Quality of life

Quality of life (QOL) is the general well-being of individuals and societies. QOL has a wide range of contexts, including the fields of international development, healthcare, politics and employment. It is important not to mix up the concept of QOL with a more recent growing area of health relate…

Is health and welfare taxable?

Second, if the H&W is taken in cash, it constitutes a taxable wage and actually increases the employer’s costs. At a minimum the employer experiences the 7.65% FICA tax on H&W dollars paid in cash. But it also likely incurs additional costs in the form of premiums that are cash wage driven, such as workers’ comp and general liability premiums.

What is the difference between welfare and health?

is that health is the state of being free from physical or psychological disease, illness, or malfunction; wellness while welfare is (uncountable) health, safety, happiness and prosperity; well-being in any respect. The state of being free from physical or psychological disease, illness, or malfunction; wellness.

What is h and W pay?

W H Smith faces a revolt among its investors over plans to pay chief executive Carl Cowling a £550,000 bonus when it has not repaid money from the furlough scheme. Sky News reported that three of the main proxy advisers, which issue guidance to City ...

What are the benefits of welfare?

Taxpayers typically fund welfare programs, so those suffering financial stress in tough times have access to services. Most welfare recipients will receive payments biweekly or monthly in proportion to their need. How Much Do Benefits Cost The Uk Per Year?

What is Health and Welfare on a paystub?

“HEALTH & WELFARE: Life, accident, and health insurance plans, sick leave, pension plans, civic and personal leave, severance pay, and savings and thrift plans. Minimum employer contributions must cost an average of $4.41 per hour computed on the basis of all hours worked by service employees employed on the contract.”

How do you calculate H&W?

Average cost H&W is calculated by taking the total fringe benefit contributions for all service employees on the contract divided by all hours worked for all service employees that were employed on the contract during the period of performance.

What does H&W mean?

Health and WelfareHealth and Welfare (H&W)

What does SCA stand for in payroll?

Service Contract ActService Contract Act (SCA) wage determinations set forth the prevailing wages and benefits that are to be paid to service employees working on covered contracts exceeding $2,500.

What is SCA compliance?

Strong Customer Authentication (SCA), a rule in effect as of September 14, 2019, as part of PSD2 regulation in Europe, requires changes to how your European customers authenticate online payments. Card payments require a different user experience, namely 3D Secure, in order to meet SCA requirements.

What does H W mean in real estate?

The words after the names could be "husband and wife" (also abbreviated as H/W), or "joint tenant with right of survivorship" (abbreviated as JTWROS), or "tenants in common." Each of those phrases means something in law that could affect your rights as an owner.

What does HW mean on Snapchat?

"Homework" is the most common definition for HW on Snapchat, WhatsApp, Facebook, Twitter, Instagram, and TikTok. HW. Definition: Homework.

What is SCA in business?

Thus in business, a sustainable competitive advantage is an element of business or marketing strategy that provides a meaningful advantage over both existing and future competitors.

What are service employees?

A person engaged in performing a service contract other than any person employed in a bona fide executive, administrative or professional capacity.

