Term life insurance has several benefits:

- It provides protection during the years when coverage is needed.

- It is affordable, with premiums sometimes starting as low as $30 per month

- It can provide important protection for loved ones in case of an untimely death

What are the advantages of term life insurance?

Pros of term life insurance for smokers Here are some benefits of term life insurance for smokers: Cheaper: Term life insurance is cheaper than whole life insurance. Since smokers pay more in ...

Is term insurance the most expensive type of life insurance?

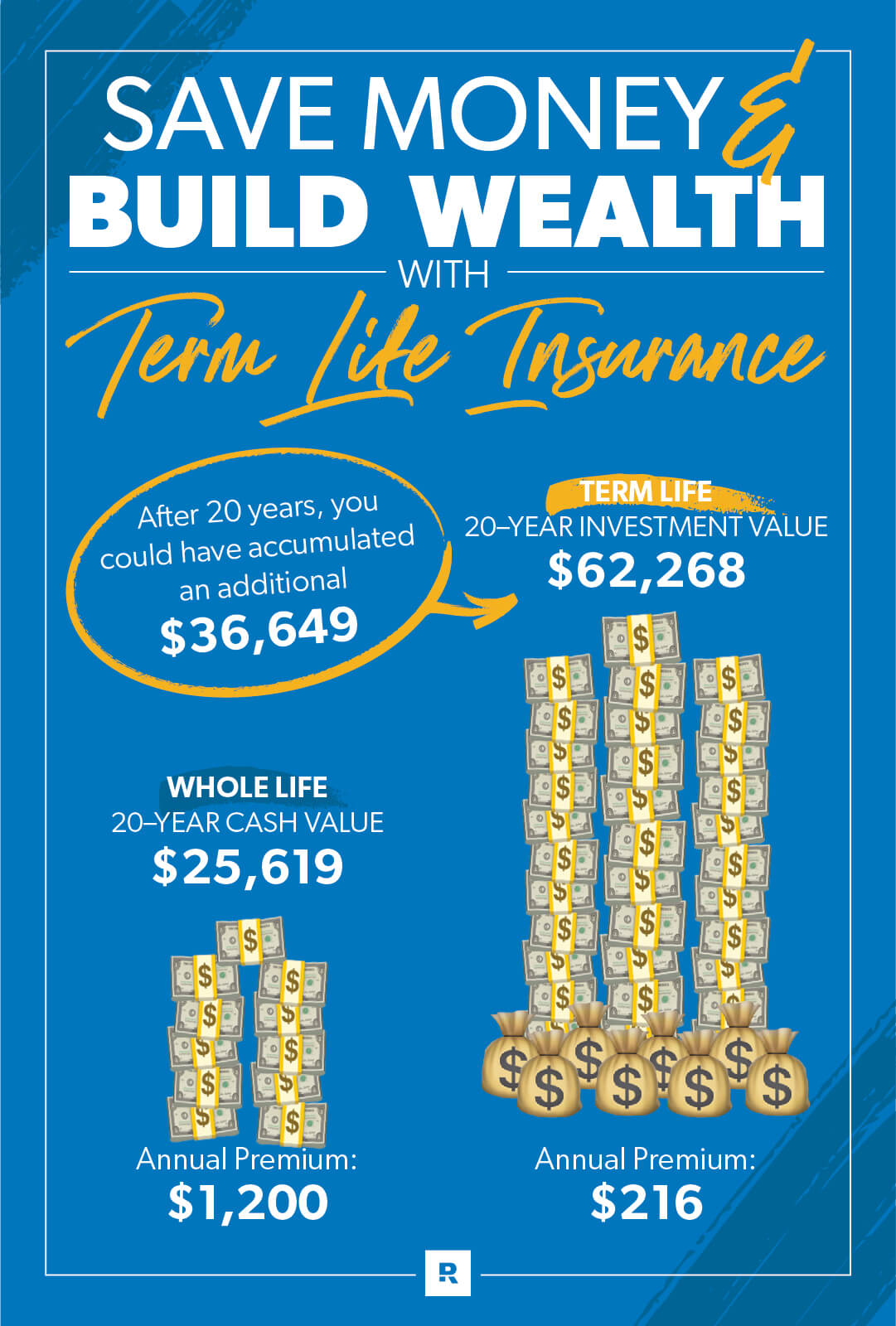

Whole life insurance is considered to be the most expensive type of life insurance. Its premiums can be as much as five to 10 times more expensive than term life insurance premiums.

What exactly does term life insurance mean?

Term life insurance is like renting life insurance coverage just in case you suddenly pass away. It only lasts for a few years and provides basic life insurance services. But whole life insurance lasts your entire life in addition to providing a savings account that builds interest and accumulates cash over time.

Which is better term or universal life insurance?

This depends on your family structure, financial situations, and goals; whether term, universal, or whole life insurance is better for you. Considering all, term life insurance is best for most families because of its affordability and simplicity.

