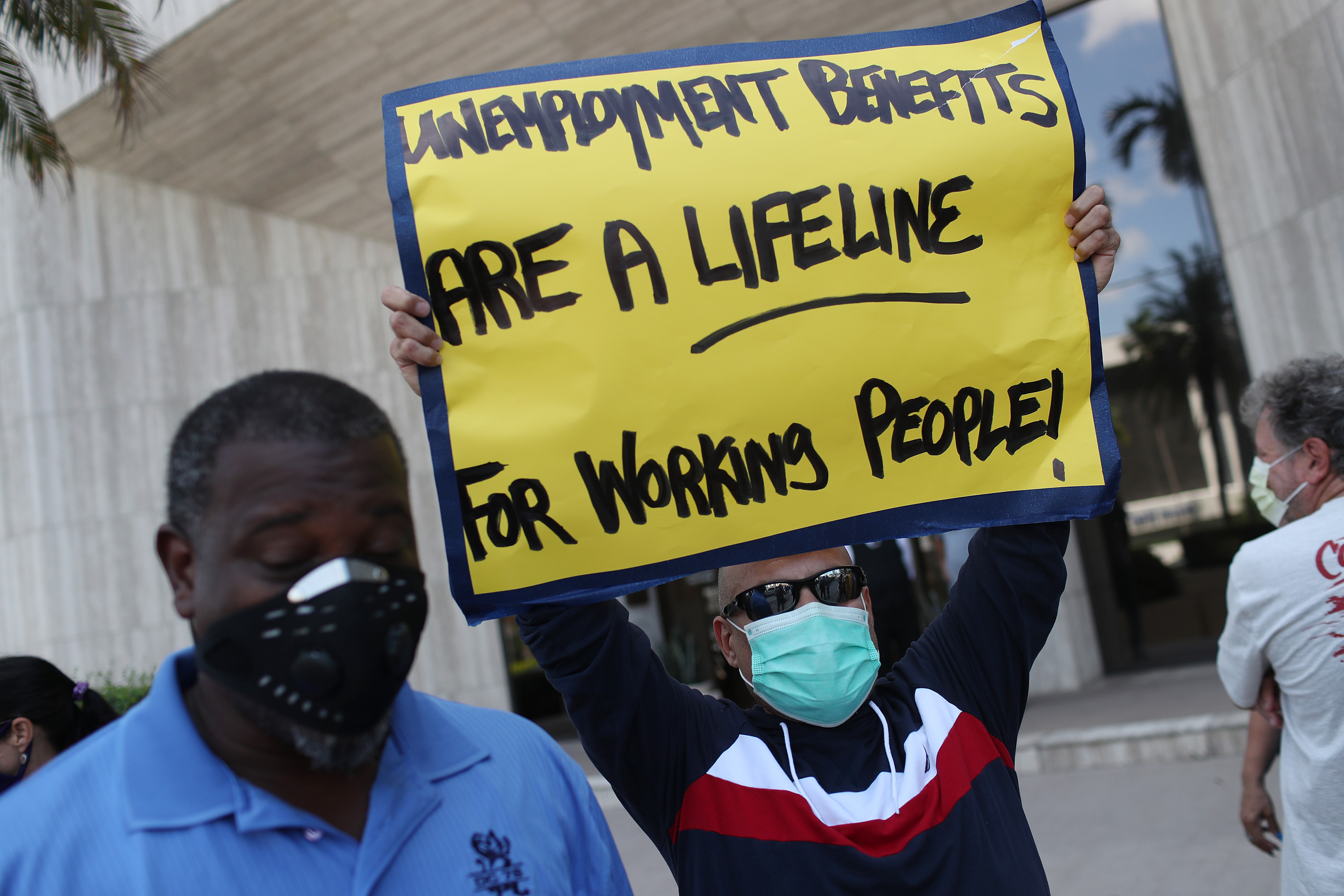

Under the CARES Act, eligible Americans who are out of work entirely or underemployed because of reasons related to coronavirus can receive an additional $600 a week for up to four months. Benefits from the federal government and state governments are generally taxable as income.

What is CARES Act funding?

