Generally, to apply for Survivors Benefits you will need to submit the following documentation:

- Birth certificate or proof of birth

- Death certificate of the deceased worker

- Proof of your U.S. ...

- Marriage Certificate

- Documents showing the deceased workers military discharge

- Documents showing the deceased persons income and taxes (W-2 or self-employment tax return)

Full Answer

What documents do I need to apply for Social Security survivor benefits?

If you are applying for survivors benefits as someone caring for the deceased workers child you will need to provide the following documents to Social Security: Documents showing the deceased persons income and taxes (W-2 or self-employment tax return) If the child was adopted you will need to provide proof of adoption as well.

Do I need to apply for survivors benefits?

You generally will not need to file an application for survivors benefits. We'll automatically change any monthly benefits you receive to survivors benefits after we receive the report of death. We may be able to pay the Special Lump-Sum Death Payment automatically. If you are getting retirement or disability benefits on your own record:

How do I apply for Social Security survivor benefits?

A widow, widower, or surviving divorced spouse cannot apply online for survivors benefits. You should contact Social Security at 1-800-772-1213 to request an appointment.

Who is eligible for Social Security Survivors Benefits?

Social Security survivors benefits are paid to widows, widowers, and dependents of eligible workers. This benefit is particularly important for young families with children. This page provides detailed information about survivors benefits and can help you understand what to expect from Social Security when you or a loved one dies.

What documents are needed for survivor benefits?

Get Started Applying for Survivor's BenefitsProof of death.Birth certificate.Proof of citizenship.Proof of disability.Certain SSA forms.W-2s and tax forms.Marriage certificate.Divorce decree.More items...

How do I apply for survivor benefits?

If you need to report a death or apply for benefits, call 1-800-772-1213 (TTY 1-800-325-0778). You can speak to one of our representatives between 8:00 am – 7:00 pm. Monday through Friday. You can also contact your local Social Security office.

How long does it take for survivor benefits to start?

30 to 60 daysIt takes 30 to 60 days for survivors benefits payments to start after they are approved, according to the agency's website.

How do you qualify for widow's benefits?

Who is eligible for this program?Be at least age 60.Be the widow or widower of a fully insured worker.Meet the marriage duration requirement.Be unmarried, unless the marriage can be disregarded.Not be entitled to an equal or higher Social Security retirement benefit based on your own work.

Can you be denied survivor benefits?

If a person's application for Social Security Survivor Benefits is denied, the person can appeal the denial. A person has 60 days after they receive a notice of decision on their case from the SSA to ask for an appeal.

Can I file for survivor benefits online?

Survivors Benefits You cannot report a death or apply for survivors' benefits online. If you need to report a death or apply for survivors' benefits, call 1-800-772-1213 (TTY 1-800-325-0778). You can speak to a Social Security representative between 7 AM and 7 PM Monday through Friday.

What is the difference between survivor benefits and widow benefits?

While spousal benefits are capped at 50% of your spouse's benefit amount, survivor benefits are not. If you're widowed, you're eligible to receive the full amount of your late spouse's benefit, if you've reached full retirement age. The same is true if you are divorced and your ex-spouse has died.

How much do you get for survivor benefits?

As previously noted, if you have reached full retirement age, you get 100 percent of the benefit your spouse was (or would have been) collecting. If you claim survivor benefits between age 60 and your full retirement age, you will receive between 71.5 percent and 99 percent of the deceased's benefit.

How long does a spouse get survivors benefits?

Widows and widowers Generally, spouses and ex-spouses become eligible for survivor benefits at age 60 — 50 if they are disabled — provided they do not remarry before that age. These benefits are payable for life unless the spouse begins collecting a retirement benefit that is greater than the survivor benefit.

How much are widows benefits?

Widow or widower, full retirement age or older—100% of your benefit amount. Widow or widower, age 60 to full retirement age—71½ to 99% of your basic amount. A child under age 18 (19 if still in elementary or secondary school) or has a disability—75%.

