Common life insurance riders

| Accelerated death benefit | Receive a portion of the death benefit t ... |

| Disability income | Receive a percentage of the death benefi ... |

| Family income benefit rider | Provides a monthly payment to your benef ... |

| Guaranteed insurability rider | Increase your coverage without an additi ... |

| Long-term care | Pay for long-term care using some of the ... |

What are living and death benefit riders?

Variable Annuity Living and Death Benefits

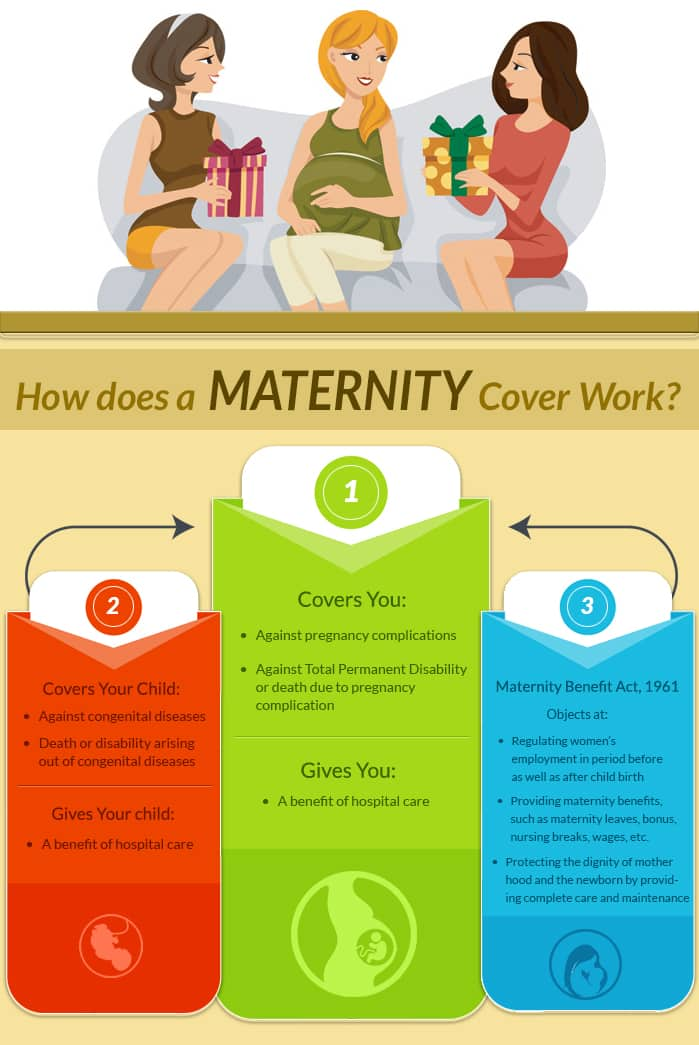

- Living Benefits. Living benefits are payments made during your lifetime. ...

- The Income Base. Many policies guarantee that your "benefit base" or "income base" will grow at a fixed rate of return.

- Learning the Rules. Living benefits can provide a promise of retirement income, but only if you meet certain requirements.

- Enhanced Death Benefits. ...

What are term insurance riders and what are its benefits?

Insurance Riders are an impeccable way to increase your insurance coverage without taking on a completely new policy. To sum up the benefits of term riders: They provide extra coverage under term insurance, which can be a very crucial help in times of financial crises. Affordability: Buying a rider is much more affordable than buying a separate ...

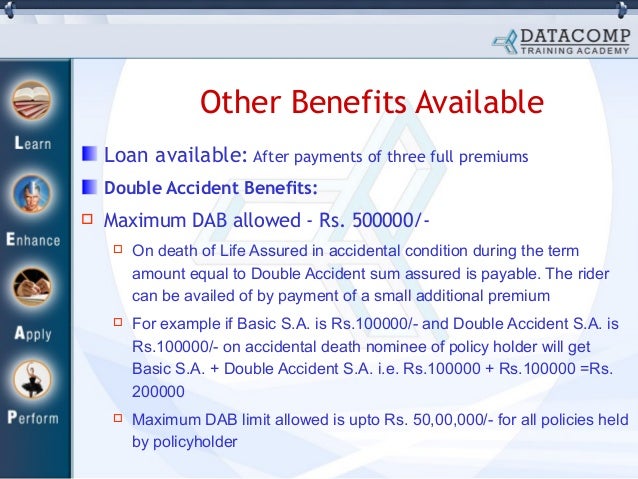

What is an accidental death benefit Rider?

Types of Accidental Death Benefit Plans

- Group Life Supplement. In this type of arrangement, the accidental death benefit plan is included as part of a group life insurance contract, such as those offered by your employer.

- Voluntary. This accidental death benefit plan is offered to members of a group as a separate, elective benefit.

- Travel Accident. ...

- Dependents. ...

What is a residual disability benefit Rider?

What is the Residual Disability Rider? The residual disability rider is unique in that it allows you to collect a portion of your benefits even if you’re not completely disabled. Investopedia describes it as follows: “Residual disability policies pay benefits according to the amount of income you have lost because of your disability.

What is a life insurance rider?

The riders are additional benefits that you can use to enhance your existing life cover. The riders are also known as add-ons. To avail of the benefits, you need to pay an additional premium. However, the extra price proves beneficial in the form of financial security.

Can you take the rider with any insurance policy?

Now that you have the answer to what is insurance rider, you might be asking yourself if you are eligible to buy the riders with any life policy. The answer to that is ‘yes.’

Benefits of the riders

The riders of the life insurance policy come with various benefits. Here are the ones that guarantee overall security for you and your family:

Why do you need a rider on your insurance?