Congress passed the $2.2 trillion CARES Act passed in March of 2020, provided economic relief to municipalities across the nation. Sacramento County received $181 million from the relief bill.

What is the maximum Pandemic Emergency Unemployment Compensation benefits (PEUC) eligibility in weeks?

No PEUC is payable for any week of unemployment beginning after April 5, 2021. In addition, the length of time an eligible individual can receive PEUC has been extended from 13 weeks to 24 weeks.

Are self-employed, independent contractor and gig workers eligible for the new COVID-19 unemployment benefits?

See full answerSelf-employed workers, independent contractors, gig economy workers, and people who have not worked long enough to qualify for the other types of unemployment assistance may still qualify for PUA if they are otherwise able to work and available for work within the meaning of the applicable state law and certify that they are unemployed, partially unemployed or unable or unavailable to work for one of the following COVID-19 reasons:You have been diagnosed with COVID-19, or have symptoms, and are seeking a medical diagnosis.A member of your household has been diagnosed with COVID-19.You are caring for a family member of a member of your household who has been diagnosed with COVID-19.A child or other person in your household for whom you have primary caregiving responsibility is unable to attend school or another facility that is closed as a direct result of COVID-19 and the school or facility care is required for you to work.

How is the CARES Act supporting small businesses?

The Paycheck Protection Program is providing small businesses with the resources they need to maintain their payroll, hire back employees who may have been laid off, and cover applicable overhead.

What is a coronavirus-related distribution?

A coronavirus-related distribution is a distribution that is made from an eligible retirement plan to a qualified individual from January 1, 2020, to December 30, 2020, up to an aggregate limit of $100,000 from all plans and IRAs.

Who is considered to be essential worker during the COVID-19 pandemic?

Essential (critical infrastructure) workers include health care personnel and employees in other essential workplaces (e.g., first responders and grocery store workers).

What is the Pandemic Emergency Unemployment Compensation Program for COVID-19?

See full answerTo qualify for PUA benefits, you must not be eligible for regular unemployment benefits and be unemployed, partially unemployed, or unable or unavailable to work because of certain health or economic consequences of the COVID-19 pandemic. The PUA program provides up to 39 weeks of benefits, which are available retroactively starting with weeks of unemployment beginning on or after January 27, 2020, and ending on or before December 31, 2020.The amount of benefits paid out will vary by state and are calculated based on the weekly benefit amounts (WBA) provided under a state's unemployment insurance laws.

What kinds of relief does the CARES Act provide for people who are about to exhaust regular unemployment benefits?

Under the CARES Act states are permitted to extend unemployment benefits by up to 13 weeks under the new Pandemic Emergency Unemployment Compensation (PEUC) program.

What are the new changes to the COVID-19 Economic Injury Disaster Loan program?

Key changes announced included: Increased COVID EIDL Cap. The SBA lifted the COVID EIDL cap from $500,000 to $2 million. Loan funds can be used for any normal operating expenses and working capital, including payroll, purchasing equipment, and paying off debt.

Do I have to pay the 10% additional tax on a coronavirus-related distribution from my retirement plan or IRA?

No, the 10% additional tax on early distributions does not apply to any coronavirus-related distribution.

When do I have to pay taxes on coronavirus-related distributions?

The distributions generally are included in income ratably over a three-year period, starting with the year in which you receive your distribution. For example, if you receive a $9,000 coronavirus-related distribution in 2020, you would report $3,000 in income on your federal income tax return for each of 2020, 2021, and 2022. However, you have the option of including the entire distribution in your income for the year of the distribution.

How do qualified individuals report coronavirus-related distributions regarding retirement plans?

See full answerIf you are a qualified individual, you may designate any eligible distribution as a coronavirus-related distribution as long as the total amount that you designate as coronavirus-related distributions is not more than $100,000. As noted earlier, a qualified individual may treat a distribution that meets the requirements to be a coronavirus-related distribution as such a distribution, regardless of whether the eligible retirement plan treats the distribution as a coronavirus-related distribution. A coronavirus-related distribution should be reported on your individual federal income tax return for 2020. You must include the taxable portion of the distribution in income ratably over the 3-year period – 2020, 2021, and 2022 – unless you elect to include the entire amount in income in 2020.

