Worksite benefits provide employees with access to great insurance programs like:

- Accident Insurance

- Short Term Disability Insurance — Long term, too!

- Critical Illness Insurance can cover cancer, heart attack, and stroke

- Hospital Indemnity — a deductible buster!

- Vision and Dental Insurance too

- Term/Whole Life Insurance

What are the most common employee benefits?

Useful contacts and further reading

- Recent developments. More recently, some employers have adopted a more individualistic approach to employee reward, transferring more of the risk (and, potentially, reward) and cost of the provision to their ...

- Company cars and car allowances. ...

- Other benefits. ...

- Flexible and voluntary benefits. ...

- Contacts

- Books and reports. ...

- Journal articles. ...

What are standard employee benefits?

as well as amping up employee benefits, compensation and other perks to existing keep workers happy and engaged. Even after the Great Resignation ebbs, these new tactics will likely become the new standard. As we continue our series on 2022 workplace and b ...

What are unique employee benefits?

Reviewing these 25 unique and low-cost employee perks will help your organization create a robust employee benefits package that will appeal to top candidates. 1. Unlimited Vacation Time. One of the more appealing employee benefits that any company can offer is unlimited vacation time.

What are the benefits of being a worker?

Workers are entitled to certain employment rights, including:

- getting the National Minimum Wage

- protection against unlawful deductions from wages

- the statutory minimum level of paid holiday

- the statutory minimum length of rest breaks

- to not work more than 48 hours on average per week or to opt out of this right if they choose

- protection against unlawful discrimination

What are examples of work benefits?

Here is a list of popular employee benefits in the United States:Health insurance.Paid time off (PTO) such as sick days and vacation days.Flexible and remote working options.Life insurance.Short-term disability.Long-term disability.Retirement benefits or accounts.Financial planning resources.More items...•

What is a worksite product?

Voluntary benefits, often referred to as Worksite Marketing products can be any type of additional benefit that is added to an employer's menu of benefit options. These benefits may be provided through insurance products that can be classified as either core products or ancillary products.

What are the 4 major types of employee benefits?

There are four major types of employee benefits many employers offer: medical insurance, life insurance, disability insurance, and retirement plans. Below, we've loosely categorized these types of employee benefits and given a basic definition of each.

What are the 3 types of benefits?

There are three main types of employee benefits:Employee benefits that are required by law.Employee benefits that aren't required by law but considered an industry standard.Employee benefits that are offered as an added perk or fringe benefit.

What is a worksite insurance policy?

Voluntary benefits, also known as worksite benefits, are a cost-effective solution to help employees offset out-of-pocket medical expenses. These benefits are employee-paid and can help your employees fill the gaps created by high deductibles and rising copays, providing the financial security they need and deserve.

What is the definition of a worksite?

: a place (such as a shop or factory) where work is done.

What are 5 employee benefits?

Here is a list of the top five types of benefits employers can offer to employees - each can be a valuable tool for recruiting and retaining employees.1) Health Benefits. ... 2) Retirement. ... 3) Workplace Flexibility. ... 4) Wellness Program. ... 5) Tuition Reimbursement.

What are different types of benefits?

6 different types of employee benefits and incentivesBenefits that are required by law.Medical insurance.Life insurance.Retirement plans.Disability insurance.Fringe benefits.

What are typical employee benefits?

Various types of employee benefits typically include medical insurance, dental and vision coverage, life insurance and retirement planning, but there can be many more types of benefits and perks that employers choose to provide to their employees.

What are the most common types of employee benefits?

The most common benefits are medical, disability, and life insurance; retirement benefits; paid time off; and fringe benefits. Benefits can be quite valuable. Medical insurance alone can cost several hundred dollars a month. That's why it's important to consider benefits as part of your total compensation.

Do employees pay for benefits?

An employee benefits package typically includes healthcare insurance, retirement plans, vacation and paid time off. Generally, these packages will cover 80%, and in some cases 100%, of healthcare costs. Both the employer and employee pay the monthly premium on benefits.

What are core benefits for an employee?

Core Benefits means retirement, separation pay, paid time off, medical (excluding retiree medical), dental, vision, life, short-term and long-term disability plans or coverage.

What is voluntary worksite benefits?

Voluntary worksite benefits, also known as supplemental insurance, are a cost-effective solution to help employees offset out-of-pocket medical expenses. These benefits are employee-paid and can help your employees fill the gaps created by high-deductibles and rising co-pays, providing the financial security they need and deserve.

What are the most common voluntary benefits offered in the workplace?

Listed below are the most common types of voluntary benefits offered in the workplace: Accident Insurance – Accident insurance helps offset the unexpected medical expenses that result from a covered accidental injury.

What are the benefits of voluntary benefits?

Listed below are the most common types of voluntary benefits offered in the workplace: 1 Accident Insurance – Accident insurance helps offset the unexpected medical expenses that result from a covered accidental injury. 2 Critical Illness Insurance – Critical illness with Cancer insurance supplements major medical coverage by providing a lump-sum benefit for an employee diagnosed with a covered critical illness. 3 Hospital Indemnity Insurance – Hospital indemnity insurance provides a lump-sum benefit to help with out-of-pocket costs related to a hospital stay. 4 Short-Term/Long-Term Disability Insurance – Disability insurance replaces a portion of an employee’s income if they become disabled as a result of a covered accident or sickness. 5 Life Insurance – life insurance pays out a lump sum to help provide financial protection for an employee’s family members in the event of the employee’s death. 6 Identity Theft Protection – ID theft protection includes monitoring public records and alerting the employee to any fraudulent use of their personal details. It also covers the cost of repairing credit history. It does not cover financial loss that results from identity theft.

