In a nutshell, spousal benefits are intended to provide retirement income to Americans who have earned significantly less than their spouses. For example, if one spouse worked full-time for their entire career while the other stayed home to raise children, then a spousal benefit could provide income to the former stay-at-home parent.

Who qualifies for Social Security spousal benefits?

You may also qualify for the spousal benefit If you’re divorced but the marriage lasted for at least 10 years and you’re not currently married. How Much Is the Social Security Spousal Benefit? If you’re eligible and can qualify, the spousal benefit can be as much as 50% of the higher-earning spouse’s full retirement age benefit.

Can you collect government pension and spousal benefits?

benefits as a spouse, widow, or widower if you: • Receive a government pension that’s not based on your earnings; or • Are a federal (including Civil Service Offset), state, or local government employee and your government pension is from a job for which you paid Social Security taxes; and: —Your last day of employment (that your pension is based on) is before July 1, 2004; or

How are spousal Social Security benefits calculated?

To qualify for Social Security spousal benefits:

- Both you and your spouse must be at least 62

- Married at least 1 year

- The other spouse must be receiving their worker benefit

Can I get spousal Social Security benefits?

You can expect the following when applying for Social Security spousal benefits: You can receive up to 50% of your spouse’s Social Security benefit. You can apply for benefits if you have been married for at least one year. If you have been divorced for at least two years, you can apply if the marriage lasted 10 or more years.

How much is spousal benefit reduced?

A spousal benefit is reduced 25/36 of one percent for each month before normal retirement age, up to 36 months. If the number of months exceeds 36, then the benefit is further reduced 5/12 of one percent per month.

What is the reduction factor for spousal benefits?

For a spouse who is not entitled to benefits on his or her own earnings record, this reduction factor is applied to the base spousal benefit, which is 50 percent of the worker's primary insurance amount. For example, if the worker's primary insurance amount is $1,600 and the worker's spouse chooses to begin receiving benefits 36 months ...

What age can a spouse file for Social Security?

When a worker files for retirement benefits, the worker's spouse may be eligible for a benefit based on the worker's earnings. Another requirement is that the spouse must be at least age 62 or have a qualifying child in her/his care. By a qualifying child, we mean a child who is under age 16 or who receives Social Security disability benefits.

Can a spouse reduce their spousal benefit?

However, if a spouse is caring for a qualifying child, the spousal benefit is not reduced. If a spouse is eligible for a retirement benefit based on his or her own earnings, and if that benefit is higher than the spousal benefit, then we pay the retirement benefit. Otherwise we pay the spousal benefit. Compute the effect of early retirement ...

How old do you have to be to get spousal benefits?

The spouse must be at least 62 years old or have a qualifying child – a child who is under age 16 or who receives Social Security disability benefits – in his or her care.

What is the maximum amount of benefits a spouse can receive?

Note that the maximum benefit for a spouse is 50% of their spouse’s benefit. That means that your spouse would have had to earn a substantial amount more over his or her working life to make that benefit higher ...

What is the maximum Social Security benefit for a spouse?