They offer extra coverage which can be helpful in times of financial crises. Buying a rider is much more economical than buying a separate insurance policy. It makes the insurance policy more economical. It allows you to customise your insurance policy.

What is a rider in life insurance?

Simply put, a rider provides additional coverage and added protection against risks. Insurance riders are effective add-ons you can choose in addition to your life insurance policy at economical rates. They make your policies robust and broad, covering more than just the cost of your demise.

What are the types of riders?

Types of Riders: 1. Accelerated death benefit rider: This is an added feature that comes as an extra rider and allows a policyholder or his nominee to have additional benefits. Apart from the base plan benefits, it allows extra coverage to in the event of the policyholder’s death due to any specific and pre-defined condition. 2. ...

What is a waiver of premium?

Waiver of premium: This is the most sought-after rider, often added to other policies, especially a child plan. In this rider, there will be no payable premiums if the policyholder’s dies and her/his nominee will be eligiblefor the base plan benefits.

Can you add riders to a policy after the base policy is bought?

Keep in mind that these riders should be bought at the time of purchasing the base insurance plan. The riders cannot be added after the base policy is bought.

What is an insurance rider?

The takeaway. An insurance rider adds features to a basic life insurance policy. The riders could benefit you as the policy owner or the beneficiaries if you die. Some riders provide you with living benefits, meaning you can withdraw money from the death benefit amount before you die.

What is a rider on life insurance?

A rider on a life insurance policy is an optional add-on that allows you to customize your standard life insurance for a small additional cost. There are two generic categories of riders: living benefit and death benefit riders. The main difference is who can take advantage of them. A living benefit means you can use some ...

How much money do you get from accelerated death benefits?

An accelerated death benefit lets you receive up to 80% of the funds designated to beneficiaries if you’re terminally ill and have less than twelve months to live. The money is intended to help you pay medical and hospice care and is deducted from what your beneficiaries would receive. If you draw $100,000 of a $500,000 policy for example, your beneficiaries will inherit the remaining $400,000.

What happens if you add a disability rider to your life insurance?

Disability income. If you’re unable to work due to a qualifying disability, you could receive a percentage of the death benefit each month if you add the disability income rider to your life insurance policy.

What is the difference between a death benefit rider and a living benefit rider?

A living benefit means you can use some of the money you’ve designated for your beneficiaries after you die for your needs while you’re still alive. Death benefit riders are exclusively intended to help your beneficiaries after you pass.

What is a lump sum death benefit?

Pays you a lump sum for medical treatment if you’re diagnosed with a life-threatening condition. Receive a percentage of the death benefit each month if you become disabled and can’t work. Provides a monthly payment to your beneficiaries in addition to the lump-sum death benefit.

What is critical illness rider?

The critical illness rider pays you a lump sum which can be used for medical treatment if you’re diagnosed with or suffer from a life-threatening condition, such as cancer, kidney failure or heart disease. The amount will be deducted from the death benefit your beneficiaries would receive.

1. Waiver of Premium Cover

This rider offers a waiver on all future premiums of the policy in case of an eventuality such as dismemberment, disability, or critical illness due to an accident or disease, or any other cause.

2. Disability Cover

A disability rider is a beneficial cover in case the insured suffers from a total, partial, or permanent disability due to an accident, or instances of stroke, or any other cause. Such an incident can significantly impact the future income generation capability of the breadwinner.

3. Accidental Death And Dismemberment Cover

Accidents can disrupt future goals and dip into the family’s finances. This rider safeguards the family’s financial future in case of accidental death or accidental dismemberment. The additional protection benefits are applicable in case the life insured meets an accident, leading to death or dismemberment.

4. Term Cover

Term rider when attached to a life insurance policy, offers supplementary additional life coverage making it an essential component to strengthening the overall risk cover offered by the policy.

5. Critical Illness and Disability Cover

Under this rider, the policyholder is provided with comprehensive financial protection against a range of critical illnesses post a ‘waiting period’. In case of diagnosis of the covered critical illnesses (Like cancer, heart attack of specific severity), the insurance company will pay a fixed benefit to the life insured and their family.

Value That Riders Add

A life insurance plan is not a one-size-fits-all. Hence, before comparing different plans, one should consider specific needs like the sum assured, affordability, premium payment tenure and policy coverage period. Once a suitable base plan is selected, appropriate riders to cover specific risks may be added.

What is a guaranteed insurability rider?

A guaranteed insurability rider allows you to add more coverage to your policy without a medical exam, typically during stated time periods. Note that this rider is usually only available with a whole or universal life insurance policy.

What is a life insurance rider?

Life insurance riders are optional benefits you can add on top of the normal coverage your life policy offers. For example, you may add a rider that lets you defer your premiums if you become disabled, or another that lets you add more coverage later without a medical exam. Adding a rider to your policy may increase your premium, ...

What is accelerated death benefit rider?

For example, an accelerated death benefit rider will let you take some of your death benefit early if you're diagnosed with a terminal illness.

What is a living benefit rider?

Also called a living benefit rider, this rider lets you take an advance on your death benefit money if you're diagnosed with a terminal illness. Your insurance company may subtract the amount you take out from the death benefit your beneficiaries receive upon your death.

What is term rider?

A term life insurance rider allows you to purchase term life coverage on top of a permanent life insurance policy, giving you extra coverage for a set period of time.

What is a long term care rider?

This rider adds long-term care insurance to your life policy, which can help pay for in-home care, medical equipment, and other health care costs associated with aging. Note that your policy's death benefit may be reduced if you use this rider. Is a long-term care rider worth it?

What is a family income benefit rider?

Family income benefit rider. This rider adds an additional death benefit to your policy that's paid out in monthly installments, rather than one lump sum. This way, your family has a steady source of income to replace your own.