Benefits of Group Life Insurance

- Convenience As mentioned earlier, getting group life insurance is often as easy as filling out a few forms as a part...

- Affordability The basic coverage is often free for an employee in an employer-sponsored plan. This employee benefit...

- Automatic Acceptance

What are the disadvantages of group life insurance?

Disadvantages of Group Term Life Insurance. Since the company owns the policy, they could drop it due to budget cuts. Coverage amounts tend to be very small (about one or two times your salary) Coverage ends when you leave the company. If you’re young and healthy, you might be overpaying.

How much does group life insurance cost?

“Group Life Insurance can cost as little as 1% of your company’s salary costs. It’s an affordable employee benefit and is deductible as a business expense.” Any organisation/employee can be insured if legally with a discretionary trust – registered in the UK, Channel Islands or Isle of Man

Is group life insurance a good deal?

Group life insurance might not be enough to protect your family. Group life insurance from work is usually a good deal, but it may not be enough coverage for your needs. Also, if you leave your job, group life insurance usually doesn't go with you.

How can group universal life insurance benefit you?

- This policy is permanent, portable, and owned by you, regardless of where you work. 1

- The coverage is flexible to fit your needs over time.

- Helps secure your financial future by supplementing retirement income.

- Can include a tax-deferred savings feature for added flexibility so you can use your money when and how you see fit. 2

What is the difference between life insurance and group life insurance?

A group insurance policy provides insurance to all the employees in the company under a single plan. All the formalities during the purchase of life insurance are completed by the employer. While individual life insurance, as the name suggests, covers only you (and in some cases, your spouse).

What type of benefit is group term life insurance?

Group term life insurance is a type of term insurance in which one contract is issued to cover multiple people. The most common group is a company, where the contract is issued to the employer who then offers coverage as a benefit to employees.

Can you cash out group life insurance?

Group Term Life Insurance You cannot cash out on a policy that carries no accrued savings, whether it is a group policy or an individual one.

How is group life insurance paid out?

When you sign onto a group life insurance policy with an employer, you will be given a copy of your coverage details and, in most cases, will make a monthly premium payment. These premiums will usually be lower than what you would pay if purchasing an equivalent policy from the insurance company on your own.

How does a group life policy work?

Compared to traditional life insurance where the individual signs up as the owner of the policy, group insurance goes under the company's name. This means that you as the employer are the one responsible for physically paying the premiums each month, rather than the individual that's being insured.

What happens to my group life insurance when I retire?

If you are on a group life insurance plan with your employer, you will not continue to receive benefits once you retire. Essentially, life insurance plans through your employer are left behind if they are not needed. You may have the option to continue your coverage through an individual plan.

Does Group Life Insurance have surrender value?

Does Group Term Life Insurance have a cash value? No. Group Term Life Insurance does not have a cash value; however, the annual premiums are usually lower than those types of insurance with cash values.

What happens to your life insurance when you leave a company?

Generally, if you have no other options, your life insurance coverage will end when you leave your job. That means you'll need to apply for new coverage (either at your new job or independently from a life company or broker) based on your current age and health status.

Does life insurance pay while alive?

Life insurance allows you, the policy owner, to build cash value through your life insurance policy that accumulates over your lifetime. This is considered a living benefit of life insurance because, in contrast to a death benefit that pays out when you pass away, you can use the money while you're still alive.

How often does group life insurance payout?

Group term life is typically provided in the form of yearly renewable term insurance. When group term insurance is provided through your employer, the employer usually pays for most (and in some cases all) of the premiums. The amount of your coverage is typically equal to one or two times your annual salary.

How long do you have to pay life insurance before it pays out?

A waiting period of two years is common, but it can be up to four. If you were to die during the waiting period, your beneficiaries can claim the premiums paid to date, or a small portion of the death benefit.

Who gets life insurance payout?

beneficiariesLife insurance payouts are sent to the beneficiaries listed on your policy when you pass away. But your loved ones don't have to receive the money all at once. They can choose to get the proceeds through a series of payments or put the funds in an interest-earning account.

How much is group life insurance?

