401 (k)s offer workers a lot of benefits, including:

- Tax breaks

- Employer match

- High contribution limits

- Contributions after age 72

- Shelter from creditors

What are the benefits of contributing to 401k?

Tax benefits for saving

- The saver's credit directly reduces your taxable income by a percentage of the amount you put into your 401 (k).

- Since its introduction in 2002, this credit for retirement savings has ranged from $1,000 to $2,000.

- Eligible taxpayers calculate their credit using form 8880 and enter the amount on their 1040 tax return.

How much should you contribute to a 401(k)?

The most common 401 (k) match formula is 50 cents for each dollar saved, up to 6% of pay. Employees in this type of plan would need to contribute at least 6% of their salary to the 401 (k) plan to get the maximum possible 401 (k) match.

What is considered eligible compensation for a 401k?

- Calculating contributions and deferrals.

- Calculating the dollar amounts reported under the various definitions of compensation.

- Using the payroll reports, a source document, to confirm the accuracy of the Forms W-2, a non-source document.

- Verifying the correct definition (s) of compensation are used for contributions and deferrals.

What is better a pension or a 401k?

The major differences between pensions and 401 (k) plans can be summed up as follows:

- Pensions are primarily funded by employers while 401 (k) plans are primarily funded by employees.

- Pension investments are controlled by employers while 401 (k) investments are controlled by employees.

- Pensions offer guaranteed income for life while 401 (k) benefits can be depleted and depend on an individual's investment and withdrawal decisions.

What are the benefits of a 401k?

Here are 5 benefits of most traditional 401(k) plans:Tax advantages. Contributions to a traditional 401(k) are taken directly out of your paycheck before federal income taxes are withheld. ... You are in control. ... Time is on your side. ... You can take it with you. ... Easy payroll deductions.

How are 401k benefits paid out?

Generally speaking, retirees with a 401(k) are left with the following choices—leave your money in the plan until you reach the age of required minimum distributions (RMDs), convert the account into an individual retirement account (IRA), or start cashing out via a lump-sum distribution, installment payments, or ...

Is 401k retirement benefit?

Key Takeaways. A 401(k) is a retirement plan to which employees can contribute; employers may also make matching contributions. With a pension plan, employers fund and guarantee a specific retirement benefit for each employee and assume the risk of the financial obligation.

How do I get my 401k money?

By age 59.5 (and in some cases, age 55), you will be eligible to begin withdrawing money from your 401(k) without having to pay a penalty tax. You'll simply need to contact your plan administrator or log into your account online and request a withdrawal.

How do 401k work when you quit?

When you quit your job, your 401(k) could be left with your old employer if you choose. Alternatively, they could be rolled over to an IRA if you decide to. Your 401(k) could also be rolled over automatically to an IRA by your employer if it has less than $5000 in balance.

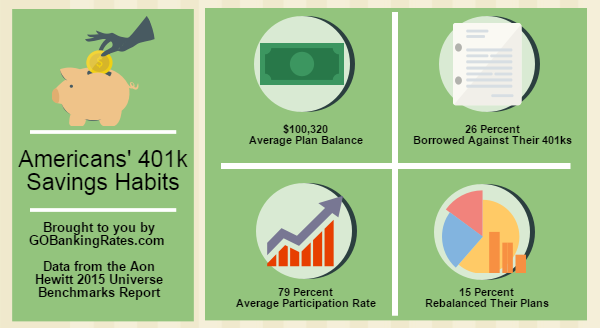

How do I find out my 401k balance?

You can find your 401(k) balance by logging into your 401(k) plans online portal and check how your 401(k) is performing. If you don't have access to your account online, contact your HR department and make sure your quarterly statements are being sent to the correct address.

Is 401k the same as pension?

What's the difference between a pension plan and a 401(k) plan? A pension plan is funded by the employer, while a 401(k) is funded by the employee. (Some employers will match a portion of your 401(k) contributions.) A 401(k) allows you control over your fund contributions, a pension plan does not.

What is 401(k) DC?

Named after a section of the Internal Revenue Code, 401 (k)s are employer-sponsored defined-contribution plans (DC) that give workers a tax-advantaged way to save for retirement. If your employer offers a 401 (k), you can opt to contribute a percentage of your income to the plan. The contributions are automatically taken out of your paycheck, ...

How many people are in 401(k)?

