The audit of the financial statements of an employee benefit plan is meant to safeguard the financial integrity of the plan to provide health, retirement and other associated benefits of the plan to participants over the term of payments.

What is an audit of an employee benefit plan?

An audit of an employee benefit plan involves the examination of financial statements provided by a third party to the DOL, plan management and plan participants. The primary focus of an EBP audit is to accurately gauge the ability of the plan to cover current and future benefits and payments.

What are the benefits of an EBP audit?

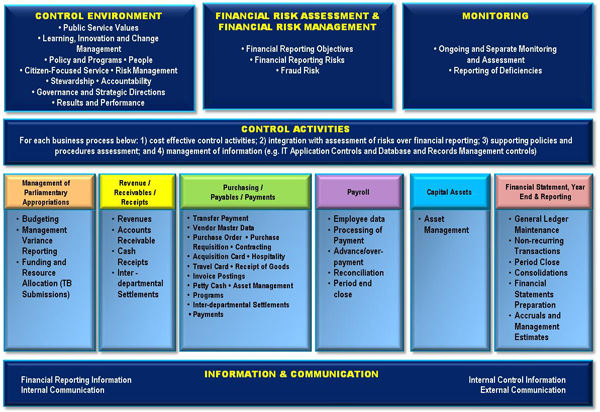

An EBP audit may also provide benefits to a company in streamlining and making the operations of the plan more efficient by identifying the strengths of the internal controls involved in financial reporting.

What is the purpose of the audit?

The audit serves as a wellness check for your plan, ensuring all contributions are remitted timely to the Plan, in accordance with the DOL regulations, avoiding late contributions, and lost earnings calculations.

How do I get help filling out a benefit audit?

If you need help completing the benefit audit forms, call 1-866-401-2849 Monday through Friday, from 8:00 a.m. to 12:00 p.m., except on state holidays. Submit additional information (such as reason for separation, availability, refusals of work, self-employment, and more) on a separate piece of paper if needed.

What is benefit payment control audit on unemployment in PA?

WHAT IS THE PURPOSE OF THIS AUDIT? Pennsylvania UC audits are performed to verify your reported payroll and exclusions taken for UC purposes, to ensure that benefits have been charged correctly to your account, and to answer any questions you may have regarding the UC Law.

What does benefit audit mean?

The benefit audit process is a joint effort by employers and the Employment Development Department (EDD) to protect the integrity of the Unemployment Insurance (UI) Fund and to detect potential fraud.

What does payment audit mean?

A pay audit is a process that lets you verify employees' wages/salaries and identify any pay disparities. Pay audits are vital to achieving pay equity, ensuring employees are paid equally for performing the same or similar work.

What triggers a benefit audit?

Typically what happens to trigger an EDD audit is an independent contractor file for unemployment. Independent contractor is not eligible for unemployment benefits; so his claim triggers the EDD to look into the business practice.

What happens after EDD benefit audit?

The EDD will instruct you to complete the audit form and respond within 10 days of receiving the notice. Completing the audit form helps the EDD determine if the correct payments were made to the claimant. If incorrect payments were made, a credit can be given to an employer's account.

What does benefit payment control mean Illinois?

The Benefit Payment Control (BPC) unit promotes and maintains the integrity of the unemployment insurance (UI) program through prevention, detection, investigation, establishment, recovery and prosecution of UI overpayments made to claimants. Unemployment Insurance Overpayment.

How do I get rid of my unemployment overpayment?

What can you do? File an appeal: If you feel that you received the notice in error, go to your state unemployment website to request a hearing. Request a waiver: If the overpayment is legitimate, then you may be entitled to either a waiver or forgiveness of it.

What is a benefit payment?

a payment of money by the government to people who are ill, unemployed, poor or who have children.

Does EDD audit everyone?

The EDD Verification Process While the Employment Development Department does not audit all employers, rather it does conduct “verification audits” of companies that are selected at random or based on certain criteria.

What does it mean when an employee is audited?

A legal compliance audit measures how well an organization is complying with federal, state and local employment and labor laws and involves a thorough review of HR policies and procedures to ensure legally mandated requirements are incorporated and followed.

Does the IRS audit unemployment benefits?

Because unemployment benefits are taxable income, states issue Form 1099-G, Certain Government Payments, to recipients and to the IRS to report the amount of taxable compensation received and any withholding. Box 1 on the form shows "Unemployment Compensation." You should report fraud to the issuing state agency and ...

How long does an EDD audit take?

six monthsHow Long Does the Audit Take? If everything is done correctly, the payroll tax audit process should not take any longer than six months.

Why is an employee benefit plan audit necessary?

An employee benefit plan audit is necessary to assess a plan’s accuracy and viability due to the multiple stakeholders who are part of the financial reporting process. Generally, EBPs that involve at least 100 eligible participants must have an independent audit of financial statements. The primary objective of ERISA is to protect participants ...

Why is an EBP audit important?

An EBP audit may also provide benefits to a company in streamlining and making the operations of the plan more efficient by identifying the strengths of the internal controls involved in financial reporting.

What is an EBP audit?

Specifically, an EBP audit is part of the process for all sponsors to file a Form 5500, which is a required annual report filed with the DOL. This form assesses investments, operations and 401 (k) financial conditions and provides the IRS and DOL important information concerning compliance and operations of the EBP.

What is the conclusion of an EBP audit?

The conclusion of the audit will provide credibility that your plan will have the funds available to pay benefits to respective participants when these benefits become due. Generally, if your plan has more than 100 eligible participants, an audit requirement is triggered. It’s important to understand what an employee benefit plan (EBP) ...

Why do you need a CPA to audit your financial statements?

Hiring an independent certified public accountant (CPA) to audit your financial statements to ensure your plan is adhering to relevant legislation is standard practice when your plan reaches certain participant count thresholds. The conclusion of the audit will provide credibility that your plan will have the funds available to pay benefits ...

What is a report on specific provisions of plans?

Reports on specific provisions of plans will address both risk response and risk assessment from the perspective of both the auditor as well as the plan management. An effect of these changes will result in increased documentation in financial statements.

Is an audit election considered scope limitation?

The audit election is not considered as part of the scope limitation. Furthermore, a limited scope audit is now referred to as an ERISA 103 (a) (3) (C) audit. The limited scope report will aim to reflect the purpose of the auditor in various reports.

What is an EBP audit?

The audit, which must be fulfilled by an independent party, is intended to uncover any areas for improvement or concern in management of your company’s employee benefit funds. EBP audits typically include a detailed deep dive and review of: Employee and employer contributions into the Plan. Loans and distributions taken out of the Plan.

When are IRS audits due?

Audits are typically due with annual tax returns, with extension filings due October 15, 2020 for calendar year-end Plans.