To be eligible for Unemployment Insurance (UI) benefits, you must:

- Have earned at least: $5,700 during the last 4 completed calendar quarters, and 30 times the weekly benefit amount you would be eligible to collect

- Be legally authorized to work in the U.S.

- Be unemployed, or working significantly reduced hours, through no fault of your own

- Be able and willing to begin suitable work without delay when offered

Full Answer

How to tell if you are eligible for unemployment benefits?

You must be:

- Physically able to work.

- Available for work.

- Ready and willing to accept work immediately.

What can you do to get denied unemployment benefits?

- You voluntarily quit your job. You may still be eligible for unemployment benefits if you quit your last job, as long as you had a good reason (as defined by ...

- You were fired for misconduct. Being fired from your job doesn't necessarily disqualify you from unemployment benefits. ...

- You don't have sufficient earnings or work during the base period. ...

When should I file for unemployment benefits?

- Lost your job through no fault of your own - To qualify for unemployment benefits, you need to have been let go from a company because of a lack of ...

- Be an employee - Only company employees qualify under unemployment guidelines. ...

- Meet wage requirements - Most states have a base period used to qualify an individual for benefits. ...

How much money do you get from unemployment benefits?

You can collect benefits if you meet a series of legal eligibility requirements:

- Have earned qualifying wages

- Are unemployed through no fault of their own

- Are able and obtainable to work full-time and

- Are keenly looking for full-time work

Who can apply for pandemic unemployment in NY?

Quit a job as a direct result of COVID-19; Place of employment closed as a direct result of COVID-19; Had insufficient work history and affected by COVID-19; Otherwise not qualified for regular or extended UI benefits and affected by COVID-19.

What can disqualify you from unemployment benefits in Texas?

You may be eligible for benefits if you were fired for reasons other than misconduct. Examples of misconduct that could make you ineligible include violation of company policy, violation of law, neglect or mismanagement of your position, or failure to perform your work adequately if you are capable of doing so.

How much is NY unemployment benefits?

The New York State Department of Labor (NYSDOL) determines your weekly unemployment benefit amount by dividing your earnings for the highest paid quarter of the base period by 26, up to a maximum of $504 per week.

How long after being laid off can I file for unemployment Texas?

You should apply for benefits as soon as you become unemployed. When you apply for unemployment benefits, the effective date of your initial claim is the Sunday of the week in which you apply. We cannot pay benefits for weeks before your claim effective date.

What reasons can you be denied unemployment in Texas?

Common reasons why unemployment claims are denied include:Failing to Meet the Earnings Requirements. To qualify for benefits in Texas (as in most states), you must have earned a minimum amount in wages during a 12-month stretch called the "base period."Getting Fired for Misconduct. ... Quitting Your Last Job.

Can you quit your job and get unemployment?

Your eligibility for benefits will depend on your means and on the details of how your job ended. You are likely to be penalised by the loss of benefits for around three months if you left your last job voluntarily, unless you can show that you did so for “good reason”.

Is NYS getting $300 unemployment?

Pandemic Unemployment Compensation: Additional payments of $600 per week for benefit weeks ending 4/5/2020 to 7/26/2020 and $300 per week for the benefit weeks ending 1/3/2021 to 9/5/2021 while unemployed.

How many months do you need to work to qualify for unemployment in NY?

1. You must have worked for at least two calendar quarters. A calendar quarter is three months of the year. In other words, you cannot claim unemployment benefits unless you have worked for at least six months.

How long is unemployment in NY 2021?

26 weeksYou can get up to 26 weeks of benefits while you are unemployed.

What can disqualify you from unemployment benefits?

Unemployment Benefit DisqualificationsInsufficient earnings or length of employment. ... Self-employed, or a contract or freelance worker. ... Fired for justifiable cause. ... Quit without good cause. ... Providing false information. ... Illness or emergency. ... Abusive or unbearable working conditions. ... A safety concern.More items...•

Do you have to pay back unemployment in Texas?

