What companies offer defined benefit pension plans?

Who has the best pension plan?

- The Typical 401 (k) Match. When an employer decides to offer a 401 (k) plan for its workers, there are different types of plans on the market to choose from. ...

- Generous Employer 401 (k) Matches. …

- Amgen.

- Boeing. …

- BOK Financial. …

- Farmers Insurance. …

- Ultimate Software.

What is traditional defined benefit?

In a traditional defined benefit (or “DB”) plan, the plan defines the benefit that will be paid at retirement age (or earlier separation from employment). An actuary determines the annual amount that must be deposited into the DB plan on an annual basis to provide the benefit called for under the terms of the plan.

How to freeze a defined benefit plan?

- Separate Business Units. In some larger, multi-industry companies, a pension benefit may be competitive in one part of the business, but not in another part. ...

- Satisfy Collective Bargaining Commitments. ...

- Continue Pay Growth. ...

- Offer Choice. ...

- Delay Announcement. ...

What are the types of retirement plans?

Typical retirement plans offered by big businesses deduct a portion of the individual’s salary before taxes. This allows for a bigger monthly payout, but means your retirement funds are taxed when you eventually withdraw them. The Roth IRA works differently. Contributions come from your taxed salary that you then pay into your retirement account.

How does a defined benefit plan work?

Defined benefit plans provide a fixed, pre-established benefit for employees at retirement. Employees often value the fixed benefit provided by this type of plan. On the employer side, businesses can generally contribute (and therefore deduct) more each year than in defined contribution plans.

What type of plan is a defined benefit plan?

A defined benefit plan, more commonly known as a pension plan, offers guaranteed retirement benefits for employees. Defined benefit plans are largely funded by employers, with retirement payouts based on a set formula that considers an employee's salary, age and tenure with the company.

Who is a defined benefit plan best for?

A Personal Defined Benefit Plan may be best for professionals age 50 or over who can make annual contributions of $90,000 or more for at least five years and who have few, if any, employees.

What is one disadvantage to having a defined benefit plan?

The main disadvantage of a defined benefit plan is that the employer will often require a minimum amount of service. Although private employer pension plans are backed by the Pension Benefit Guaranty Corp up to a certain amount, government pension plans don't have the same, albeit sometimes shaky guarantees.

Is a 401k a defined benefit plan?

A 401(k) is a defined contribution plan. The employee and employer can make contributions to the account up to the dollar limits set by the Internal Revenue Service (IRS). A defined contribution plan is an alternative to the traditional pension, known in IRS lingo as a defined-benefit plan.

What happens to my defined benefit plan if I leave the company?

If the plan you are leaving is a defined benefit plan, you would be notified of the amount that your reduced pension benefit would be.

Can you withdraw money from a defined benefit plan?

Typically an employee cannot just withdraw funds as with a 401(k) plan. Rather, they become eligible to take their benefit as a lifetime annuity or in some cases as a lump sum at an age defined by the plan's rules.

Who pays for defined benefit retirement?

Defined-contribution plans are funded primarily by the employee, as the participant defers a portion of their gross salary. Employers can match the contributions up to a certain amount if they choose. A shift to defined-contribution plans has placed the burden of saving and investing for retirement on employees.

Is a defined benefit plan a pension?

Defined benefit (DB) pension plan is a type of pension plan in which an employer/sponsor promises a specified pension payment, lump-sum or combination thereof on retirement that depends on an employee's earnings history, tenure of service and age, rather than depending directly on individual investment returns.

What percentage of retirees have a defined benefit pension?

Not very. The percentage of workers in the private sector whose only retirement account is a defined benefit pension plan is now 4%, down from 60% in the early 1980s. About 14% of companies offer a combination of both types.

Should I keep my defined benefit pension?

Transferring a DB pension may give you more options for your retirement, but it's not right for everyone. The FCA and TPR believe that it will be in most people's best interests to keep their defined benefit pension. If you transfer out of a defined benefit pension, you cannot reverse it.

What is the difference between a 401k and a defined benefit plan?