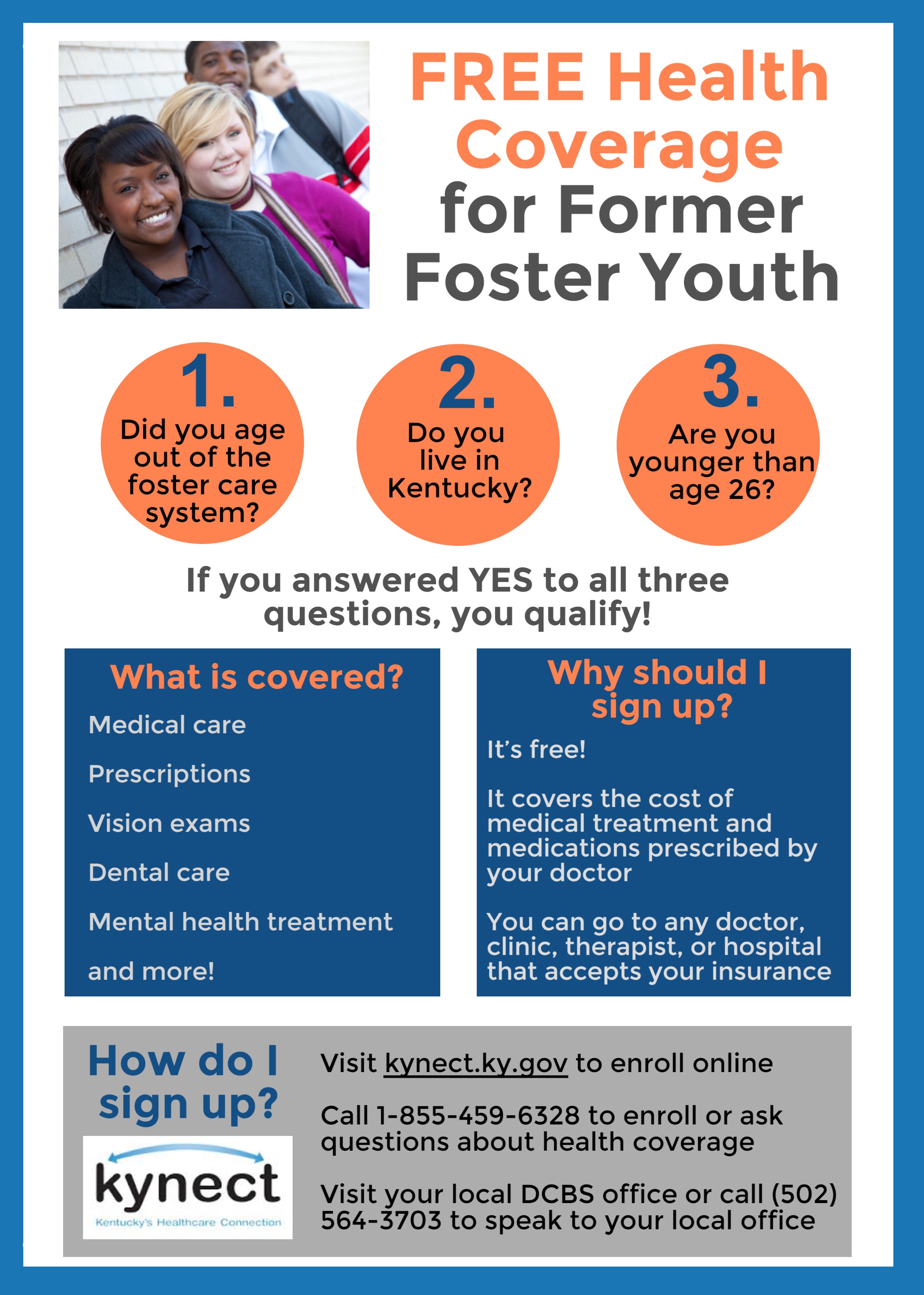

What is health and welfare benefits?

Health and Welfare Benefits means all Company medical, dental, vision, life and disability plans in which Employeeparticipates. Health and Welfare Benefits means employee health and welfare benefits (excluding pension benefits) as determined from time to time by the Trustees.

What is health and welfare?

Health and Welfare Benefits means any form of insurance or similar benefit programs, including, but not limited to, medical, hospitalization, surgical, prescription drug, dental, optical, psychiatric, life, disability, prepaid legal, or income protection insurance, or annuity programs.

How long is a sentence for health and welfare?

Successful applicants who fill a temporary vacancy may apply for Article 27 ( Health and Welfare Benefits) for which they are eligible, after three months in the temporary vacancy .

What is a Wage Determination?

Wage determinations are issued by the DOL (published online here) and list the required minimum hourly wage rate for covered employees , and also lists the required vacation entitlement and the hourly Health & Welfare (H&W) contribution to which each employee is entitled . Wage determinations are issued for each job classification and the wage and benefit levels are based on the job being performed as well as the geographic location where the employees perform the work. Thus, federal contractors need to be mindful at the outset that they correctly identify the wage determination that covers the correct job, as well as the correct geographic location.

What is a fixed cost H&W?

“Fixed Cost” H&W is required to be paid on a “per employee” basis, for all hours paid for up to 40 hours in a work week (2,080 hours per year). This excludes overtime hours, but includes paid leave and holidays.

What is H&W in SCA?

H&W is the hourly supplement (on top of the base hourly wage) that contractors must pay their SCA employees for each hour that is worked or paid . Whether you pay H&W on “hours worked” or “hours paid” depends on whether your WD number is “odd” or “even.”. The WD will indicate the H&W hourly rate that you must pay.

How many hours of vacation do you have to work to get a H&W?

Under the “fixed cost” benefit requirements (i.e., odd numbered wage determinations), any time an employee uses vacation leave, they must be paid H&W on those vacation hours, as long as it does not exceed the H&W maximum of up to 40 hours in a work week.

How many hours does a part time employee get for SCA?

For example, if they work 20 hours out of 40 hours, part-time employees will only receive half of the amount of vacation indicated in the WD.

Is H&W taxable?

Second, if the H&W is taken in cash, it constitutes a taxable wage and actually increases the employer’s costs.

Is fringe considered an employer cost?

The hourly fringe is considered to be an employer cost. When an employer pays for a benefit out of the hourly fringe, it is considered to be at no cost to the employee, as the employee is not entitled to that fringe in cash or entitled to direct how that fringe should be spent.

What are employer contributions?

These employer contributions, made according to the terms of applicable collective bargaining agreements, are used to pay: 1 Fund-provided benefits, 2 insurance plan premiums, and 3 administrative fees for self-insured benefit plans.

What is union dues?

Union dues are used strictly to pay for the functioning of the union and covers associated expenses for such things as salaries, maintenance of union offices, utilities, and recruiting efforts among other things . Click here to learn more about Union Dues.

What is the minimum wage and fringe benefits?

The minimum monetary wages and fringe benefits to be paid are established based on what is prevailing in the locality. A rate is determined to prevail where a single rate is paid to a majority (50 percent or more) of the workers in the same class in a particular locality.

How many hours are paid for sick leave?

Unless otherwise specified on the applicable wage determination, health and welfare payments are due for all hours, including paid vacation, sick leave, and holiday hours, up to a maximum of 40 hours per week and 2, 080 hours per year on each contract.

What is a class of service employee not listed in the wage determination?

Any class of service employee not listed in the wage determination must be classified by the contractor to provide a reasonable relationship (i.e. appropriate level of skill comparison) between the unlisted classifications and the classifications listed in the wage determination.

Does the SCA require minimum wage?

However, the SCA does require that employees performing work on such contracts be paid not less than the above minimum wage rate provided by section 6 (a) (1) of the Fair Labor Standards Act. All provisions of the SCA except the safety and health requirements are administered by the Wage and Hour Division.