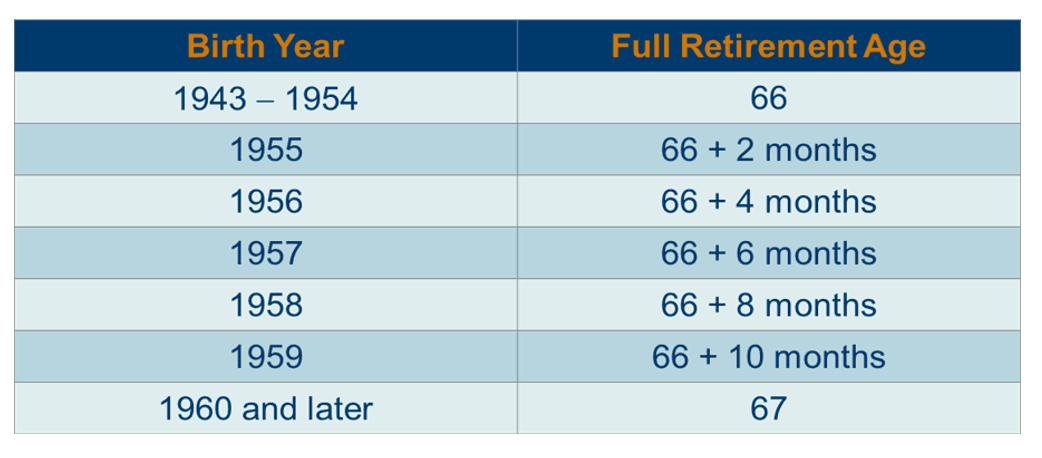

The allowed Social Security retirement benefit for a spouse starts at 32.5% at age 62 and gradually increases to 50% of the amount that their spouse is eligible to receive at full retirement age, which is 66 or 67 depending on their birth year.

How much Social Security can a widow receive?

Widows and widowers may be able to receive up to 100% of the deceased spouse's Social Security benefit. Social Security uses a formula for families with more than one eligible dependent to calculate maximum benefits.

Can same sex couples get Social Security?

Both opposite-sex and same-sex married couples are eligible for Social Security spousal and dependent benefits. So are some individuals in legal relationships such as civil unions and domestic partnerships. And those who were married for at least 10 years and have been divorced for at least two years also can apply.

Is Social Security complicated for married people?

Social security is complicated for individual filers, and being married can make it even more complicated. That’s because Social Security includes benefits for the spouse as well as the individual. When an individual files for retirement benefits, that person’s spouse may be eligible for a benefit based on the worker's earnings according to ...

Can a spouse receive a survivor's benefit if they remarry?

If the surviving spouse remarries at age 60 or older, he or she can still receive the survivor benefit. However, remarrying before age 60 eliminates eligibility to collect the deceased spouse’s benefit.

How long do you have to be married to get spousal benefits?

You must have been married for over 10 years to get this income. 2. You also must be age 62 to file for or receive a spousal benefit. You can also wait longer. If you wait until you are at full retirement age (up to 67, depending on when you were born) to file, you will get a larger amount than if you file sooner. 3.

How much of my spouse's Social Security is based on my work history?

If you take the benefits based on your spouse's work history and earnings, you will get 50% of the amount of your spouse’s Social Security benefit. This amount is calculated their full retirement age, or FRA. FRA depends on when you were born. You can check the Social Security website to find out how old you or your spouse need to be to reach FRA.

How much life insurance can a married couple get?

In many cases, it can provide $50,000 to $250,000 of life insurance. Married couples should plan how to get the most out of both their spousal and survivor benefits.

What happens if your spouse's retirement benefits are higher than your own?

If your benefits as a spouse are higher than your own retirement benefits, you will get a combination of benefits equaling the higher spouse benefit. Here is an example: Mary Ann qualifies for a retirement benefit of $250 and a spouse’s benefit of $400.

When will my spouse receive my full retirement?

You will receive your full spouse’s benefit amount if you wait until you reach full retirement age to begin receiving benefits. You will also receive the full amount if you are caring for a child entitled to receive benefits on your spouse’s record who is younger than age 16 or disabled.

How old do you have to be to get spouse's Social Security?

To qualify for spouse’s benefits, you must be one of these: At least 62 years of age.

How much is spousal benefit?

