Which pension plan is the best plan?

Those include:

- Railroad employee benefits

- Thrift Savings Plans (TSP)

- Defined benefit pension plans

What are the advantages of a defined benefit plan?

What Are the Advantages of a Defined Benefit Plan?

- Guaranteed Benefits. Unlike most other retirement schemes, a defined benefit plan allows you to determine exactly how much you’ll receive at retirement.

- Reduce Your Tax Liability. Introducing a defined benefit plan to your business can significantly reduce your tax liabilities. ...

- Spouses Can be Employees. ...

How do you calculate defined benefit?

How do you calculate the present value of a defined benefit pension? The formula is simple: Net present value = CF/[(1 + r) ^ n] — where CF, or “cash flow,” is the final number from the last section’s calculation. This formula accounts for the number of years you have left until you retire and the pension begins to pay out.

What are the features and benefits of a pension plan?

Some unique features of pension plans include the following:

- Deferred annuity plans come in both traditional and unit-linked variants.

- Deferred annuity plans offer a death benefit during the policy tenure. ...

- A policyholder is offered three options when deferred annuity plans vest:

- Withdraw up to 60% of the maturity benefit in cash. ...

How do defined benefit pension plans work?

As the name implies, a defined benefit plan focuses on the ultimate benefits paid out. Your employer promises to pay you a certain amount at retirement and is responsible for making sure that there are enough funds in the plan to eventually pay out this amount, even if plan investments don't perform well.

Is a defined benefit pension plan good?

Easier to plan for retirement – defined benefit plans provide predictable income, making retirement planning much more straightforward. The predictability of these plans takes the guesswork out of how much income you will have at retirement.

What is a defined benefit pension?

Pensions are defined-benefit plans. In contrast to defined-contribution plans, the employer, not the employee, is responsible for all of the planning and investment risk of a defined-benefit plan. Benefits can be distributed as fixed-monthly payments like an annuity or in one lump-sum payment.

What is the difference between a defined benefit and a defined contribution retirement plan?

The basic difference is what each plan promises its participants. A defined benefit plan (APERS) specifies exactly how much retirement income employees will get once they retire. A defined contribution plan only specifies what each party – the employer and employee – contributes to an employee's retirement account.

What is one disadvantage to having a defined benefit plan?

The main disadvantage of a defined benefit plan is that the employer will often require a minimum amount of service. Although private employer pension plans are backed by the Pension Benefit Guaranty Corp up to a certain amount, government pension plans don't have the same, albeit sometimes shaky guarantees.

What happens to my defined benefit plan if I leave the company?

If the plan you are leaving is a defined benefit plan, you would be notified of the amount that your reduced pension benefit would be.

How does Defined benefits work?

Simply, the longer you work and the higher the rate you contribute, the bigger the number that's multiplied by your final salary. This means your Defined Benefit isn't impacted by market movements – so if the market crashes you still get the same 'defined' amount.

What is the difference between a 401k and a defined benefit plan?

A 401(k) and a pension are both employer-sponsored retirement plans. The most significant difference between the two is that a 401(k) is a defined-contribution plan, and a pension is a defined-benefit plan.

What are examples of defined benefit plans?

Examples of defined contribution plans include 401(k) plans, 403(b) plans, employee stock ownership plans, and profit-sharing plans.

Why is defined benefit plan better?

Defined Benefit Plan Advantages Employer tax benefits: Employers generally get a tax deduction for contributions to defined benefit plans. Improved retention: Defined benefit plans can keep employees with a company for a long period of time as they wait to vest and earn the most retirement benefits.

Is a defined benefit plan a 401k?

Yes, a 401(k) is usually a qualified retirement account. Defined-benefit and defined-contribution plans are two of the most popular categories of qualified plans.

What are the advantages of defined benefit plan?

A defined benefit plan delivers retirement income with no effort on your part, other than showing up for work. And that payment lasts throughout retirement, which makes budgeting for retirement a whole lot easier.

Defined Benefit Plans: A Definition

In a defined benefit plan, a company takes charge of its workers’ retirement income. Using a formula based on each worker’s salary, age and time wi...

