How do you calculate cost benefit analysis?

- Establish a framework to outline the parameters of the analysis

- Identify costs and benefits so they can be categorized by type, and intent

- Calculate costs and benefits across the assumed life of a project or initiative

- Compare cost and benefits using aggregate information

- Analyze results and make an informed, final recommendation

How do you calculate cost benefit?

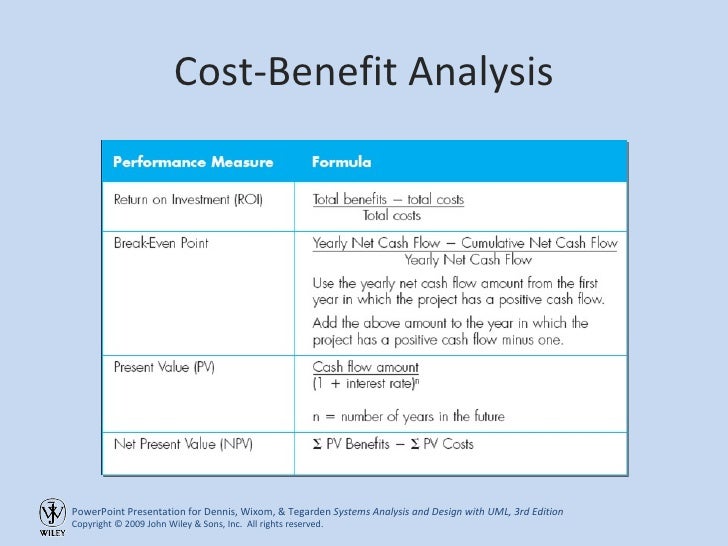

Benefit-Cost Ratio = ∑PV of all the Expected Benefits / ∑PV of all the Associated Costs Step 6: Now, the formula for net present value can be derived by deducting the sum of the present value of all the associated costs (step 4) from the sum of the present value of all the expected benefits (step 4) as shown below.

What are the types of cost analysis?

- Absolute cost quantifies an asset's loss in value.

- Relative cost compares the selected action or decision, and the alternative action or decision that was not selected.

- Opportunity cost is the cost or sacrifice (loss) incurred as a result of selecting one activity or action over another.

How to do a cost analysis?

How high do petrol prices need to go to make electric cars more affordable?

- Supply a bigger speed hump. Consultancy Bloomberg New Energy Finance (BNEF) said even if rising petrol prices drove people towards electric cars, they might not be able to get one ...

- Governments drive change. ...

- No incentives for automakers. ...

- Up-front costs more important. ...

- EV rush later this decade. ...

