The total amount of unemployment benefits the department could pay you during your benefit year. It is the lesser of 26 times your WBR, or 40% of your total base period wages from all covered employment.

What does an employer pay for unemployment?

What Does an Employer Pay Off for Unemployment? The amount that an employer shells out for unemployment will depend on the sum of his payroll, his track record in keeping employees and the rates that are specific to his state.

What are the liabilities of an employer for unemployment?

Employer Liability for Unemployment Taxes. In order to fund unemployment compensation benefit programs, employers are subject to federal and state unemployment taxes depending on several factors. These factors include the sums employers pay their employees, the unemployment claims filed against the business, and the type & age of the business.

What is the weekly amount of unemployment benefits you get?

The weekly amount of unemployment benefits you are paid when you have no wages or other income during the week. It is 4% of the total high quarter wages from all covered employment. The maximum and minimum benefit rates are determined by UI law.

What is an employer’s unemployment contribution?

Employers make a legally required contribution as well. When unfortunate circumstances cause a person to need unemployment, states look at the associated contribution history, including previous wages to determine the total amount of unemployment the person can claim.

What does total benefits payable mean Ohio unemployment?

If you are eligible to receive unemployment, your weekly benefit rate in Ohio will be 50% of your average weekly wage (see "Past Earnings" section above) during the base period. The most you can receive each week is $480, although if you have dependents, you may be entitled to a higher benefit payment.

What is claim balance unemployment?

Your claim balance is the maximum benefit amount for your claim and is calculated at the beginning of a claim or an extension program. You may not be eligible to collect the full amount. For example, if you were placed on a FED-ED extension on September 5, 2021, the FED-ED extension had a maximum of 13 weeks available.

How do you know if you got approved for unemployment in Illinois?

Within 7-10 days of filing your claim, you will receive a blank debit card and a UI Finding in the mail. The UI Finding will tell you whether you are monetarily eligible for benefits, meaning you have earned sufficient wages in your base period.

Is the 600 unemployment extended in Texas?

TWC: State Unemployment Benefits to Continue But $600 Federal Payment Ends July 25. AUSTIN – The Texas Workforce Commission reminds claimants that the Federal Pandemic Unemployment Compensation ( FPUC ) ends the week of July 25, 2020.

Why does my unemployment claim say $0?

If your claim shows a determination of “0-0” while it is pending, this means we are still processing your claim, and there is nothing more you need to do. If you received a confirmation number, rest assured your claim is in process, and you will receive the full amount to which you are entitled.

How long after monetary determination do you get paid?

You should receive this within 3 to 4 days after processing. This monetary determination letter will serve as your only confirmation notification that your claim has been processed. You will be required to certify that you have read your “Rights and Responsibilities” prior to filing your first weekly claim.

How long after certifying for unemployment will I get paid Illinois?

2-3 daysAfter certifying, please allow for 8 days before receiving your payment via check, or 2-3 days for direct deposit. You must continue to certify (on the same day of the week indicated in your UI Finding letter) every two weeks to continue to receive benefits.

How long does unemployment take to get approved?

It takes at least three weeks to process a claim for unemployment benefits and issue payment to most eligible workers.

Why haven't I received my unemployment this week?

Your state is overwhelmed with new jobless benefits applications. The most likely reason why you haven't yet received your unemployment check is probably also the most frustrating: State unemployment agencies have been inundated with new filings and are hard-pressed to process them in a timely manner.

How long will the extra 300 last in Texas?

Greg Abbott announced in May that, after June 26, Texas will opt out of all federal assistance programs. That includes the extra $300 per week congress approved earlier this year under the American Rescue Plan.

Will TWC extended unemployment benefits 2021?

The new American Rescue Plan Act of 2021 ( ARP ) further extends unemployment benefits claims created under the Coronavirus Aid, Relief, and Economic Security Act ( CARES Act ) and the Continued Assistance Act ( CAA ) passed in December. Programs under this new act will extend benefits through September 4, 2021.

How do you get your unemployment back pay in Texas?