How do plans and IRAs report coronavirus-related distributions?

The payment of a coronavirus-related distribution to a qualified individual must be reported by the eligible retirement plan on Form 1099-R, Distributions from Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. This reporting is required even if the qualified individual repays the coronavirus-related distribution in the same year. The IRS expects to provide more information on how to report these distributions later this year. See generally section 3 of Notice 2005-92.

What was the Cares Act?

When the CARES Act passed, almost all the attention was on the stimulus checks, unemployment insurance, and small business support such as the Paycheck Protection Program. These $1,200 direct payments to families and thousands of dollars in loans to businesses were vital but they don’t tell the whole story of all that the CARES Act did ...

How long can you pay back the Cares Act?

Finally, you can pay back the amount within those three years and claim a refund on your taxes.

Will the Cares Act waive minimum distributions for 2020?

While there has been a recovery, the CARES Act waived required minimum distributions for 2020.

What was the Cares Act?

The CARES Act was the first of three major pieces of COVID-19 relief legislation. The Consolidated Appropriations Act (CAA) followed the CARES Act and the American Rescue Plan Act (ARPA) came last. The table below compares base funding in several key areas for each law.

How much did the stimulus plan help healthcare?

The plan boosted payments to healthcare providers and suppliers by $100 billion through various programs, which included Medicare reimbursements, grants, and other direct federal payments.

What is the purpose of the Paycheck Protection Program?

The law appropriated $349 billion to support small businesses' efforts to maintain their payroll and some overhead expenses through the period of emergency. The stated goal was to keep workers paid and employed during the period of the emergency.

When will the CAA be signed into law?

The act was passed by the U.S. Congress and signed into law by President Trump on Dec. 27, 2020, as part of the Consolidated Appropriations Act (CAA), 2021. Also, individuals can collect unemployment benefits for an additional 24 weeks (versus the original 13 weeks under the CARES Act). 4.

What was the stimulus plan?

The stimulus plan relaxed numerous laws, Medicare payment rules, and drug approval requirements to allow more flexibility to respond to the emergency, and it introduced a few new rules. It required health insurers to cover tests for the virus as well as treatments and vaccines that were in development.

What is the Cares Act?

CARES Act: Tax benefits for individuals and businesses. The Coronavirus, Aid, Relief, and Economic Security Act (CARES Act), enacted on March 27, 2020, in response to the 2019 novel coronavirus (COVID-19) pandemic provides assistance for businesses and individuals. This assistance comes in the form of various tax provisions intended ...

When will the Cares Act be refunded?

The CARES Act allows the remaining credit to be refunded in 2019 (or 2018 at the election of the taxpayer) and to file a tentative refund claim no later than Dec. 31, 2020.

What is the TCJA deduction?

The TCJA limited the business interest expense deduction to 30 percent of the taxpayer’s adjusted taxable income (initially similar to earnings before interest, taxes, depreciation, and amortization (EBITDA), but starting in 2022 similar to earnings before interest and taxes (EBIT)).

How much penalty for early retirement?

The normal 10 percent penalty tax on early distributions from qualified retirement plans, including Individual Retirement Accounts (IRAs), does not apply to up to $100,000 of coronavirus-related distributions made during calendar year 2020.

Is the Cares Act retroactive to 2018?

The CARES Act classifies qualified improvement property as 15-year property retroactively to 2018, which, in addition to shortening the depreciation period, makes the property eligible for bonus depreciation. This provision could result in potential refund opportunities for 2018 returns.

What is the Cares Act?

The CARES Act specifically provides for serious consequences for fraudulent cases including fines, confinement and an inability to receive future unemployment benefits until all fraudulent claims and fines have been repaid.

What is the PUA Act?

On December 27, 2020, President Donald Trump signed into law the Continued Assistance for Unemployed Workers Act of 2020 (Continued Assistance Act), which extends some federal unemployment programs authorized by the CARES Act. Pandemic Unemployment Assistance (PUA). PUA provides unemployment benefits to eligible individuals who are self-employed, ...

Who is eligible for PUA?

PUA provides unemployment benefits to eligible individuals who are self-employed, independent contractors, nonprofit employees and gig economy workers, as well as to individuals working part-time, or who otherwise would not qualify for regular Unemployment Compensation (UC) or Extended Benefits (EB) ...

What is the Cares Act?

Major amendments. Paycheck Protection Program and Health Care Enhancement Act. The Coronavirus Aid, Relief, and Economic Security Act, also known as the CARES Act, is a $2.2 trillion economic stimulus bill passed by the 116th U.S. Congress and signed into law by President Donald Trump on March 27, 2020, in response to the economic fallout ...

When was the Cares Act passed?

Congress and signed into law by President Donald Trump on March 27, 2020, in response to the economic fallout ...

What is the purpose of the 14 billion dollar Higher Education Emergency Relief Fund?

Creates a 14-billion-dollar higher education emergency relief fund to provide cash grants to college students for costs such as course materials, technology, food, housing, and child care. Each college will determine which of its students receive cash grants.

How much relief was signed in 2020?

Two relief bills were signed by the president early in 2020: $8 billion on March 6, and $192 billion on March 18. It was apparent to Congress that these would not be sufficient. A much larger third package, which was to become the CARES Act, was negotiated.

When did the Paycheck Protection Act pass?

On April 21, 2020 , the Senate approved the Paycheck Protection Program and Healthcare Enhancement Act, providing $484 billion in additional funding to the existing Paycheck Protection Program, and President Trump signed it into law three days later. On May 15, 2020, the Democratic-controlled House passed a $3 trillion relief bill called the HEROES Act, but the Republican-controlled Senate never brought it to a vote. There was no other significant economic relief bill until late December 2020 when Congress reached an agreement on a $900 billion stimulus.

Do nursing homes have to be repaid?

Funds do not have to be repaid if the healthcare provider meets specified criteria. An August 2020 Washington Post analysis found that for-profit nursing homes accused of "Medicare fraud and kickbacks, labor violations and widespread failures in patient care" had received hundreds of millions of dollars from this fund.

Did the Cares Act pass quickly?

Congress passed the CARES Act relatively quickly and with unanimity from both parties despite its $2.2 trillion price tag, indicating the severity of the global pandemic and the need for emergency spending, as viewed by lawmakers. Writing in The New Republic, journalist Alex Shephard nevertheless questioned how the Republican Party "... had come to embrace big spending" when, during the Great Recession, no Republicans in the House and only three in the Senate supported President Barack Obama 's $800 billion stimulus, known as the American Recovery and Reinvestment Act of 2009 (ARRA), often citing the deficit and national debt. Shephard opined that, unlike CARES, much of the media attention to ARRA focused on its impact on the deficit, and he questioned whether Republicans would again support a major spending request under a hypothetical future Democratic president.

Group health plan provisions

Telehealth and HDHPs. The CARES Act provides a safe harbor to allow HSA-qualifying HDHPs to provide telehealth or other remote health care services for all conditions (not just COVID-19) with no deductible or with a deductible that is lower than the applicable HDHP deductible. 1 Such services can be offered without risking HSA eligibility.

COVID-19 emergency paid leave

The CARES Act provides some clarifications to the emergency paid leave programs enacted as part of the FFCRA, such as giving an employee who was laid off by an employer on March 1, 2020, or later access to paid family and medical leave in certain instances if he or she is rehired by the employer.

Student loan repayment assistance

The CARES Act amends the tax code pertaining to Educational Assistance Programs. Between March 27, 2020 (the CARES Act’s enactment date) and December 31, 2020, employer payments of principal or interest on any employee qualified education loan will not be included in the employee’s gross income.

Further guidance required

Certain provisions have no immediate implications for employers but will require additional government guidance:

What is the Cares Act?

In response, the federal government passed the Coronavirus Aid, Relief, and Economic Security (CARES) Act in March, which provided an array of financial supports for businesses and households to help them weather the financial impacts of widespread economic shutdowns necessitated by the spread of the virus. Stephen Roll.

How much money was allocated to the Cares Act?

Of the $560 billion allocated to support individual households through the policy, $300 billion went to the Economic Impact Payments and $260 billion financed the expanded unemployment ...