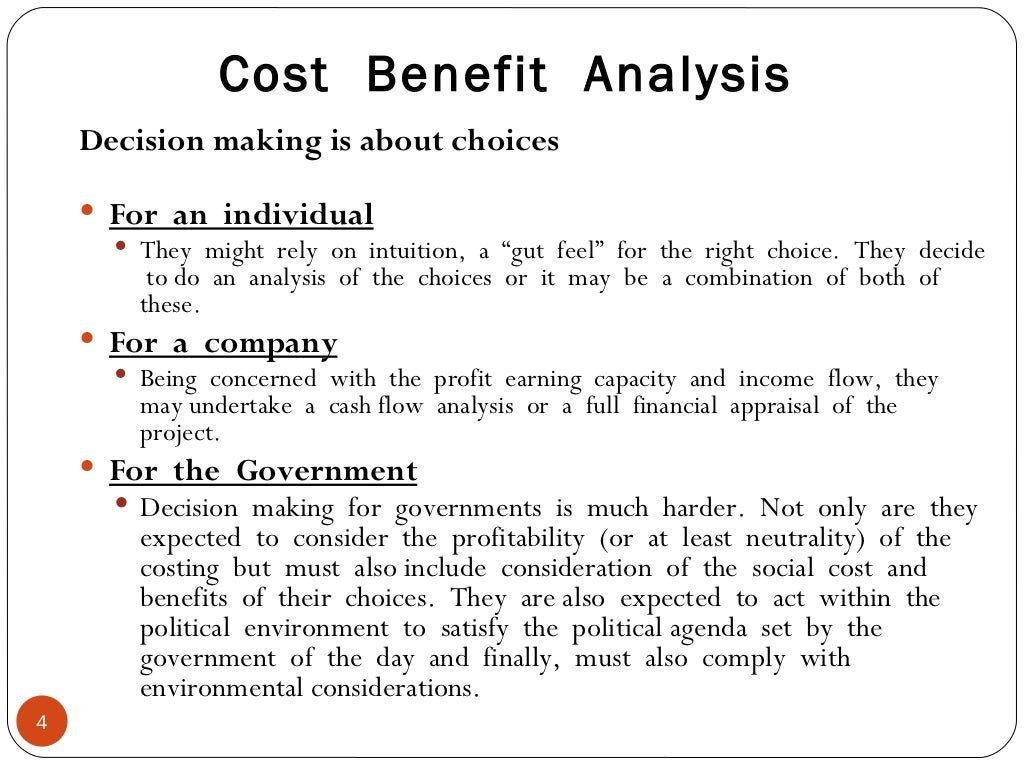

What Is A Cost-Benefit Analysis?

A cost-benefit analysis is the process of comparing the projected or estimated costs and benefits (or opportunities) associated with a project decision to determine whether it makes sense from a business perspective.

Why is cost benefit analysis important?

It makes decisions simpler: Business decisions are often complex by nature. By reducing a decision to costs versus benefits, the cost-benefit analysis can make them less complex.

What to do if costs outweigh benefits?

If the costs outweigh the benefits, ask yourself if there are alternatives to the proposal you haven’t considered. Additionally, you may be able to identify cost reductions that will allow you to reach your goals more affordably while still being effective.

What happens if you don't give all the costs and benefits a value?

If you don’t give all the costs and benefits a value, then it will be difficult to compare them accurately. Direct costs and benefits will be the easiest to assign a dollar amount to. Indirect and intangible costs and benefits, on the other hand, can be challenging to quantify.

What are the limitations of cost-benefit analysis?

Limitations of Cost-Benefit Analysis 1 It’s difficult to predict all variables: While cost-benefit analysis can help you outline the projected costs and benefits associated with a business decision, it’s challenging to predict all the factors that may impact the outcome. Changes in market demand, materials costs, and global business environment can occasionally be fickle and unpredictable, especially in the long term. 2 It’s only as good as the data used to complete it: If you’re relying on incomplete or inaccurate data to finish your cost-benefit analysis, the results of the analysis will be similarly inaccurate or incomplete. 3 It’s better suited to short- and mid-length projects: For projects or business decisions that involve longer timeframes, cost-benefit analysis has greater potential of missing the mark, for several reasons. It typically becomes more difficult to make accurate predictions the further out you go. It’s also possible that long-term forecasts will not accurately account for variables such as inflation, which could impact the overall accuracy of the analysis. 4 It removes the human element: While a desire to make a profit drives most companies, there are other, non-monetary reasons an organization might decide to pursue a project or decision. In these cases, it can be difficult to reconcile moral or “human” perspectives with the business case.

What happens if the projected benefits outweigh the costs?

If, on the other hand, the costs outweigh the benefits, then a company may want to rethink the decision or project.

What happens if total benefits outnumber total costs?

If total benefits outnumber total costs, then there is a business case for you to proceed with the project or decision. If total costs outnumber total benefits, then you may want to reconsider the proposal.

What Is Cost Benefit Analysis?

Cost benefit analysis, also known as benefit cost analysis, is a tool for comparing the costs of a decision with its benefits. The tool is often used in the business world, where the decision can be anything from developing a new product, to changing an existing process.

How is the cost and benefit tool used?

It’s made possible by placing a monetary value on both the costs and benefits of a decision. Some costs and benefits are easy to measure since they directly affect the business in a monetary way.

Is cost benefit analysis still useful?

Overall, we think cost benefit analysis is still a useful tool. However, in some circumstances, it might be too difficult to estimate costs or benefits so as to draw meaningful conclusions. In these cases, consider cost benefit analysis as a guiding tool, but look to other business analysis techniques to support your conclusion.

Can cost benefit ratios be numerically expressed?

Since both costs and benefits can be expressed in monetary terms, these ratios can also be expressed numerically. As a result, cost benefit or benefit cost ratios lend themselves well to comparison, which is why cost benefit analysis can be used to compare two or more definitions. The process is simple. For each decision or path in question, ...

What is Cost Benefit Analysis?

Cost benefit analysis is a process used primarily by businesses that weighs the sum of the benefits, such as financial gain, of an action against the negatives, or costs, of that action . The technique is often used when trying to decide a course of action, and often incorporates dollar amounts for intangible benefits as well as opportunity cost into its calculations.