If you request benefit payment using Tele-Serv by calling 800-558-8321, select Option 1, the Tele-Serv automated system will ask you if you want to request payment for your backdated weeks. Select “yes” and answer the certification questions like you did for the other claim weeks you requested payment.

How much unemployment is paid if you have no income?

The weekly amount of unemployment benefits you are paid when you have no wages or other income during the week. It is 4% of the total high quarter wages from all covered employment. The maximum and minimum benefit rates are determined by UI law.

How long does unemployment last?

A benefit year lasts 52 weeks. When one benefit year ends, the week that you file your next initial claim application will start a new benefit year. During the 52 weeks of each benefit year, there is a maximum amount of unemployment benefits you can be paid. This is called your maximum benefit amount (MBA).

What is the minimum WBR for unemployment?

The minimum WBR is $54, requiring high quarter earnings of $1,350; and the maximum WBR is $370, requiring high quarter earnings of $9,250. The “Weekly Benefit Rate Chart” is a listing of all the weekly benefit rates and the amount of high quarter wages needed for each rate.

How many quarters of your base period do you have to be paid to qualify for unemployment?

To qualify for unemployment benefits you must have been paid wages from covered employment in at least two quarters of your base period. You need: Enough wages in your high quarter to qualify for the minimum WBR; Wages in your 3 lowest quarters that equal at least 4 times your WBR when added together;

When is the benefit computation mailed?

Benefit Computation. A benefit computation is generally mailed to you the day after you file an initial claim application. The benefit computation will list the covered employment in your base period and the wages paid to you in each quarter by each of your employers.

Is unemployment excluded work?

However, some work is "excluded" (not covered) even when performed for a covered employer. Only wages paid from covered employment can be used to qualify for unemployment benefits and to calculate how much you can be paid. (Excluded employment is one of the eligibility issues listed in Part 6 .)

What is the purpose of unemployment benefits?

Unemployment benefits are intended to partially replace lost wages, so the precise amount you receive will depend on what you used to earn. States use different formulas to calculate benefit payments, but all states take prior earnings into account in some way.

What is unemployment insurance?

Unemployment insurance is a joint federal-state program that provides temporary benefit payments to employees who are out of work through no fault of their own. Thanks to the coronavirus pandemic, finding another job is no small feat. In recognition of these tough economic times, the federal government has passed a law that temporarily increases ...

How long will the extra 300 unemployment last?

In December 2020, Congress passed a Covid-19 relief package that, among other things, gives recipients of unemployment benefits an extra $300 per week in benefits for up to 11 weeks (through mid-March 2021). In addition, the law extends two unemployment programs originally created by the CARES Act.

How long does the Cares Act extend unemployment?

The first program, known as Pandemic Emergency Unemployment Compensation (PEUC), extends unemployment benefits by an extra 13 weeks (up to 39 weeks) when state unemployment payments expire.

What is the formula for a state to pay half of what you used to earn?

A common formula is to pay half of what the employee used to earn, up to a cap that's tied to the average earnings in that state. This means that employees with higher wages may receive a larger overall benefits check, but a smaller percentage of what they used to earn.

How much can an employee receive per week?

These amounts tend to be small; most states that provide this benefit offer $25 or less per dependent per week in additional benefits.

When does PUA unemployment end?

Both programs close to new claimants on March 14, 2021, and expire for existing claimants on April 5, 2021.

What is the eligibility for unemployment?

Eligibility for Unemployment Benefits. The U.S. Federal-State Unemployment Insurance Program provides unemployment benefits to eligible workers who are unemployed through no fault of their own. If your reason for leaving your last job was something other than "lack of work" (which states recognize as a legitimate reason for unemployment), ...

What are the conditions to collect unemployment?

The following circumstances may disqualify you from collecting unemployment benefits: 2 . Insufficient earnings or length of employment.

How long do you have to work to qualify for unemployment?

This also means you usually have to have worked for your employer for at least a year. Self-employed, or a contract or freelance worker.

How to appeal unemployment denial?

2 . When your claim is denied, you should be provided with the reason for the denial and information on the appeal process.

Can self employed workers get unemployment?

Self-employed, or a contract or freelance worker. Independent contractors are technically self-employed, so they typically cannot receive unemployment benefits. However, during the coronavirus pandemic, benefits were extended to cover self-employed workers and independent contractors. Fired for justifiable cause.

Can you get unemployment if you leave your job?

Typically, if you leave because of a significant pay decrease, you may be considered for unemployment benefits. The employer failed to honor an employment contract. If an employer fails to honor the terms of an employment contract, even after the issue is brought to his or her attention, this can qualify as good cause.

How long can you get unemployment benefits?

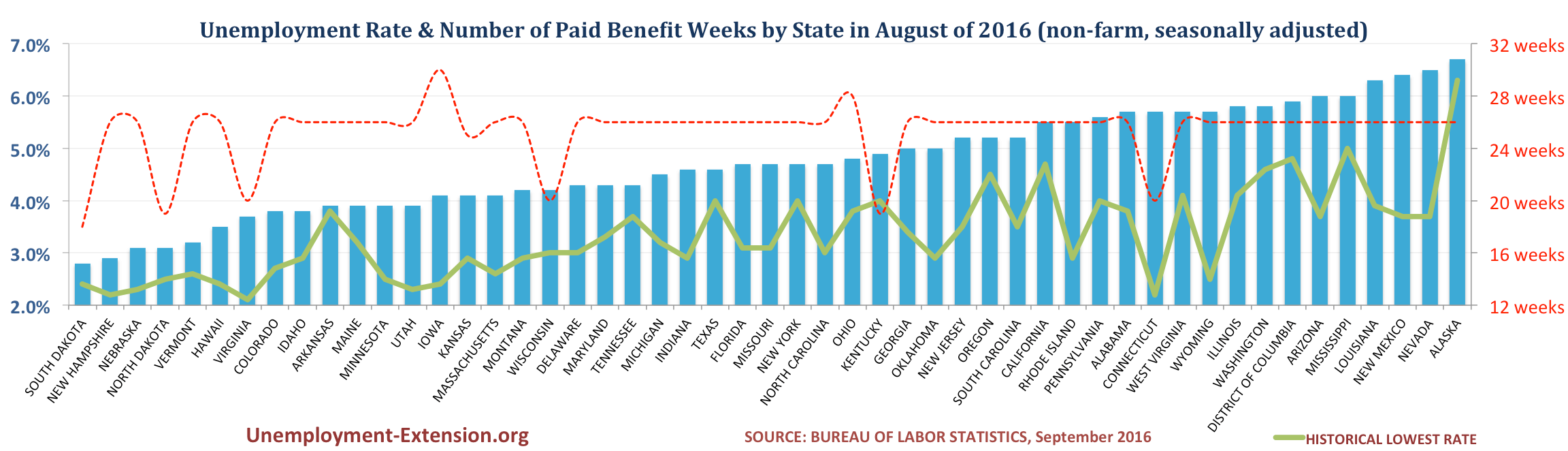

Typically, you can receive unemployment benefits for up to 26 weeks — or until you find another job. But it can be extended to 39 or even 46 weeks during periods in your state when the unemployment rate is high.

What is the maximum unemployment benefit in 2020?

Maximum benefit amounts vary by state, but as of January 2020, Massachusetts had the highest maximum ($1,234) and Mississippi the lowest ($235). Keep in mind that even if you qualify for unemployment benefits, you might not qualify for the maximum benefits available in your state. CORUNEMPLOYPAY - Infogram.

When will the 600 extra unemployment be paid?

If you collected unemployment between March 27 (when the CARES Act took effect) and July 31, 2020 , you may have been eligible to receive an additional $600 per week in Pandemic Additional Compensation on top of the weekly benefit amount your state would normally pay.

Do I have to pay taxes on unemployment?

That means you’ll have to pay taxes on your unemployment benefits. You can have taxes withheld upfront from your unemployment payments, or you can report the money when you file your federal income taxes. Before you file your tax returns, make sure you look for your 1099-G form in the mail.

What is unemployment insurance?

Unemployment insurance (UI), also called unemployment benefits, is a type of state-provided insurance that pays money to individuals on a weekly basis when they lose their job and meet certain eligibility requirements. Those who either quit their jobs or were fired for a just cause are not eligible for UI.

How long does unemployment last?

Benefits under unemployment insurance, also called unemployment compensation, typically last up to 26 weeks, depending on the state in which you live and have worked. You do not qualify for unemployment insurance if you quit your job or are fired for cause. The U.S. Department of Labor oversees the unemployment insurance program.

What is extended unemployment?

Extended benefits give unemployed workers an additional number of weeks of unemployment benefits. The availability of extended benefits will depend on a state's overall unemployment situation. If you have become unemployed due to the coronavirus pandemic, see below for details of the various programs.

How long does it take to file unemployment claim?

A participant may file claims by phone or on the state unemployment insurance agency's website. After the first application, it generally takes two to three weeks for the processing and approval of a claim.

How long does it take to get unemployment benefits?

Department of Labor oversees the program and ensures compliance within each state. Workers who meet specific eligibility requirements may receive up to 26 weeks of benefits a year.

What are the requirements for unemployment?

Requirements for Unemployment Insurance (UI) An unemployed person must meet two primary requirements to qualify for unemployment insurance benefits. An unemployed individual must meet state-mandated thresholds for either earned wages or time worked in a stated base period. The state must also determine that the eligible person is unemployed ...

Do employers pay federal unemployment tax?

States fund unemployment insurance using taxes levied on employers. The majority of employers will pay both federal and state unemployment FUTA tax. Companies that have 501 (c)3 status do not pay FUTA tax. Three states also require minimal employee contributions to the state unemployment fund.

What is the liability of an employer for unemployment?

In order to fund unemployment compensation benefit programs, employers are subject to federal and state unemployment taxes depending on several factors. These factors include the sums employers pay their employees, the unemployment claims filed against the business, and the type & age of the business.

Why is unemployment tax so high?

When you first open your UI account, your tax rate will be fairly high because you have no track record. If you work for several years without laying off an employee, your tax rate will go down. If you continually lay off employees, your tax rate will increase.

How much is a FUTA tax?

The FUTA tax is imposed at a single flat rate on the first $7,000 of wages that you give each employee. Once an employee’s wages for the calendar year go beyond $7000, you have no additional FUTA liability for that employee for the year.

How much do you pay in a quarter for a FUTA?

You pay wages totaling at least $1,500 to your employees in any calendar quarter; or. You have at least one employee on any given day in each of 20 different calendar weeks. Once you fulfill either of the tests, you become liable for the FUTA tax for the whole calendar year and for the next calendar year as well.

How does each state limit the tax you have to pay with respect to any one employee?

However, each state confine the tax you have to pay with respect to any one employee by detailing a maximum wage amount to which the tax applies. Once an employee’s wages for the calendar year surpass that maximum amount, your state tax liability with respect to that employee ends.

What is the premium rate for new non-governmental employers?

All other new employers are allotted a 2.7% new employer premium rate. In the past, mining and construction are the only industries with new employer rates higher than 2.7%.

Can you claim a credit against your federal unemployment tax?

You can usually claim credits against your gross FUTA tax to reflect the state unemployment taxes you pay. If you paid all your state unemployment taxes on time , and prior to the due date of your FUTA tax return, you will be permitted to claim a credit equal to 5.4% of your federally taxable wages. This will in effect reduce the FUTA tax to 0.6%.

When unfortunate circumstances cause a person to need unemployment, what does the state look at?

When unfortunate circumstances cause a person to need unemployment, states look at the associated contribution history, including previous wages to determine the total amount of unemployment the person can claim.

Can unemployment increase your balance?

During difficult economic times, state legislatures and Congress may increase benefits or extend the time period over which a claim can be paid. If your unemployment occurred as a result of massive layoffs or during a period of economic downturn, you may notice your remaining balance increases.

Can you deduct unemployment if you are out of work?

That's why states created unemployment insurance. While working, employers deduct a portion of every paycheck for unemployment insurance contribution. Employers make a legally required contribution as well.