Full Answer

What is LINA benefit?

The LINA Disability Income Protection Plan is a fully insured disability policy that can help protect your income — and your family's lifestyle — in the event you are unable to work due to a covered accident or sickness.

Are Lina benefits taxable?

You must report as income any amount you receive for your disability through an accident or health insurance plan paid for by your employer: If both you and your employer have paid the premiums for the plan, only the amount you receive for your disability that's due to your employer's payments is reported as income.

Do SSDI benefits count as income?

Those benefits are not subject to income tax. However, SSDI is potentially taxable, coming under the same set of tax rules as Social Security retirement, family and survivor benefits.

Do I have to report disability income on my tax return?

Generally, you must report as income any amount you receive for your disability through an accident or health insurance plan paid for by your employer. If both you and your employer pay for the plan, only the amount you receive for your disability that is due to your employer's payments is reported as income.

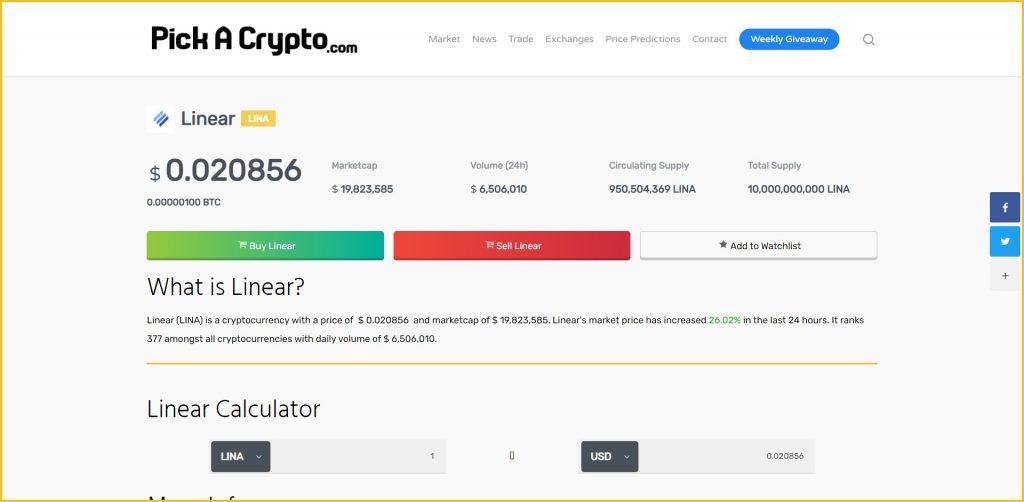

What is Lina insurance?

Lina Insurance Services is here to help you in all stages of your insurance policy, from quoting, to purchasing, to servicing. Call us today for a free quote on any of our services! We can’t wait for you to join the family!

Who is Lina Insurance Services?

Lina Insurance Services has been the leading provider of professional insurance services to the residents of Southern California since 1997. We specialize in identifying your specific needs so that we can find the perfect coverage for you at the perfect price. If you can build it, move it, or sue it, we can insure it!