Of course, the more you know about 401 (k)s, the more you'll be able to take advantage of those 401 (k) benefits. More than 80 million workers actively participate in 401 (k)s, with more than half-a-million different company plans in place, according to a January 2019 report by the American Benefits Council.

What is the maximum amount you can contribute to a Roth 401(k) in 2020?

Roth 401 (k) Limits. Roth 401 (k) contribution limits follow those of 401 (k)s—not Roth IRAs. For 2020, that combined limit goes up to $57,000, or $63,500 with the catch-up contribution. and in 2021 that amount is $58,000, or $64.500 with the catch-up contribution. 5 .

What is a Roth 410?

Roth 410 (k)s are ideal for high earners who aren't eligible to contribute to a Roth IRA and for people who expect to be in a higher tax bracket in retirement.

How are 401(k) withdrawals taxed?

Withdrawals from your 401 (k) are taxed at your prevailing income-tax rate when you take money out. There are restrictions on how and when you can withdraw money from the account.

What is the maximum 401(k) contribution for 2021?

401 (k) Contribution Limits. You can save much more each year in a 401 (k) than in an IRA. For 2020 and 2021, the 401 (k) contribution limits are $19,500 and $26,000 (includes a $6,500 catch-up for those age 50 and older), respectively. 4 . Your employer can contribute, too.

How much does a 6% match add to a 401(k)?

Some employers even go one better and match your contributions dollar-for-dollar for up to the first 6%, which would add another $2,700 in this scenario, thus doubling your annual contributions to the plan.

What are the benefits of 401(k)?

The main benefit of 401(k) plans is that they allow retirement savings to grow tax deferred. But there are more advantages, especially in comparison to individual retirement accounts (IRAs). Read on for these less-known 401(k) benefits – plus for info about the newer Roth 401(k).

What is 401(k) plan?

Named after the federal tax code section that created them, 401(k) plans are voluntary savings programs. Employers provide them and employees choose to participate in them. When employees do, a defined amount is taken out of their paychecks and sent directly to their 401(k) investment accounts.

Why do you need to stow your savings in a 401(k)?

For one thing, because taxes are deferred until you retire, your earnings will compound – and grow faster than if you had to deduct taxes from the earnings. For another, companies often offer matches, which grow your nest egg even more. Additionally, 401(k) plans have benefits for late savers, individuals experiencing financial hardship and people who are not sophisticated investors and can use the screening and help of 401(k) plan administrators.

What happens if you don't count your contributions as income?

Second, by not being counted as income, your contributions could put you in a lower tax bracket. The result: your tax bill will be smaller for your having socked away money for retirement. Third, your savings grow tax deferred. In a regular investment account, your net gains and dividends would be taxed.

What is 401(k) fiduciary?

Because 401(k) plans fall under the Employee Retirement Income Security (ERISA) Act, employers have a responsibility to make sure that participants’ best interests are being put first. In other words, the plan administrators are held to fiduciary standard.

Is 401(k) pre-tax?

These contributions are pre-tax, which means they are deducted from your income before your income tax is calculated. Participation in 401(k)s has risen as pensions have become less common.

Who can help with 401(k)?

A financial advisor can help. More people, including part-timers and those who work for small businesses, may soon have access to 401(k) plans than ever before. That is, if legislation that passed almost unanimously in the House, the Setting Every Community up for Retirement Enhancement (SECURE) Act of 2019, also passes in the Senate.

What is the maximum 401(k) contribution?

401 (k) plans have the highest contribution limits of any retirement account. The employee deferral limit is $19,500 in 2020 and 2021. If you're 50 or older, you can defer an extra $6,500 per year. Those limits far exceed IRA contribution limits, which are capped at $6,000 in 2020 and 2021, with an extra $1,000 catch-up contribution for older savers.

How long does a 401(k) loan last?

The account holder has up to five years to fully repay the loan.

Can creditors get your 401(k)?

Most creditors won't be able to get their hands on your retirement savings in a 401 (k) account. There are a couple of exceptions: Ex-spouses can seek a share of 401 (k) assets in divorce proceedings, and the IRS can come after your savings for unpaid taxes. But in the case of a lawsuit against you or if you need to declare bankruptcy, your retirement savings are safe.

Is 401(k) tax free?

Savings in a 401 (k) are tax advantaged. Depending on the type of account an employee sets up, contributions may be tax deferred (traditional) or tax free upon withdrawal (Roth).