Employers can provide employees with up to $50,000 of tax-free group term life insurance coverage. According to Internal Revenue Service (IRS) Code Section 79, the cost of any coverage over $50,000 that is paid for by an employer must be recognized as a taxable benefit and reported on the employee’s W-2 form as income. The taxable amount is calculated using an IRS premium table, based on the employee’s age, and is subject to Social Security and Medicare taxes. 1

What is group term life insurance?

Group term life insurance is a common part of employee benefit packages. Many employers provide, at no cost, a base amount of coverage as well as an opportunity for the employee to purchase additional coverage through payroll deductions. The insurance plan also may offer employees the option to buy coverage for their spouses and children.

What happens to group insurance when you retire?

As mentioned above, because group coverage is linked to employment, if you change jobs, stop working for a period of time, leave to open a business, or retire, then the coverage will stop. This puts you at risk of being uninsured or, if you have health issues, having difficulty with finding new coverage.

Is term life insurance tax free?

Group term life insurance is an employee benefit that’s often provided for free by employers. Employees may also have the option to buy additional coverage through payroll deductions. The first $50,000 of group term life insurance coverage is tax-free to the employee.

Does supplemental insurance require underwriting?

Unlike basic coverage, supplemental coverage may require underwriting. Usually, it is a simplified underwriting process in which the employee answers some questions to determine eligibility rather than going through a physical exam.

Is group term insurance cheap?

Group term coverage is generally inexpensive, especially for younger workers. However, the rates go up as individuals age. Most plans also have rate bands in which the cost of insurance automatically goes up in increments—for example, at ages 30, 35, 40, etc.

Does group life insurance cover spouses?

The insurance plan also may offer employees the option to buy coverage for their spouses and children. Like other types of life insurance, group term life insurance pays out a death benefit to your designated beneficiary if you pass away while the policy is in effect.

What is group life insurance?

Group life insurance is a type of life insurance offered by employers, usually through large insurance companies like MetLife, Principal, or Liberty Mutual . As the name suggests, it’s offered to a large group (in this case, employees of the same company), rather than an individual. Much like health insurance, employer-provided group life insurance ...

How long do you have to be in a company to get group life insurance?

Some organizations may require a minimum tenure to qualify and will only allow employees to opt-in after their first 90 days. Unlike most private life insurance policies, your health and age rarely determine whether you qualify for group life insurance.

What is supplemental life insurance?

Supplemental group life insurance. Your company may offer you the opportunity to buy life insurance coverage on top of your employer-sponsored plan. This is called supplemental life insurance, optional life insurance, or voluntary life insurance. The type of coverage and specifics around premiums vary by employer.

How long does life insurance last?

The coverage expires after a certain number of years. Your employer pays some or all of the premiums, either monthly or annually, to keep the policy active. Upon your death, a death benefit is paid out to a designated group or person known as the beneficiary . Most employers don’t let you keep your group life insurance if you leave the company.

What is life insurance portability?

Life insurance portability: Porting your life insurance allows you to stay on your employer’s group life insurance plan even after you leave your job. The benefit is still managed by your employer, but you’re solely responsible for paying your premiums. Life insurance conversion: Converting your group life insurance policy turns it ...

How many people will have life insurance in 2020?

According to the Bureau of Labor Statistics (BLS), in 2020, 60% of non-government workers had access to employer-provided life insurance and 98% of those workers participated in their company plan. It’s easier to qualify for group life insurance than an individual life insurance policy, but group policies rarely provide the level ...

How much is group term life taxable?

The taxable amount varies on an individual basis, but you should be able to find it on your paycheck: Group life as imputed income: Group term life coverage above $50,000 is considered imputed income by the IRS.

What are the advantages of group life insurance?

The advantages of group life insurance. Group life has two things going for it: It's easy to qualify for coverage. Unlike an individual life insurance policy, where you might be rejected, group life coverage is guaranteed and there are no medical questions. The insurer bases the premium on the risk of the group as a whole ...

Why does group life insurance end?

Your group life insurance benefits can also end if the employer decides to terminate the policy to cut costs. Another reason not to rely solely on employer-sponsored group life is the small coverage amount. Typically the death benefit is one or two times your annual salary -- not enough to cover a family's long-term financial needs.

How much is a 30-year-old's life insurance?

