The assignment of benefits gives contractors the ability to:

- File the insurance claim.

- Work directly with insurance claims adjusters.

- Make repair decisions.

- Complete repairs.

- Directly bill the insurance carrier for all work completed.

- Sue your insurance company regarding your claim.

What is meant by 'accepting assignment of benefits'?

Terms in this set (13)

- Required information is available to process the claim.

- The claim is not a duplicate.

- Payer rules and procedures have been followed.

- Procedures performed or services provided are covered benefits.

What does "assignment of benefits" mean for insurance?

What Is the Assignment of Insurance Benefits?

- Health Insurance. When you require medical care, it's important to have health insurance in place to protect your financial well-being.

- Income Loan. Whole life insurance policies with accumulating cash values can act as supplementary retirement income planning investments.

- Collateral Loan. ...

- Charitable Contribution. ...

What is assignment of benefits (AOB)?

Use these tips when opting for an AOB:

- Do not let the insurance company bully you!

- Personally contact your insurance company when damage occurs, as soon as possible, then contact a licensed contractor.

- Maintain control – Refuse to sign any documentation that resembles power of attorney legalese as this may relinquish control

What is assignment of benefits in medical billing?

Other documentation required for prescribing CGM to Medicare patients:

- Certificate of Medical Necessity (serves as the prescription)

- Images of insurance card (s) (front/back)

- Chart notes reflecting coverage criteria

What is assignment of benefits in healthcare?

Assignment of Benefits: An arrangement by which a patient requests that their health benefit payments be made directly to a designated person or facility, such as a physician or hospital.

What does assignment of insurance mean?

Assignment — a transfer of legal rights under, or interest in, an insurance policy to another party. In most instances, the assignment of such rights can only be effected with the written consent of the insurer.

What is the assignment of benefits consent?

An Assignment of Benefits Agreement (AOB) is an agreement that allows a third party to work directly with your insurance company on your behalf. If an AOB is signed, the third party can file insurance claims, collect money and make decisions without having you do anything extra.

What is the difference between accept assignment and assignment of benefits?

To accept assignment means that the provider agrees to accept what the insurance company allows or approves as payment in full for the claim. Assignment of benefits means the patient and/or insured authorizes the payer to reimburse the provider directly.

Can you revoke an assignment of benefits?

Generally, donative assignments are revocable. An assignor can revoke an assignment by notifying the assignee of the revocation, by accepting the obligor's performance, or by subsequently assigning the same right to another party. Also, the death or bankruptcy of the assignor will automatically revoke the assignment.

What are the two types of assignments in insurance?

There are two types of conventional insurance policy assignments:An absolute assignment is typically intended to transfer all your interests, rights and ownership in the policy to an assignee. ... A collateral assignment is a more limited type of transfer.

Who signs assignment of benefits in medical billing?

the patientDefinition of Assignment of Benefits This agreement is signed by the patient as a request to pay the designated amount to the health care provider for the health benefits he/she may have received. On the patient's request the insurance payer makes the payment to the hospital/doctor.

What is an AOB In medical terms?

What is an Assignment of Benefits (AOB) in Medical Billing? Aug 29 2016. This term refers to insurance payments made directly to a healthcare provider for medical services received by the patient. Assignment of benefits occurs after a claim has been successfully processed with an insurance company.

What if the AOB is not signed by the patient?

Insurance company does not have right to make the payment directly to provider, if AOB is not signed by the patient.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

Is cob primary coverage?

COB is a process that decides which health plan pays first when you have multiple health insurance plans. These plans are called primary and secondary plans.

Can a doctor charge more than Medicare allows?

A doctor is allowed to charge up to 15% more than the allowed Medicare rate and STILL remain "in-network" with Medicare. Some doctors accept the Medicare rate while others choose to charge up to the 15% additional amount.