Defined Benefit Plan vs. Defined Contribution Plan

Defined benefit plans used to be common, particularly in heavily unionized industries, like the auto industry. Today, though, they have largely bee...

Frozen Defined Benefit Plans

Many of the remaining defined benefit plans have been “frozen.” This means the company wants to phase out its retirement plan, but will wait to do...

The Solo Defined Benefit Plan

There is a way certain savers can start a DIY defined benefit plan. It’s built off of contributions you make yourself, without any help from your e...

What is defined benefit retirement plan?

A defined benefit retirement plan provides a benefit based on a fixed formula.

When can defined benefit plans not make in-service distributions?

Generally, a defined benefit plan may not make in-service distributions to a participant before age 59 1/2.

Can you deduct more than you contribute to a defined benefit plan?

On the employer side, businesses can generally contribute (and therefore deduct) more each year than in defined contribution plans. However, defined benefit plans are often more complex and, thus, more costly to establish and maintain than other types of plans. If you establish a defined benefit plan, you: Can have other retirement plans.

What is defined benefit plan?

A defined benefit plan is a retirementplan in which employers provide guaranteed retirement benefits to employees based on a set formula. These plans, often referred to as pension plans, have become less and less common over the last few decades. This decline is especially pronounced in the private sector, where more and more employers have shifted ...

What is the difference between defined benefit and defined contribution?

Some companies offer both defined benefit and defined contribution plans. The key difference between each of these employer-sponsored retirement plans is in their names. With a defined contribution plan, it’s only the employee’s contributions (and the employer’s matching contributions) that’s defined. The benefits they receive in retirement depend ...

Why do you have to keep funding a defined benefit plan?

Because the benefits of a defined benefit plan are very specific, you have to keep funding the plan to make sure it will pay those benefits in your retirement. Plus, you’ll need to have an actuary perform an actuarial analysis each year.

Why are defined benefit plans not flexible?

Because defined benefit plans are meant to keep employees at a job for years, they can lack flexibility . Although there are ways to transfer your funds from one job to another, your projected benefits will likely suffer.

How to maximize retirement savings?

To maximize your retirement savings, consider working with a financial advisor. Finding the right financial advisor doesn’t have to be hard. SmartAsset’s free toolmatches you with up to three financial advisors in your area in five minutes. Get started now.

Why do companies have pensions?

In turn, a pension that increased in value the longer you stay with the company helped to keep employees on.

When did 401(k) plans become possible?

401(k) plansonly became possible in 1978, and they didn’t catch on until several years after that. Between their defined benefit plans and Social Security benefits, workers could expect to sail into a dignified retirement.

What is defined benefit plan?

Key Takeaways. A defined-benefit plan is an employer-based program that pays benefits based on factors such as length of employment and salary history. Pensions are defined-benefit plans. In contrast to defined-contribution plans, the employer, not the employee, is responsible for all of the planning and investment risk of a defined-benefit plan.

Why is defined benefit pension called defined benefit?

Also known as pension plans or qualified-benefit plans, this type of plan is called "defined benefit" because employees and employers know the formula for calculating retirement benefits ahead of time, and they use it to define and set the benefit paid out. This fund is different from other retirement funds, like retirement savings accounts, where the payout amounts depend on investment returns. Poor investment returns or faulty assumptions and calculations can result in a funding shortfall, where employers are legally obligated to make up the difference with a cash contribution. 1

What is a single life annuity?

Payment options commonly include a single- life annuity, which provides a fixed monthly benefit until death; a qualified joint and survivor annuity , which offers a fixed monthly benefit until death and allows the surviving spouse to continue receiving benefits thereafter; 2 or a lump-sum payment, which pays the entire value of the plan in a single payment.

How does an employer fund a fixed benefit plan?

The employer typically funds the plan by contributing a regular amount, usually a percentage of the employee's pay, into a tax-deferred account.

Does working past retirement age increase benefits?

This extra year may also increase the final salary the employer uses to calculate the benefit. In addition, there may be a stipulation that says working past the plan's normal retirement age automatically increases an employee's benefits.

Who is responsible for all of the planning and investment risk of a defined benefit plan?

In contrast to defined-contribution plans, the employer, not the employee, is responsible for all of the planning and investment risk of a defined-benefit plan.

