What is full retirement age and why does it matter?

Your full retirement age, is the age at which the social security administration will pay you 100% of your calculated benefit. If you take your benefits earlier than your full retirement age, your benefit will be reduced by 25%. The percentage will gradually reduce every year you wait until your full retirement age.

When will I reach full retirement age?

The current full retirement age is 67 years old for people attaining age 62 in 2022. (The age for Medicare eligibility remains at 65.) See Benefits By Year Of Birth for more information. When you’re ready to apply for retirement benefits, use our online retirement application, the quickest, easiest, and most convenient way to apply.

How do you calculate age of retirement?

- Increase the annual contribution

- Achieve a higher rate of return on your retirement savings

- Achieve a higher rate of return during retirement

- Reduce your desired retirement income

What are the benefits of retiring at 62?

- You have more time on your hands, which means there are more activities that you will want to do each day.

- Older individuals tend to outsource more of their needs than younger people, which creates an additional cost to consider.

- Your healthcare expenses will continue to increase as you age.

Is it better to take Social Security at 62 or 67?

There is no definitive answer to when you should collect Social Security benefits, and taking them as soon as you hit the early retirement age of 62 might be the best financial move.

What is full benefit retirement?

For someone at full retirement age (FRA), the maximum benefit is $3,240. The absolute maximum benefit that an individual can receive per month in 2022 is $4,194, and to get it, you must wait until age 70 to claim benefits and have been a high earner for 35 years.

What is full retirement age for a 60 year old?

67The full retirement age for those who turn age 62 in 2022, born in 1960, is 67. The full retirement age will remain age 67 for everyone born in 1960 or later.

Can I retire at 55 and collect Social Security?

Can you retire at 55 to receive Social Security? Unfortunately, the answer is no. The earliest age you can begin receiving Social Security retirement benefits is 62.

At what age do you get 100 of your Social Security benefits?

age 66If you start receiving benefits at age 66 you get 100 percent of your monthly benefit. If you delay receiving retirement benefits until after your full retirement age, your monthly benefit continues to increase. The chart below explains how delayed retirement affects your benefit.

Is it better to retire at 62 or 65?

The short answer is yes. Retirees who begin collecting Social Security at 62 instead of at the full retirement age (67 for those born in 1960 or later) can expect their monthly benefits to be 30% lower. So, delaying claiming until 67 will result in a larger monthly check.

Can you retire at 65 with full benefits?

You can start receiving your Social Security retirement benefits as early as age 62. However, you are entitled to full benefits when you reach your full retirement age. If you delay taking your benefits from your full retirement age up to age 70, your benefit amount will increase.

Can I retire at 62 and still work?

Can You Collect Social Security at 62 and Still Work? You can collect Social Security retirement benefits at age 62 and still work. If you earn over a certain amount, however, your benefits will be temporarily reduced until you reach full retirement age.

When did the full retirement age change?

Although full retirement age once was 65 for everyone, Congress passed a law in 1983 that gradually increased it to age 67, because people were living longer. 3 . Year you were born. Full retirement age. 1937 or earlier. 65.

What is the retirement age for 1955?

According to the Social Security Administration, full retirement age for 1955 as a birth year would be 66 and 2 months, therefore that is their retirement age, even though they were actually born in 1956.

What is the FRA age?

Full retirement age (FRA) is the age at which you are eligible to receive full, unreduced Social Security benefits. Figuring your full retirement age will depend on the day and a year of your birth. Therefore, people born on January 1 should use the prior year to calculate their FRA.

What age do you use FRA?

66 and 10 months. 1960 or later. 67. Not only does FRA depend on the year you were born, but it also depends on the day, because Social Security considers you to have attained an age the day before your birthday. 4 Therefore, if you were born on January 1, you would use the FRA for the year before your year of birth.

Can you get Social Security at 65?

Once you reach FRA, you can earn as much as you like and your Social Security benefit will not be reduced. Social Security is separate from Medicare. Although age 65 is frequently referenced when referring to Medicare, your full retirement age may be something different.

Can you get survivor benefits if you are married?

8 If you're married, be sure to coordinate your claiming decision to put the two of you in the most secure position.

What is the full retirement age?

Full retirement age, or FRA, is the age when you are entitled to 100 percent of your Social Security benefits, which are determined by your lifetime earnings. If you were born between 1943 and 1954, your full retirement age was 66. If you were born in 1955, it is 66 and 2 months.