When my husband dies do I get his Social Security and mine?

Social Security will not combine a late spouse's benefit and your own and pay you both. When you are eligible for two benefits, such as a survivor benefit and a retirement payment, Social Security doesn't add them together but rather pays you the higher of the two amounts.

How do I apply for spousal death benefits?

Form SSA-10 | Information You Need to Apply for Widow's, Widower's or Surviving Divorced Spouse's Benefits. You can apply for benefits by calling our national toll-free service at 1-800-772-1213 (TTY 1-800-325-0778) or visiting your local Social Security office.

How Does Social Security Help You When Your Loved One Dies

When someone dies, you should notify the Social Security Administration as soon as you can.

What Are Death Benefits

The Death Benefit is a one-time lump-sum payment for the spouse of the deceased.

What Documents Do I Need To Provide For The Death Benefit Lump Sum Payment

To apply for the lump sum Death Benefit you will need to provide the following:

When Will I Receive Death Benefits Payments

Once you have provided all the necessary documents, answer all Social Securities questions, and they have reviewed your case you should receive the death benefit lump sum payment within 30-60 days.

Who Can Receive Survivors Benefits

Widows and widowers, divorced spouses, children, stepchildren, and other family members could be eligible for Survivors Benefits. In some cases, the individual must prove they are related to the deceased or prove they are caring for the deceased’s child.

How Do I Apply For Childs Benefits

You can apply for Child’s Benefits by calling Social Securities national toll-free number at 1-800-772-1213 or (TTY 1-800-325-0778). You could also visit your local Social Security office. Find your nearest office here.

What Documents Do I Need To Submit For Survivors Benefits

Generally, to apply for Survivors Benefits you will need to submit the following documentation:

How to report a death to Social Security?

To report a death or apply for survivors benefits, use one of these methods: Call our toll-free number, 1-800-772-1213 (TTY 1-800-325-0778 ). Visit or call your local Social Security office. More Information. If You Are The Survivor. Survivors Benefits.

How old do you have to be to get a widower's pension?

Widows and Widowers. A widow or widower can receive benefits: At age 60 or older. At age 50 or older if disabled. At any age if they take care of a child of the deceased who is younger than age 16 or disabled. Divorced Widows and Widowers.

What age can you get disability benefits?

Younger than age 18 (or up to age 19 if they are attending elementary or secondary school full time). Any age and were disabled before age 22 and remain disabled. Under certain circumstances, benefits also can be paid to stepchildren, grandchildren, stepgrandchildren, or adopted children. Dependent parents.

How much is a death benefit for dependent parents?

Parents age 62 or older who received at least one-half support from the deceased can receive benefits. One-time lump sum death payment. A one-time payment of $255 can be made only to a spouse or child if they meet certain requirements.

Can you get Social Security if you die?

When you die, members of your family could be eligible for benefits based on your earnings. You and your children also may be able to get benefits if your deceased spouse or former spouse worked long enough under Social Security.

How long do you have to wait to receive Social Security if you die?

If the eligible surviving spouse or child is not currently receiving benefits, they must apply for this payment within two years of the date of death. For more information about this lump-sum payment, contact your local Social Security office or call 1-800-772-1213 ( TTY 1-800-325-0778 ).

How to report a death to the funeral home?

You should give the funeral home the deceased person’s Social Security number if you want them to make the report. If you need to report a death or apply for benefits, call 1-800-772-1213 (TTY 1-800-325-0778 ). You can speak to a Social Security representative between 8:00 am – 5:30 pm. Monday through Friday.

What percentage of a widow's benefit is a widow?

Widow or widower, full retirement age or older — 100 percent of the deceased worker's benefit amount. Widow or widower, age 60 — full retirement age — 71½ to 99 percent of the deceased worker's basic amount. A child under age 18 (19 if still in elementary or secondary school) or disabled — 75 percent.

How much can a family member receive per month?

