Here’s what happens with Social Security payments when someone dies

- In most cases, funeral homes notify the government that a person has passed away.

- If the person was receiving Social Security benefits, a payment is not due for the month of their death.

- Survivor benefits may be available, depending on several factors.

What happens to your Social Security benefits when you die?

“Any benefit that’s paid after the month of the person’s death needs to be refunded,” Sherman said. With Social Security, each payment received represents the previous month’s benefits. So if a person dies in August, the check for that month — which would be paid in September — would need to be returned if received.

What happens to my child's benefits if I Die?

If there are two surviving parents, each parent will receive 75% of the deceased child's benefit. Note that you have only two years after the death of your disabled child to provide evidence to show that your child provided at least one half of your support.

What benefits can I claim if my husband has died?

You may be able to claim the following benefits after someone has died: Bereavement Support Payment if the person who died was your husband, wife or civil partner and you’re under State Pension age. Funeral Expenses Payment if you live in England, Wales or Northern Ireland, or Funeral Support Payment if you live in Scotland.

What happens to a defined benefit pension when you die?

If you have already retired when you die a defined benefit pension will usually continue paying a reduced pension to your spouse, civil partner or other dependent. The scheme rules will define who is classed as a dependant and are usually much stricter on who may receive a death benefits payment compared to a personal pension.

When someone dies who gets their Social Security benefits?

Your family members may receive survivors benefits if you die. If you are working and paying into Social Security, some of those taxes you pay are for survivors benefits. Your spouse, children, and parents could be eligible for benefits based on your earnings.

When a person dies does Social Security take back money?

Widow or widower, full retirement age or older — 100% of the deceased worker's benefit amount. Widow or widower, age 60 — full retirement age — 71½ to 99% of the deceased worker's basic amount.

Who receives the death benefit?

A death benefit is a payout to the beneficiary of a life insurance policy, annuity, or pension when the insured or annuitant dies. For life insurance policies, death benefits are not subject to income tax and named beneficiaries ordinarily receive the death benefit as a lump-sum payment.

What is a benefit after someone dies?

Social Security (Monthly survivors benefits and a one-time death benefit) Military Benefits (This may include a burial allowance, wartime service pension, and/or Dependency and Indemnity Compensation) Disability or Workman's Compensation (You're entitled to any balance owed at the time of death)

Does Social Security pay a month behind?

Social Security benefits are paid a month behind. April's benefits are paid in May, May's in June, and so on. Social Security regulations require that a person live an entire month to receive benefits for that month.

What happens to Social Security direct deposit after death?

We can't pay benefits for the month of death. That means if the person died in July, the check received in August (which is payment for July) must be returned. If the payment is by direct deposit, notify the financial institution as soon as possible so it can return any payments received after death.

Who is eligible for lump sum death benefit?

Only the widow, widower or child of a Social Security beneficiary can collect the $255 death benefit, also known as a lump-sum death payment. Priority goes to a surviving spouse if any of the following apply: The widow or widower was living with the deceased at the time of death.

Who qualifies for funeral grant?

You must be one of the following: the partner of the deceased when they died. a close relative or close friend of the deceased. the parent of a baby stillborn after 24 weeks of pregnancy.

What is the difference between funeral claim and death claim?

Filing Funeral Claims Again, funeral claims are different from death claims. Funeral claims are given to the person who shouldered the funeral expenses regardless of his/her relationship to the SSS member.

How do I claim money for someone who has passed away?

You therefore need to contact his former employer's Human Resources department, and ask them who is looking after this (unclaimed) money. Most likely, it will be with an Unclaimed Benefits Fund. You then need to contact this Fund, and ask them what you need to do, prove your claim.

Why is the death benefit only $255?

In 1954, Congress decided that this was an appropriate level for the maximum LSDB benefit, and so the cap of $255 was imposed at that time.

What are Social Security conserved funds?

Conserved Funds – funds saved, or conserved, by the representative payee. Funds in excess of the amount needed to meet a beneficiary's current or reasonably foreseeable needs are the property of the beneficiary. A payee must conserve these funds on behalf of the beneficiary.

Who is responsible for Social Security overpayment?

Section 204(a) of the Social Security Act provides that the overpaid person (whether or not he or she still receives benefits), his or her representative payee, and any other person receiving benefits on the overpaid person's earnings record are liable (responsible) for repayment of an overpayment.

Do I have to pay back pension overpayment after death?