When performing a cost benefit analysis, what is the purpose of the CBA?

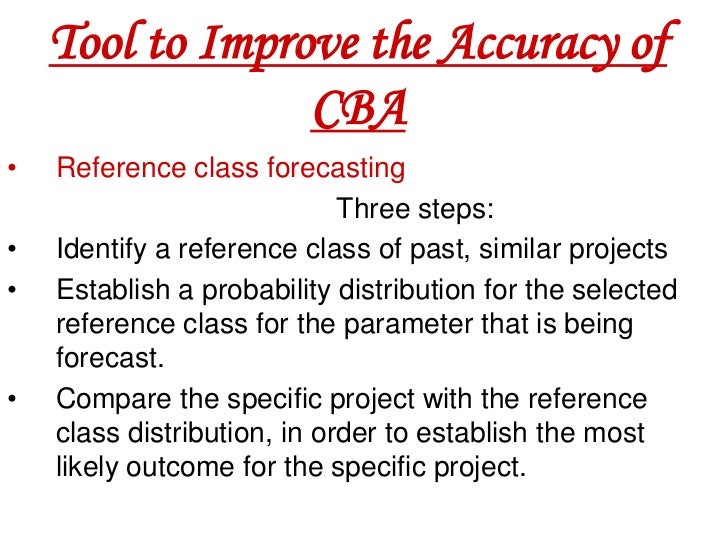

When performing a cost benefit analysis, or CBA, it is generally helpful to weigh the total benefits and total costs of a future project at their present value - which is where net present value comes in. Given that CBAs are often done with a long-term view in mind, the value of money often changes due to inflation and other factors, making it helpful to factor in the net present value of the figures you are analyzing when conducting a CBA.

What is the benefit cost ratio?

While there are slightly more complex formulas, the benefit-cost ratio is essentially just taking into account all of the direct or indirect costs and benefits and seeing if one outweighs the other. Additionally, running a CBA often takes into account opportunity cost and is frequently used to compare different options by calculating their benefit-cost ratios.

What is the first thing to do when running a cost benefit analysis?

The first thing to do when running a cost benefit analysis is to compile a comprehensive list of all the costs and benefits associated with the potential action or decision.

What is CBA in accounting?

Still, CBA is similar to net present value (or NPV), which is often used by investors.

What is the CBA process?

CBA is an easy tool to determine which potential decision would make the most financial sense for the business or individual. The process also takes indirect benefits or costs into consideration, like customer satisfaction or even employee morale.

Why do we need a CBA?

Running a CBA for a potential decision can help visualize the implications and impact of that course of action, and is often very helpful for smaller or medium-sized decisions that are more immediate in scope of time. However, there are some disadvantages to practicing a CBA in certain circumstances.

What is cost-benefit analysis?

Cost-benefit analysis is the process of predicting the costs and benefits of a project to guess if it can generate a positive gain. Company leaders do this analysis to see if a certain project can give them a high return on investment, or ROI. A good ROI means that a business receives more value than it spent, earning a profit. The benefits of a project can also be non-monetary, like if they help a company fulfill its mission.

What are real costs and benefits?

Real: Real costs and benefits involve labor and raw materials necessary to produce items.

What is tangible cost?

Tangible: These costs and benefits are easy to measure and quantify in terms of monetary value. They're identifiable and clear, like payroll, rent and purchases.

What is the purpose of "with/without comparison"?

In this method, they analyze both the worth of a project and the costs and benefits of not implementing it. They compare what would happen if a business did or didn't complete a project to see the impact it would have. Assessing the current conditions of a business and the risks involved in keeping things the same can help a business decide whether to make changes in the future.

What is direct cost?

Direct: Direct costs and benefits directly relate to production, like a product, service, project or activity.

Why is it important to consider discount rates?

This is the idea that the value of money changes over time, decreasing due to inflation. The value of dollars in the future is going to be less than the value of dollars today. Leaders can calculate the net present value of a project's benefits to adjust them for the future. Here is the formula for net present value:

How do leaders assign monetary values to projects?

After listing and categorizing costs and benefits, leaders assign monetary values to them, deciding how much they are worth. They should also consider the possibility of changes in values over the time of the project's life cycle. They can organize these values in a table to make calculation processes easier. They should add up the various costs to get the total cost of a project and do the same with a project's benefits .

How is cost benefit analysis used?

