Health insurance protects you from unexpected, high medical costs. You pay less for covered in-network health care, even before you meet your deductible. You get free preventive care, like vaccines, screenings, and some check-ups, even before you meet your deductible.

Full Answer

What are the advantages and disadvantages of health insurance?

Some of the advantages of offering health benefits to employees are:

- It helps you draw in and keep the most talented employees in your firm. ...

- As a small business, you are entitled to certain tax advantages even if you offer your employees a component that increases their remuneration. ...

- Self-employed people can deduct 100 percent of their health insurance premium costs as a business expense. ...

What are the benefits of having life insurance?

- The biggest benefit of life insurance is financial security for your loved ones.

- A death benefit can be used to pay for anything and doesn't have stipulations on spending.

- Certain life insurance policy add-ons (riders) can increase the benefits of your coverage.

What are the advantages of insurance?

Some of the benefits are discussed below:

- The obvious benefit of insurance is the payment of losses.

- Manages cash flow uncertainty when paying capacity at the time of losses is reduced significantly.

- Complies with legal requirements by meeting contractual and statutory requirements, also provides evidence of financial resources.

Who benefits from life insurance?

Life insurance is a contract between you and an insurance company that pays a death benefit to named beneficiaries, or the recipients of your choosing, in exchange for premium payments.

What are the costs of having insurance?

In 2020, the average national cost for health insurance is $456 for an individual and $1,152 for a family per month. However, costs vary among the wide selection of health plans. Understanding the relationship between health coverage and cost can help you choose the right health insurance for you.

What are the benefits and costs of insurance?

1.1 Costs and benefits of insuranceCategoryCostsBenefitsSocialOpportunity costs insurance premiumImproved creditworthiness Increased opportunity for increasing livelihood profitabilityEconomicBasic risk, losses from un-covered RisksIncreased confidence, post-disaster liquidity, ability to recover from disaster3 more rows•Mar 13, 2018

What are the benefits of having insurance?

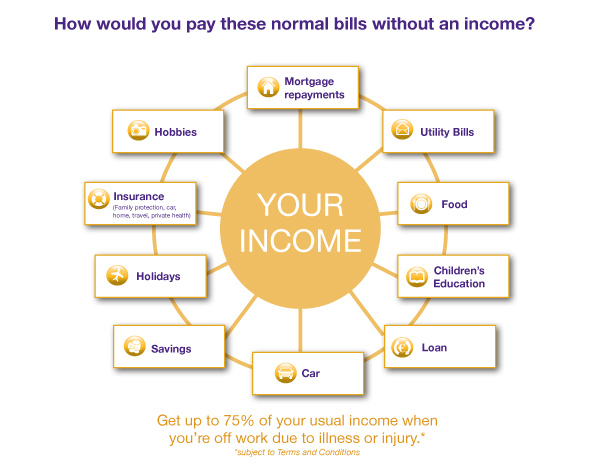

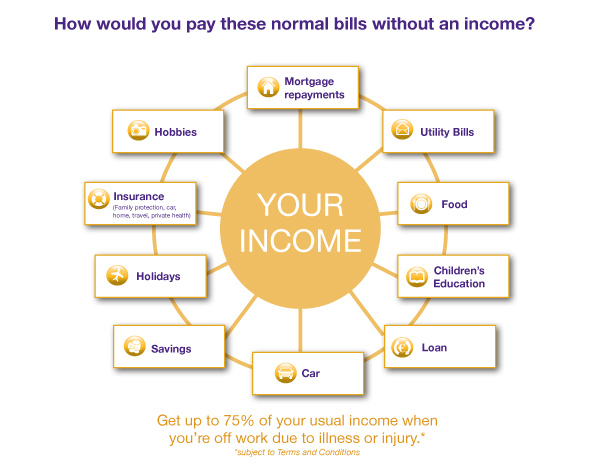

Insurance is a financial safety net, helping you and your loved ones recover after something bad happens — such as a fire, theft, lawsuit or car accident. When you purchase insurance, you'll receive an insurance policy, which is a legal contract between you and your insurance provider.

What are the five benefits of insurance?

5 reasons why insurance mattersProtection for you and your family. ... Reduce stress during difficult times. ... To enjoy financial security. ... Peace of mind. ... A legacy to leave behind.

What is the major costs of insurance to society?

The major social costs of insurance include the following: Cost of doing business. Fraudulent claims. Inflated claims.

What is the disadvantage of insurance?

It does not compensate all types of losses which caused baisness to insured by insurance company. It takes more time to provide financial compensation because lengthy legal formalities. Although insurance encourages savings, it does not provide the facilities that are provided by bank.