A 401(k) and a pension are both employer-sponsored retirement plans. The most significant difference between the two is that a 401(k) is a defined-contribution plan, and a pension is a defined-benefit plan.

What is defined benefit plan?

A defined benefit plan is a pension plan that is based on the age and the compensation history of the individual participant. In this article we will focus on defined benefit plans for self employed individuals and small business owners. We will also look at a defined benefit plan example and understand how these plans work.

Can I make 100% of my retirement income?

As per IRS rules, an individual can make 100% of their compensation in retirement. For example, if a self employed individual has a business which is registered as an S-Corp. The compensation from the business is W-2 income of $100,000 and the remaining portion is K-1 income for the business owner. If we were to apply the IRS rule ...

Can a defined benefit plan suspend distributions?

However, the defined benefit plan can utilize unique vesting schedule options to suspend the distributions for a few years . This will give you the option to defer taxes in high income years and roll over the remaining balance to an IRA.

Can I set up a retirement plan after 70?

Some retirement plans cannot be set up after a certain age, however, defined benefit plans do not fall in to this category. So if you have significant amount of income after age 70, you can still set up a defined benefit plan and contribute a large amount of money. The IRS typically requires participants to take a taxable distribution from ...

Does the IRS require a defined benefit plan?

The IRS mandates that a business owner benefiting in a defined benefit plan make some contributions for the employees also. However, the IRS provides significant leeway in how the contributions are provided to the employees. One of the pension plan design that proves to be the most efficient for the business owner is the floor offset defined ...

When does the QBI deduction expire?

The TCJA QBI deduction is set to expire at the end of 2025.

What can I do with my life insurance if I live to the maximum?

If they live to the maximum span of the permanent life insurance, it will be used for estate planning and to leave a legacy for their children or grandchildren. They also have the ability to combine 401k, profit sharing, and defined benefit plans to maximize their contributions and tax deductions.

Is a defined benefit plan more complex than a 401k?

Defined benefit plans are certainly more complex than 401k plans. But there are also significant tax advantages. Especially with the introduction of the Tax Cuts and Jobs Act (TCJA). The best way to understand the plan is to take a look at a few defined benefit plan examples. The TCJA introduced the concept of a tax deduction for QBI (qualified ...

What is defined benefit plan?

Defined benefit plans provide a fixed, pre-established benefit for employees at retirement. Employees often value the fixed benefit provided by this type of plan. On the employer side, businesses can generally contribute (and therefore deduct) more each year than in defined contribution plans. However, defined benefit plans are often more complex ...

What is an excise tax plan?

Most administratively complex plan. An excise tax applies if the minimum contribution requirement is not satisfied. An excise tax applies if excess contributions are made to the plan.

What is defined benefit plan?

What are defined benefit plans? Defined benefit plans are qualified employer-sponsored retirement plans. Like other qualified plans, they offer tax incentives both to employers and to participating employees. For example, your employer can generally deduct contributions made to the plan.

How to calculate retirement benefits?

Many plans calculate an employee's retirement benefit by averaging the employee's earnings during the last few years of employment (or, alternatively, averaging an employee's earnings for his or her entire career), taking a specified percentage of the average, and then multiplying it by the employee's number of years of service.

Why is it important to choose the right payment option?

Choosing the right payment option is important, because the option you choose can affect the amount of benefit you ultimately receive. You'll want to consider all of your options carefully, and compare the benefit payment amounts under each option. Because so much may hinge on this decision, you may want to discuss your options with a financial ...

What is hybrid retirement plan?

Some employers offer hybrid plans. Hybrid plans include defined benefit plans that have many of the characteristics of defined contribution plans. One of the most popular forms of a hybrid plan is the cash balance plan.

Is it too early to start planning for retirement?

It's never too early to start planning for retirement. Your pension income, along with Social Security, personal savings, and investment income, can help you realize your dream of living well in retirement. Start by finding out how much you can expect to receive from your defined benefit plan when you retire.

Do pension benefits hinge on performance?

