Nontaxable fringe benefits are as follows:

- Professional development perks. Examples include books, conferences, and courses.

- Cell phone. If you are using your phone for work (and who isn’t using their phone for work), your data plan can be untaxed.

- Commuter perks related to parking. ...

- Commuter perks related to transit. ...

- Student loan repayments. ...

- Equipment stipends. ...

- Internet stipends. ...

What payments and benefits are non-taxable?

Health benefits include providing employees with health, dental, and vision insurance, and paying for uninsured health-related expenses. Long-term care insurance. This insurance covers expenses such as the cost of nursing home care. Premiums paid for such insurance are not taxable.

What are non-monetary fringe benefits?

Fringe benefits are non monetary incentive to motivate employees apart from normal salary. Good fringe benefits attract fresh talent people to the organization. The fringe benefits are more popular among the business right now. Compare to monetary terms most of the fringe benefits are inexpensive. Flexible work arrangement.

What are some examples of common fringe benefits?

What Are Some Examples of Common Fringe Benefits?

- Understanding Fringe Benefits. Most employers offer their employees competitive wages and salaries. ...

- Insurance Coverage. The most common fringe benefits offered to employees include combinations of insurance coverage. ...

- Retirement Plan Contributions. ...

- Dependent Assistance. ...

- Bonus Compensation. ...

- Other Fringe Benefits. ...

- Fringe Benefits FAQs. ...

- The Bottom Line. ...

What are the advantages of fringe benefits?

What advantages do fringe benefits have?

- Additional remuneration in addition to wages or salary

- Indirect benefits are also known as Supplemental Benefits.

- It might be either financial or non-financial.

- Some of them are obligatory, such as the Provident Fund.

- Other perks include insurance and financing. Free meals and gym membership

What is an exclusion for a non-employee?

What it is: This exclusion applies to a price reduction given to employees on property or services you offer to customers. The discount may not be more than the gross profit percentage times the price charged to non-employee customers or not more than 20% of the price charged non-employee customers. The benefit may not discriminate in favor of highly compensated employees.

What is working condition benefit?

Working Condition Benefits. What it is: Property and services provided to an employee so that the employee can perform their job. Who’s exempt from income tax withholding: All employees, provided it satisfies the necessary requirements.

How much can an employer exclude from group term life insurance?

Group-Term Life Insurance. What it is: An employer can generally exclude up to $50,000 of the cost of group-term life insurance. Excess value of coverage is subject to federal income tax and FICA, but not subject to FUTA.

How much is transportation exclusion for 2020?

In 2020, there is an exclusion for transportation benefits up to $270 a month. See IRS Publication 15-B for details. Who’s exempt from income tax withholding: Most employees with the exception of greater than 2% shareholders of an S-corporation.

How much can an employer pay for dependent care?

What it is: An employer can pay for or provide dependent care assistance to employees, exempt up to certain limits, $5,000 ($2,500 for married employee filing separate return) per year. Value of all payments must be reported in Box 10 of Form W-2. Excess payments must be included in Boxes 1, 3 and 5.

Can an employer pay for adopted expenses?

What it is: An employer may pay or reimburse adopted expenses an employee incurs. An employer shouldn't pay more than 5% of its payments during the year for shareholders or owners (or their spouses or dependents) and the benefit should not favor highly compensated employee. All payments must be reported on Form W-2 in Box 12 with Code “T”. For more information see Instructions for Form 8839, Qualified Adoption Expenses.

Is fringe benefit taxable?

An employer is the provider of a fringe benefit, even if a third party provides the actual benefit. Fringe benefits are taxable unless they are specifically excluded from an employee's income. Here, let’s take a deeper dive into the most common fringe benefits that can be excluded from income.

How much are perks/fringe benefits taxed?

Any fringe benefit under the taxable section above is considered taxable income .

How to determine if a benefit is de minimis?

In determining whether a benefit is de minimis, you should always consider its frequency and its value. An essential element of a de minimis benefit is that it is occasional or unusual in frequency. It also must not be a form of disguised compensation.

What are some examples of de minimis benefits?

Examples of de minimis benefits are: Occasional snacks, coffee, doughnuts, etc. Occasional tickets for entertainment events. Holiday gifts.

What are some examples of family services?

Family. Examples include day-care subsidies, tickets to a sporting event, or house-keeping services.

Is equipment stipend taxable?