Can you withdraw from a Roth 401(k) without penalty?

Employees can also withdraw their contributions (but not their gains) without penalty at any time.

What is a 401(k) plan?

In the United States, a 401 (k) plan is an employer-sponsored defined-contribution pension account defined in subsection 401 (k) of the Internal Revenue Code. Employee funding comes directly off their paycheck and may be matched by the employer. There are two main types corresponding to the same distinction in an Individual Retirement Account (IRA); variously referred to as traditional vs. Roth, or tax-deferred vs. tax exempt, or EET vs. TEE. For both types profits in the account are never taxed. For tax exempt accounts contributions and withdrawals have no impact on income tax. For tax deferred accounts contributions may be deducted from taxable income and withdrawals are added to taxable income. There are limits to contributions, rules governing withdrawals and possible penalties.

What is the benefit of a tax exempt 401(k)?

The benefit of the tax-exempt account is from tax-free profits. The net benefit of the tax deferred account is the sum of (1) the same benefit from tax-free profits, plus (2) a possible bonus (or penalty) from withdrawals at tax rates lower (or higher) than at contribution, and (3) the impact on qualification for other income-tested programs from contributions and withdrawals reducing and adding to taxable income. As of 2019, 401 (k) plans had US$ 6.4 trillion in assets.

How long do you have to make a Roth 401k distribution?

To qualify, distributions must be made more than 5 years after the first designated Roth contributions and not before the year in which the account owner turns age 59. +.

How old do you have to be to withdraw from a 401(k)?

Generally, a 401 (k) participant may begin to withdraw money from his or her plan after reaching the age of 59#N#+#N#1⁄2 without penalty. The Internal Revenue Code imposes severe restrictions on withdrawals of tax-deferred or Roth contributions while a person remains in service with the company and is under the age of 59#N#+#N#1⁄2. Any withdrawal that is permitted before the age of 59#N#+#N#1⁄2 is subject to an excise tax equal to ten percent of the amount distributed (on top of the ordinary income tax that has to be paid), including withdrawals to pay expenses due to a hardship, except to the extent the distribution does not exceed the amount allowable as a deduction under Internal Revenue Code section 213 to the employee for amounts paid during the taxable year for medical care (determined without regard to whether the employee itemizes deductions for such taxable year). Amounts withdrawn are subject to ordinary income taxes to the participant.

How long can you keep 401(k) money?

To maintain the tax advantage for income deferred into a 401 (k), the law stipulates the restriction that unless an exception applies, money must be kept in the plan or an equivalent tax deferred plan until the employee reaches 59. +. 1⁄2 years of age. Money that is withdrawn prior to the age of 59. +.

When did the 401(k) plan become popular?

Congress did this by enacting Internal Revenue Code Section 401 (k) as part of the Revenue Act. This occurred on November 6, 1978. Only a few people paid any attention to Section 401 (k) until the early 1980s. The old plan design it reauthorized had never been popular and wasn’t likely to become popular.

When did retirement plans stop giving cash?

Before 1974, a few U.S. employers had been giving their employees the option of receiving cash in lieu of an employer-paid contribution to their tax-qualified retirement plan accounts. The U.S. Congress banned new plans of this type in 1974, pending further study.

What is 401(k) retirement?

A 401 (k) is an employer-sponsored savings plan designed to give employees an income when they retire. Employees can choose to invest some of their pre-tax earnings into their 401 (k) and their employer can choose to match some of all of their staff members' contributions. The tax on a standard 401 (k) is deferred, meaning that it isn't taken as the income is earned, but instead applied when the money is withdrawn from the account.

What is a 401(k)?

A 401 (k) is the main source of retirement funds for many once they stop working. Contributing to a 401 (k) throughout your career can help you save money for your retirement. Many employers will also contribute to your 401 (k) plan (called "matching funds") when you regularly save, so it can be an easy way to maximize savings.

How does 401(k) work?

A 401 (k) works by contributing a part of your salary or wages to a dedicated account. You can choose to contribute up to $19,500 per year to your 401 (k) in 2020, with the catch-up contribution for those over 50 being an additional $6,500. Employers usually work with a dedicated financial professional to invest your funds in the market. That way, your funds continue to grow based on the investment plan. Your employer may give you different investment options that include varying stock and bond mixes.

What happens if you leave your 401(k) before it is vested?