The limit varies, but it is generally equal to between 150 and 180 percent of the basic benefit rate.

Can I apply for survivors benefits now?

You can apply for retirement or survivors benefits now and switch to the other (higher) benefit later. For those already receiving retirement benefits, you can only apply for benefits as a widow or widower if the retirement benefit you receive is less than the benefits you would receive as a survivor.

When can I switch to my own Social Security?

If you qualify for retirement benefits on your own record, you can switch to your own retirement benefit as early as age 62 .

Can a minor receive Social Security?

Minor Or Disabled Child. If you are the unmarried child under 18 (up to age 19 if attending elementary or secondary school full time) of a worker who dies, you can be eligible to receive Social Security survivors benefits. And you can get benefits at any age if you were disabled before age 22 and remain disabled.

You can still file a claim and apply for benefits during the coronavirus pandemic

Get the latest information about in-person services, claim exams, extensions, paperwork, decision reviews and appeals, and how best to contact us during this time. Go to our coronavirus FAQs

Should I submit an intent to file form?

You may want to submit an intent to file form before you apply for VA Survivors Pension benefits. This can give you the time you need to gather your evidence while avoiding a later potential start date (also called an effective date).

How long does it take VA to make a decision?

It depends. We process VA Survivors Pension claims in the order we receive them, unless a claim requires priority processing.

What to do if you disagree with a decision made on your claim?

If you disagree with a decision made on your claim, you can appeal it. For an explanation of the steps you can take, read The Appeals Process (Publication No. 05-10041).

Do you pay Social Security taxes to survivors?

Many people think of Social Security only as a retirement program. But some of the Social Security taxes you pay go toward survivors benefits for workers and their families. In fact, the value of the survivors benefits you have under Social Security is probably more than the value of your individual life insurance.

How to claim survivor benefits?

How To Claim Survivor’s Benefits. To begin receiving survivor’s benefits, you must make a claim with the Social Security Administration . Survivor’s benefit’s claims may not be made online. You can start the claims process over the telephone, 1-800-772-1213, or go to your local Social Security office.

What is a surviving spouse?

A surviving spouse, who was residing with the deceased spouse, or. A surviving spouse, who was not residing with the deceased, but was receiving benefits based upon the work record of the deceased spouse, or who becomes eligible for benefits after the death of the spouse , or.

What happens if a spouse dies after full retirement age?

If the deceased spouse never filed for benefits, and died after their full retirement age, the survivor receives the deceased’s benefit in the same amount it would have been on the date of the deceased’s death (including delayed retirement credits) reduced for the filing age of the survivor.

What happens if a deceased spouse files for Social Security?

If the Deceased DID File for Benefits. If the deceased spouse filed for benefit on or after their full retirement age, and the surviving spouse is at full retirement age, the benefit amount payable to the survivor will remain unchanged.

How long do you have to be married to receive Social Security?

In general, spouse survivor benefits are available to: Surviving spouses, who were married at least 9 months, beginning at age 60. Benefit amount may depend on the age at which you file ...

What is the maximum amount you can draw if you are a deceased spouse?

This rule states that if your deceased spouse filed early, you’ll be forever limited to either the amount they were drawing, or 82.5% of their full retirement age benefit.

What is proof of death?

Proof of death—either from a funeral home or death certificate; Your Social Security number, as well as the deceased worker’s; Your birth certificate; Your marriage certificate, if you are a widow or widower; Dependent children’s Social Security numbers, if available, and birth certificates;

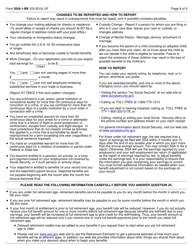

Documents you may need to provide

We may ask you to provide documents to show that you are eligible, such as:

What we will ask you

You also should bring along your checkbook or other papers that show your account number at a bank, credit union or other financial institution so you can sign up for Direct Deposit, and avoid worries about lost or stolen checks and mail delays.