What is the retirement age for a survivor?

Full retirement age for survivors is 66 for people born between 1945 and 1956 and gradually increases to age 67 for people born in 1962 or later.

How long is a person born in 1955?

If you were born in 1955, it is 66 and 2 months. For those born between 1956 and 1959, it gradually increases, and for those born in 1960 or later, it is 67. Those dates apply to the retirement benefits you earned from working and to spousal benefits, which your husband or wife can collect on your work record.

What is the full retirement age?

In the United States, the term "full retirement age"—also known as " normal retirement age "—generally refers to the age you must reach to be eligible to receive full benefits from Social Security. This age can vary depending on when you were born. The Social Security Administration (SSA) has been slowly increasing the full retirement age as life expectancy increases. Any age at which you start collecting before your "full retirement age" is considered "early retirement." The youngest age an individual can begin collecting Social Security retirement benefits is 62. As of 2020, the full retirement age was 67. 1

What does it mean to retire at full retirement age?

Full retirement age generally means the age at which you become eligible to receive full benefits from Social Security. 1. Choosing to receive benefits before you reach full retirement age means you will receive a reduced monthly benefit. 1.

What is the difference between SSA and SSA?

That means, if you decide to retire early by SSA standards, the monthly payouts you receive will be lower than those of older, full-age retirees—to compensate for the fact that you're getting them sooner and will presumably be getting them for a longer period of time. 1

What is a PIA for Social Security?

2. The PIA is the amount you would receive at your full retirement age. If you are eligible for Social Security, you receive benefits based on your average annual earnings during the 35 years when you made the most money.

How many credits can you get per year?

You can obtain four credits per year, meaning you must work at least a total of 10 years to become eligible for any benefits. 4. If you have not worked enough to qualify for benefits but are married to someone who did, you may be eligible to receive a spousal benefit based on your working spouse's benefit.

What is the age limit for reduced benefits?

There are several factors that determine the size of your reduced benefits, based on a formula used by the SSA. Individuals born prior to 1938 reached full retirement age at 65. 3 Those born between 1938 and 1960 are on a graduated scale, up to age 67. 1. Year of Birth.

How many credits do you need to get Social Security?

Accumulating Work Credits. You must also have accrued at least 40 credits to receive Social Security benefits if you were born in 1928 or later. You accumulate credits when you work and pay Social Security taxes.

Why is the full retirement age set at 65?

The Social Security Administration sets a full retirement age to standardize benefit calculations and ensure fairness. Originally, Social Security’s full retirement age was set at 65 for all beneficiaries, but the Social Security Amendment of 1983 gradually raised the full retirement age to 67. “Increasing the full retirement age preserved revenue ...

What age can you collect Social Security?

Social Security survivor benefits, which provide a monthly payment to the surviving spouse based on their deceased partner’s work history, can start at 60, or 50 if the survivor themselves is disabled. Social Security’s full retirement age also matters in these cases, because if you live to claim Social Security, ...

How much is Social Security reduced?

Your Social Security benefit is reduced by around half a percent for each month between the date when you claim benefits early and your full retirement age. At the very most, you could see a reduction of up to 30% of your PIA by claiming benefits before reaching full retirement age.

What age do you start receiving Social Security?

That’s your early retirement age, which is 62 regardless of what year you were born. And while all Americans may start receiving benefits when they turn 62, doing so will decrease the amount of each monthly payment. Here’s a bit of the Social Security Administration’s official jargon, which is essential for getting a complete picture ...

When was the last time Social Security was changed to full retirement?