The human capital approach considers the value of future earnings of those benefiting from an intervention, thus placing a value on health outcomes that reflects one source of benefits to the patient and the rest of society. The willingness-to-pay approach monetizes health outcomes by considering the preferences of the affected individual (s). These preferences can either be revealed (by observing the behavior of individuals in relation to health-related activities or purchasing habits) or stated (using choice modeling approaches such as discrete choice experiments, DCEs). Whichever approach is used, cost–benefit analysis results are usually expressed as either a ratio of benefits to costs or a simple sum representing the net benefit of one intervention compared to another . The decision rule used when deciding which intervention to adopt is therefore straightforward: if a new intervention generates a positive net benefit (or a ratio of benefits to costs greater than one), it is worthwhile to adopt this intervention. The use of a common unit (money) to value outcomes means that healthcare interventions in a wide variety of disease areas can be easily compared in terms of their net benefit.

Why is cost benefit analysis important?

Cost-benefit analysis may be an appropriate tool if one wants to optimize the expected economic value of a design. Still, even in such cases, some additional value-laden assumptions and choices need to be made. One issue is how to discount future benefits against current costs (or vice versa). The choice of discount rate may have a major impact on the outcome of the analysis. One might also employ different choice criteria once the cost-benefit analysis has been carried out. Sometimes all of the options in which the benefits are greater than the costs are considered to be acceptable. However, one can also choose the option in which the net benefits are highest, or the option in which the net benefits are highest as a percentage of the total costs.

How does the BCA tool work?

The BCA tool automates cost-effectiveness analysis and allows the grant applicants to calculate a project BCR. Using this tool, applicants enter data regarding their mitigation projects and structures in the data fields of the program. The cost-effectiveness of the project is determined by built-in calculations using the user-provided data. Default values such as FEMA standard values and the results of previously conducted economic and statistical analyses have been assigned to certain data fields in the BCA tool ( FEMA, n.d.a ). However, the software allows users to override some of the prefilled standard data inputs, such as the Project Useful Life standard value. In this case, users must justify the value by providing documentation explaining and supporting their new value. The BCA program consists of seven modules covering a range of major natural hazards:

What is CBA in ECD?

CBA is a major departure from traditional measures of effect size, such as the d statistic and percentage-change metrics, which take into account only program effects while ignoring their costs. The use of CBA in the field of ECD has increased dramatically. To illustrate estimation, relative to the control group, participants in the Child–Parent Center preschool program spent an average of 0.7 fewer years in special education from kindergarten to high school. The effect size is 0.29 standard deviations. This translates to an average savings in special education of US$5317 per program participant, which was calculated by multiplying the program effect of 0.7 years by the average annual cost per child for special education services above and beyond regular instruction estimated in 2007 dollars for the Chicago school district in which they were enrolled and discounting the cost, occurring at an average age of 10, to age 3 by an annual rate of 3% ( Reynolds et al., 2002 ).

What is CBA in economics?

CBA is an economic approach for estimating the value of alternative programs and policies relative to costs. Levin and McEwan (2001) define CBA as the “evaluation of alternatives according to their costs and benefits when each is measured in monetary terms” (p. 11).

What is the benefit of CBA?

The major advantage of CBA is that benefits for multiple outcomes can be summarized in dollar terms, either the net return (benefits minus costs) or return per dollar invested (benefits divided by costs). However, the ability to conduct a CBA depends on whether or not it is possible to reflect program benefits in dollar terms. Researchers have a long tradition of estimating the benefits of increased graduation rates and reductions in crime. Often program budgets contribute information used to create estimates of the benefits of reductions in services such as special education or child welfare. It is more difficult to monetize the benefits of higher test scores or problem behaviors because relatively few studies link test scores or behavior to the more monetizable outcomes of higher future incomes or fewer crimes committed. When program outcomes cannot be easily converted to monetary terms, cost-effectiveness analysis is the recommended approach (see Levin and McEwan, 2001). Cost-effectiveness analysis typically assumes that there is one main outcome of interest such as test scores.

Why do we need a CBA?

A CBA can give a prioritized ranking to alternative interventions, and thereby help in the decision-making process. Ranking according to the relative costs and benefits can help a health ministry to choose among putting resources into a high-technology hospital, home care, expansion of an immunization program, or investment in primary care services.

How does a cost-benefit analysis work?

Many companies use cost-benefit analysis to help them make important short-term and long-term business decisions. While the process likely looks a little different for every company, the steps are roughly the same.

What are the limitations of cost-benefit analysis?

