Maximum benefit pet insurance will typically pay for vet bills that result from the following:

- Accidental injury

- Illness, including behavioural illnesses if referred by your vet

- Physiotherapy if referred by your vet

Is maximum benefit pet insurance the right choice for You?

Maximum Benefit could be the pet insurance for you if you think about it in terms of you and your pet. It will cover the accidents and short-term illnesses but may not work out if your pet develops a long-term illness, which requires a lot of treatment over the years.

Do you need a pet insurance policy for your pet?

It will cover the accidents and short-term illnesses but may not work out if your pet develops a long-term illness, which requires a lot of treatment over the years. Think about your pet and their medical history, if they’re a puppy or a kitten, do a bit of breed research and find out if the breed is prone to any long-term health issues.

How do maximum benefit options work?

Maximum benefit options allow an owner to claim year after year, up to a specified limit. This means that, unlike with a time-limited policy, you can claim for the same condition more than once. However, once vet bills reach the maximum amount, you have to fund further treatment yourself. Policies will differ...

What limit should I get for pet insurance?

The maximum annual limit for most pet insurance providers is $10,000, but a few will insure your pet up to $20,000. If you decide to get pet insurance, experts recommend getting it when your pet is young and healthy, because most policies exclude pre-existing conditions.

What does maximum payout mean for pet insurance?

The maximum payout is the amount of money the pet insurance company will reimburse you. It is important that you pay special attention to maximum payout amounts as you research pet insurance companies as this determines how much monetary coverage you will have during the life of your pet.

What is the difference between maximum benefit and lifetime?

While maximum benefit policies offer a fixed, one-off amount per condition with no time limit, lifetime cover offers a fixed amount per condition, which resets when you renew your policy each year. Because it offers more extensive cover, lifetime policies usually cost more than maximum benefit cover.

Are there different levels of pet insurance?

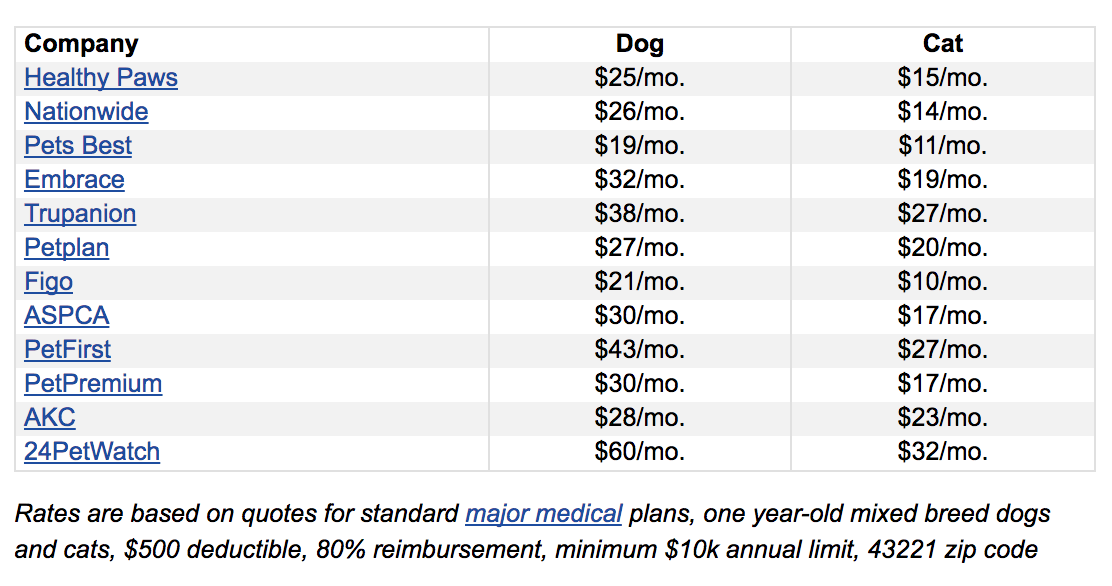

There are two main types of pet insurance — comprehensive and accident-only. You can add wellness, dental, and other benefits for an additional fee. The cost of pet insurance varies based on your pet's breed, species, and age, as well as your plan deductible, reimbursement percentage, and annual maximum benefit.

What is Max vet limit mean?

A maximum limit or payout per year determines the maximum amount of money a pet insurance provider will reimburse you for within one year. Once you've hit your maximum limit or payout, all veterinary bills will be 100% out of pocket until your pet insurance policy is renewed the following year.

Is 5000 enough for pet insurance?

If you want pet insurance for accidents and illnesses, our analysis found the average monthly cost is about $57 for dogs and $28 for cats, based on $5,000 in annual coverage with a $250 deductible and 90% reimbursement level.

Does pet insurance go up as your pet ages?