Friends or relatives can ignore requests by the Government to return overpaid state pension payments in the event of the recipient's death, as there is no legal obligation to pay the money back.

How long do you have to wait to receive Social Security if you die?

If the eligible surviving spouse or child is not currently receiving benefits, they must apply for this payment within two years of the date of death. For more information about this lump-sum payment, contact your local Social Security office or call 1-800-772-1213 ( TTY 1-800-325-0778 ).

What percentage of a widow's benefit is a widow?

Widow or widower, full retirement age or older — 100 percent of the deceased worker's benefit amount. Widow or widower, age 60 — full retirement age — 71½ to 99 percent of the deceased worker's basic amount. A child under age 18 (19 if still in elementary or secondary school) or disabled — 75 percent.

How to report a death to the funeral home?

You should give the funeral home the deceased person’s Social Security number if you want them to make the report. If you need to report a death or apply for benefits, call 1-800-772-1213 (TTY 1-800-325-0778 ). You can speak to a Social Security representative between 8:00 am – 5:30 pm. Monday through Friday.

How much can a family member receive per month?

The limit varies, but it is generally equal to between 150 and 180 percent of the basic benefit rate.

Can I apply for survivors benefits now?

You can apply for retirement or survivors benefits now and switch to the other (higher) benefit later. For those already receiving retirement benefits, you can only apply for benefits as a widow or widower if the retirement benefit you receive is less than the benefits you would receive as a survivor.

When can I switch to my own Social Security?

If you qualify for retirement benefits on your own record, you can switch to your own retirement benefit as early as age 62 .

Can a widow get a divorce if she dies?

If you are the divorced spouse of a worker who dies, you could get benefits the same as a widow or widower, provided that your marriage lasted 10 years or more. Benefits paid to you as a surviving divorced spouse won't affect the benefit amount for other survivors getting benefits on the worker's record.

What are the benefits of a deceased person?

You may be able to claim the following benefits after someone has died: 1 Bereavement Support Payment if the person who died was your husband, wife or civil partner and you’re under State Pension age. 2 Funeral Expenses Payment if you live in England, Wales or Northern Ireland, or Funeral Support Payment if you live in Scotland.

How long does Universal Credit last after death?

This is known as a ‘bereavement run-on’. The carer amount in Universal Credit can continue for two months after the payment month when your loved one died.

How to report someone's death in Northern Ireland?

In Northern Ireland, you can contact the Bereavement Service on 0800 085 2463 to report someone’s death. They will help you sort out the person’s benefits. They can also help you access any benefits you’re entitled to.

What is the phone number to call when someone dies?

You can find more information or support in our section on When someone dies, or you can call our Support Line on 0800 090 2309. You can also download our booklet, When someone dies.

How long does a carer's allowance last?

If you’re getting Carer’s Allowance or Income Support for carers, you can receive them for up to eight weeks after the death of the person you were caring for. The carer premium and other means-tested benefits may also continue for up to eight weeks.

Can you get a tell us once if someone dies?

In most parts of England, Wales and Scotland you can contact the government’s Tell Us Once service after someone dies. Tell Us Once will contact other organisations to report the person’s death on your behalf. Benefit payments won’t automatically stop when someone dies.

What happens to the checks if someone dies in January?

So if a person dies in January, the check for that month — which would be paid in February — would need to be returned if received. If the payment is made by direct deposit, the bank holding the account should be notified so it can return benefits sent after the person’s death.

When does a spouse's benefit automatically convert to a survivor's benefit?

As for benefits available to survivors: If a spouse or qualifying dependent already was receiving money based on the deceased’s record, the benefit will auto-convert to survivors benefits when the government gets notice of the death, Sherman said.