Which is better term life or whole life insurance?

Term coverage only protects you for a limited number of years, while whole life provides lifelong protection—if you can keep up with the premium payments. Whole life premiums can cost five to 15 times more than term policies with the same death benefit, so they may not be an option for budget-conscious consumers.

What are 3 benefits of term insurance?

Following are the primary benefits of term life insurance that you can avail by buying term insurance: High Sum Assured at Affordable Premium. Easy to Understand. Multiple Death Benefit Payout Options.

What happens to a term life insurance policy at the end of the term?

Generally, when term life insurance expires, the policy simply expires, and no action needs to be taken by the policyholder. A notice is sent by the insurance carrier that the policy is no longer in effect, the policyholder stops paying the premiums, and there is no longer any potential death benefit.

What are the disadvantages of term life insurance?

Disadvantages Of Term Life insurance Premium payments for term life insurance increase after the initial guarantee period. Cost Prohibitive Over Time. Term insurance is designed to be temporary and will become cost-prohibitive at some point, Not Designed to Last a Lifetime. ... No Cash Value.

At what age should you stop term life insurance?

Most life insurance policies have an upper age limit for applications. Many insurers stop taking life insurance applications from shoppers who are over 75 or 80, while some have much lower age limits and a few have higher limits.

Do you lose money with term life insurance?

Term life insurance, unlike permanent life insurance, does not have any cash value and therefore does not have any investment component. 5 If you're still alive when the term ends, the policy simply lapses and you and your beneficiaries don't see any money.

Does term life insurance pay full amount?

Term life is typically less expensive than a permanent whole life policy – but unlike permanent life insurance, term policies have no cash value, no payout after the term expires, and no value other than a death benefit.

Is term insurance a good idea?

A term insurance plan will help the family to meet their day to day expenses and accomplish the long-term financial goals too. Yes, it is worth buying a term insurance policy no matter what year it is. When compared to other types of life insurance products, a term insurance policy is much beneficial.

Can you convert term life to whole life?

Most term life insurance is convertible. That means you can make the coverage last your entire life by converting some or all of it to a permanent policy, such as universal or whole life insurance.

Is life insurance worth it after 50?

Once you pass 50, your life insurance needs may change. Perhaps the kids are grown and financially secure, or your mortgage is finally paid off. If so, you may be able to reduce or eliminate coverage. On the other hand, a disabled dependent or meager savings might require you to hold on to life insurance indefinitely.

What is term life insurance?

Term life insurance is a type of life insurance that lasts for a specific period of time known as a term, which can be a fixed number of years or u...

Is term life insurance a good idea?

Term life insurance has several benefits over other forms of life insurance including permanent life insurance or whole life insurance. Therefore,...

How does term life insurance work?

Term life insurance is a contract between the individual being insured and the life insurance provider, whereby the insurance company agrees to mak...

What is premium for term life insurance?

An insurance premium is the cost for the life insurance offered by the life insurance company. It is payable periodically, generally on a monthly o...

How long does term life insurance last?

You have many options when it comes to term life insurance. Coverage can last as little as one year, as with annual renewable term life. Or you can lock in rates for as few as five years if you need to cover a short-term debt like tuition expenses while your child is in college.

Why is term life insurance more affordable than whole life insurance?

Term life insurance rates are more affordable than whole life insurance because it offers protection for a predetermined time. The life insurance company is hoping it will never pay out because you will outlive the term and the policy will expire. Whole life insurance premiums, by comparison, are higher because the policies pay out no matter ...

How many decisions do you need to make when buying term life insurance?

Term life insurance is easy to understand, which makes it simple to shop around and compare rates. You need to make only three main decisions: coverage amount, length of term and preferred company. As long as you pay the premium, you’re covered for the duration of the policy.

Is term life insurance good?

Term life insurance can be a good fit, particularly for young families on a budget looking for coverage for a set amount of time. Term life insurance offers four important advantages. 1. Less expensive. Term life insurance rates are more affordable than whole life insurance because it offers protection for a predetermined time.

Does life insurance pay out after you die?

Life insurance pays out after you die and can be an important safety net for your family. Get free online life insurance quote s from multiple companies today.

What are the benefits of term life insurance?

Although the death benefit of a term life insurance policy can be used any way the beneficiary chooses, the funds are commonly used for: 1 Funeral and Burial Expenses 2 Loss of Income 3 Medical Bills 4 College Loans 5 Mortgages 6 Rent 7 Business Expenses 8 Others

Why is term life insurance more affordable than permanent life insurance?

1. Cost. Term life insurance is typically more affordable than permanent life insurance because it only provides protection for a set amount of time. Policy premiums are determined by your insurance carrier. Factors include age, health, occupation and others.

What factors determine the eligibility for term life insurance?

Factors include age, health, occupation and others. Traditional term life insurance policies usually require a medical exam and a health questionnaire to determine eligibility. In general, a healthy, non-smoking person in their 20s will pay much less than a 60 year-old smoker, for example. 2. Versatility.