If you leave before their funds are vested, then you lose that money. The money you contributed stays, but the funds the employer contributed returns to them. Vesting could happen in increments., meaning you may get 25% of your employer's contributions after one year, then 50% after two years and so on.

What does it mean to roll over a 401(k) to a new employer?

Rolling over an existing account to your new employer's plan means you don't need to pay any taxes or penalties. The rollover process is designed to make it easy for you to move your 401 (k) with you as you change jobs. It's an ideal option if your new employer offers a retirement plan.

Why is 401(k) a popular retirement account?

The 401 (k) became a popular choice due to the tax advantages and level of control given to employees.

How long can you use 401(k) funds?

You can use this money for a 60-day period between withdrawing it and completing the rollover. This means that your 401 (k) plan must withhold 20% of the total for federal taxation which will be credited on your income tax return for the year. The amount withheld will be treated as a taxable distribution unless you have the funds to make up the additional 20% when depositing the funds. There may also be a 10% premature distribution penalty and if you don't deposit within 60 days, then the entire sum will be subject to tax.

What is 401(k) plan?

A 401 (k) is a retirement savings and investing plan that employers offer. A 401 (k) plan gives employees a tax break on money they contribute. Contributions are automatically withdrawn from employee paychecks and invested in funds of the employee’s choosing (from a list of available offerings).

What is a Roth 401(k)?

The traditional (or regular) 401 (k) offers upfront tax break on your savings. Contributions to a Roth 401 (k) are made with after-tax dollars, so you don’t get to deduct the money from ...

How much does Uncle Sam take out of your 401(k)?

Let’s say Uncle Sam normally takes 20 cents of every dollar you earn to cover taxes. Saving $800 a month outside of a 401 (k) requires earning $1,000 a month — $800 plus $200 to cover the IRS’ cut. When they — whoever the “they” is in your life — say that you won’t miss the money, this is what they’re referring to.

Where does the 401(k) tax break come from?

The catchy name comes from the section of the tax code — specifically subsection 401 (k) — that established this type of plan. Employees contribute money to an individual account by signing up for automatic deductions from their paycheck. Depending on the type of plan you have, the tax break comes either when you contribute money or when you withdraw it in retirement.

Does 401(k) contribution lower taxes?

Contributions can significantly lower your income taxes. Besides the boost to your savings power, pretax contributions to a traditional 401 (k) have another nice side effect: They lower your total taxable income for the year. For example, let’s say you make $65,000 a year and put $19,500 into your 401 (k).

Does Uncle Sam tax 401(k)?

Investments in the account grow unimpeded by Uncle Sam ... Once money is in your 401 (k), the force field that protects it from taxation remains in place. This is true for both traditional and Roth 401 (k)s. As long as the money remains in the account, you pay no taxes on any investment growth. Not on interest.

Do you get a tax break on 401(k) contributions?

How’s that, exactly? Remember we mentioned earlier that, depending on the type of 401 (k) plan, you get a tax break either when you contribute or when you withdraw money in retirement? Well, the IRS can charge you income taxes only once. With a Roth 401 (k), you’ve already paid your due because your contributions were made with post-tax dollars. So when you withdraw money in retirement, you and Uncle Sam are already settled up.

What is a 401(k) plan?

A 401 (k) plan is an account that allows you to contribute a certain amount of money from each paycheck to your retirement. Though it is not required, many employers offer 401 (k) plans for their employees for them to have a source of income once they retire. Some companies offer a 401 (k) plan as soon as new employees start, ...

How does a 401(k) work?

How Does a 401 (k) Plan Work? If your employer offers a 401 (k) plan, you can set aside a certain amount of money from your earnings to save for retirement. Many companies offer 401 (k) plans to attract potential team members and maintain employee satisfaction. In this article, we will discuss what a 401 (k) is and some of its features.

What does it mean when your employer matches your 401(k)?

Employers usually contribute in one of the following three ways: Matching contribution: If your employer offers a matching contribution, it means they provide the same amount that you do to your 401 (k). For example, your employer may match the whole amount of your contribution up to 3%.

How much does an employer contribute to a salary of $40,000 a year?

If your salary is $40,000 a year, you will receive a fixed annual contribution of $800 from your employer. Profit-sharing contribution: Under this plan, your employer contributes only if your company makes a profit. Companies use different formulas to formulate the amount of contribution.

How old do you have to be to pay penalty on 401(k)?