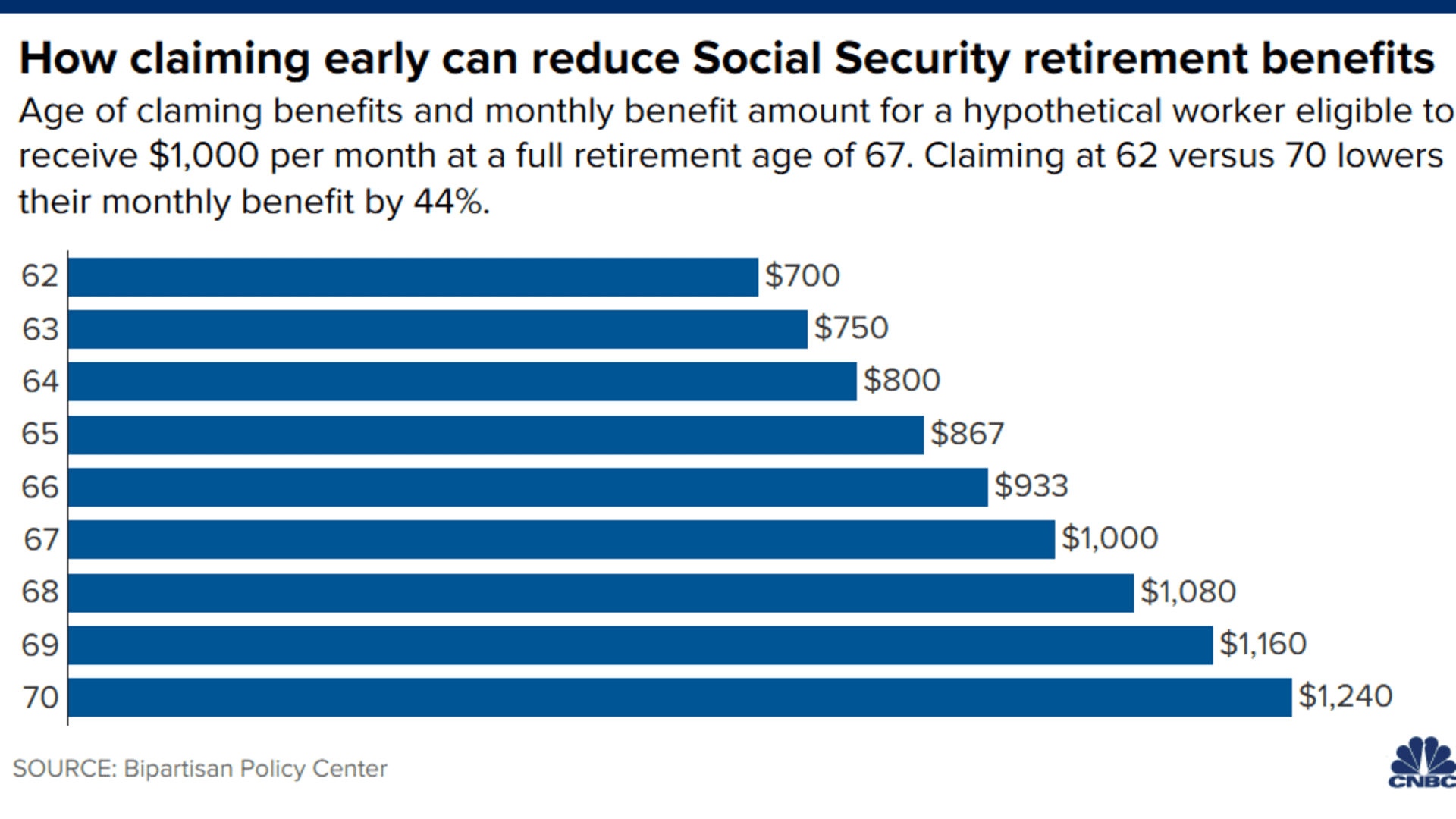

When can I apply for reduced Social Security benefits?

They can apply for reduced benefits as early as age 60, in contrast to the standard earliest claiming age of 62. If the survivor qualifies for Social Security on their own record, they can switch to their own benefit anytime between ages 62 and 70 if that payment would be more.

Can a funeral home report a death to the government?

In most cases, funeral homes notify the government. There’s a form available that those businesses use to report the death. “The person serving as executor [of the estate] or the surviving spouse can also call Social Security,” said certified financial planner Peggy Sherman, a lead advisor at Briaud Financial Advisors in College Station, Texas.

Can I use someone else's Social Security after they die?

Using someone else’s Social Security benefits after they die is a federal crime. Funeral homes often alert the government when someone passes away. Depending on the situation, survivors benefits may be available. There is a lot to deal with when a loved one passes away.

Is it a crime to use someone else's benefits after they die?

It may be no surprise that using someone else’s benefits after they die is a federal crime, regardless of whether the death was reported or not. If the SSA receives notice that fraud might be happening, the allegation is reviewed and potentially will warrant a criminal investigation.

What happens to a check if someone dies in January?

So if a person dies in January, the check for that month — which would be paid in February — would need to be returned if received. If the payment is made by direct deposit, the bank holding the account should be notified so it can return benefits sent after the person’s death. Zoom In Icon.

