How does the new stimulus package impact unemployment benefits?

The new stimulus package impacts unemployment benefits in the following ways: People eligible for unemployment benefits in their state will receive an additional $300 per week from the federal government. This amount will be available to people claiming benefits between March 14 and Sept. 6, 2021.

What does the new stimulus bill mean for your tax return?

Under the new bill, your family may also get far more money this time, as well as tax breaks for parents and older adults. One sticking point that could still cause complications is your 2020 tax return. Here's what we know so far about what the new stimulus bill means for those who receive unemployment, and how the numbers could work out for you.

How does the federal stimulus stimulus program work?

Economists have long supported tying federal stimulus to economic indicators, like the unemployment rate, rather than an arbitrary date picked by Congress. One program, Extended Benefits, operates in a similar way. The federally funded program triggers “on” for select states during times of high unemployment.

What does the new unemployment law mean for You?

The new law will not only extend supplemental benefits for the unemployed, but it will also give them a tax break — in addition to providing third stimulus checks, additional funding for COVID-19 vaccine distribution and other provisions. Here’s everything you need to know about the changes to unemployment benefits. Ads by Money.

What is the maximum time for which I can receive unemployment benefits in New Jersey 2021?

Per federal regulations, on April 17, 2021, NJ state extended unemployment benefits were reduced from up to 20 weeks to up to 13 weeks because New Jersey's unemployment rate went down.

Is there still stimulus for unemployment?

Federal Unemployment Benefits Have Ended Federal unemployment benefit programs under the CARES Act ended on September 4, 2021. You will no longer be paid benefits on the following claim types for weeks of unemployment after September 4: Pandemic Unemployment Assistance (PUA)

Does the unemployment stimulus count as income?

Yes. All unemployment benefits (including the extra $300 per week PUC payment) are included in your taxable gross income and Modified Adjusted Gross Income for purposes of eligibility for financial help available through Covered California.

Did the stimulus raise unemployment?

A $1.9 trillion Covid relief bill, the American Rescue Plan, passed Saturday by the Senate raises unemployment benefits by $300 a week. The House passed an earlier version with a $400 weekly increase. An extra $300 a week replaces 74% of lost wages for the average person. A $400 boost would have replaced 85%.

How much was the 3rd stimulus check?

$1,400 per personHow much are the payments worth? The third round of stimulus payments is worth up to $1,400 per person. A married couple with two children, for example, can receive a maximum of $5,600. Families are allowed to receive up to $1,400 for each dependent of any age.

Is pandemic unemployment still available?

The COVID-19 Pandemic Unemployment Payment (PUP) was a social welfare payment for employees and self-employed people who lost all their employment due to the COVID-19 public health emergency. The PUP scheme is closed.

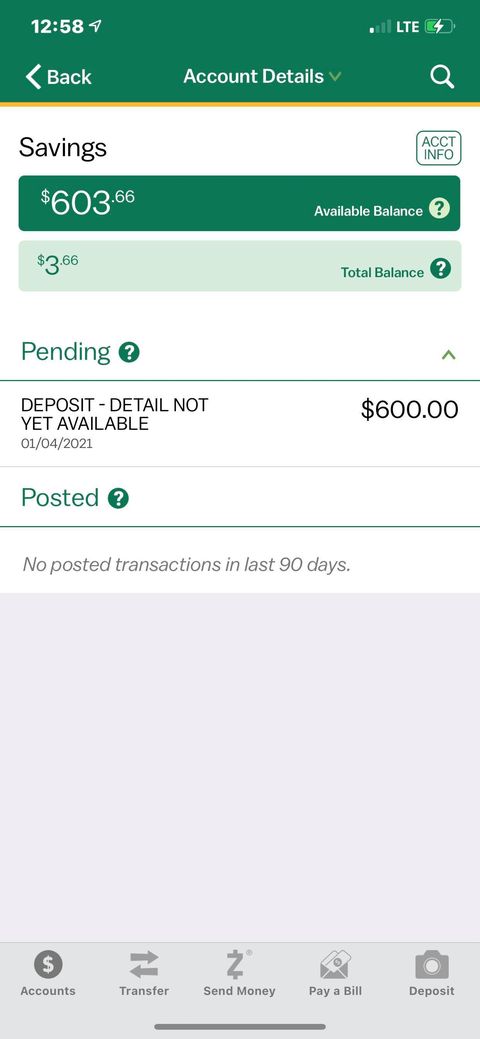

How much of the 600 will be taxed?