State law requires that you repay your overpayment before we can pay further unemployment benefits. TWC cannot dismiss or forgive an overpayment, and there is no exception in the law for hardship cases.

How will I know if I'm approved for unemployment Texas?

You can check your claim status online at Unemployment Benefits Services or call Tele-Serv at 800-558-8321. We use information from you and your last employer to determine if you qualify. TWC sends your last employer a letter with the reason you gave for no longer working there.

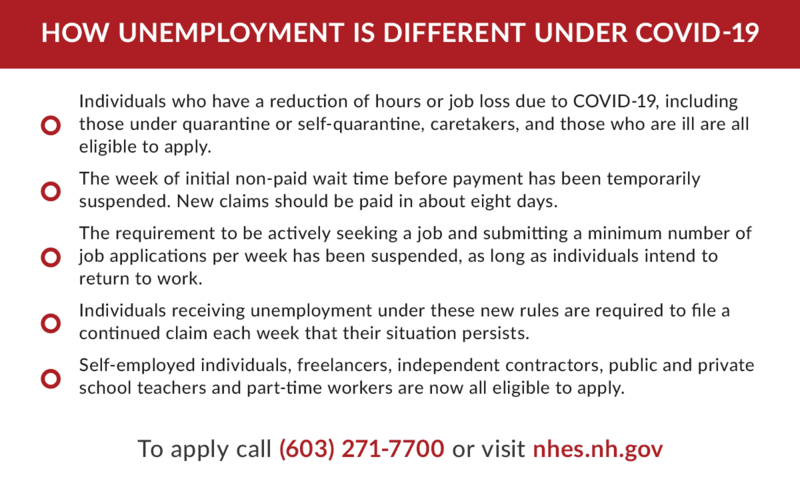

COVID-19 Unemployment Benefits

COVID-19 extended unemployment benefits from the federal government have ended. But you may still qualify for unemployment benefits from your state...

How to Apply for Unemployment Benefits

There are a variety of benefit and aid programs to help you if you lose your job. CareerOneStop.org is a good place to start. It can help with unem...

Continuation of Health Coverage: COBRA

Learn how you can continue your health care coverage through COBRA.What is COBRA?COBRA is the Consolidated Omnibus Budget Reconciliation Act. COBRA...

Short-Term and Long-Term Disability Insurance

If you can't work because you are sick or injured, disability insurance will pay part of your income. You may be able to get insurance through your...

Workers' Compensation for Illness or Injury on the Job

Workers' compensation laws protect employees who get hurt on the job or sick from it. The laws establish workers’ comp, a form of insurance that em...

Wrongful Discharge/Termination of Employment

If you feel that you have been wrongfully fired from a job or let go from an employment situation, you may wish to learn more about your state's wr...

Welfare or Temporary Assistance for Needy Families (TANF)

Temporary Assistance for Needy Families (TANF) is a federally funded, state-run benefits program. Also known as welfare, TANF helps families achiev...

How long does unemployment last?

Extended unemployment insurance benefits last for 13 weeks. You can apply for extended benefits only once you've run out of regular benefits. Check with your state; not everyone qualifies. You must report unemployment benefits as income on your tax return.

What is the extension for unemployment in 2021?

The American Rescue Plan Act of 2021 temporarily authorized: An extension for people already receiving unemployment benefits. Automatic, additional payments of $300 per week to everyone qualified for unemployment benefits. Extension of the Pandemic Unemployment Assistance (PUA) program for self-employed or gig workers.

How Do I Qualify For Unemployment Benefits

To qualify for unemployment benefits, we look at the wages you were paid in the first four of the last five calendar quarters the standard base period.

Where Do I File For Unemployment Insurance

Unemployment insurance is a joint state-federal program that provides cash benefits to eligible workers. Each state administers a separate unemployment insurance program, but all states follow the same guidelines established by federal law.