When does a spouse's benefit automatically convert to a survivor's benefit?

As for benefits available to survivors: If a spouse or qualifying dependent already was receiving money based on the deceased’s record, the benefit will auto-convert to survivors benefits when the government gets notice of the death, Sherman said.

How much does a child receive when they die from Social Security?

Finally, upon the death of a Social Security recipient, survivors are generally given a lump sum payment of $255.

When can a survivor switch to Social Security?

If the survivor qualifies for Social Security on their own record, they can switch to their own benefit anytime between ages 62 and 70 if their own payment would be more. An ex-spouse of the decedent also might be able to claim benefits, as long as they meet some specific qualifications.

When can a widow get a full retirement?

They can apply for reduced benefits as early as age 60 , in contrast to the standard earliest claiming age of 62.

Is it a crime to use someone else's Social Security benefits after they die?

It may be no surprise that using someone else’s benefits after they die is a federal crime, regardless of whether the death was reported or not. If the Social Security Administration receives notice that fraud might be happening, the allegation is reviewed and potentially will warrant a criminal investigation.

Do funeral homes notify Social Security?

In most cases, funeral homes notify the government. There’s a form available that those businesses use to report the death.

Where to start

It’s important for the Social Security Administration to be alerted as soon as possible after the person dies.

When payments stop

Be aware that a person is due no Social Security benefits for the month of their death.

More from Portfolio Perspective

If the payment is made by direct deposit, the bank holding the account should be notified so it can return benefits that shouldn’t have been delivered.

Benefits for survivors

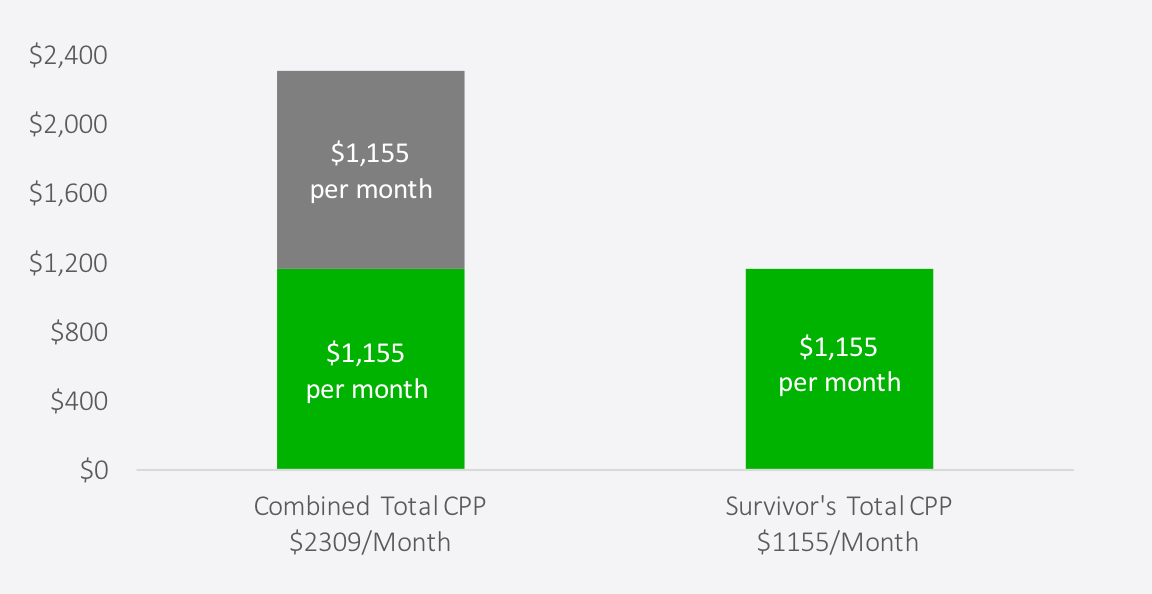

If a spouse or qualifying dependent already was receiving money based on the deceased’s record, the benefit will auto-convert to survivors benefits when the government gets notice of the death, Sherman said.

What happens to pension when you die?

If you die before you retire your pension will pay out a lump sum worth 2-4 times your salary. If you’re younger than 75 when you die, this payment will be tax-free for your beneficiaries. Defined benefit pensions also usually pay what’s called a ‘survivor’s pension’ to either a spouse, civil partner or dependent child, ...

How to ensure pension gets passed on after you die?