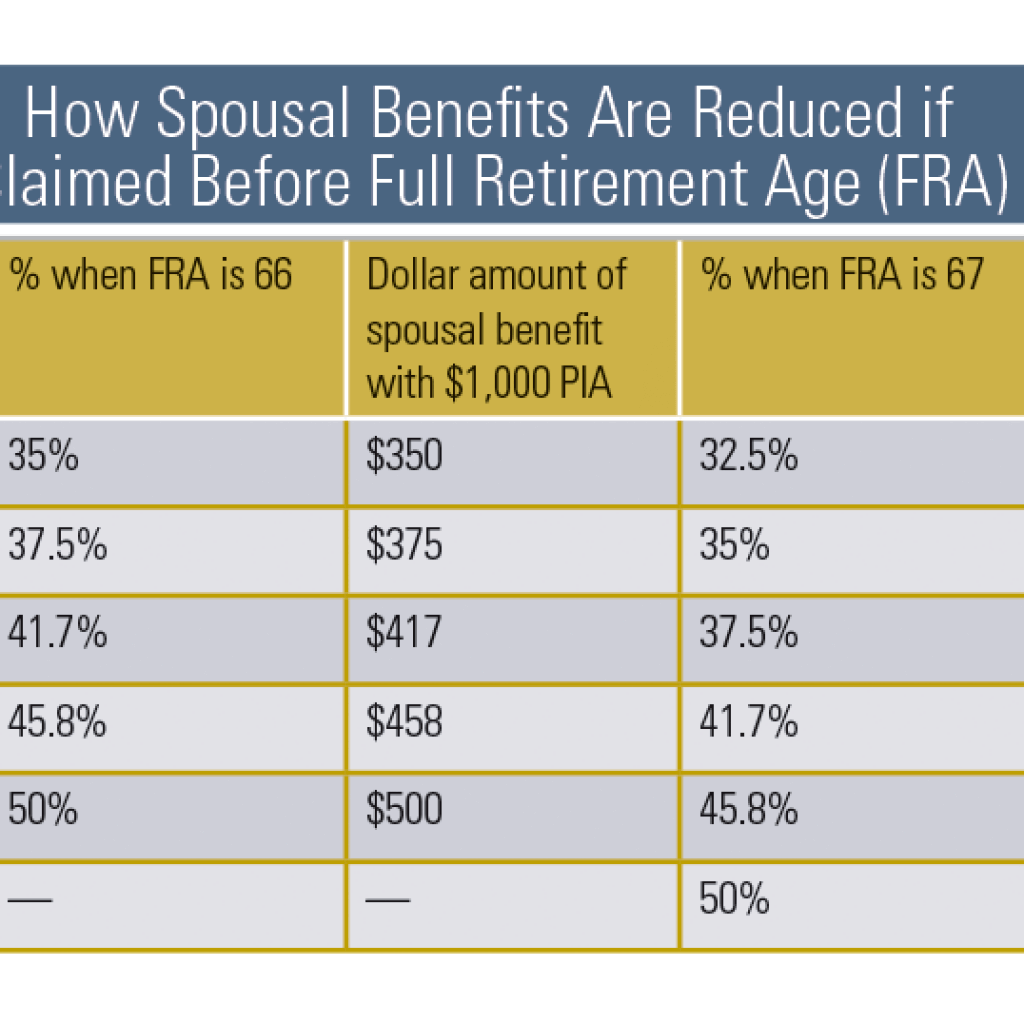

Depending on how old you are when you file, the spousal benefit amount will range between 32.5% and 50% of the higher-earning spouse’s full retirement benefit. Check out the chart below to get an idea of how the benefit works and what your payment might be if you can take advantage ...

How long do you have to be married to get spousal benefits?

The Two Exceptions to Know Around the 1 Year Marriage Requirement. Normally, you must be married for at least 12 continuous months to meet the spousal benefit duration-of-marriage requirement. However, there are two exceptions to this rule.

How many people receive Social Security benefits as a spouse?

A recent Social Security report found that 2.3 million individuals received at least part of their benefit as a spouse of an entitled worker. Some of these spouses had benefits of their own, but were eligible to receive higher benefit because the spousal benefit amount was greater than their own benefit. Others never worked outside the home ...

What is Julie's reduction to her own benefit?

This means that Julie’s reduction to her own benefit would be based on her age when she filed for her benefit. However, her reduction to the spousal benefit would be based on her age when Joe filed for his benefit. So, if Julie filed when she was 62, her own benefit would be reduced.

How much of my spouse's Social Security is my full retirement?

Remember, in that case, it’s between 32.5% and 50% of the higher-earning spouse’s full retirement age benefit, depending on your filing age. However, it can seem a little more complicated if you have Social Security benefits from your work history.

Can a spouse receive Social Security?