Withdraw the money from your account. If you withdraw the money from your 401 (k) plan, you will most likely have to pay a penalty on it, unless you are 59.5 years or older.

Is 401(k) money taxed?

Since it is an investment, it continues to grow throughout your career. The money you contribute to your 401 (k) is not taxed, but the rest of your paycheck is.

Can you stop making contributions to a retirement plan?

You may start and stop making contributions to the plan according to the rules of your company.

What is 401(k) plan?

A 401 (k) plan is a special type of account funded through payroll deductions that are made before taxes are paid on the balance. The funds in the account can be put into stocks , bonds , or other assets. They're not taxed on any capital gains, dividends, or interest until the earnings are withdrawn. 1.

What is 401(k) contribution?

A 401 (k) plan allows you to avoid paying income taxes in the current year on the amount of money that you put into the plan, up to the 401 (k) contribution limit . The amount you put in is called a " salary deferral contribution ," because you've chosen to defer some of the salary you earn today to put it into the plan.

How much tax do you pay if you withdraw from a 401(k)?

You'll pay a 10% penalty tax and income taxes if you withdraw funds too early, before age 55 or 59 1/2. The age limit depends on your 401 (k) plan's rules. 3. The most you can invest in your 401 (k) account depends on your plan, your salary, and government guidelines.

What are the most common types of investments offered in 401(k) plans?

The most common types of investments offered in 401 (k) plans are mutual funds because of these rules.

How much does an employer match your contribution?

It may match your contributions dollar for dollar, up to the first 3% of your pay, then 50 cents on the dollar, up to the next 2% of your pay.

What are the rules for 401(k)?

A 401 (k) plan must follow several other rules to determine who is eligible, when money can be paid out of the plan, whether loans can be allowed, and when money must go into the plan. You can find a wealth of info on the Retirement Plans FAQ page of the U.S. Department of Labor website.

When to make Roth contributions?

Make your Roth contributions using after-tax dollars during years when your earnings and tax rate aren't as high. These years often occur during the early stages of a career, or during a phased retirement when you work part-time.

What are the goals of retirement?

There are many key financial goals to meet as you get older and plan for retirement. Think about paying off high-interest debt, building an emergency fund, and securing overall financial wellness.

What is the gold standard for retirement?

You may have to decide whether you'd like to take advantage of an employer-sponsored retirement plan. The 401 (k) is the gold standard, with rules and limits set by the federal government.

How many people have no retirement savings?

According to a study by the New School, 35% of all workers age 55 through 64 have no retirement savings at all. This includes individual retirement accounts (IRAs), 401 (k)s, and pension plans.

Is a 401(k) the only thing that needs to be funded during your working years?

Your 401 (k) is not the only thing that needs to be funded during your working years . There are a few key money goals that most experts agree you should focus on before you put all your excess cash in a 401 (k). Ask yourself:

How 401(k) Plans Work

- The 401(k) plan was designed by the United States Congress to encourage Americans to save for retirement. Among the benefits they offer is tax savings. There are two main options, each with distinct tax advantages.

Contributing to A 401(k) Plan

- A 401(k) is a defined contribution plan. The employee and employer can make contributions to the account up to the dollar limits set by the Internal Revenue Service (IRS). A defined contribution plan is an alternative to the traditional pension, known in IRS lingo as a defined-benefit plan. With a pension, the employer is committed to providing a specific amount of money to the employee …

Taking Withdrawals from A 401

- Once money goes into a 401(k), it is difficult to withdraw it without paying taxes on the withdrawal amounts. "Make sure that you still save enough on the outside for emergencies and expenses you may have before retirement," says Dan Stewart, CFA®, president of Revere Asset Management Inc., in Dallas. "Do not put all of your savings into your 401(k) where you cannot easily access it, i…

Required Minimum Distributions

- Traditional 401(k) account holders are subject to required minimum distributions, or RMDs, after reaching a certain age. (Withdrawals are often referred to as "distributions" in IRS parlance.) After age 72, account owners who have retired must withdraw at least a specified percentage from their 401(k) plans, using IRS tables based on their life expectancy at the time. (Prior to 2020, the …

Traditional 401

- When 401(k) plans became available in 1978, companies and their employees had just one choice: the traditional 401(k).7 Then, in 2006, Roth 401(k)s arrived. Roths are named for former U.S. Senator William Roth of Delaware, the primary sponsor of the 1997 legislation that made the Roth IRA possible.8 While Roth 401(k)s were a little slow to catch on, many employers now offe…

What Is A 401(k)?