Unemployment Benefits And Public Charge

The U.S. Department of Homeland Security does not list unemployment benefits as public benefits under its new rules on public charge.

Florida Unemployment Phone Number

If you need assistance filing a Florida unemployment claim online due to a language barrier, a disability, computer illiteracy, or for legal reasons, you can call 1-800-681-8102 for help.

Im Partially Employed Because Im A Student And Work Part Time Doing Ride

You may be eligible for PUA, depending on your personal circumstances. A gig economy worker, such as a driver for a ride-sharing service, is eligible for PUA provided that he or she is unemployed, partially employed, or unable or unavailable to work for one or more of the qualifying reasons provided for by the CARES Act.

Where Do You Go To Apply And When Can You Expect The Money

The Federal Pandemic Unemployment Compensation program, authorized by the CARES Act and renewed by subsequent legislation and a presidential order, originally provided $600 per week in extra unemployment benefits to unemployed workers in states that opted in to the program.

My Regular Unemployment Compensation Benefits Do Not Provide Adequate Support Given The Unprecedented Economic Challenges Caused By The Covid

Yes, depending on how your state chooses to implement the CARES Act.

What is the eligibility for unemployment?

When you apply for Unemployment Insurance (UI), your initial eligibility for benefits is based on your earnings and your reason for leaving your job. Ongoing eligibility requirements include being able to work, available for work, and actively searching for work.

How to qualify for unemployment benefits each week?

To qualify for benefits, each week, you must be: Physically able to work. Available to work. Actively looking for work (3 work search attempts) You may also be required to register with a Career Center to complete mandatory seminars to remain eligible to receive unemployment benefits.

What affects weekly unemployment?

Your eligibility for weekly benefits may be affected if you: Aren’t able, available, or actively seeking work. Refuse, quit, or are fired from a job. Receive other income.

How much do you have to earn to collect unemployment?

To be eligible for Unemployment Insurance (UI) benefits, you must: Have earned at least: $5,400 during the last 4 completed calendar quarters, and. 26 times the weekly benefit amount you would be eligible to collect. Be legally authorized to work in the U.S.

Can I get unemployment if I am self employed?

You may not be eligible for Unemployment Insurance (UI) benefits if your only source of employment is from working as: If you’re self-employed, a contractor, or otherwise not traditionally eligible for Unemployment Insurance (UI) benefits, you may be eligible for Pandemic Unemployment Assistance (PUA). If you’re unemployed due to the COVID-19 ...

Can I get PUA if I am self employed?

If you’re self-employed, a contractor, or otherwise not traditionally eligible for Unemployment Insurance (UI) benefits, you may be eligible for Pandemic Unemployment Assistance (PU A). If you’re unemployed due to the COVID-19 public health emergency, and are able and available to work, learn more about PUA.

Is unemployment insurance covered in Massachusetts?

Learn about the requirements for staying eligible and discover what can affect your weekly benefits. Most Massachusetts workers are covered by the Unemployment Insurance (UI) program, although workers in some jobs may not be eligible for benefits.

What are the requirements to apply for unemployment in Maryland?

If you choose to apply for Maryland (MD) unemployment insurance benefits, the State of Maryland requires you to meet several eligibility requirements. Because these benefits are meant as a temporary aid following a layoff or other kinds of job loss, you must: Be able to work. Be actively searching for a new job.

How much unemployment do you get in Maryland?

In Maryland, unemployment amounts range from $50 to $430 per week depending on how much you made at your last job. Maryland unemployment laws dictate that you can only collect benefits for up to 26 weeks, although your Maryland unemployment weekly claims will no longer be filled if you find new work before then.

What is the base period for unemployment in Maryland?

In Maryland, your base period is the last four of five quarters that you worked , and you must have earned a minimum amount to be eligible. Maryland requires you to:

Can you get unemployment benefits in Maryland?

