Treatment of de minimis benefits in the Philippine payroll process

| Salaries & Wages (Basic Compensation) | Income Tax Rate |

| De Minimis Benefits | Exempt |

| Excess of De Minimis (Add with 13 th Mon ... | Exempt |

| Benefits & Bonuses in Excess of P82,000. ... | Income Tax Rate Fringe Benefit Tax Rate |

| All Other Benefits | Income Tax Rate |

What are de minimis benefits given to employees?

De minimis benefits are benefits of relatively small values provided by the employers to the employee on top of the basic compensation intended for the general welfare of the employees. Being of relatively small values, the same is not being considered as a taxable compensation. This concept has initially been introduced by Revenue Regulations No. 8-2000 sometime in year 2000 amending Revenue ...

What is a de minimis fringe benefit?

However, these are some of the most common examples of de minimis fringe benefits:

- Holiday Gifts

- Occasional Snacks

- Tickets to entertainment events

- Transport and food money for overtime working

- Gift baskets/books

- Birthday gift

- Personal use of employer equipment

- Educational assistance

- Cocktail parties

- Local phone calls

What is de minimis threshold?

When Canada, the United States and Mexico announced that they had reached an agreement to amend the North American Free Trade Agreement (“NAFTA”), one of the important changes was an increase to the de minimis threshold. The de minimis threshold is the monetary value for courier shipments that can enter Canada without payment of duties and taxes.

What is the de minimis rule?

The de minimis tax rule sets the threshold at which a discount bond should be taxed as a capital gain rather than as ordinary income. The rule states that a discount that is less than a quarter-point per full year between its time of acquisition and its maturity is too small to be considered a market discount for tax purposes.

What are examples of de minimis benefits in the Philippines?

In the Philippines, there are certain benefits and allowances that are given to employees which are not subject to income tax. This is known as a de minimis benefit, and it includes items such as food and transportation allowances, small gifts, and other minor expenses.

What qualifies as de minimis?

In general, a de minimis benefit is one for which, considering its value and the frequency with which it is provided, is so small as to make accounting for it unreasonable or impractical.

How do you understand de minimis benefits?

From a tax standpoint, a de minimis benefit is a small amount of employee compensation, and Internal Revenue Code section 132(a)(4) states that these small amounts are not subject to taxation. They're not worth the time and effort it would take to account for them.

What is not a de minimis employee benefit?

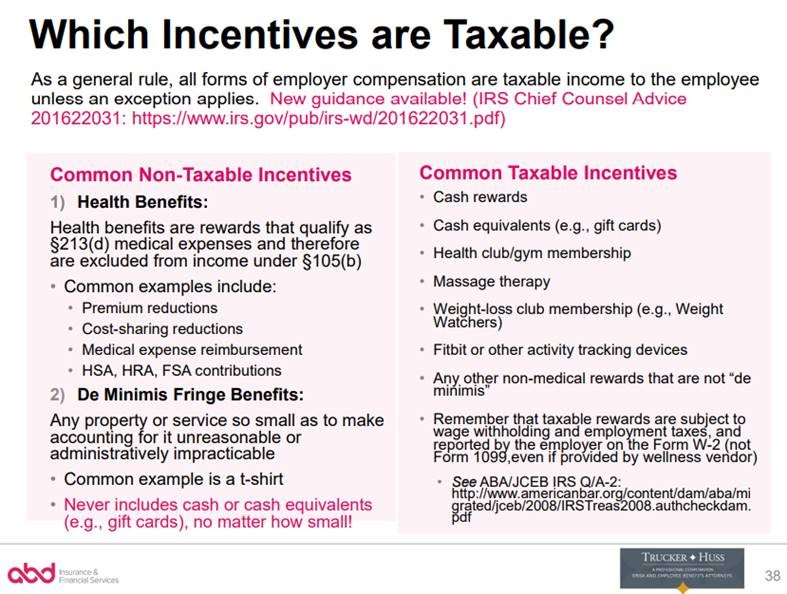

Cash and cash equivalent fringe benefits (for example, a gift card), no matter how small the amount, cannot qualify as a de minimis benefit, except for occasional meal money or transportation fare.

What is the difference between de minimis benefit and other benefits?

The term “relatively small value” differentiates de minimis benefits from fringe benefits. Fringe benefits include employer support to an employee's major expenses, such as housing and vehicle or foreign travel costs. De minimis benefits, on the other hand, include minor perks and rewards with a capped value.

What are de minimis benefits not subject to income tax?

The De Minimis Benefits are benefits of relatively small value given by the employer to his or her employees to improve health, goodwill, contentment, or efficiency of his/her employees. These are not subject to Income Tax as well as withholding tax on compensation of both managerial and rank and file employees.

What benefits are not taxable?

HS207 Non taxable payments or benefits for employees (2019)Accommodation, supplies and services on your employer's business premises.Supplies and services provided to you other than on your employer's premises.Free or subsidised meals.Meal vouchers.Expenses of providing a pension.Medical treatment abroad.More items...•

Is 13th month pay a de minimis benefits?