Benefits

- 401(k)s offer workers a lot of benefits, including: 1. Tax breaks 2. Employer match 3. High contribution limits 4. Contributions after age 72 5. Shelter from creditors Below, we'll take a closer look at these 401(k) benefits.

Disadvantages

- Withdrawals from your 401(k) are taxed at your prevailing income-tax rate when you take money out. There are restrictions on how and when you can withdraw moneyfrom the account.

Roth 401

- The advantages of contributing pre-tax income to a regular 401(k) when your earnings (and tax rate) are at their peak may diminish as your career is winding down. Indeed, your income and tax rate may rise as you get older, as Social Security payments, dividends, and RMDs kick in—especially if you keep working. Enter a different flavor of retirement account—the Roth 401(k…

The Bottom Line

- It's little wonder that the 401(k) is the most popular employer-sponsored retirement planin the nation. With the numerous 401(k) benefits, this savings plan should be part of your retirement financial portfolio, especially if your employer offers a match. Once you're aboard with a 401(k), however, don't simply sit back and allow it to run on auto-pilot. Changes from year to year in con…

Overview

In the United States, a 401(k) plan is an employer-sponsored, defined-contribution, personal pension (savings) account, as defined in subsection 401(k) of the U.S. Internal Revenue Code. Periodical employee contributions come directly out of their paychecks, and may be matched by the employer. This legal option is what makes 401(k) plans / contracts attractive to employees, and many employers offer this option to their (full-time) workers.

History

Before 1974, a few U.S. employers had been giving their staff the option of receiving cash in lieu of an employer-paid contribution to their tax-qualified retirement plan accounts. The U.S. Congress banned new plans of this type in 1974, pending further study. After that study was completed, Congress reauthorized such plans, provided they satisfied certain special requirements. Congress did this by enacting Internal Revenue Code Section 401(k) as part of the Revenue …

Taxation

There are two main types corresponding to the same distinction in an Individual Retirement Account (IRA); variously referred to as traditional vs. Roth, or tax-deferred vs. tax exempt, or EET vs. TEE.

Income taxes on pre-tax contributions and investment earnings in the form of interest and dividends are tax deferred. The ability to defer income taxes to a period where one's tax rates m…

Withdrawal of funds

Generally, a 401(k) participant may begin to withdraw money from his or her plan after reaching the age of 59+1⁄2 without penalty. The Internal Revenue Code imposes severe restrictions on withdrawals of tax-deferred or Roth contributions while a person remains in service with the company and is under the age of 59+1⁄2. Any withdrawal that is permitted before the age of 59+1⁄2 is subject to an excise tax equal to ten percent of the amount distributed (on top of the or…

Rollovers

Rollovers between eligible retirement plans are accomplished in one of two ways: by a distribution to the participant and a subsequent rollover to another plan or by a direct rollover from plan to plan. Rollovers after a distribution to the participant must generally be accomplished within 60 days of the distribution. If the 60-day limit is not met, the rollover will be disallowed and the distribution will be taxed as ordinary income and the 10% penalty will apply, if applicable. The sa…

Technical details

There is a maximum limit on the total yearly employee pre-tax or Roth salary deferral into the plan. This limit, known as the "402(g) limit", was $19,000 for 2019, $19,500 for 2020–2021, and $20,500 for 2022. For future years, the limit may be indexed for inflation, increasing in increments of $500. Employees who are at least 50 years old at any time during the year are now allowed additional pre-tax "catch up" contributions of up to $6,000 for 2015–2019, and $6,500 for 2020–2021. The l…

Plans for certain small businesses or sole proprietorships

The Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA) made 401(k) plans more beneficial to the self-employed. The two key changes enacted related to the allowable "Employer" deductible contribution, and the "Individual" IRC-415 contribution limit.

Prior to EGTRRA, the maximum tax-deductible contribution to a 401(k) plan was 15% of eligible pay (reduced by the amount of salary deferrals). Without EGTRRA, an incorporated business per…

Other countries

Even though the term "401(k)" is a reference to a specific provision of the U.S. Internal Revenue Code section 401, it has become so well known that it has been used elsewhere as a generic term to describe analogous legislation. For example, in October 2001, Japan adopted legislation allowing the creation of "Japan-version 401(k)" accounts even though no provision of the relevant Japanese codes is in fact called "section 401(k)".