“The premiums on most policies skyrocket as the pets get older. Rates double by the time a puppy or kitten reaches 4- or 5-years-old and might actually need expensive veterinary care,” Brasler told NBC News BETTER. “Most pet owners will understandably drop coverage once they have to pay more than $200 a month for it.”

Does lifetime pet insurance go up every year?

Lifetime. This is the most comprehensive type of cover you can get. You pay premiums every year during your pet's life, and the insurer will have to keep covering you – regardless of age or any existing conditions (subject to conditions). As your pet gets older, your premiums are likely to increase.

What does no lifetime maximum mean?

Lifetime Maximum: Lifetime maximum or lifetime limits refers to the maximum dollar amount that a health insurance company agrees to pay on behalf of a member for covered services during the course of his or her lifetime.

Does pet insurance cover MRI scans?

Does pet insurance cover MRI scans? MRI scans are becoming a common part of vet treatment, however, they are expensive. Pet insurance should cover an MRI scan that is recommended by a vet as long as the cost falls within your cover limits.

Are vaccinations covered by pet insurance?

Vaccinations are not covered by pet insurance. Neither is spaying or neutering. But, having all your animal's vaccinations up to date could mean lower insurance premiums.

What happens to pet insurance when pet dies?

Pet Insurance for Death from Illness or Injury The "Death from Illness or Injury" section of pet insurance, when applicable, typically covers the purchase or donation price of your pet if it dies or has to be put to sleep by a vet as a result of an illness or injury.

What is money limited pet insurance?

You’ll sometimes hear them called money limited or per condition pet insurance policies. Don’t mistake maximum benefit for being all encompassing though. If your pet has a pre-existing condition before you take the policy out, that won’t be covered.

How long can you claim a pet?

You can claim up to a fixed amount per illness or injury within a certain time period, usually 12 months. When you reach the financial or time limit – whichever comes first – your pet will no longer be covered for that condition. Find out more.

How long can you claim a life insurance policy?

There’s no time limit on how long you can claim, like with a time limited policy. This means you can keep claiming for the same condition until you reach the financial cap, as long as you renew your policy each year, and keep up with premium payments.

Is pet insurance covered for accidents?

Your pet will be covered for accidental injuries. Emergency treatment for illnesses as a result of an accident might be covered too – but it’s rare. There’s usually either a financial cap or time limit on the cover. Find out more.

Can you claim a pet condition once?

Disadvantages. You can only claim for each condition once, even if it reoccurs. You could reach the limit quickly if your pet needs expensive treatment, like a major operation. The maximum amount per condition isn’t reset each year, like with lifetime pet insurance.

Get cheap pet insurance quotes

Vet fees can really escalate, particularly if your pet needs expensive surgery or suffers from a recurring condition like diabetes.

What is maximum benefit pet insurance

Maximum benefit pet insurance is one of the four main types of insurance policies you can get for your furry friend.

Difference between maximum benefit and lifetime pet insurance

The key difference is lifetime pet insurance offers your furry pal far more protection for each individual injury or ailment.

What does maximum benefit pet insurance cover?

Maximum benefit pet insurance will typically pay for vet bills that result from the following:

What does maximum benefit pet insurance not cover?

Each insurer will have reasons why it won’t pay out. However, typical reasons a maximum benefit pet insurance policy won’t pay out include:

Esther Wolffowitz

Esther Wolffowitz was a publisher at finder.com specialising in insurance. Esther holds an MSc in Media and Communication Governance from the London School of Economics and Political Science (LSE).

What is maximum benefit pet insurance?

Maximum benefit pet insurance – sometimes known as per condition cover – covers your pet for accidents and illnesses up to a given limit. Unlike time-limited cover there’s no time limit on how long you can make claims for.

What is covered by a maximum benefit policy?

Maximum benefit pet insurance allows you to claim the cost of veterinary treatments needed by your pet during the plan year. It aims to cover new conditions or accidents your pet has up to the per condition limits set by the policy wording.

Advantages of maximum benefit pet insurance

Provides you with a fixed cover amount for each accident, injury and illness.

Disadvantages of maximum benefit pet insurance

If your pet needs expensive treatment like an operation then you can max out the per condition limit quite quickly.

How much does maximum benefit pet insurance cost?

Maximum benefit cover tends to be the second most comprehensive cover you can find, and the price reflects this.

What affects the cost?

Maximum benefit pet insurance is the second most comprehensive cover you can get for your pet and due to this tend to be slightly cheaper than lifetime pet insurance but more expensive that time limited plans.

How can I impact the price?

Some things in the list above you are not going to be able to impact – vet fee inflation, pet age, pet breed for example.

What is maximum benefit pet insurance?

Maximum benefit is a type of pet insurance which covers conditions up to a set financial limit. Maximum benefit policies no term limit so do not expire, and you can claim for the same condition multiple times. But once the policy has paid out its set maximum, you will have to cover any extra costs yourself.

What does this sort of pet insurance cover?