There are flaws in a cost-benefit analysis that can lead to inaccuracies in the results.

What is the benefit to cost ratio?

The resulting number is your benefit-to-cost ratio. If the number is more than one, your benefits outweigh your costs. The higher the number, the more your benefits outweigh your costs. If the number is less than one, your costs exceed your benefits.

What are intangible costs?

Your intangible expenses could include the impact on your employees or the effect on your customers and the way they see your company. Intangible costs could also include the social and environmental impact of a particular decision.

What are the benefits of a project?

The benefits of any given project might include tangible benefits, such as additional revenue and profit. You should also consider intangible benefits such as increased customer satisfaction and public awareness or increased employee productivity.

What are direct costs?

For the costs, first consider the direct costs. These are the actual costs involved with moving forward with your project or product. The direct costs would include raw materials, labor costs, and manufacturing costs. Be thorough. Will you have to hire more people as a result of a particular project? Will it require equipment you don’t currently have? These are the tangible costs of the project. If we’re talking about a company considering producing a new product, these tangible costs are the cost of goods sold.

How to calculate the benefit to cost ratio?

First, add up the monetary value of each (meaning the sum of all of your costs and the sum of all of your benefits). Then, you’re going to take the total dollar value of your benefits and divide it by the total dollar value of your costs. The resulting number is your benefit-to-cost ratio.

Understanding Cost-Benefit Analysis

- Before building a new plant or taking on a new project, prudent managers conduct a cost-benefit analysis to evaluate all the potential costs and revenues that a company might generate from the project. The outcome of the analysis will determine whether the project is financially feasible or i…

The Cost-Benefit Analysis Process

- A cost-benefit analysis should begin with compiling a comprehensive list of all the costs and benefits associated with the project or decision. The costs involved in a CBA might include the following: 1. Direct costs would be direct labor involved in manufacturing, inventory, raw materials, manufacturing expenses. 2. Indirect costs might include electricity, overhead costs from manag…

Limitations of The Cost-Benefit Analysis

- For projects that involve small- to mid-level capital expenditures and are short to intermediate in terms of time to completion, an in-depth cost-benefit analysis may be sufficient enough to make a well-informed, rational decision. For very large projects with a long-term time horizon, a cost-benefit analysis might fail to account for important financial concerns such as inflation, interest …

What Is A Cost-Benefit Analysis?

- A cost-benefit analysisis the process of comparing the projected or estimated costs and benefits (or opportunities) associated with a project decision to determine whether it makes sense from a business perspective. Generally speaking, cost-benefit analysis involves tallying up all costs of a project or decision and subtracting that amount from the...

How to Conduct A Cost-Benefit Analysis

- 1. Establish a Framework for Your Analysis

For your analysis to be as accurate as possible, you must first establish the framework within which you’re conducting it. What, exactly, this framework looks like will depend on the specifics of your organization. Identify the goals and objectives you’re trying to address with the proposal. W… - 2. Identify Your Costs and Benefits

Your next step is to sit down and compile two separate lists: One of all of the projected costs, and the other of the expected benefits of the proposed project or action. When tallying costs, you’ll likely begin with direct costs, which include expenses directly related to the production or develo…

Pros and Cons of Cost-Benefit Analysis

- There are many positive reasons a business or organization might choose to leverage cost-benefit analysis as a part of their decision-making process. There are also several potential disadvantages and limitations that should be considered before relying entirely on a cost-benefit analysis.

What Is Cost-Benefit Analysis?

- Cost-benefit analysis is the process of predicting the costs and benefits of a project to guess if it can generate a positive gain. Company leaders do this analysis to see if a certain project can give them a high return on investment, or ROI. A good ROI means that a business receives more value than it spent, earning a profit. The benefits of a pr...

When to Use Cost-Benefit Analysis

- Cost-benefit analysis can help leaders and teams make important decisions in a variety of fields, including government, finance, IT, software development, healthcare and education. This technique can also aid people in making personal financial decisions, such as buying a car or renting an apartment. Here are some situations in which a business leader may use cost-benefi…

Performing Cost-Benefit Analysis

- The basic process of cost-benefit analysis is subtracting a decision's costs from its benefits, where a positive result represents a profit. However, there are a few more parts of this examination that allow business leaders to consider the comprehensive effects of a decision. Here are nine important components of performing cost-benefit analysis:

Examples

- Businesses and people can apply cost-benefit analysis to many different types of decisions. It may help in understanding the process to think about some real-world examples, such as: