How do you calculate unemployment benefits in NY?

You will receive your unemployment benefits one week after filing the claim.

- Your Social Security Number

- The year you were born in

- Your home address and telephone number

- Whether you have filed an unemployment insurance claim in your state or any other state during the past 12 months

- Your last day of employment

- The names and addresses of all the employers you have worked for during the past 15 months before you file your claim. ...

What is the maximum unemployment benefits in New York?

States That Pay The Lowest Unemployment Insurance Compensation

- Mississippi – $235

- Arizona – $240

- Louisiana – $247

How much does unemployment pay in NY?

New York. Your Weekly Benefit Amount in New York would be 1/25th to 1/26th of your wages in the highest quarter of your base period. If you collect wages while on UI benefits, the state will disregard none. North Carolina. Your Weekly Benefit Amount in North Carolina is determined by dividing your total wages in the recent two quarters by 52.

How to certify for weekly NY unemployment insurance benefits?

What to Do and Expect After You’ve Been Certified

- The Governor has suspended the one-week delay time for those affected by the pandemic public health crisis as of March 12, 2020. ...

- If you are entitled, the first payment will be received within two to three weeks of the completion and processing of your claim. ...

- Claim weekly payments as long as you are jobless and follow the eligibility criteria.

What is the maximum New York State unemployment benefit?

$504The current maximum weekly benefit rate is $504. We establish your entitlement and benefit rate with information that your employers report to the New York State Wage Reporting system. We will send you an initial Monetary Determination based on this.

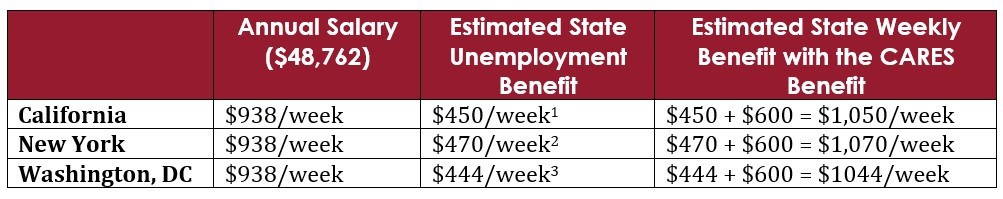

How much is unemployment in NY Covid?

In addition to their weekly benefits, claimants received a weekly Federal Pandemic Unemployment Compensation (FPUC) benefit: $600 per week for benefit weeks ending 4/5/2020 to 7/26/2020 and $300 per week for benefit weeks ending 1/3/2021 to 9/5/2021.

What is the maximum unemployment benefit in NY for 2022?

Effective the first Monday of October 2019 the maximum benefit rate increased to $504. The minimum benefit rate is $116 as of January 3, 2022. For more information and more examples of the information contained in this fact sheet, please see the claimant handbook at www.labor.ny.gov/uihandbook.

Is NY getting extra unemployment benefits?

The enhanced benefits were originally an extra $600 a week last year under federal CARES Act signed by former President Donald Trump. The extra money was later cut in half to $300 a week until Sept. 5. The aid to the unemployed was on top of the $504 a week New York already offers to those out of work.

What is the maximum unemployment benefit in NY for 2021?

The New York State Department of Labor (NYSDOL) determines your weekly unemployment benefit amount by dividing your earnings for the highest paid quarter of the base period by 26, up to a maximum of $504 per week.

Is Nys still giving pandemic unemployment?

Regular Unemployment Insurance The Pandemic Emergency Unemployment Compensation Program (PEUC) provided 53 weeks of additional benefits. It went into effect April 5, 2020 and expired the benefit week ending September 5, 2021.

What state has the highest unemployment pay?

MassachusettsIt's Massachusetts that currently has the highest possible unemployment benefits amount per week, at 823 dollars, while the lowest is Mississippi with just 235 dollars.

Is NY unemployment back 2022?

The New York State Senate passed legislation that adjusts the unemployment insurance tax rate schedule for the 2022 and 2023 fiscal years to reduce an employer's tax obligation and to increase the weekly maximum unemployment benefit for workers in 2022 and 2023.

How long can you collect unemployment in NY Covid 19?

Pandemic Emergency Unemployment Compensation: An additional 53 weeks of UI benefits, beyond the 26 weeks already provided by New York State, until the benefit week ending 9/5/2021.

Who qualifies for pandemic unemployment in NY?

WHO SHOULD APPLY? New Yorkers otherwise not qualified for regular or extended UI benefits and affected by COVID-19.

What happens when unemployment benefits are exhausted in NY 2022?

If your unemployment benefits program has expired, there are other programs that you could explore, such as the Pandemic Unemployment Assistance (PUA), Pandemic Emergency Unemployment Compensation (PEUC) program, State's Extended Benefits (EB) program.

Are they extending unemployment?

About the PEUC Extension Pandemic Emergency Unemployment Compensation (PEUC) provided up to 53 additional weeks of payments if you've used all of your available unemployment benefits. The first 13 weeks were available from March 29, 2020 to September 4, 2021.

How much is unemployment in New York?

The New York State Department of Labor determines your weekly unemployment benefit amount by dividing your earnings for the highest paid quarter of the base period by 26, up to a maximum of $504 per week.

How to claim weekly benefits in NY?

Its best to claim weekly benefits or obtain benefit payment information online with your NY.GOV ID. Go to www.labor.ny.gov/signin.

Why is unemployment denied?

First, a claim for unemployment compensation will be denied if the claimant has not met the work and earnings requirements.

How long is EB available in New York?

Initially, New Yorkers could access up to 20 weeks of EB. But the amount of EB available was dependent on New Yorks unemployment rate. If the rate ran less than 8% for a three-month period a threshold set by the federal government the EB amount available to New Yorkers would decrease to 13 weeks.