Maryland unemployment benefits can help you cover living expenses while you search for a new job, and until you begin receiving paychecks from a new employer. Maryland unemployment eligibility depends on several factors. State of Maryland unemployment benefits are available to workers who have lost their job, but for reasons ...

Can you get unemployment if you were fired?

You may not qualify for unemployment benefits if you lost your job because of workplace behaviors, attitudes or other issues. An employer can contest your application for unemployment benefits if you were fired for: Failure to follow safety and workplace rules. Damaging employer property or theft.

Does Maryland have unemployment?

To avoid confusion, you should know that Maryland calls its unemployment benefits “Unemployment Insurance,” but despite having a different name, offers the same assistance as many states offering unemployment payments. The Department of Labor, Licensing and Regulation handles all Maryland unemployment claims.

How long do you have to wait to apply for unemployment benefits after your last job?

If your last job was for a temporary agency, you must immediately contact the temporary agency for a new assignment and wait three business days after your assignment ended before applying for benefits. The agency has three business days to offer you a new assignment.

Is Social Security claim information confidential?

Your claim is confidential. However, we share some information with government agencies and their contractors for the administration and enforcement of laws, including verifying eligibility for public assistance, supporting law enforcement activities, and other purposes permitted by law. Allowable uses of confidential information may include performing statistical analysis, research and evaluation.#N#Disclosure may be made to entities that manage and evaluate programs such as Social Security, Medicaid, nutrition assistance, and child support. We mail a notice of your claim to your last employer and may communicate with other former employers. If we pay you benefits by debit card, we share information with U.S Bank because it manages your debit-card account. U.S. Bank and government agencies with access to information must agree to comply with state and federal laws regarding the confidentiality of claim information.

How many hours do you have to work to get unemployment?

To determine if you are eligible for unemployment benefits we examine: 1. Whether you worked enough hours in your base year: You must have worked at least 680 hours in your base year.

Is unemployment based on financial need?

( en español) Unemployment benefits partially replace your regular earnings and help you meet expenses while you look for another job. It is not based on financial need.

What is the regular base period for unemployment?

The regular base period consists of the first four of the last five completed calendar quarters prior to the effective date of your claim. If you feel the wages shown on the determination are incorrect, call 1-866-832-2363 (Available 8:15am to 4:30pm, Monday - Friday and 9am to 1pm Saturday.

How long does unemployment last?

If you qualify monetarily, your claim remains in effect for one year. This period is called a benefit year.

What happens if you work less than your weekly income?

If you work and your gross income for the week is less than your weekly benefit amount, that gross amount less $50 will be deducted from your weekly benefit amount. If your gross earnings equal or exceed your weekly benefit amount, you will not receive benefits for that week.

How many hours do you have to work to get a pension?

If you receive a pension, retirement, or other annuity, it will be deducted from your weekly benefit amount if it is paid by your most recent employer of 30 days or 240 hours or more, or from any employer in the base period of your claim (as shown on your monetary determination).

What is considered suitable work?

The term suitable work takes into account many factors such as previous work experience, physical and mental fitness, risk to your health, safety, or morals, and the distance from your home. Conditions of the work offered, such as wages and hours, are also considered.

How long do you have to file a weekly claim?

To avoid denial of benefits, you must file your first weekly claim within 28 days of the date you filed your initial/new claim. For example, if you filed your claim on January 2, your first weekly claim must be filed by January 30. Subsequent weekly claims for benefits must be filed within 28 days of the Saturday date of the week claimed. For example, if your last week claimed ended on Saturday, February 4, then your subsequent weekly claim must be filed no later than March 4. The Voice Response System and the Internet will not allow you to claim benefits for weeks that are more than 28 days old.

When does the weekly request for unemployment end?

You must meet the weekly eligibility requirements listed below. Your benefit week begins on Sunday and ends at midnight on Saturday. You cannot claim the week until it is completely over.