What benefits does SSI offer?

Which States Pay Supplemental Benefits for SSI Disability in 2022?

- States That Offer Either SSI Supplemental Benefits or Other Financial Aid for Residents. Some states provide supplemental benefits for residents that depend on SSI. ...

- Other Federal Financial Aid Services Unrelated to SSI Payments. All states provide some type of healthcare program for disabled residents. ...

- You May Qualify for Legal Assistance. ...

What are the differences between SSI and SSA benefits?

Social Security benefits include the following:

- Social Security Disability Income (SSDI) benefits

- Survivor benefits

- Social Security benefits for children

- Supplemental Security Income (SSI) benefits

- Social Security retirement benefits

How much money can you make and still get SSI?

- You were eligible for SSI monthly payments for at least one month.

- You are disabled.

- You meet all non-disability eligibility guidelines for SSI.

- You must have Medicaid coverage to continue working.

- Your gross earnings are insufficient to replace SSI, Medicaid, and publicly-funded care services.

What is the maximum household income for SSI?

You may qualify for monthly SSI payments if:

- you are 65 or older, blind or disabled;

- you are a U.S. citizen or lawful resident;

- and you have very limited income and financial resources.

What is the maximum SSI benefit in 2021?

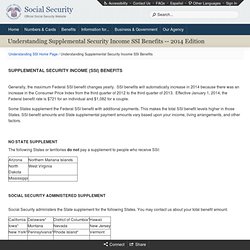

SUPPLEMENTAL SECURITY INCOME (SSI) BENEFITS. Generally, the maximum Federal SSI benefit changes yearly. SSI benefits increased in 2021 because there was an increase in the Consumer Price Index from the third quarter of 2019 to the third quarter of 2020. Effective January 1, 2021 the Federal benefit rate is $794 for an individual ...

What is the federal SSI rate for 2021?

Effective January 1, 2021 the Federal benefit rate is $794 for an individual and $1,191 for a couple. Some States supplement the Federal SSI benefit with additional payments. This makes the total SSI benefit levels higher in those States.

What is SSI income?

What Is Supplemental Security Income? Supplemental Security Income (SSI) is a federal program in the United States that provides additional income for older and disabled people with little to no income. This program provides participants with monthly cash distributions to help them meet their basic needs.

How long does a child have to be disabled to get SSI?

In special cases, children under 18 may be considered disabled and earn SSI eligibility. For a child to qualify, the disability must result in severe functional limitations and can be expected to cause death or has lasted—or is expected to last—longer than 12 months. 3 .

What is the maximum SSI payment for 2021?

The FBR currently sets monthly payments at $794 for an individual and $1,191 for couples, for the year 2021. The FBR will increase moderately each year in conjunction with the Social Security cost-of-living adjustment, ...

How much is SSI 2021?

SSI is a separate program from Social Security income benefits for retired or disabled people. For the year 2021, SSI pays a maximum of $794 per month to eligible individuals or $1,191 to couples. In addition to federal SSI, many states also provide supplementary income to those in need.

When do SSI payments arrive?

SSI Payments arrive on the first day of each month and can also include food stamps and Medicaid benefits. 1 . There are very specific requirements a person must meet to become eligible for SSI. First, SSI candidates must be 65 or older, blind, or disabled.

Does the federal government add money to SSI?

Most states will also add money to the federal SSI payments. This added money will increase both the allowed income level for eligibility as well as the amount of the monthly SSI payment. The amount of the supplement varies from state to state. 6

What is Social Security benefits?

What Are Social Security Benefits? Social Security benefits are payments made to qualified retirees and disabled people, and to their spouses, children, and survivors. Social Security—officially the Old-Age, Survivors, and Disability Insurance (OASDI) program in the U.S.—is a comprehensive federal benefits program designed to provide partial ...

How does Social Security work?

How Social Security Benefits Work. Payroll taxes under the Federal Insurance Contributions Act (FICA) or the Self Employed Contributions Act (SECA) (for self-employed individuals) fund Social Security and all of its benefits. 4. The Internal Revenue Service (IRS) collects tax deposits and formally entrusts them to the Social Security Trust Fund, ...

What is the current law on Social Security?

The current law, after a number of amendments, encompasses several social insurance and social welfare programs, including the issuance of Social Security benefits. Benefits are determined by a specific set of criteria issued by the Social Security Administration (SSA). 2 3 .

What is the income limit for Social Security?

If an individual taxpayer's income exceeds $25,000, or a married couple filing jointly has income that's more than $32,000, they will be required to pay taxes on their Social Security benefits.

How many credits do you need to get Social Security?

An individual must pay into the Social Security program during their working years and accrue 40 credits in order to qualify for benefits. The benefit amount someone receives is based on their earnings history, the year they were born, and the age when they start to claim Social Security.

When can I claim my spouse's Social Security benefits?

Spouses who didn’t work or who didn’t earn enough credits to qualify for Social Security on their own can receive benefits starting at age 62 based on their spouse’s work record. Similar to claiming benefits on one's own record, a spouse's benefit will be reduced if they claim benefits before reaching full retirement age.

How many credits can you earn on full insurance?

Full insurance is based on accumulating 40 quarters or "credits" from covered wages, and a worker can earn up to four credits a year. One credit is awarded for every $1,470 in earnings for 2021 (up from $1,410 in 2020), an amount that is adjusted annually to keep up with inflation.