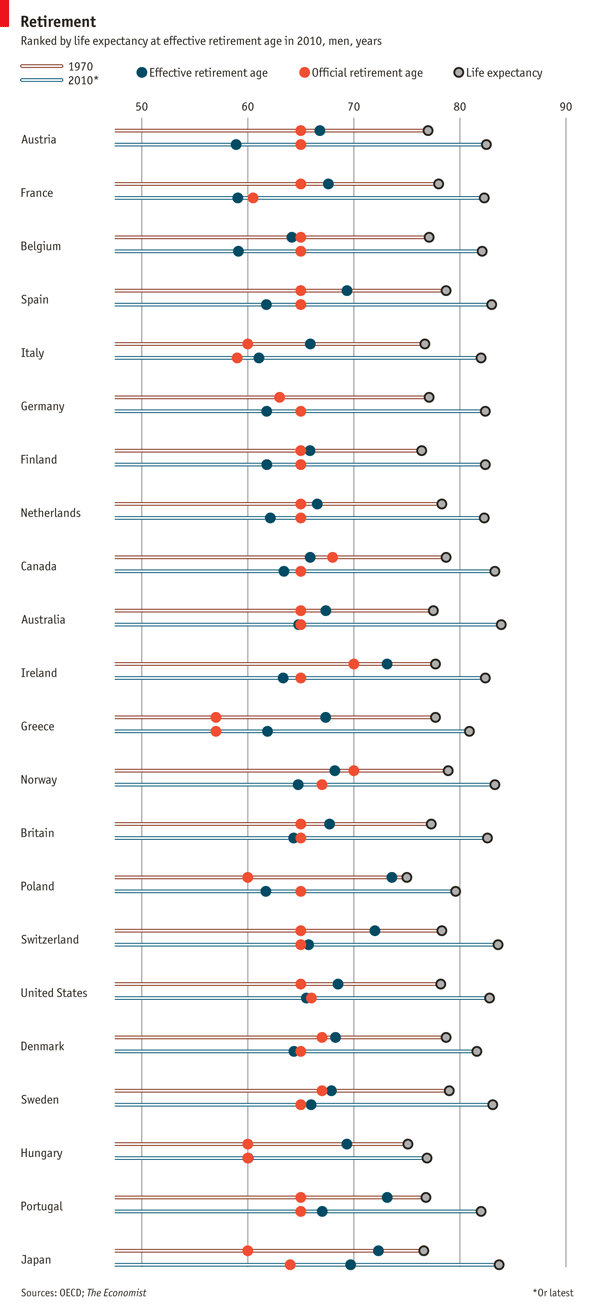

Though the last legislative change to full retirement age was in 1983, Carroll warns that a future increase in full retirement age is a likely component of a comprehensive Social Security reform package. The culprit for this likely change is our increasing longevity.

Does working longer affect PIA?

Working longer replaces each of those zeroes , or even lower earning years if you have no zeros, which boosts your PIA. It’s also important to note that lower-earning years after retirement will not affect your benefits since Social Security uses whichever 35 years are your highest earning.

Does Social Security disability affect your retirement?

Social Security disability benefits do not have any specific retirement age, since disability can strike at any age.

What is the full retirement age?

Your FRA varies, depending on when you were born. According to the Social Security Administration, if you were born in 1937 or earlier, your FRA is 65. If you were born in 1960 or later, it’s 67. If you were born between those two years, it’s between 65 and 67. Below is the Social Security retirement age chart:

How are Social Security benefits determined?

The first number you need to know about is your average indexed monthly earnings, or AIME, which is your average monthly wages, adjusted for inflation, over the 35 years in which you had the highest earnings. 4

How your FRA affects the amount of your Social Security benefit payments

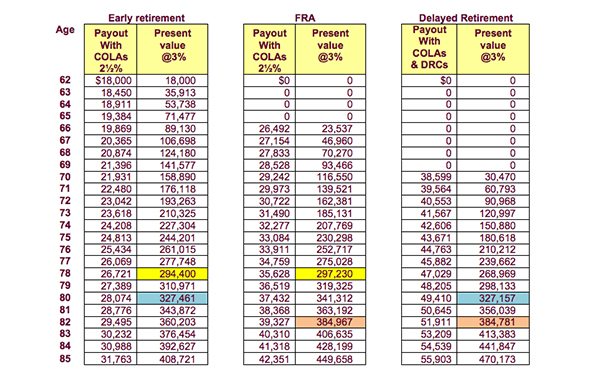

This part is pretty simple: Retiring before your FRA results in a reduction of Social Security benefits, 8 while retiring after your FRA increases your monthly benefits. The earliest you can claim Social Security retirement benefits, in most cases, is age 62, and the latest year in which you can receive an increase in benefits is age 70. 9

Deciding when to retire and begin claiming Social Security benefits

Some people choose or need to retire before FRA because of health issues, lack of job opportunities, or family obligations. Others prefer to retire early so their retirement period can last as long as possible. Keep in mind, there’s an opportunity cost associated with taking payments later and missing out on years of Social Security income.