How to get a free voluntary benefit quote?

If you’re an employer who is interested in providing voluntary worksite benefits to your employees, give InsureOne a call today at (800) 836-2240 and a friendly, knowledgable agent will answer your questions. You can also request a free voluntary benefits quote online by entering your zip code in the form at the top of the page.

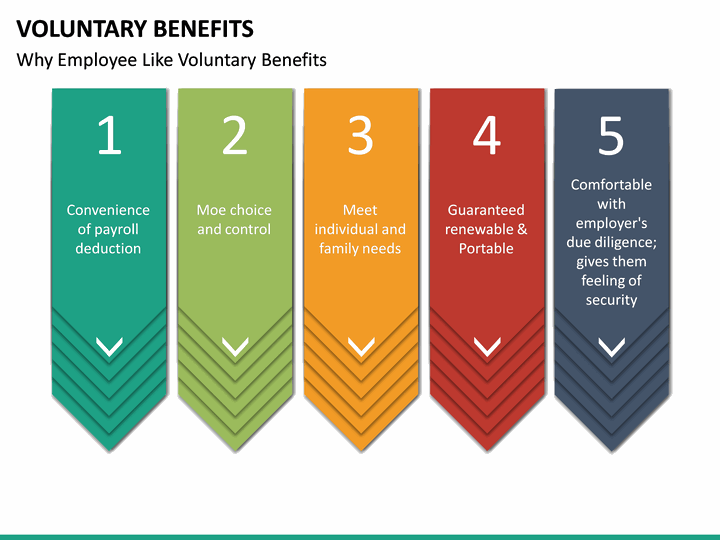

Can you deduct employee premiums?

Employees’ premiums can be payroll deducted and administration is simple . As employers look for new ways to leverage limited benefit dollars, voluntary worksite benefits provide an excellent opportunity to enrich a traditional benefits program.

What is voluntary worksite benefit?

Voluntary benefits, also known as worksite benefits, are a cost-effective solution to help employees offset out-of-pocket medical expenses. These benefits are employee-paid ...

Why are voluntary benefits important?

Your employees can make informed decisions and will not be pressured to purchase products that don’t fit their needs or budgets. As employers look for new ways to leverage limited benefit dollars, voluntary/worksite benefits provide an excellent opportunity to enrich a traditional benefits program.

Innovative and flexible benefit choices for your employees

In today’s ultra competitive environment, your benefits package can make the difference in recruiting and retention efforts. Offering employee paid voluntary worksite benefits is a great way to bolster and round out your benefits without increasing cost.

Why Gibson?

Our platform creates the greatest amount of enrollment flexibility and ease of administration. We utilize a non-commissioned voluntary benefit expert to provide communication and counseling on benefit offerings.

Technology Based Enrollment

We utilize a number of application options to ensure a timely and accurate enrollment process that has little disruption to your workflow. Group meetings coupled with one-on-one laptop based enrollments ensures accurate electronic collection of data for your payroll system.

How do employers benefit employees?

Worksite benefits can help supplement your employees' core health benefits by providing them with additional financial protection in the event of a covered accident, injury, or hospitalization. Benefit payments can help cover out-of-pocket expenses not fully covered by regular health insurance. Worksite benefits include accident insurance, critical illness insurance, and hospital confinement indemnity insurance.

Does a worksite plan include wellness?

Does the plan include a wellness incentive? Most worksite plans offer a wellness benefit, which could reimburse an employee, spouse, and/or dependent children each year for having certain tests and routine exams done.

What is the term for the product that remains firmly in the worksite camp?

These products might be cloaked as universal life, whole life or “permanent term .”.

Is a death claim a disability?

A death claim is a death claim. A disability is a disability, and although there are vast differences in the definition of disability between products, these differences have nothing to do with the worksite/voluntary distinction.

What is worksite benefit?

Worksite benefits: Enrolling in worksite benefits will likely involve a one-on-one session with an enroller. You are the end customer and all communications about the policy go directly to you. Group benefits: Group voluntary enrollment offers informational group sessions, but you usually enroll on your own. The employer is the end customer, so ...

What is the difference between worksite and group voluntary benefits?

There are several major differentiators between worksite benefits and group voluntary benefits: 1. Keeping your coverage. Worksite benefits: You own the policy, which means it is fully portable and can be taken with the you even if you leave your employer. There is no age or time limitation on the policy .

Can you cancel a worksite policy?

Renewability. Worksite benefits: Worksite policies are guaranteed renewable and cannot be cancelled by the carrier. No annual renewal process means you don’t have to sign up for these benefits on a yearly basis. Group benefits: The employer owning the benefits is responsible for annually renewing the group policy.

Who owns group benefits?

Group benefits: The policy is owned by the employer, which means that they are responsible for annually renewing the policy and employees could lose coverage if the master policy is cancelled or if they leave their job. There may also be age limitations in which you could lose coverage after reaching a certain age.

Do you have to sign up for worksite benefits each year?

Worksite benefits: Premiums are based on your age at the time you purchase the policy and don’t increase over time. You don’t have to sign up for these benefits each year since there is no annual renewal process.