Equipment stipends. If your company is going to have you return the equipment you purchase for your home office, then this can be untaxed. Note though that if you get to keep that desk, chair, mouse, etc - those are taxable benefits.

Can a company cover taxes?

Either the company can choose to cover the taxes or pass the tax on to the employees.

Is public transportation tax free?

Commuter perks related to transit. Public transportation costs between home and work are tax-free up to $270 a month. Student loan repayments. Putting payments toward interest or the principal on a “qualified education loan” are tax-free according to the CARES act of 2020.

What are taxable fringe benefits?

Unless otherwise stated by the Internal Revenue Code, an employee fringe benefit is likely taxable to some extent.

What is fringe benefit?

A fringe benefit, sometimes referred to as an employee benefit or perk, is the additional compensation or benefit an employer offers an employee on top of their regular salary or wages. The IRS considers most fringe benefits to be taxable compensation that must be reported on tax forms (e.g., Form W-2, Wage and Tax Statement, and Form 1099-MISC, ...

Why should you offer fringe benefits?

Offering employees superb benefits packages, in addition to competitive salaries, can bolster your recruitment process and help you attract and retain top talent. However, before you ramp up your employee benefits, you should understand how each benefit is taxed. Having a good understanding of what fringe benefits are and how each is taxed (or not taxed) can save you and your employees from unpleasant surprises during tax season.

What are the benefits of Section 132?

Transportation benefits in excess of employer/employee pretax deferrals under a Section 132 Plan. Housing allowance. Moving expenses. Meals and lodging (distinct from business travel) Reimbursement for classes or development unrelated to work (e.g., foreign language classes, if those classes are not work-related)

What to do when creating an employee benefits package?

When you create an employee benefits package, identify each benefit's "taxability," and clearly outline what you are offering in your employee handbook. It is often helpful to work with an experienced benefits administrator to create your benefits package.

What is qualified transportation benefit?

Qualified transportation benefits, also known as commuter benefits (up to certain limits) No additional cost services. Employers can also take advantage of an affordable, nontaxable fringe benefit option: de minimis benefit.

How much is dependent care assistance taxable?

Most benefits an employee receives under the policy are taxable) Dependent care assistance (up to $5,000 per year, as long as it doesn't exceed the earned income of the employee or employee's spouse) Educational assistance (up to $5,250 annually) Employee stock options (These may be subject to taxes)

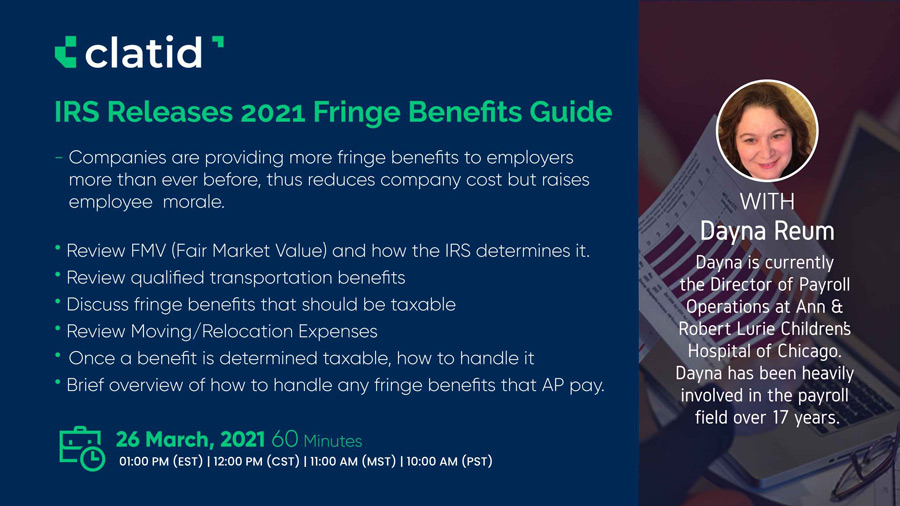

What is fringe benefit?

The Taxable Fringe Benefits Guide was created by the Internal Revenue Service office of Federal, State and Local Governments (FSLG) to provide governmental entities with a basic understanding of the Federal tax rules relating to employee fringe benefits and reporting.

What is the supplemental wage rate for fringe benefits?

The employer may elect to add taxable fringe benefits to employee regular wages and withhold on the total, or may withhold on the benefit at the supplemental wage rate of 25% .

What is considered timely if an arrangement does not meet one of the safe harbor methods?