Aside from the benefits that we are familiar with, like maternity leaves, thirteenth-month pays, and government contributions there are others that voluntarily being provided by our employers, and this is what we call De Minimis Benefits.

How much is de minimis benefits in Philippines?

What are de minimis benefits?De Minimis BenefitPrescribed Maximum AmountMedical cash allowance to employees' dependentsPhp 750 per employee per semester or Php 125 per monthRice subsidyPhp 1,500 per month or one sack of 50kg rice per monthUniform and clothing allowancePhp 5,000 per year7 more rows

Can an employer gift money to an employee?

Gift vs. Compensation As a general rule, an employer can't really give you a "gift" under the tax code. With only a couple of exceptions, the IRS considers anything your employer gives you to be taxable compensation for your services.

Do gift cards count as income?

Per IRS Regulations, gift cards are taxable to the recipient and must be reported as income to the IRS. In addition, because the IRS considers them to be cash equivalents, there is no de minimis value (see 2018 IRS Publication 15-B page 9 De Minimis (Minimal) Benefits).

What does "de minimis" mean?

De Minimis. The term de minimis is a Latin expression that translates roughly to “pertaining to minimal things.”. In the U.S. legal system, the term is used to refer to certain facts or issues that are so minor as to be undeserving of the court’s attention. In addition, de minimis is relevant to certain bond and securities income, ...

What is fringe benefit?

A de minimis fringe benefit is one that is so low in value as to make it impractical to report on an employee’s income taxes. For example, a de minimis benefit might be the $10 coffee shop gift card given to an employee for handling a difficult client.

What are some things that you can get for work?

Coffee, doughnuts or pastries, and occasional snacks. Occasional tickets for concerts, sports games, or other entertainment events. Occasional money for meals or transportation in connection with working overtime. Holiday gifts, and gifts for special circumstances, such as flowers, candy, fruit, books, etc.

Do you report fringe benefits on W-2?

Reporting De Minimis Fringe Benefits. If a fringe benefit meets the requirements to be considered de minimis, it does not need to be reported at all. If the benefit is taxable, however, it should be reported in the wages section of the employee’s Form W-2.

Is a de minimis award a cash equivalent?

The award is not disguised wages. The award is not cash, a cash equivalent, a vacation, theater or sports tickets, meals, lodging, or securities.

Is de minimis compensation fringe benefit?

To be considered de minimis, a benefit cannot be a type of compensation in disguise as a fringe benefit. If a benefit that might be considered de minimis because of its infrequent nature is valued too high, it is taxable for its full value, not only the difference between the dollar limit for de minimis benefits and the item’s true value.

What is De Minimis?

De Minimis is a legal term that has been applied in many ways, including to copyright law, business law, and income tax law.

What is the De Minimis Rule?

The De Minimis Rule is established in the United States Internal Revenue Code under Section 132 (e) (1). This section of the tax code deals with the computation of taxable income, and in particular with items that may be specifically excluded from gross income.

What is a De Minimis Benefits Example?

De Minimis benefits include a variety of products or services that employers may provide to employees, and which employees are not required to claim as part of their gross income.

Which Benefits are Not Considered De Minimis Benefits?

The Internal Revenue Service has indicated specific types of benefits that should never be considered De Minimis fringe benefits. These include:

Keep Learning

Few compliance programs harness automation to its full potential. Learn how you can drive impact with every process by infusing technology where it matters most.

What is de minimis benefit?

What are de minimis benefits? De minimis benefits are a particular set of monetary benefits that employers voluntarily give to rank-and-file and managerial employees in the Philippines that are not subject to withholding tax and income tax on compensation income. Since they are tax-exempt, de minimis benefits reduce an employee’s income tax ...

Why is de minimis tax exempt?

Since they are tax-exempt, de minimis benefits reduce an employee’s income tax and increase their take-home pay. You might be receiving de minimis benefits from your employer but not aware of it, probably because they’re not called as such. On payslips, they’re often labeled as “allowance” or “subsidy.”. It’s important to know which benefits you’re ...

What is de minimis tax?

The de minimis tax rule is a law that governs the treatment and accounting of small market discounts. Translated “about minimal things,” the de minimis amount determines whether the market discount on a bond is taxed as capital gain. Capital Gain A capital gain is an increase in the value of an asset or investment resulting from ...

What is a de minimis safe harbor?

De minimis safe harbor refers to an annual tax return election that allows taxpayers to deduct various purchases that are usually affected by taxation. It allows businesses that prepare financial statements to deduct up to $2,500. The figure can reach $5,000 if a company uses an applicable financial statement (AFS).

What is taxable income?

Taxable Income. Taxable Income Taxable income refers to any individual's or business’ compensation that is used to determine tax liability. The total income amount or gross income is used as the basis to calculate how much the individual or organization owes the government for the specific tax period.

Can de minimis benefits be taxed?

De minimis benefits cannot assume a tangible monetary value. In other words, money cannot be given as a gift to increase morale without it being taxed. Due to the frequency and small monetary value of the items listed above, de minimis benefits avoid taxation.