Benefits do not hinge on the performance of underlying investments, so you know ahead of time how much you can expect to receive at retirement. Most benefits are insured up to a certain annual maximum by the federal government through the Pension Benefit Guaranty Corporation (PBGC).

How Does a Defined-Benefit Plan Work?

A defined-benefit plan gives the employer a fixed benefit when they retire that is not dependent on an accumulated investment and the return on that investment from the market. Therefore, it could be considered a safer savings option.

Advantages of a Defined-Benefit Plan

An employee can accrue substantial benefits in a short period, unlike a defined-contribution plan that takes time to accumulate funds.

Disadvantages of a Defined-Benefit Plan

For the employer, this type of plan is the most complex and the most costly to establish.

How Are the Benefits Calculated?

The benefits for a defined-benefit plan are calculated with a set formula.

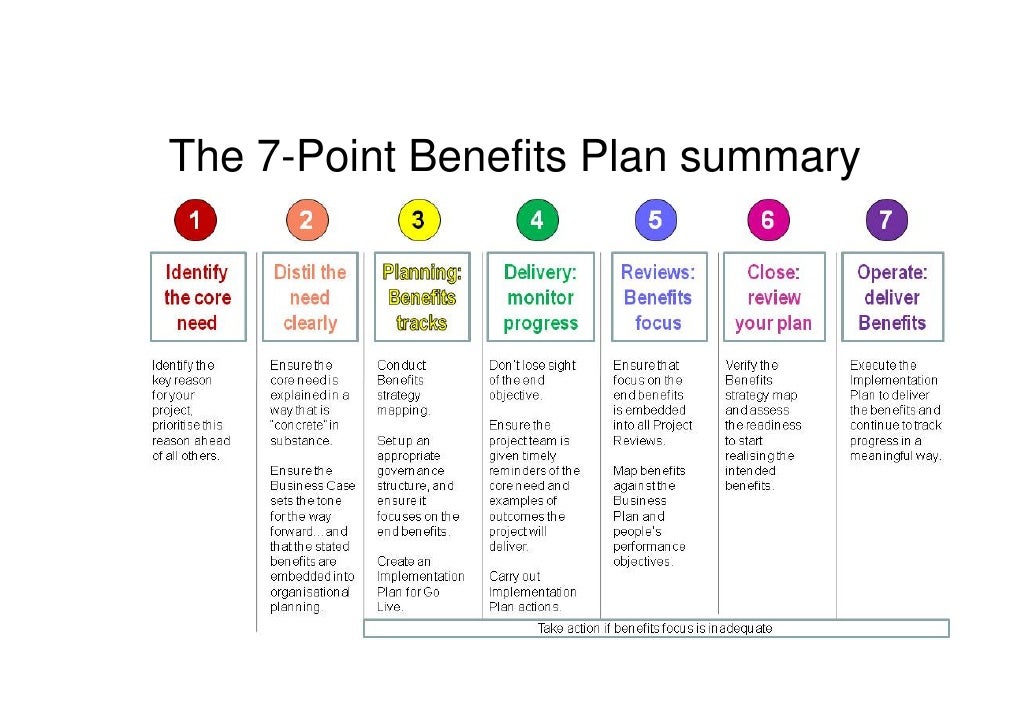

How to Set Up and Operate a Defined Benefit Plan

The process to set up and operate a defined benefit plan begins with an assessment of goals for the plan.

Payment Options for Defined-Benefit Plans

Most plans allow the beneficiary to choose how they will receive benefits: either a single life annuity, a qualified and joint survivor annuity, or a lump-sum payment.

What is defined benefit plan?

A defined benefit plan is a retirementplan in which employers provide guaranteed retirement benefits to employees based on a set formula. These plans, often referred to as pension plans, have become less and less common over the last few decades. This decline is especially pronounced in the private sector, where more and more employers have shifted ...

Why do you have to keep funding a defined benefit plan?

Because the benefits of a defined benefit plan are very specific, you have to keep funding the plan to make sure it will pay those benefits in your retirement. Plus, you’ll need to have an actuary perform an actuarial analysis each year.

What is the difference between defined benefit and defined contribution?