Maximum benefit pet insurance is primarily designed to cover accidents and illnesses, up to the limits stated. These policies will commonly pay the cost of vet treatment and medication, however you may also find providers which offer additional benefits for an extra fee. Each of these benefits will have their own individual payout limits.

Are there any exclusions?

Yes. While maximum benefit pet insurance is a fairly comprehensive type of pet cover, you need to be aware of the main restriction: once you reach the maximum limit on any condition, you can’t claim on that condition any more - even if it develops elsewhere in your pet’s body.

Which animals are eligible for maximum benefit insurance?

This pet insurance is primarily designed for cats or dogs, and it’s quite rare to find these policies to cover other animals. Other types of pets, including rabbits, horses, and exotic pets, are usually covered under annual or lifetime insurance policies.

How much does maximum benefit insurance cost?

Maximum benefit pet insurance is a mid-priced option. This style of policy isn’t as cheap as accident only cover, but it provides substantially more coverage and isn’t as costly as a lifetime policy.

What affects my monthly premiums?

The cost of insuring your pet will vary from provider to provider, however you should also keep in mind the following factors which can have a huge bearing on your monthly premiums:

How do I make a claim?

That’s simple. On any insurance website, they’ll have a claims page or number you can call to get things started. If your provider has a claims page, then fill out a form for the treatment or situation in question, and they’ll get back to you promptly.

Our customers feedback

Great Service with dedicate customer services and good prices. Highly recommend it. - Jay Stavious

What types of pet insurance are there?

Accident only. Will cover your pet in the event of an accident, but won’t cover long-term illness. There may also be limits on the amount of time and money allowed for treatment.

What does Max Benefit Pet Insurance mean?

Pet insurance can be tricky to get your head around at the best of times, so here’s Max Benefit Pet Insurance explained. Maximum Benefit or Max Benefit or Per Condition Pet Insurance, as it’s sometimes known, is just that, a per condition pet insurance that covers each condition separately up to a set amount – the maximum benefit.

What is included with Max Benefit Cover?

Argos offer 2 levels of Max Benefit Cover, giving you either £2,000 or £5,000 to spend per condition, at any time, until that limit has been spent. On top of the veterinary fees included in our Max Benefit policies, there is also a full range of features to make use of.

Got a question?

Need help or support when it come to your pet insurance, or just need a question answering? Our FAQs and support are there for you when you need them.

Compare Maximum Benefit Pet Insurance cover

There are only two Maximum Benefit cover levels to choose from, so this makes comparing them easy but you should think about other types of insurance The comparison table below includes all our cover types and features so you can draw comparison side by side.

Max Benefit or Lifetime Pet Insurance?

Comparing between Maximum Benefit cover levels, is, on the face of it, pretty straightforward, but what about in terms of other types of pet insurance. Argos Pet Insurance offers you three types of cover to choose from, but which one is right for you? Lifetime or Max Benefit Pet Insurance or Time Limited cover?

Frequently asked questions

Maximum Benefit works like a lot of other types of pet insurance, your pet takes a tumble or falls ill, receives vet treatment resulting in your need to make a claim. Every condition you make a claim for has its own vet fee limit, the maximum benefit.

What does maximum benefit pet insurance cover?

Maximum benefit pet insurance policies cover each new medical condition up to the policy limit, for as long as the policy remains in place. Once you reach the policy limit for a condition, it will be classed as a pre-existing condition and will be excluded from future claims.

Is maximum benefit pet insurance right for me?

Maximum benefit pet insurance is more comprehensive than time limited or accident only pet insurance. Because of this, premiums are slightly more expensive.

Can I claim for the same condition more than once?

Yes, if you have a maximum benefit pet insurance policy it's possible for you to claim for the same condition more than once. However, once you've reached the maximum limit for that particular condition, it will be excluded from cover and you won't be able to make a claim for it again.

What other types of pet insurance can I get?

Time limited pet insurance – covers vet fees for a year, once the year’s up, you’ll have to pay for further treatment.

What is the most expensive pet insurance?

Lifetime pet insurance is the most comprehensive pet insurance policy as it will cover your pet for long-term and chronic conditions for the duration of its life. Because of this, lifetime pet insurance is usually the most expensive type of pet insurance and you are most likely to benefit from taking it out when the pet is young. This is because if a pet develops an illness/injury before a pet insurance policy is opened, it will be classed as a pre-existing condition and will not be covered by any insurer unless you choose a pre-existing condition pet insurance policy where there may be some exceptions.

Does pet insurance cover accidents?

Accident-only pet insurance does not cover your pet for illnesses which means you will only be insured for veterinary treatment as a result of an accident. Some accident-only pet insurance policies, such as the RSPCA, will impose time-limits on how long you have to claim for fees relating to the accident. Some policies will have a condition limit on the veterinary fees which means you can only claim up to a certain limit for each condition and other policies have a total claim limit per year for multiple conditions.