Is employer contribution deferred compensation?

The employer contribution is, in effect, deferred compensation. 1 . Upon retirement, the plan may pay monthly payments throughout the employee’s lifetime or as a lump-sum payment. For example, a plan for a retiree with 30 years of service at retirement may state the benefit as an exact dollar amount, such as $150 per month per year ...

How does a defined benefit pension plan work?

How a Defined-Benefit Pension Plan Works. A defined-benefit pension plan requires an employer to make annual contributions to an employee’s retirement account. Plan administrators hire an actuary to calculate the future benefits that the plan must pay an employee and the amount that the employer must contribute to provide those benefits.

How much does a defined benefit plan pay?

One type of defined-benefit plan might pay a monthly income equal to 25% of the average monthly compensation that an employee earned during their tenure with the company. 3 Under this plan, an employee who made an average of $60,000 annually would receive $15,000 in annual benefits, or $1,250 every month, beginning at the age of retirement (defined by the plan) and ending when that individual died.

How does a straight life annuity work?

In a straight life annuity, for example, an employee receives fixed monthly benefits beginning at retirement and ending when they die. The survivors receive no further payments. In a qualified joint and survivor annuity, an employee receives fixed monthly payments until they die, ...

What is future benefit?

The future benefits generally correspond to how long an employee has worked for the company and the employee’s salary and age. Generally, only the employer contributes to the plan, but some plans may require an employee contribution as well. 1 To receive benefits from the plan, an employee usually must remain with the company for ...

What is the amount of benefits linked to?

The amount of each individual's benefits is usually linked to their salary, age, and length of employment with a company.

When can defined benefit plans make in service distributions?

The IRS also notes that defined-benefit plans generally may not make in-service distributions to participants before age 62, but such plans may loan money to participants. 1 .

Does the federal government insure defined contribution plans?

The federal government does not insure defined-contribution plans, according to the Pension Benefit Guaranty Corporation (PBGC), but it currently does insure a percentage of defined-benefit plans. 5 .

How Does a Defined Benefit Plan Work?

