Key Takeaways

- A defined-benefit plan is an employer-based program that pays benefits based on factors such as length of employment and salary history.

- Pensions are defined-benefit plans.

- In contrast to defined-contribution plans, the employer, not the employee, is responsible for all of the planning and investment risk of a defined-benefit plan.

Full Answer

What companies offer defined benefit pension plans?

Who has the best pension plan?

- The Typical 401 (k) Match. When an employer decides to offer a 401 (k) plan for its workers, there are different types of plans on the market to choose from. ...

- Generous Employer 401 (k) Matches. …

- Amgen.

- Boeing. …

- BOK Financial. …

- Farmers Insurance. …

- Ultimate Software.

What companies have defined benefit plans?

What job has the best pension?

- Protective service. …

- Insurance. …

- Pharmaceuticals. …

- Nurse. …

- Transportation. …

- Military. …

- Unions. A union card might be your ticket to more comprehensive retirement benefits. …

- Check out these jobs with pensions: Teacher.

What are the advantages of a defined benefit plan?

What Are the Advantages of a Defined Benefit Plan?

- Guaranteed Benefits. Unlike most other retirement schemes, a defined benefit plan allows you to determine exactly how much you’ll receive at retirement.

- Reduce Your Tax Liability. Introducing a defined benefit plan to your business can significantly reduce your tax liabilities. ...

- Spouses Can be Employees. ...

How do you calculate defined benefit?

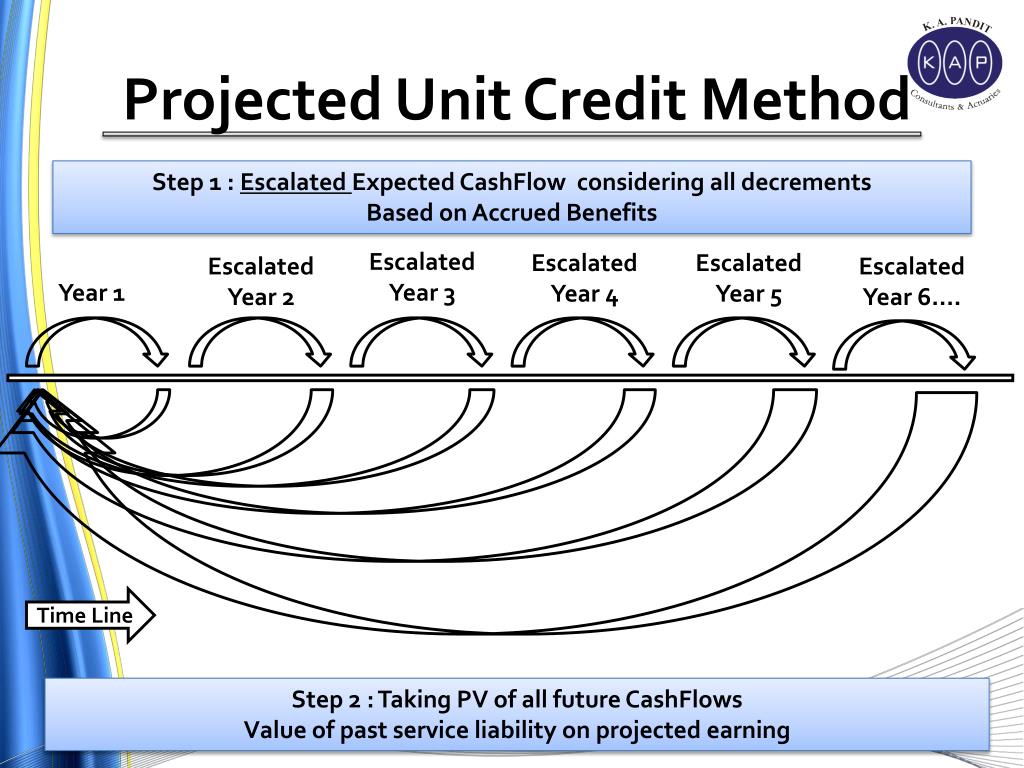

How do you calculate the present value of a defined benefit pension? The formula is simple: Net present value = CF/[(1 + r) ^ n] — where CF, or “cash flow,” is the final number from the last section’s calculation. This formula accounts for the number of years you have left until you retire and the pension begins to pay out.

How does a defined benefit pension work?

A defined benefit (DB) pension scheme is one where the amount you're paid is based on how many years you've been a member of the employer's scheme and the salary you've earned when you leave or retire. They pay out a secure income for life which increases each year in line with inflation.

Is a defined benefit pension plan good?

Easier to plan for retirement – defined benefit plans provide predictable income, making retirement planning much more straightforward. The predictability of these plans takes the guesswork out of how much income you will have at retirement.

What is the difference between a defined benefit and defined contribution pension?

A defined contribution (DC) pension scheme is based on how much has been contributed to your pension pot and the growth of that money over time. It may be set up by you or an employer. A defined benefit (DB) plan is always set up by an employer and offers you a set benefit each year after you retire.

What is one disadvantage to having a defined benefit plan?

The main disadvantage of a defined benefit plan is that the employer will often require a minimum amount of service. Although private employer pension plans are backed by the Pension Benefit Guaranty Corp up to a certain amount, government pension plans don't have the same, albeit sometimes shaky guarantees.

What happens to my defined benefit plan if I leave the company?

If the plan you are leaving is a defined benefit plan, you would be notified of the amount that your reduced pension benefit would be.

Can I lose my defined benefit pension?

Key Takeaways. Pension plans can become underfunded due to mismanagement, poor investment returns, employer bankruptcy, and other factors. Religious organizations may opt out of pension insurance, giving their employees less of a safety net.

Is defined benefit better?

The result is that while Defined Benefit Funds are generally more attractive in the early years of employment (and especially for younger employees), Accumulation funds become relatively more attractive over time for each employee.

What are the 3 main types of pensions?

The three types of pensionDefined contribution pension. Sometimes called a 'money purchase' pension or referred to as a pension pot, these schemes are very common today. ... Defined benefit pension. This type of pension scheme has declined in popularity. ... State pension.

What happens to defined contribution pension when you retire?

In a defined contribution pension plan, you know how much you will pay into the plan but not how much you will get when you retire. Usually you and your employer pay a defined amount into your pension plan each year. The money in your defined contribution pension is invested in one or more products on your behalf.

How long does a defined benefit plan last?

Upon retirement, the plan may pay monthly payments throughout the employee's lifetime or as a lump-sum payment. 3 For example, a plan for a retiree with 30 years of service at retirement may state the benefit as an exact dollar amount, such as $150 per month per year of the employee's service.

Why are defined benefit schemes closing?

Companies are closing the schemes – which are also known as defined benefit schemes – because they are expensive to run. Under defined benefit schemes, a person's income in retirement is based on their final or average salary.

Should I cash in my defined benefit pension?

Stephen Cameron, pensions director at Aegon, warns: 'Don't cash in a defined benefit pension if you think you can only just get by in retirement. As soon as you transfer out, you will be taking a risk and you won't be able to change your mind. '