They have no benefit of their own, but thanks to the Social Security spousal benefit available under their spouse’s work record, they can still receive payments. This particular benefit doesn’t just provide retirement income, either. As an eligible spouse, you could also receive premium-free Medicare benefits.

Does spousal benefit increase after full retirement?

You may have also noticed that the spousal benefit does not increase beyond your full retirement age. When considering your own Social Security benefit, there can be a lot of advantages to waiting to file and delaying when you start receiving payments well past your retirement age, but that’s not the case here.

How much is spousal benefit reduced?

The spousal benefit is reduced by about seven-tenths of one percent for each month before full retirement age, up to 36 months. If you exceed the 36 months, Social Security will dock about four-tenths of one percent for further months. The math can be complicated, but Social Security provides a tool to help you calculate your spousal benefit.

How old do you have to be to get spousal benefits?

For spouses to receive the benefit, they must be at least age 62 or care for a child under age 16 (or one receiving Social Security disability benefits). In addition, spouses cannot claim the spousal benefit until the worker files for her or his benefit. There are other important caveats about the spousal benefit as well.

How much will my spouse get in Social Security in 2021?

The average monthly payout for all retired workers was $1,553.68 in May 2021 according to the Social Security Administration (SSA), while those claiming spousal benefits received an average check of $795.89.

What percentage of my spouse's retirement benefits are reduced?

Benefits may be reduced so that the spouse receives as little as 32.5 percent of the retiree's benefit.

How long do you have to be married to claim Social Security?

The requirements for claiming benefits based on your ex-spouse's work record include: You must have been married at least 10 years. You must have been divorced from the spouse for at least two consecutive years. You are unmarried. Your ex-spouse must be entitled to Social Security retirement or disability benefits.

Can a spouse take their own benefit?

Spouses may also take their own benefit early and then switch to their partner's benefit later. "I have several clients where her own benefit is less than or very close to half the spousal benefit and he plans to wait until age 70 to claim," Toth says.

Can ex spouses get Social Security?

Spouses are one of the many beneficiaries of Social Security, and even ex-spouses can claim a payout from the program in some circumstances. When you apply for Social Security, you automatically apply for the greater of your benefit or half your spouse's benefit.

What Are Social Security Spousal Benefits?

Social Security spousal benefits are retirement benefits paid by the Social Security Administration to the spouse of a primary beneficiary. When Social Security started, many women did not work outside the home.

Who Qualifies For Social Security Spousal Benefits?

There are a few eligibility criteria that must be met to qualify for spousal benefits. Here are the basics, and then we will dive into a few exceptions to the basic rules. First, your spouse must already have filed for his or her own benefits. You cannot apply for spousal benefits until your spouse has already applied for their own benefits.

When Can A Spouse Claim Social Security Spousal Benefits?

A spouse can claim Social Security spousal benefits as early as age 62, as long as the other spouse has already applied for benefits. You cannot claim benefits until your spouse has claimed benefits using their own record. This rule applies to both a current spouse and a divorced spouse.

How Social Security Spousal Benefits Are Calculated

The calculation for spousal benefits is fairly straightforward. If you wait until full retirement age, then your benefit will be 50% of the spouse’s benefit amount. However, starting your benefits early will reduce your monthly payment.

Social Security Spousal Benefits For Divorced & Widowed Spouses

When it comes to retirement planning, many divorced and widowed spouses wonder whether they can still receive spousal benefits. The answer depends on a few different facts. Here are the rules you need to know when it comes to divorced or widowed spouses receiving spousal benefits.

Maximizing Spousal Benefits For Divorced & Widowed Spouses

Now that most of the spousal benefit loopholes have been closed, there are not as many strategies for maximizing your spousal benefits. One of the biggest tips for maximizing your benefits now is to wait as long as possible to start your benefits.

The Bottom Line

A spouse can claim spousal benefits at age 62 as long as the primary spouse has already applied for benefits. The age requirement can be waived if the spouse is caring for a child under 16 or a disabled child. An ex-spouse can claim spousal benefits at age 62 as well, as long as the marriage lasted for ten years.