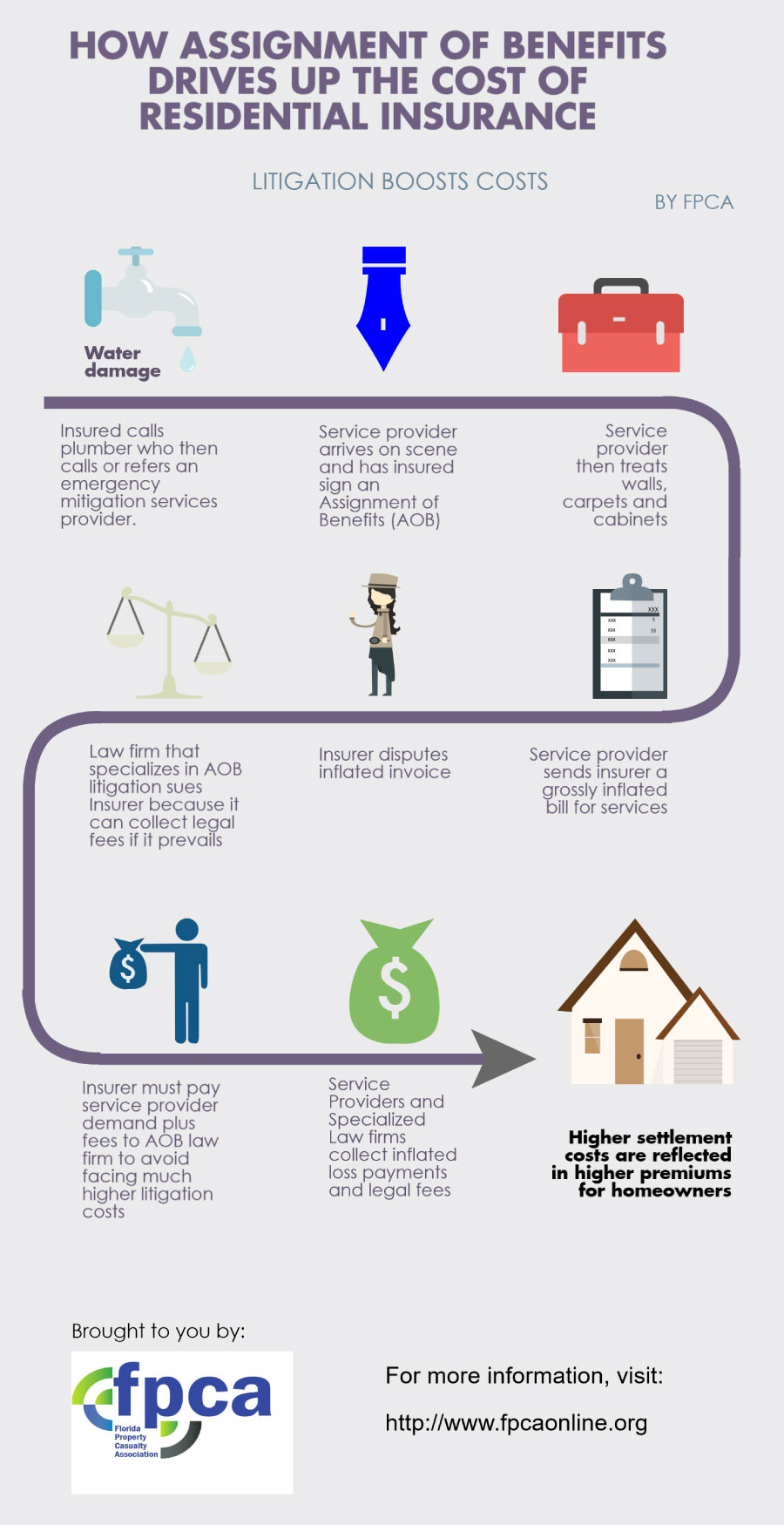

What is an assignment of benefits?

An assignment of benefits (or AOB for short) is an agreement that gives your claims benefits to someone else. It’s usually used so that a contracto...

When do homeowners use an assignment of benefits?

Homeowners may sign an assignment of benefits form because they think it’s more convenient and efficient than dealing with the claims process first...

How are assignment of benefits causing insurance fraud in Florida?

Some contractors may take advantage of the situation and inflate repair needs and costs or bill for work that was never completed. They may also hi...

What Does Assignment of Benefits (AOB) Mean?

Assignment of benefits (AOB) is the official way an insured person asks their insurance company to pay a professional or facility for services rendered.

Insuranceopedia Explains Assignment of Benefits (AOB)

Assignment of benefits is a document that directs payment to a third party at the insured's request. It becomes legitimate once both the insured party and their insurer have signed the AOB form.

How does AOB affect insurance?

Insurers who choose to dispute inflated AOB bills are up against it in the era of plaintiff-friendly court verdicts. If the insurance companies fight in court and lose, they must pay compensation to the plaintiff’s attorneys, but the opposite is not true if the insurers win their case.

What is an AOB?

Assignment of benefits, widely referred to as AOB, is a contractual agreement signed by a policyholder, which enables a third party to file an insurance claim, make repair decisions, and directly bill an insurer on the policyholder’s behalf. The Insurance Information Institute (III) describes AOB as “an efficient and customer-friendly way ...

What happens if a contractor violates the terms of an AOB?

If a contractor violates any of those terms, the claim could be deemed void, leaving the policyholder out of pocket for a potentially significant loss.

Who is the assignee of insurance?

Assignee or Third-Party is a person or entity who is assigned insurance claims rights or policy benefits through an AOB and has the authority to file a claim with the insurance company, make repair decisions and collect insurance payments without the involvement of the homeowner.

What is AOB penalty?

A penalty or fee for rescission of the AOB during the timeframes outlined in the AOB. A check or mortgage processing fee. A penalty or fee for cancellation of the AOB. An administrative fee. If you are concerned with the language or terms of the contract, you should seek legal advice prior to signing the AOB.

What is an AOB?

Do you know how it impacts you? An AOB is an agreement that, once signed, transfers the insurance claims rights or benefits of your insurance policy to a third party. An AOB gives the third party authority to file a claim, make repair decisions and collect insurance payments without your involvement.

What is Direct Payment Authorization Clause?

Direct Payment Authorization Clause provides authorization for the direct payment of any benefits or proceeds to the company that is performing the work.

Can a third party assignee claim a third party deductible?

The AOB prohibits the third-party assignee from seeking payment from you in any amount in excess of the applicable policy deductible unless you have agreed to have additional work performed at your own expense. Florida law prohibits a third-party assignee from including the following charges/fees in an AOB:

Why is an assignment of benefits form important?

This is why an assignment of benefits form is so important. It essentially removes the patient from the equation and puts the medical provider in their place as far as the insurance policy is concerned. This enables the provider to be paid directly.

What is an assignment of benefits form?

What Should An Assignment of Benefits Form Include? An assignment of benefits form (AOB) is a crucial document in the healthcare world. It is an agreement by which a patient transfers the rights or benefits under their insurance policy to a third-party – in this case, the medical professional who provides services.

What does "assigns the rights and benefits including the right to bring suit" mean?

Essentially, this means that a provider gives up the right to collect payments at the time of service in exchange for the right to bring suit against the insurance company if they are not paid in full.

Can Callagy Law review AOB?

Callagy Law can not only review these documents, but also ensure you are pursuing all recoverable bills to which you are eligible. If you have any questions, would like us to review your AOB form, or have issues collecting payment from insurance companies, please contact the Callagy Law team today.