How low are the best rates? A healthy 30-year-old man can buy a $500,000 term life for 20 years for about $400 annually on average. That same policy for a 30-year-old woman averages about $350. Another advantage of individual term life insurance is you can lock in the rate for 15, 20 or even 30 years.

Does group life insurance increase as you age?

With a group life policy, your premium may increase as you age. Before you opt for additional group coverage, get quotes for a comparable individual life insurance policy to compare rates. If you do buy life insurance through the group, make sure it's enough to cover your family's needs.

Is free life insurance a supplement?

When offered as part of a basic benefits package, the coverage is often free to the employee, with higher levels of coverage available at group rates. Free life insurance is a great deal, but think of group life as a supplement, versus a replacement, for an individual life insurance policy. Experts generally advise against relying solely on ...

Do you need group or individual life insurance?

Group life insurance is a great deal, but given its limited coverage, typically you will also need an individual policy to be sure your loved ones are fully protected should the unthinkable happen.

Do you have to supply health information for group insurance?

But generally you won't have to supply as much health information for the group coverage as you would when buying an individual policy. That could be an important advantage if you have a health condition that makes qualifying for an individual life policy challenging.

What is group life insurance?

The Group life insurance policy is an insurance cover that is offered to the employees by default, whether you have an insurance cover or not. It is a master contract where an organisation purchases a master policy where the premium depends on the number of members and the sum assured amount chosen by the company.

Why is group life insurance less expensive?

This is because the insurance company can club various expenses such as administration, operation, and renewal under one master policy.

What happens if an insured person dies with an incomplete loan?

Banks and lending agencies often have to suffer a huge loss if an insured person dies with an incomplete loan liability. In such a situation, the banks can opt for a Group Credit Protection Plan to protect themselves from the loss.

What does a fund manager do for a group life insurance policy?

If there are any emergencies, the employer is provided with adequate funds. Fund managers help the employer to manage superannuation, gratuity, and other payouts.

What is insurance cover?

The insurance cover is an added advantage, which is part of the employee benefits package. Once you are selected to be part of a company, you're by default enrolled in the plan. Some companies allow you to buy an additional individual plan and the group policy so that whenever you decide to leave the organisation, the individual policy will continue operating.

Does group life insurance give you gratuity?

Under this, you, as an employee, receive gratuity benefits for completing a certain number of years with an organisation. Group life insurance helps an employer to accumulate funds so that employees can derive gratuity benefits.

How much is Supplemental Life Insurance?

The amount of coverage available varies among companies, but can reach $500,000 or five times your annual salary.

How much is LIMRA coverage?

Coverage amounts are typically low, often ranging from $25,000 to a multiple of your annual salary.

Does life insurance increase as you age?

However, the cost of life insurance typically increases as you age, and you never know if you might develop a medical condition that could seriously raise your rates. Limited choice. Coverage through work tends to be a type of term life insurance, and employers typically only work with one carrier.

Is basic coverage free for employees?

Price. Basic coverage through work is usually free for the employee, making it an easy way to get a small amount of coverage at no cost to you. Acceptance.

Can you take life insurance with you if you leave your job?

If you leave your job, you may not be able to take the policy with you. This is often referred to as the policy’s portability. You might be able to convert your group policy to individual life insurance if you leave, but the cost could go up significantly.

Is it better to get life insurance through work or home?

Pros and cons of buying life insurance through work. Here are three main advantages of getting group life insurance through your employer: Convenience. Getting coverage through work can be relatively easy.

What is group life insurance?

Group life insurance is a benefit offered by some companies to help employees get free life insurance coverage. The policy is paid for by the company. A medical exam isn’t usually required, so it’s a nice addition to your broader financial plan.

How group life insurance works

You may be automatically enrolled in your company’s group life insurance plan when you’re hired. Alternatively, you may need to manually opt in. Either way, pay attention to the details of your policy. You’ll need to name a beneficiary so that if you do pass away, the policy funds may be disbursed according to your wishes.

Advantages

Getting life insurance through your job is a free benefit, so there’s no sense in not accepting it. That being said, group term life is usually very limiting. Unless you’re an executive receiving a large multiple of your salary, your basic life insurance through an employer is probably not enough.

Disadvantages

One major issue with employer paid life insurance is that you lose the coverage when you leave the company. There is a chance you can purchase the policy and bring it with you, but it can be a costly move.