The second stimulus check from the $900 billion relief package is not taxable. The $600 stimulus payment is also considered an advance of a tax credit for the 2020 tax year and is not considered part of your taxable income.

Do I have to pay taxes on stimulus unemployment?

This means you don't have to pay tax on unemployment compensation of up to $10,200 on your 2020 tax return only. If you are married, each spouse receiving unemployment compensation may exclude up to $10,200 of their unemployment compensation. Amounts over $10,200 for each individual are still taxable.

What happens if you don't withhold taxes on unemployment?

If you don't have taxes withheld from your unemployment benefits and you fail to make estimated payments, you'll have to pay any lump sums and penalties by tax day (usually April 15), when your tax return is due.

What is the 300 dollar stimulus?

Around 36 million eligible American families received financial relief as part of the Child Tax Credit, which issued monthly payments between July 2021 and December 2021. Families received up to $300 per child under 6 years of age and up to $250 per child between the ages of 6 and 17.

How long is the unemployment stimulus?

The stimulus package extends PUA benefits from 57 weeks to 86 weeks. EDD also notes some changes for people filing new PUA claims. EDD says new claimants can file now and will start receiving a minimum of $167 a week, alongside the additional $300.

Where is the stimulus check?

But if you're still asking yourself "where's my stimulus check," the IRS has an online portal that lets you track your payment. It's called the "Get My Payment" tool, and it's an updated version of the popular tool Americans used to track the status of their first- and second-round stimulus checks.

How much unemployment money can I expect to get with the new stimulus bill?

Now that President Joe Biden has signed the new bill into law, you can receive $300 a week through Sept. 6. This is down from the House's proposal of $400 a week. However, it does include a new tax break (more below).

What are the current unemployment benefits in place?

The $300 federal unemployment checks from December's bill have officially expired and have been replaced by the new bill. With that, those who are on unemployment will continue to receive $300 extra each week and the benefits won't expire until Sept. 6.

How much is the unemployment tax exemption for Sept 6?

However, the final bill offers people $300 a week until Sept. 6, plus an exemption of up to $10,200 for last year's unemployment payments. Under the new bill, your family may also get far more money this time, as well as tax breaks for parents and older adults.

How much is the third stimulus check?

Currently, the third stimulus checks of up to $1,400 per person are getting delivered into bank accounts via direct deposit -- you can now track your stimulus payment. For unemployment, the amount you can get each week has been lowered -- but the benefits include tax forgiveness and will be extended an additional month.

Do you have to file amended taxes if you collect unemployment?

If you collected unemployment and have already filed your taxes, the IRS is urging you not to file an amended return and will provide you will additional guidance. According to the White House, the addition of the tax break will provide more relief to the unemployed than the previous legislation did.

Do unemployment benefits get taxed?

Typically, your unemployment benefits do get taxed. But the new stimulus bill changes that.

Who benefits the most from tax changes?

The people who benefit the most from the changes are people who have a good income and are unemployed for only part of the year , or someone who is unemployed but has a spouse who makes a decent salary , "because a tax deduction will provide the most benefit to people in the highest personal income tax brackets," Wamhoff said.

What is the stimulus package for unemployment?

Biden signs $1.9 trillion stimulus package—here’s what it includes for unemployment. The $1.9 trillion American Rescue Plan provides a $300 weekly boost, extends pandemic aid until Sept. 6 and offers a new tax waiver on the first $10,200 of unemployment benefits for many Americans. The stimulus bill passed through Congress Wednesday ...

How much is the stimulus check?

The relief bill offers $1,400 stimulus checks to individuals who earned less than $75,000 a year and phases out until $80,000. Workers who lost income between 2019 and 2020 and now fall under this threshold have an incentive to file their taxes soon in order to get a third stimulus check quickly.

How long is the PUA benefit?

The maximum duration of PU A benefits increases to 79 weeks (up to 86 weeks in high-unemployment states), and for PEUC up to 53 weeks.

What is the original stimulus package?

The package differs from Biden’ s original proposal in a few key ways: The original provided a $400 weekly UI boost and extended aid until the end of September. However, the value of federally enhanced UI, among other stimulus provisions, was changed in the last week to appease moderate Democrat Senator Joe Manchin of West Virginia, who threatened not to support the bill .