What is the Department of Labor in New York?

The New York Department of Labor is the state agency that oversees administering unemployment insurance claims for citizens. It provides monetary benefits, job training, job search and other related services for those people who are actively seeking work in New York and who have lost their jobs through no fault of their own.

When does unemployment end in New York?

If your unemployment insurance claim has reached or surpassed the originally allotted 26 weeks, your benefits will end. This is because two federal programs called Pandemic Emergency Unemployment Compensation, or PEUC, and Extended Benefits, or EB, will be expiring on Sept. 5. These programs extended the length of time someone could receive unemployment benefits in New York to account for the economic challenges of the pandemic. As of Aug. 7, more than 713,000 people were claiming PEUC benefits, and more than 7,000 people were claiming EB benefits.

How to request a hearing in New York?

You can request a hearing online by sending a message to the state through your NY.gov account. You may also request a hearing by completing a Claimant Hearing Request Form and mailing it to: New York State Department of Labor, PO Box 15131, Albany, NY 12212-5131.

What is the base period for unemployment?

All of the wages the state considers when determining when your eligibility must occur are in the base period. The base period is the first four of the last five full calendar quarters.

How does the Department of Labor calculate your weekly benefit?

It calculates your weekly benefit amount by dividing your base period high quarters by 26. So to collect the highest weekly benefit amount offered by New York state, you must have earned more than $10,530 in that high quarter.

What is the high quarter for unemployment in 2011?

The high quarter is the quarter in which you earn the most insured wages. This is the three months you must have earned that $10,530 needed to receive the maximum weekly benefit amount.

What is insured wages?

Insured Wages. Insured wages are those you earn from work covered under the New York unemployment compensation laws. Only the wages earned from insured work counts toward your weekly benefit amount.

Does New York have unemployment?

Like all states, New York has unemployment compensation laws that limit the amount you can collect. These laws prevent anyone from collecting overly large amounts from the unemplo yment insurance program. When you apply for benefits, the New York state Department of Labor calculates your benefits based on your previous wages.

How long does it take to get a first unemployment check?

Make sure to give complete and correct information to minimize delays with your claim processing. It generally takes two to four weeks after you file your claim to receive your first first benefit check.

Why do I need to certify on time for unemployment?

Certify on time (weekly or bi-weekly) to claim your benefits in order to get your unemployment check paid on schedule. One of the main reason people see disruptions is failing to file on time and with the required information.

What happens if you miss your unemployment certification?

If you miss several weeks of certification, you may have to file a new claim. Your state unemployment website will generally allow you to calculate your estimated state unemployment benefits prior to or when submitting a claim.

Does dependents affect unemployment?

In many states the number of dependents you have and your average maximum weekly wage will impact the unemployment benefits you are eligible to receive. Please check your respective states unemployment website referenced in the table below for state specific UI details, benefit eligibility and process to claim/file for benefits.

Does unemployment insurance include enhanced benefits?

It does not include federally funded enhanced and supplementary benefit payments which have now expired.

Do you have to certify for unemployment?

Certify on time (weekly or bi-weekly) to claim your benefits in order to get your unemployment check paid on schedule. One of the main reason people see disruptions is failing to file on time and with the required information. Further, with the new federal programs in place, the unemployment certification requirements could be more onerous so make sure you take time to review your weekly or bi-weekly certification requirements. If you miss several weeks of certification, you may have to file a new claim.

How much does New York pay in unemployment benefits?

Out of work compensation amounts in New York are based on your earnings. Those who make around $52,000 or more can claim the maximum weekly jobless assistance of $504. With the onset of the covid-19 induced economic crisis, lawmakers in Washington created federal pandemic unemployment programs to boost unemployment payments.

How long does unemployment last in New York?

How long do unemployment benefits last in New York? New York normally provides up to 26 weeks of unemployment assistance, but due to the high unemployment rate in the state, benefits were extended for an additional 20 weeks. Anyone who filed an initial claim after September 7, 2020 will be eligible for 46 weeks of benefits.

How many weeks of unemployment benefits are there in 2020?

Anyone who filed an initial claim after September 7, 2020 will be eligible for 46 weeks of benefits. However, should the economic situation improve, extended benefits could be reduced thus limiting the total number of weeks that can be claimed.

How much can you get out of work in New York?

Out of work compensation amounts in New York are based on your earnings. Those who make around $52,000 or more can claim the maximum weekly jobless assistance of $504. With the onset of the covid-19 induced economic crisis, lawmakers in Washington created federal pandemic unemployment programs to boost unemployment payments.

How many days can you work without losing unemployment?

Under the new rules, you can work up to 7 days per week without losing full unemployment benefits for that week. If you work 30 hours or fewer and earn $504 or less in gross pay excluding earnings from self-employment, your benefits will be reduced in increments based on your total hours of work for the week.

Is New York open for business?

New York is OPEN for business! Companies are hiring in record numbers and they need your help. We can connect you with your next job – all you have to do is take the first step. New Yorkers can also receive partial unemployment benefits if they meet certain requirements.

What is the new employer contribution rate for 2021?

For 2021, the new employer normal contribution rate is 3.4%.

When do employers get UI notices?

The Department of Labor mails employers UI rate notices in March of every year.

Will employers be charged for unemployment in 2021?

Cuomo, New York State Department of Labor Commissioner Roberta Reardon ordered that employers’ UI accounts will not be charged for unemployment insurance (UI) benefits paid during the COVID-19 pandemic. Subsequently, Governor Cuomo signed legislation that further ensures the relief to employers of UI experience rating charges related to the COVID-19 pandemic. These actions will ease the burden on both contributory and non-contributory (reimbursable) employers. For more information, please see the UI Experience Rating Charges fact sheet.