Does de minimis apply to fringe benefits?

De minimis tax rule also applies to fringe benefits offered by employers. Since the de minimis benefits offered are so small, it will be unreasonable to account for them, and they are exempt from taxation. These are some of the main de minimis benefits:

Why are some benefits considered de minimis?

Minimal or occasional employee benefits are considered de minimis. In some cases, it's because the amount is small, such as the holiday turkey. Other benefits are considered de minimis because it's simply too difficult to sort out employee personal use from business use, such as the office copier.

Why is de minimis important?

The concept of de minimis is important in employee benefits, in capital gains taxes, and in other business tax areas. A small benefit might not be subject to income tax. The amount can vary depending on circumstances.

What is considered de minimis for cell phones?

The IRS considers employer-provided cell phones de minimis if they're not part of the company's compensation to the employee and if they're provided for "substantial business reasons." Some examples include:

What is an occasional de minimis?

Commuting use of an employer’s vehicle more than once a month. Membership in a country club or athletic facility. Notice the use of the word "occasional" in the list of de minimis benefits. A benefit is almost never de minimis if it's provided routinely.

What is a de minimis on a 1099?

On Form 1099-S, Proceeds from Real Estate Transactions, a transfer of less than $600 is considered de minimis. De minimis limits are considered in capital gains tax on the purchase of discount bonds. A discount of less than a quarter of a point per year is effectively too small to count for tax purposes.

What is an occasional award dinner?

Occasional award dinners or holiday dinners for employees and guests. Coffee and donuts at staff meetings, or occasional meals provided to employees who must work overtime. Occasional tickets to sporting events or theater, such as the use of the company box at a basketball game.

Can you treat benefits as de minimis?

Like other taxes, the de minimis rule must be applied fairly. You can't treat benefits the company provides to high-level employees as de minimis if the same benefit isn't available to all your employees.

What is de minimis benefit?

3 – 1998 (C), defined the term “de minimis benefits” as facilities or privileges furnished or offered by an employer to his employees that are of relatively small value and are offered or furnished by the employer merely as a means of promoting the health, goodwill, contentment, or efficiency of his employees.

Is fringe benefit taxable?

However, unlike finge benefits they are totally non taxable. Employers are also not required to give these kind of benefits but they are highly encouraged.

Is de minimis tax exempt in the Philippines?

Treatment of de minimis benefits in the Philippine payroll process. Remember that you should include these benefits on your payroll but should be tax exempt. As an employer these benefits are also deductible from your income. Here is an illustration to further explain how to view “de minimis benefits” in payroll processing.

Introduction

- The term de minimis is a Latin expression that translates roughly to pertaining to minimal things. In the U.S. legal system, the term is used to refer to certain facts or issues that are so minor as to be undeserving of the courts attention. In addition, de minimis is relevant to certain bond and securities income, as well as employee wage claims and fringe benefits. To explore this concept…

Criticism

- At some point, the court or other enforcement entity must decide not to entertain every single tiny piece of information brought to bear. Otherwise, every proceeding would be swamped with arguments, reasonings, and excuses that have little to do with the matter at hand. These facts and issues are referred to by the Latin phrase de minimis, which means pertaining to minimal things.

Origin

- This phrase follows the Latin edicts of de minimis non curat praetor (the praetor does not concern himself with trifles), and de minimis non curat lex (the law does not concern itself with trifles). Early in the 17th century, the queen of Sweden was known to spout the Latin adage aquila non capit muscās (the eagle does not catch flies).

Purpose

- In practice, for example, de minimis doctrine seeks to keep trivial matters from clogging up the court system. This may keep a party from bringing up unrelated, insignificant things, or it may result in the dismissal of a lawsuit completely.

Benefits

- Many people do not realize that the fringe benefits they receive from their employers may be subject to income tax. A de minimis fringe benefit is one that is so low in value as to make it impractical to report on an employees income taxes. For example, a de minimis benefit might be the $10 coffee shop gift card given to an employee for handling a ...

Definition

- In determining whether a fringe benefit is de minimis, or if its value can be taxed, the IRS considers, not only the benefits value, but the frequency in which it is received. A de minimis benefit is something that is received only occasionally, or which is unusual, rather than expected. To be considered de minimis, a benefit cannot be a type of compensation in disguise as a fring…

Facts

- Starbucks Corporation filed a motion for summary judgment asking the court to dismiss the case arguing that these daily tasks took, on average, about four minutes. The company claimed that these tiny slices of time after clocking out were de minimis, and not worth the administrative time and effort to track, nor the courts time to litigate.

Issues

- The de minimis doctrine has the court looking at three things to determine whether a work activity is considered de minimis:

Significance

- In this case, the court analyzed the amount of time spent doing these small tasks each day. In other cases on this subject, the courts have held that, if the time spent on post-click activities is less than 10 minutes, it is de minimis. The California court granted Starbuck Corporations motion for summary judgment. This decision is important, as it created precedent that, even though an …