Is the stimulus tied to unemployment?

Economists have long supported tying federal stimulus to economic indicators, like the unemployment rate, rather than an arbitrary date picked by Congress.

Can you get unemployment benefits retroactively?

Even if workers experience a lapse in their payments, they’ll still be entitled to their benefits from the time the bill is signed and can expect to receive their aid retroactively. That does little to help cash-strapped households stay on top of recurring bills and essential expenses, Shierholz says: “They just face extreme problems when benefits are allowed to expire.”

How much is unemployment boosted?

The relief package adds $300 per week in federal payments on top of the amount you receive from the state.

How much stimulus money did Biden give to unemployment?

Biden signs $1.9 trillion stimulus package—here’s what it includes for unemployment. Here’s when the IRS could start sending out $1,400 stimulus checks. What you need to know about the third round of stimulus payments. Adult dependents are finally eligible for stimulus payments.

How does the new $10,200 tax waiver work?

A new provision waives federal taxes on the first $10,200 of unemployment benefits you received in 2020. Married couples who file jointly and both collected unemployment insurance benefits in 2020 will have taxes waived on $10,200 per person, or up to $20,400 of UI benefits total.

What if your benefit year is ending?

Many people out of work since the beginning of the pandemic are coming up to the end of their 52-week benefit year. Usually, once you reach this point, you have to start a new benefit year and recalculate your payments based on your most recent earnings.

How much is the stimulus check for 2020?

With that said, the relief package also offers $1,400 stimulus checks to individuals who earned less than $75,000 a year and phases out at $80,000. If your 2020 income was lower than your 2019 earnings, you might be inclined to file your taxes sooner rather than later in order to get the latest stimulus check more quickly.

What states are exempt from unemployment?

States must decide if they will also offer the break on state income taxes. Some like California, Montana, New Jersey, Pennsylvania and Virginia already exempt taxes on unemployment. Seven states — Alaska, Florida, Nevada, South ...

Can you continue to receive federal aid if you lapse?

Even if workers experience a lapse in their payments, they’ll still be entitled to their benefits from the time the bill is signed and can expect to receive their aid retroactively.

When will the $1.9 trillion unemployment increase end?

The $1.9 trillion plan continues federally enhanced unemployment at $300 per week until September 6, 2021. This differs from the original proposal of a $400 weekly UI boost that extended aid until the end of September. While the signed bill is lower than the House’s proposal, it does include a new tax break.

How long is the unemployment benefit for 2021?

Unemployment extends from 24 to 53 weeks. PUA has been extended from 50 to 79 weeks. $10,200 tax break for 2020. A third stimulus bill, called the American Rescue Plan, was officially signed into law on March 11, 2021. While it includes less money for weekly additional unemployment benefits, there is a bigger tax benefit for recipients.

What is the third stimulus package?

Under the third stimulus package, unemployment benefits now include a $300 weekly unemployment boost, tax exemptions, and extended PEUC and PUA benefits.

How long is the unemployment extension?

Unemployment extends from 24 to 53 weeks. PEUC has been extended until the week ending September 4, 2021, increasing the maximum span of benefits from 24 to 53 weeks. PEUC provides additional unemployment benefits to individuals who have previously exhausted state or federal unemployment compensation benefits.

Is unemployment taxable income?

By law, payments received by unemployment are taxable and must be claimed on your federal income tax return. However, with the new stimulus bill, up to $10,200 in last year’s unemployment benefits could be exempt from taxes if your adjusted gross income (AGI) is less than $150,000 according to the IRS.

How much unemployment tax is withheld?

While people collecting unemployment benefits can opt to withhold 10% from those benefits to cover some or all of their tax liability, fewer than 40% of unemployment insurance payments in 2020 had taxes withheld, according to a research paper published last month by The Century Foundation. Some states didn’t withhold the 10%, even for those who asked them to, CNBC reported.

What is the tax break for the unemployed?

Unemployment benefits are considered taxable income, but the new law provides a tax break: those receiving unemployment benefits will not need to pay federal income taxes on the first $10,200, as long their 2020 adjusted gross income was less than $150,000. For married couples in which both spouses collected unemployment benefits and their combined income is less than $150,000, experts say federal income taxes could be waived for up to $20,400 of benefits.

When did the $1.9 trillion American Rescue Plan expire?

President Joe Biden signed the $1.9 trillion American Rescue Plan into law on Thursday, welcome news for the millions of jobless Americans collecting enhanced unemployment benefits that had been set to expire on March 14.

Who is most likely to get a surprise tax bill?

Those most likely to have been hit with a surprise tax bill are — in addition to those who didn’t withhold — those without children to claim as dependents or those who usually get a refund or owe just a small amount, as they’re likely not eligible for other tax credits , says David Marzahl, a consultant with Commonwealth, which works to improve financial security for low income households. Others who have withheld all along could now get a refund when, Galle says.

Who signed the American Rescue Plan?

This story has been updated to reflect that President Joe Biden signed the American Rescue Plan into law, and to include guidance from the IRS.

Do unemployment benefits cover living expenses?

While in most states these benefits don’t even cover basic living expenses, they can ease some of the financial burden of being out of work in a pandemic.

What Does the New Unemployment Bill and Stimulus Mean for 2020 Tax Returns?

Normally, you would have to pay regular taxes on any unemployment benefits you’ve received, but the new bill gives a tax exemption to the first $10,200 of unemployment insurance received in 2020.

How Is the New Stimulus Payment Determined?

The package includes a new round of $1,400 payments for individuals with an adjusted gross income of up to $75,000, heads of household with income up to $112,500, and $150,000 for joint filers.

What Are The Extended Unemployment Benefits?

The bill extends federal unemployment insurance programs and an additional $300 boost per week until Sept. 6, 2021. This adds 25 more weeks to two federal unemployment programs: the Pandemic Emergency Unemployment Compensation (PEUC) and the Pandemic Unemployment Assistance program (PUA) .

What Other Help Is Available?

Outside this latest relief bill, Americans can also get help in the form of student loan relief, eviction and foreclosure moratoriums, and other programs already available:

What is the American Rescue Plan?

The American Rescue Plan, signed into law by President Biden Thursday, extends unemployment benefits, approves new stimulus payments, and creates several other tax credits. Editorial Independence. We want to help you make more informed decisions.

When will the stimulus check be extended?

The American Rescue Plan provides extended unemployment benefits, including a $300 boost per week, through Sept. 6, 2021. $1,400 stimulus payments for those making up to $75,000 could be received within the next two weeks. The plan offers a tax break for the first $10,200 in unemployment benefits received in 2020.

Why do we have a moratorium on utility bills?

Utility moratoriums: Your state may have a utility bill moratorium in place to allow your home to keep heat through the winter months, even if you can’t pay.

When will Schumer sign the stimulus bill?

But Senate Majority Leader Charles E. Schumer (D-N.Y.) has pledged that Congress will approve the legislation and send it to the president to sign by mid-March, when those provisions from December's $900 billion relief package begin running out.

What is the purpose of the unemployment amendment?

The amendment is an attempt to shore up support among moderate Democrats who expressed concern about increasing the federal weekly unemployment payments.

How much is the unemployment benefit for Joe Biden?

In order to get President Joe Biden’s $1.9 trillion stimulus bill passed in the Senate, Democratic leaders have agreed to a last-minute request by moderates to keep federal supplemental unemployment benefits at their current level of $300 a week instead of raising them to $400 a week, as Biden had initially proposed. But there’s some good news.

How long will the stimulus be extended?

The stimulus bill would extend the PEUC program up to 48 weeks. Those extended PEUC benefits may then be followed by additional weeks of federally funded unemployment benefits in states with high unemployment (up to 13 or 20 weeks, depending on state laws).

How long does the Peuc program last?

The CARES Act passed last year created the PEUC program, which can provide up to 24 weeks of additional benefits to those who’ve been affected by the pandemic and have exhausted regular state benefits. The stimulus bill would extend the PEUC program up to 48 weeks. Those extended PEUC benefits may then be followed by additional weeks ...

How many votes does the Senate have to pass a budget reconciliation?

Typically, the Senate has a 60-vote threshold to pass major legislation, but the so-called budget reconciliation process allows lawmakers to pass comprehensive legislation with just 51 votes.

How many Democrats are needed to pass the stimulus bill?

All 50 Democrats would need to pass the amended bill, too, if Republicans don’t vote for it. Vice President Kamala Harris would then be the tie breaker again.