What are the pros and cons of health insurance?

Top 10 Health Insurance Pros & Cons – Summary ListHealth Insurance ProsHealth Insurance ConsBetter protection against large financial burdenHealth insurance can be expensiveHigher life expectancySome people may not be able to afford itProtection of your wealthNot all insurance companies may accept you7 more rows

What are the pros and cons of life insurance?

The main advantage of owning a life insurance policy: If you die, your beneficiaries. receive a payout called a death benefit that replaces any income you provided while you were alive. The biggest disadvantage: You have to pay monthly or annual premiums for this benefit.

Why is health insurance so expensive?

The price of medical care is the single biggest factor behind U.S. healthcare costs, accounting for 90% of spending. These expenditures reflect the cost of caring for those with chronic or long-term medical conditions, an aging population and the increased cost of new medicines, procedures and technologies.

What are the 10 benefits of insurance?

Following are the Benefits of having Life InsuranceLife Risk Cover.Death Benefits.Return on Investment.Tax Benefits.Loan Options.Life Stage Planning.Assured Income Benefits.Riders.

Why is life insurance so expensive?

The cost of insurance can be quite high especially for life insurance if obtained when one has a medical condition but can at least alleviate anxiety of spouses who worry about their financial security if their partner dies early. because then they can get financial help to pay for mortgages/rent etc. Also, for car insurance, the premiums can be ...

Does not having insurance cost money?

However, not having insurance can lead to financial disasters if unexpected events happen.

What is the benefit of insurance?

The obvious and most important benefit of insurance is the payment of losses. An insurance policy is a contract used to indemnify individuals and organizations for covered losses. The second benefit of insurance is managing cash flow uncertainty. Insurance provides payment for covered losses when they occur. Therefore, the uncertainty of paying ...

Why is insurance important?

Insurance helps reduce the burden of uncompensated accident victims and the uncertainty of society. Understanding these benefits is critical when analyzing the need for insurance and helps insureds justify the purchase of insurance.

How does insurance help with loans?

Insurance facilitates loans to individuals and organizations by guaranteeing that the lender will be paid if the collateral for the loan is destroyed or damaged by an insured event. This reduces the lender's uncertainty of default by the party borrowing funds.

What are the benefits of life insurance?

The many benefits of having life insurance. All life insurance can give you financial confidence that your family will have financial stability in your absence. But generally, the more life insurance you have, the more benefits it will provide to your family when needed. For example, some people receive a nominal amount ...

Why is life insurance so expensive?

Life insurance generally gets more expensive with age, so many seniors get policies with just enough coverage to provide for funeral expenses to avoid burdening their family. Life insurance can also be used for estate planning strategies, where it can be a tax-advantaged way to leave assets to heirs.

Why do life insurance companies give younger customers lower rates?

Life insurance companies generally give younger customers lower rates for reasons that are easy to understand: They tend to have a longer life expectancy. They are less likely to have been diagnosed with a serious disease. They are likely to pay premiums over a longer number of years.

What is accelerated death benefit?

Two of the most popular riders include: Accelerated death benefit: This rider can help pay for needed care of a diagnosed chronic or terminal illness. While this can be very useful in a time of need, you should also know that funds paid out will typically lower the death benefit paid to your family. 5.

What happens to a whole life policy when you die?

A whole life policy is permanent life insurance that last your entire life.

What are the benefits of a home mortgage?

Paying off your home mortgage. Paying off other debts, such as car loans, credit cards, and student loans. Providing funds for your kids’ college education. Helping with other obligations, such as care for aging parents. Beyond your coverage amount, different kinds of policies can provide other benefits as well: ...

Is term life insurance more expensive?

Term life policies provide fewer benefits but are also less expensive – and while your premiums remain stable over the term of the policy, once it expires you can expect to pay significantly more for your next policy. Read more: Term vs. whole life insurance.

Why do you have to pay monthly premiums for life insurance?

The biggest benefit of life insurance is financial protection for your loved ones if you die. However, you do have to pay monthly premiums for this peace of mind, which can be expensive if you’re in poor health or purchasing coverage when you’re older.

What is the purpose of life insurance?

The purpose of life insurance is to provide your loved ones with financial protection if you die. A tax-free payout is the main benefit, but the advantages of life insurance extend beyond extra cash. Life insurance provides cash to help your dependents replace your lost income when you die. This money goes to your beneficiaries ...

What is life insurance riders?

Benefits of life insurance riders. Life insurance provides cash to help your dependents replace your lost income when you die. This money goes to your beneficiaries and can be used for anything — funeral expenses, living expenses, college tuition, mortgage payments or donations to charity.

What can you use a death benefit for?

A death benefit can be used to pay for anything – from paying off debts to funeral costs to a college education for your children. Certain life insurance policy add-ons (riders) can increase the benefits of your coverage.

How long does term life insurance last?

Term life insurance is meant to last until your debts are paid off (generally a 20- to 30-year period while people depend on you most). The benefits of a term life plan include: Term life insurance is the cheapest life insurance you can buy. If you buy term life insurance when you’re young, you can lock in low rates.

How long do you have to live to get death benefit?

Accelerated death benefit rider — If you’re diagnosed with a terminal illness (less than 12 to 24 months to live, depending on the state), you can get all or part of the death benefit paid out before you die. While this can support your end-of-life care, it could leave your survivors with a lower death benefit.

Is whole life insurance more expensive than term life insurance?

According to Policygenius quotes from 2020, whole life insurance is much more expensive than term – sometimes as much as five to 15 times the cost – but it also has its own benefits: Combines life insurance with an investment component. The cash value component can be used as part of a complex estate planning strategy.

What are the benefits of life insurance?

5 Top Benefits of Life Insurance. Life insurance provides a number of useful benefits. Among them: 1. Life Insurance Payouts Are Tax-Free. If you have a life insurance policy and die while your coverage is in effect, your beneficiaries will receive a lump sum death benefit. Life insurance payouts aren’t considered income for tax purposes, ...

What can you use the cash value of a life insurance policy for?

If you purchase a whole, universal, or variable life insurance policy, it can accumulate cash value in addition to providing death benefits . As the cash value builds up over time, you can use it to cover expenses, such as buying a car or making a down payment on a home.

Why don't people have life insurance in 2021?

Kat Tretina. Updated Feb 8, 2021. Life insurance can be essential for protecting your family financially in case of a tragedy, but many people go without it. In fact, nearly half of American adults do not have life insurance, according to a recent survey. 1 One reason is that people assume life insurance is too expensive.

What is accelerated benefits rider?

An accelerated benefits rider allows you to access some or all of your death benefit under certain circumstances. Under some policies, for example, if you are diagnosed with a terminal illness and are expected to live less than 12 months, you can use your death benefit while you’re still living to pay for your care or other expenses.

Is life insurance more expensive than a 401(k)?

However, a life insurance policy should not replace traditional retirement accounts like a 401 (k) or an IRA. What's more, cash value life insurance is considerably more expensive than term life insurance, which has no savings component but simply a death benefit.

Is life insurance affordable?

And, life insurance might be more affordable than you think. If you decide to get coverage, check out Investopedia's list of the best life insurance companies of 2021 .

Does life insurance cover funeral expenses?

Life Insurance Can Cover Final Expenses. The national median cost of a funeral that included a viewing and a burial was $7,640 as of 2019. 4 Because many Americans do not have enough savings to cover even a $400 emergency expense, having to pay for a funeral can be a substantial financial burden.

Why do we need insurance?

Generally speaking, insurance protects you and your bank account. If you get sick, for instance, having insurance will ensure you get the medical care you need without emptying your savings. In 2016, the average American spent $10,000 on health care – a figure that is expected to increase to nearly $15,000 by 2023.

Why is insurance important in business?

However, the role of insurance in business is mostly to protect your own bottom line. One lawsuit could put you out of business, so having the right coverage in place is essential to survival. You can also put coverage in place that keeps your business running after a natural disaster or a serious data breach.

What is commercial liability insurance?

Businesses have access to commercial insurance that provides liability protection. If your company designs a product that harms consumers or someone slips and falls on your business property, for instance, the right kind of liability insurance will take care of that person’s medical bills and other related costs.

How does insurance affect society?

Insurance’s Impact on Society. Although individuals generally get insurance for self-serving reasons, the importance of insurance for society as a whole can’t be understated . Hospitals are required to treat uninsured patients who come through the emergency room, writing off the cost as a loss. As a result, the costs of services go up, which ...

Can you drive without insurance?

In most states, you can’t drive without insurance, and even in states where you can, you’ll have to demonstrate the ability to pay if you’re responsible for damages or injuries to others. However, with health and life insurance, you have the choice. When people go uninsured, it still impacts society as a whole.

Does life insurance cover funeral expenses?

In addition to making sure you can handle a visit to the emergency room, insurance can also protect your loved ones in the event of your death. Life insurance will help pay for funeral costs, as well as provide a cushion that can help pay your family’s mortgage and other living expenses after you’re gone. 00:00. 00:01 09:16.