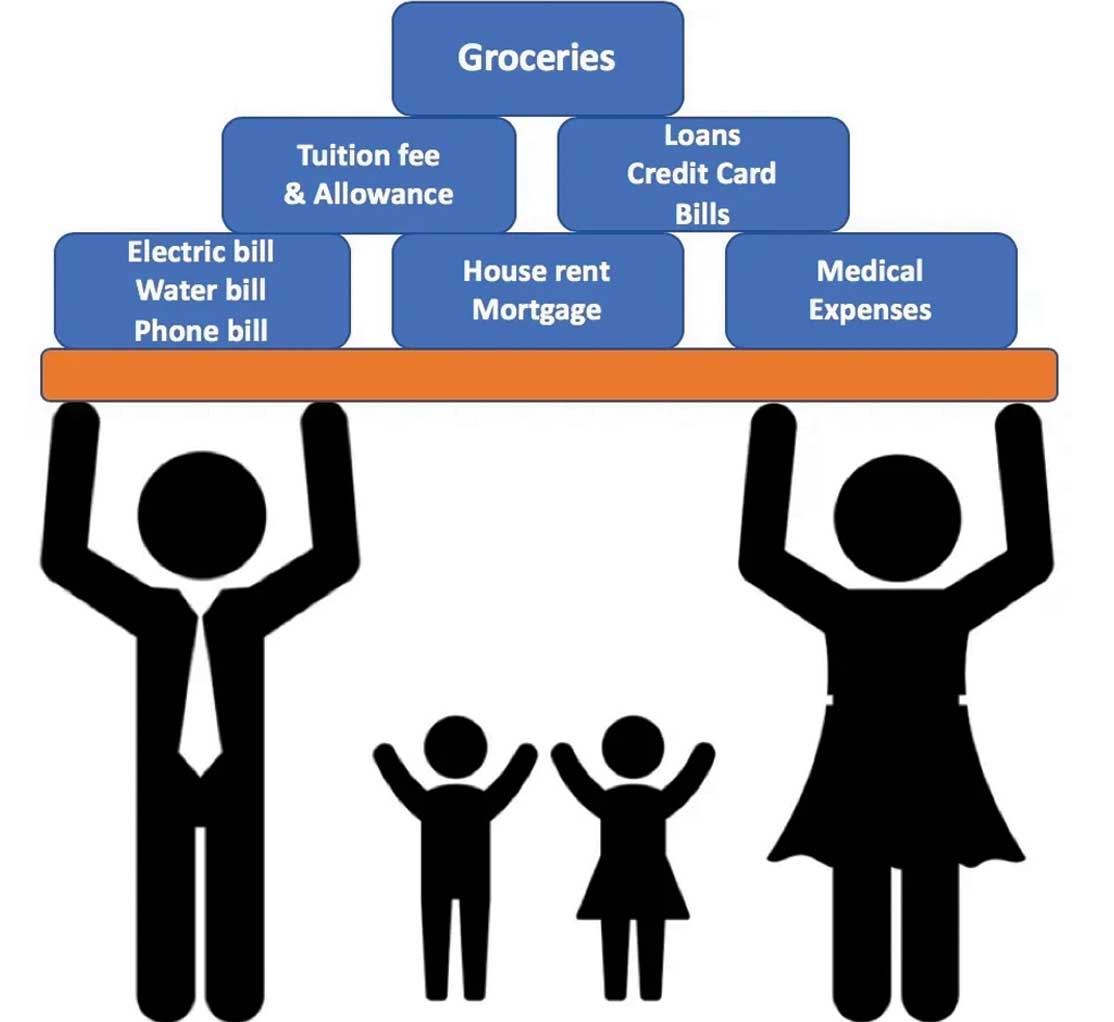

How to calculate your life insurance needs

So how much life insurance do you actually need? You need to consider a variety of factors, including who depends on you financially and what you want them to be able to do in case you pass away suddenly. At the very least, your life insurance should be enough to cover burial costs.

Bottom line

Group life insurance is a fantastic benefit to take advantage of from your employer. But for most people, it’s not enough coverage to truly help their families if they pass away. Plus, you can’t feel entirely secure if your policy is only active while you work at your current job.