Some companies offer both defined benefit and defined contribution plans. The key difference between each of these employer-sponsored retirement plans is in their names. With a defined contribution plan, it’s only the employee’s contributions (and the employer’s matching contributions) that’s defined. The benefits they receive in retirement depend ...

Do defined benefit plans grow with inflation?

Many defined benefit plans also grow with to inflation. As a result, inflation over long periods of time won’t affect your money as much as a defined contribution plan participants. Defined benefit plans also feature low fees, meaning more of your money will stay in your pocket.

Is the defined benefit plan frozen?

This has led to the shift in responsibility from employers to employees. Many of the today’s remaining defined benefit plans have been “ frozen.”. This means the company is phasing out its retirement plan, though it’s waiting to do so until the enrollees surpass the age requirement.

Can you deduct contributions to a defined benefit plan?

The problem with making your own defined benefit plan is that you have to meet the annual minimum contribution floor.

What is defined benefit plan?

A defined benefit plan, more commonly known as a pension plan, offers guaranteed retirement benefits for employees. Defined benefit plans are largely funded by employers, with retirement payouts based on a set formula that considers an employee’s salary, age and tenure with the company. In an age of defined contribution plans like 401 (k)s, ...

How much can an employee contribute to a defined benefit plan?

In 2020, the annual benefit for an employee can’t exceed the lesser of 100% of the employee’s average compensation for their highest three consecutive calendar years or $230,000.

What is the form of retirement payment?

When it comes time to collect your retirement, you usually receive payment in the form of a lump sum or an annuity that provides regular payments for the rest of your life. Deciding between the two can be a difficult decision, especially since there are different ways an annuity could be structured:

What is a vested pension plan?

After racking up the required tenure, an employee is considered “vested.”. Pension plans may have different vesting requirements. For instance, after one year with a company, an employee might be 20% vested, granting them retirement payments equal to 20% of a full pension.

What happens to your annuity when you die?

When you die, your surviving spouse will get monthly payments for the rest of their life that are equal to 50% of your original annuity. • 100% joint and survivor. When you die, your surviving spouse will get monthly payments for the rest of their life that are equal to 100% of your original annuity.

What does it mean to add more stipulations to an annuity?

Adding more stipulations to your annuity usually means you’ll get lower monthly payments. But if you’re in good health and expect to live a long life, you’ll usually get the most benefit from choosing annuity payments. If you’re in poor health and expect a short retirement, a lump sum may be the best way to go.

Is a defined benefit plan funded by employer contributions?

You’re probably more familiar with qualified employer-sponsored retirement plans like a 401 (k). Unlike 401 (k)s, defined benefit plans are usually funded entirely by employer contributions, although in rare cases employees may be required to make some contributions. The retirement benefits provided by a defined benefit plan are typically based on ...

What is defined benefit plan?

A defined benefit plan is an employee benefit plan in which the employer commits to pay its employees a defined amount based on a benefit formula which depends on future demographic/financial variables. IAS 19 Employee Benefits, the IFRS standard dealing with pension plans, defines a defined benefit plan simply as ‘an employee benefit plan other ...

What happens to the projected benefit obligation when benefits are paid out to employees?

Similarly, the projected benefit obligation decreases when benefits are paid out to employees.

Does EBP have a pension?

EBP Ltd. has post-retirement benefits plan which entitles its employees to an amount equivalent to the product of their basic salary and years of service. DCP Ltd. too has a pension plan but its agreement with the employees requires DCP to contribute an amount equal to the sum of the employee’s current basic salaries at the end of each financial year.

Is EBP defined benefit?

EBP's plan is a defined benefit plan because it entitles employees to a defined amount in future (which is based on future salary). Any risk arising from fluctuations in salary, interest rates and/or investment performance, etc. are borne by the employer. DCP’s plan is a defined contribution plan because the employees only receive an amount equal ...

Is PBO a net pension?

Any excess of PBO over plan assets is recognized as a net pension liability , and any excess of plan assets over the PBO is recognized as a net pension asset (subject to certain exceptions).