How to speak to a licensed life insurance agent?

A licensed life insurance agent can help you better understand life insurance. Speak with a licensed agent at 1-855-303-4640. ----------.

Can you use term life insurance for death benefit?

Although the death benefit of a term life insurance policy can be used any way the beneficiary chooses, the funds are commonly used for:

What is term life insurance?

Term life insurance is a contract between the individual being insured and the life insurance provider, whereby the insurance company agrees to make a payment should the individual die during the term of the policy. The life insurance provider uses detailed statistical or actuarial models that assess the risk involved in offering the death benefit coverage to the beneficiaries of the life insurance applicant.

What is life insurance premium?

An insurance premium is the cost for the life insurance offered by the life insurance company. It is payable periodically, generally on a monthly or annual basis. As long as the premium payments are made, the insurance contract stays valid through to the end of the policy term. Various factors go into determining these life insurance premiums. You can read all about what affects insurance prices here or find instant life insurance quotes.

Why is simplicity important in insurance?

Simplicity is one of the primary benefits of buying a term policy since you only need to decide on the insurance company, the term length and the coverage amount. As long as you pay your premiums on time and in full, you’re covered for the entire term.

Why don't Canadians get life insurance?

Most Canadians decide not to get life insurance because they assume it’s complicated and expensive. That’s a shame. Term insurance offers straightforward benefits and is the least expensive way to buy life insurance. The following will help you understand term insurance and determine if it is the best product for your immediate needs.

How long does a term life insurance policy last?

You can also get a policy that lasts until you reach a particular age, such as 65 years. It is generally used to cover temporary needs such as the pre-defined term of a mortgage or to cover the term up to the completion of your children’s education. Therefore, the primary consideration is to ensure the term of the policy meets such temporary needs.

Can term insurance replace mortgage insurance?

It’s also useful for those with temporary needs such as supporting beneficiaries, paying for their children’s education and paying off debts. In addition, term insurance can be used to replace mortgage insurance.

Can you get a refund on term life insurance?

Thus, when you cancel your term insurance, there is no refund of premiums.

What is life insurance?

Life insurance is there to protect your family financially after you’re gone. But what if you need the money sooner? Some life insurance policies allow you to accelerate the death benefit or access your cash value early, an option called “living benefits insurance.”. If you’re wondering “what is living benefits insurance,” here’s how term life ...

What is a living benefit rider?

A living benefit rider, which allows someone to get the payout from accelerated death benefits, can offer extra peace of mind, whether or not you end up needing it, just like regular term life policies.

What is accelerated death benefit?

A living benefits rider allows you to access a portion of your payout while you’re still alive if you’ve been diagnosed with a serious condition.

What is Fidelity Life?

At Fidelity Life, our goal is to make life insurance simple, affordable, and understandable for everyday families. This content is intended for educational purposes only. Each post is carefully fact-checked, reviewed and updated regularly to ensure the information is as relevant as possible.

Is a living benefits rider a good choice?

Consider your health history: Does Alzheimer’s, cancer, or another serious illness run in your family? If so, a living benefits rider may be a good choice.

Is cash value more expensive than term life insurance?

You can borrow against it or use it as collateral if you need extra money for expenses. While whole life policies are more expensive than term life insurance, they can provide permanent protection and extra support if the worst happens.

Can you add a rider to a life insurance policy?

You can add a rider to an existing policy or a new one, typically for an extra cost. One of the most common riders is a living benefits or terminal illness rider, also known as an accelerated death benefit rider.

Why is term insurance not permanent?

A major reason is that permanent insurance has a savings component , often referred to as the policy’s cash value , while term insurance does not. The premiums that you pay for a permanent policy go partly to buy insurance and partly to build cash value.

How much is group life insurance tax free?

The first $50,000 of group term life insurance coverage is tax-free to the employee.

What happens to group insurance when you retire?

As mentioned above, because group coverage is linked to employment, if you change jobs, stop working for a period of time, leave to open a business, or retire, then the coverage will stop. This puts you at risk of being uninsured or, if you have health issues, having difficulty with finding new coverage.

What happens to group life insurance when you pass away?

Like other types of life insurance, group term life insurance pays out a death benefit to your designated beneficiary if you pass away while the policy is in effect.

Is death benefit the same for all employees?

These policies aren’t necessarily the same from one company to the next, however. Employers can decide how much of a death benefit to offer, whether to allow employees to increase their death benefit, and whether to make coverage available for spouses and children.

Does my employer pay for my insurance?

Your employer may provide a certain amount of coverage free of charge. If you wish to buy additional coverage, what you’ll pay for it will depend, in large part, on your age.

Is group term insurance cheap?

Group term coverage is generally inexpensive, especially for younger workers. However, the rates go up as individuals age. Most plans also have rate bands in which the cost of insurance automatically goes up in increments—for example, at ages 30, 35, 40, etc.