If an arrangement does not meet one of the safe-harbor methods, it may still be considered timely, if it is reasonable based on the facts and circumstances. Reg. §1.62-2(g)(1)

Is fringe benefit taxable on W-2?

In general, taxable fringe benefits are reported as wages on Form W-2 for the year in which the employee received them. However, there are many special rules and elections for different benefits. IRC 451(a); IRS Ann. 85-113, 1985-31

What Are Taxable Fringe Benefits?

You may pay taxable fringe benefits to full-time or part-time employees, independent contractors, or owners or shareholders of the business. They’re considered part of the recipient’s taxable income and subject to federal (and possibly state) income tax withholding, Social Security, and Medicare (FICA) taxes.

Are Fringe Benefits Worth It?

Tracking taxable vs. nontaxable fringe benefits might sound confusing, but they can be an effective way to hire top talent , improve job satisfaction, and hold on to valuable employees.

What is the supplemental rate for fringe benefits?

The employer may elect to add taxable fringe benefits to employee regular wages and withhold on the total or may withhold on the benefit at the supplemental wage flat rate of 22% (for tax years beginning after 2017 and before 2026). Treas. Regs. 31.3402(g)-1 and 31.3501(a)-1T

What is de minimis fringe benefit?

De minimis fringe benefits include any property or service, provided by an employer for an employee, the value of which is so small in relation to the frequency with which it is provided, that accounting for it is unreasonable or administratively impracticable. The value of the benefit is determined by the frequency it’s provided to each employee, or, if this is not administratively practical, by the frequency provided by the employer to the workforce as a whole. IRC Section 132(e); Treas. Reg. Section 1.132-6(b)

What is wage recharacterization?

Generally, wage recharacterization occurs when the employer structures compensation so that the employee receives the same or a substantially similar amount whether or not the employee has incurred deductible business expenses related to the employer’s business. If an employer reduces wages by a designated amount for expenses, but all employees receive the same amount as reimbursement, regardless of whether expenses are incurred or are expected to be incurred, this is wage recharacterization. If wage recharacterization is present, the accountable plan rules have not been met, even if the actual expenses are later substantiated. In this case, all amounts paid are taxable as wages. For more information, see Revenue Ruling 2012-25.

How to prevent financial hardship to employees traveling away from home on business?

To prevent a financial hardship to employees traveling away from home on business, employers often provide advance payments to cover the costs incurred while traveling. Travel advances may be excludable from employee wages if they are paid under an accountable plan. (Allowable travel expenses are discussed in Transportation Expenses) There must be a reasonable timing relationship between when the advance is given to the employee, when the travel occurs and when it is substantiated. The advance must also be reasonably calculated not to exceed the estimated expenses the employee will incur. Treas. Reg. Section 1.62-2(f)(1)

Why are items listed in IRC 280F considered listed property?

Items listed in IRC Section 280F are considered “listed property” because the property by its nature lends itself to personal use. Strict substantiation requirements apply to property in this category. Employees are required to account for business and personal use. IRC Sections 274(d), 280F(d)(4) and 132(d)

When to use per diem rate?

If the employee is traveling to more than one location in one day, use the per diem rate for the area where the employee stops for rest or sleep. Rev. Proc. 2011-47

When will bicycle reimbursements be exempt from taxes?

The Tax Cuts and Jobs Act, Section 11047, suspends the exclusion of qualified bicycle commuting reimbursements from your employee’s income for any tax year beginning after December 31, 2017, and before January 1, 2026.

What is non cash fringe benefit?

What is a non cash fringe benefit? Definition. A non-cash benefit that is afforded to company employees. These benefits can include such things as a company car, a cellular phone, discounted gym memberships, memberships to a country club, and other material awards. The value of these fringe benefits must be added to the employees' gross income ...

What is fringe benefit?

Fringe benefits (FB) are employee associated costs such as health plan expenses, pension plan expenses and workman's compensation expenses, among others. These costs are expressed as a rate by employee class. The rate is the pooled costs of these benefits divided by the total salaries in each employee class.

What are fringe benefits? What are some examples?

Common examples of fringe benefits include medical and dental insurance, use of a company car, housing allowance, educational assistance, vacation pay, sick pay, meals and employee discounts. ...

Is non cash benefit taxable?

Non cash benefits are taxable to the employee. Different non cash benefits are taxed in different ways. 1. Housing and Vehicles. If you provide an employee with a rent free house or vehicle for private use then they must pay tax on the value of the benefit.