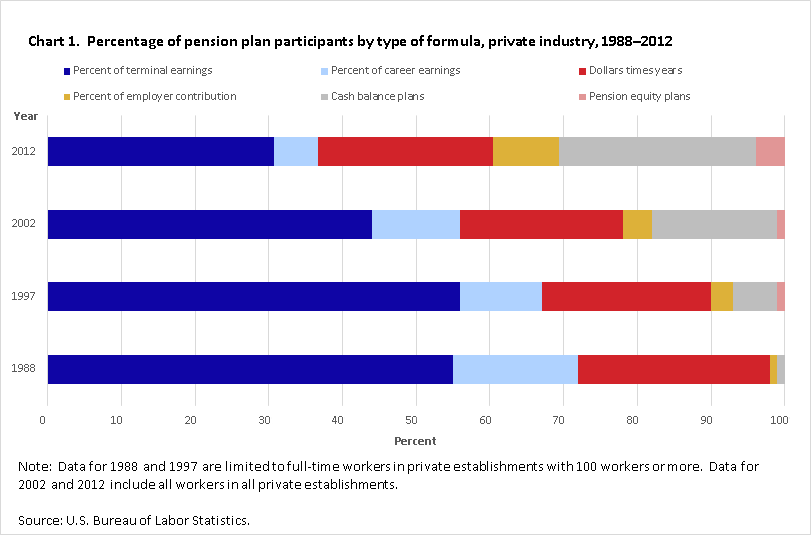

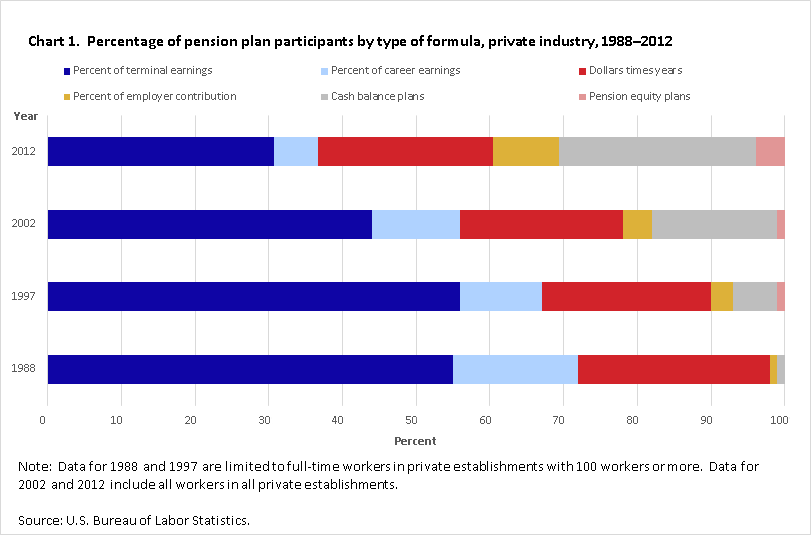

Defined benefit plans offer guaranteed salary-like payments and were historically offered in order to entice workers to stay with one company for years or even decades. Thanks to the rise of lower-cost defined contribution plans, however, defined benefit plans are much less prevalent now. In 1980, 83% of private sector workers had a defined benefit plan as an option. In 2018, only 17% of private sector workers had the option.

What are the two types of defined benefit plans?

There are two main types of defined benefit plans: pensions and cash balance plans.

How long do you have to be with a company to get a pension?

To earn pension benefits, employees usually need to remain with a company for a certain period of time. After racking up the required tenure, an employee is considered “vested.” Pension plans may have different vesting requirements. For instance, after one year with a company, an employee might be 20% vested, granting them retirement payments equal to 20% of a full pension.

What is the form of retirement payment?

When it comes time to collect your retirement, you usually receive payment in the form of a lump sum or an annuity that provides regular payments for the rest of your life. Deciding between the two can be a difficult decision, especially since there are different ways an annuity could be structured:

How much can an employee contribute to a defined benefit plan?

In 2020, the annual benefit for an employee can’t exceed the lesser of 100% of the employee’s average compensation for their highest three consecutive calendar years or $230,000.

What happens to your annuity when you die?

When you die, your surviving spouse will get monthly payments for the rest of their life that are equal to 50% of your original annuity. • 100% joint and survivor. When you die, your surviving spouse will get monthly payments for the rest of their life that are equal to 100% of your original annuity.

How do employers calculate cash balance?

Employers typically calculate the cash balance based on two factors: pay credits and interest credits. Typically, an employee’s account is credited each year with a pay credit (such as 3% of compensation from their employer). They’ll also receive an interest credit for what’s in the account (usually a fixed or variable rate linked to a benchmark such as the 30-year Treasury bond).

What are defined benefit plans?

Defined benefit plans are qualified employer-sponsored retirement plans. Like other qualified plans, they offer tax incentives both to employers and to participating employees. For example, your employer can generally deduct contributions made to the plan. And you generally won't owe tax on those contributions until you begin receiving distributions from the plan (usually during retirement). However, all qualified plans, including defined benefit plans, must comply with a complex set of rules under the Employee Retirement Income Security Act of 1974 (ERISA) and the Internal Revenue Code.

How do defined benefit plans differ from defined contribution plans?

As the name implies , a defined benefit plan focuses on the ultimate benefits paid out. Your employer promises to pay you a certain amount at retirement and is responsible for making sure that there are enough funds in the plan to eventually pay out this amount, even if plan investments don't perform well.

How are retirement benefits calculated?

Many plans calculate an employee's retirement benefit by averaging the employee's earnings during the last few years of employment (or, alternatively, averaging an employee's earnings for his or her entire career), taking a specified percentage of the average, and then multiplying it by the employee's number of years of service.

What are some advantages offered by defined benefit plans?

They're generally designed to replace a certain percentage (e.g., 70 percent) of your preretirement income when combined with Social Security .

What is cash balance plan?

Cash balance plans are defined benefit plans that in many ways resemble defined contribution plans. Like defined benefit plans, they are obligated to pay you a specified amount at retirement, and are insured by the federal government. But they also offer one of the most familiar features of a defined contribution plan: Retirement funds accumulate in an individual account (in this case, a hypothetical account).

What is hybrid retirement plan?