To ensure your pension gets passed on after you die it’s important to let your pension provider know the contact details of your nominated beneficiaries. If you’re a PensionBee customer you can do this in just a few clicks in your online dashboard.

What happens to defined contribution pensions when you die?

Defined contribution pensions. The main pension rule governing defined contribution pensions in death is your age when you die and whether you’ve already started drawing your pension. If you die before your 75th birthday and haven’t started drawing your pension it can be passed to your beneficiaries tax-free.

How does defined benefit pension work?

Defined benefit pensions work a little differently as their value is linked to your salary and how many years you’ve worked for your employer. The main pension rule governing defined benefit pensions in death is whether you were retired before you died.

How long do you have to claim death pension?

Your beneficiaries have two years to claim a death pension, after which point tax may be charged. If you die before your 75th birthday, but have already started drawing your pension, the way you have chosen to access your savings will determine the action your beneficiaries can take. If you’ve withdrawn a lump sum and you have remaining cash in ...

Do pensions sit outside of estate?

Pensions are considered to sit outside your estate, which means that when you die your beneficiaries can access your retirement savings without having to pay inheritance tax. Most workplace and private pension schemes provide death benefits and, in the event that you pass away, your beneficiaries should contact your pension scheme administrator ...

Can you get a pension after death?

Pension rules after death. When you die your spouse, civil partner or beneficiaries may be able to access your pension. The rules for pension death benefits will vary depending on the type of pension you have and your age when you pass away.

Why did the funeral home report the death of the sailor?

After his time of death the funeral home reported his death to Social Security as mandatory procedures when someone dies.

Is food stamps transferable?

The food stamps were a benefit that I believe is personal to him and not transferrable. You should call the food stamp office and ask them. Don't try using anything as you could be committing a federal crime. This is not something to play around with or hope you can get away with it... 1 found this answer helpful.

Who Typically Gets the Pension After a Loved One Dies?

Who can get your pension benefits when you die can depend on a range of factors, including:

What Happens to a Private Pension After a Death?

Whether a surviving spouse receives a deceased spouse’s pension benefits depends largely on the type of plan. Defined contribution plans depend on the age of the employee spouse when they die and whether they have already received benefits. There are generally three options:

What Happens to a Military or Government Pension After a Death?

Generally, military pension benefits terminate upon the death of the retired military personnel. However, a retiree may pay premiums to participate in the Survivor Benefit Plan (SBP).

How to Claim a Pension After a Loved One Dies

If you want to claim benefits from a deceased retiree’s pension plan or just determine if you are eligible, there are a few simple steps you can follow.

How to Cancel a Pension After a Loved One Dies

To cancel a pension after a loved one dies, the process is about the same as applying for benefits.

How much of my deceased spouse's SSDI benefits?

You will receive 75% of your deceased spouse's SSDI benefit. You are at least 50 years old and disabled, and your disability started before your spouse died or within seven years of your spouse's death (unless you were receiving mother's or father's benefits). You will receive 71.5% of your deceased spouse's SSDI benefit.

How much of my spouse's Social Security will I get if I die?

You will receive 71.5% - 99% of your deceased spouse's SSDI benefit. You are at least full retirement age. You will receive 100% of your deceased spouse's SSDI benefit. (To determine your full retirement age, go to Social Security Benefit Amounts for the Surviving Spouse by Year of Birth .)

How much of my grandparent's SSDI benefits do I get?

Qualified grandchildren will receive 75% of their grandparent's SSDI benefit, the same as children.

When does a widow's SSDI end?

If a widow is receiving benefits based on caring for a child under 16 years old who receives SSDI benefits based on the deceased spouse's earnings record, the benefits to the widow will generally end when the child turns 16 years old. However, if the child is disabled and continues to be in the care of the widow and receive SSDI benefits on ...

How long do you have to be married to receive surviving spouse?

In most cases, to be eligible for the surviving spouse benefit, the widow must have been married to the deceased spouse for at least nine months .

How much Social Security do you get if you have a deceased parent?

If you are the only surviving parent, you will receive 82.5% of your deceased child's Social Security benefits. If there are two surviving parents, each parent will receive 75% of the deceased child's benefit.

Can a widow receive SSDI?

For widows who are of retirement age, the benefit that they could receive based on their own work history may be higher than the money that they receive from their deceased spouse's SSDI benefits. You can choose to receive whichever payment is higher. Caring for deceased spouse's child.