Some employers offer hybrid plans. Hybrid plans include defined benefit plans that have many of the characteristics of defined contribution plans. One of the most popular forms of a hybrid plan is the cash balance plan.

What is a single life annuity?

A single life annuity: You receive a fixed monthly benefit until you die; after you die, no further payments are made to your survivors.

What is the difference between a private pension and a public pension?

As you probably guessed, the main difference between a public pension and a private pension is the employer. Public pensions are available from federal, state and local government bodies. Police officers and firefighters likely have pensions, for instance. So do school teachers.

How much do pensions pay out?

Your pension income is usually paid out as a percentage of your salary during your working years. That percentage depends on the terms set by your employer and your time with the employer. A worker with decades of tenure with a company or government may get 85% of their salary in retirement.

What happens if you leave your employer before your pension benefits vest?

If you leave your employer before your pension benefits vest, you forfeit the money your company put aside for your retirement. Vesting schedules come in two forms: cliff and graded. With cliff vesting, you have no claim to any company contributions until a certain period of time has passed.

What is a WEP for Social Security?

If you worked part of your career in the private sector, but also spent time working a public-sector job with a pension, brace yourself for the Social Security Windfall Elimination Provision (WEP). The WEP limits Social Security retirement benefits for people who also have pension income coming their way. There’s also the Government Pension Offset (GPO), which limits the spousal or survivor benefits available to people who have government pension income.

Why are pensions frozen?

Many, though, have frozen their pensions so that new employees are not eligible to receive them. Compared to public pension funds, private pensions have more legal protections. By law, private companies must make sure their pension funds have adequate funding.

What are the risks of not being in control of a pension?

Another risk of not being in control is that your company could change the terms of your pension plan. In particular, it could decrease the percentage of salary for each recipient, which will result in a lowered benefit amount. Seeing as pensions are much more expensive for employers than most alternatives, it’s in your employer’s interest to minimize costs. In the case of public pensions, there’s also the risk that the state or municipality will encounter economic issues and declare bankruptcy, which could result in a reduction of benefits for pension-plan participants.

What does lack of control mean for pensions?

But on the flip side, the lack of control means employees are powerless to ensure that their pension funds have adequate financing. They also must trust their company to continue being a going concern for their lifetime.

What is a Defined Benefit Pension Plan?

Defined benefit plans are designed to help members access income after retirement and they do so by providing a defined pension income at the end of their employment. Employers work with a group benefits provider to offer this benefit to long-term employees as part of a comprehensive compensation package.

Who is Eligible for a Defined Benefit Plan?

Most often, plan providers and employers require employees to work for the company for a minimum number of years before they are eligible for defined benefit plans. This length of time can vary depending on the employer and the plan provider.

Pros and Cons of Defined Benefit Pension Plans

There are several things about defined pension plans that make them a great addition to employee compensation packages. Here are some pros of defined benefit pension plans:

The Bottom Line

While defined benefit pension plans can provide you with a secure income after retirement, they don’t generally come with the same flexibility that RRSPs, TFSAs and other personal investments provide.For more information about group benefits, including defined benefit pension plans, contact DBA to schedule a meeting with one of our experienced experts..

What Is A Defined-Benefit Plan?

Understanding Defined-Benefit Plan

- Also known as pension plansor qualified-benefit plans, this type of plan is called "defined benefit" because employees and employers know the formula for calculating retirement benefits ahead of time, and they use it to define and set the benefit paid out. This fund is different from other retirement funds, like retirement savings accounts, where the payout amounts depend on invest…

Examples of Defined-Benefit Plan Payouts

- A defined-benefit plan guarantees a specific benefit or payout upon retirement. The employer may opt for a fixed benefit or one calculated according to a formula that factors in years of service, age, and average salary. The employer typically funds the plan by contributing a regular amount, usually a percentage of the employee's pay, into a tax-deferredaccount. However, depen…

Annuity vs. Lump-Sum Payments

- Payment options commonly include a single-life annuity, which provides a fixed monthly benefit until death; a qualified joint and survivor annuity, which offers a fixed monthly benefit until death and allows the surviving spouse to continue receiving benefits thereafter; or a lump-sum payment, which pays the entire value of the plan in a single payment.4 Working an additional year increas…