Social Security spousal benefits can pay an eligible spouse 50% of the partner’s benefit if it is higher than his or her own benefit. Claims can begin at age 62 but may be worth more at full retirement age. Read our Social Security review to learn more.

How do you calculate spouse Social Security benefits?

The requirements for claiming benefits based on your ex-spouse's work record include:

- You must have been married at least 10 years.

- You must have been divorced from the spouse for at least two consecutive years.

- You are unmarried.

- Your ex-spouse must be entitled to Social Security retirement or disability benefits.

- The benefit you would receive from your work record would be less than this spousal benefit.

How much can a married couple get from Social Security?

You may need to produce these documents when you apply

- Your Social Security card.

- An original birth certificate or other proof of your birth.

- A copy of your W-2 form or self-employment tax return for the previous year.

- Your marriage certificate.

- If you weren't born in the United States, proof of U.S. citizenship or lawful alien status.

How to calculate spouse SSA benefit?

Today's Social Security column addresses questions about how Social Security spousal benefits are calculated, whether it's necessary to file in January to get a given year's COLA and what effects of benefits rates not paying taxes can have. Larry Kotlikoff ...

How couples can maximize social security benefits?

You can expect the following when applying for Social Security spousal benefits: To make the most of your spousal Social Security benefit, it can be helpful to be aware of the amount you might be ...

When can a wife collect half of her husband's Social Security?

You can receive up to 50% of your spouse's Social Security benefit. You can apply for benefits if you have been married for at least one year. If you have been divorced for at least two years, you can apply if the marriage lasted 10 or more years. Starting benefits early may lead to a reduction in payments.

Who is eligible for spousal benefits under Social Security?

You're eligible for spousal benefits if you're married, divorced, or widowed, and your spouse is or was eligible for Social Security. Spouses and ex-spouses generally are eligible for up to half of the spouse's entitlement. Widows and widowers can receive up to 100%.

When can a spouse collect spousal Social Security benefits?

least 62 years of ageTo qualify for spouse's benefits, you must be one of these: At least 62 years of age. Any age and caring for a child entitled to receive benefits on your spouse's record and who is younger than age 16 or disabled.

How does spousal benefit work?

The spousal benefit can be as much as half of the worker's "primary insurance amount," depending on the spouse's age at retirement. If the spouse begins receiving benefits before "normal (or full) retirement age," the spouse will receive a reduced benefit.

Can you collect your own Social Security and spouse benefits?

Can I collect spousal benefits if I earned my own Social Security benefit? En español | Technically, yes, you can receive both spousal benefits and your own retirement payment. As a practical matter, however, you'll get the higher of the two amounts, and no more.

Can I collect my husband's Social Security if he is still alive?

The earliest a widow or widower can start receiving Social Security survivors benefits based on age will remain at age 60. Widows or widowers benefits based on age can start any time between age 60 and full retirement age as a survivor.

Can my wife collect spousal Social Security benefits before I retire?

Can my spouse collect Social Security on my record before I retire? No. You have to be receiving your Social Security retirement or disability benefit for your husband or wife to collect spousal benefits.

Does spousal benefit reduce my benefit?

If I receive a spouse benefit, will it reduce the amount that my spouse receives? No, receiving benefits on your spouse's earnings record does not affect the amount of the retirement or disability benefit that your spouse receives.

Can my wife collect spousal Social Security benefits before I retire?

Can my spouse collect Social Security on my record before I retire? No. You have to be receiving your Social Security retirement or disability benefit for your husband or wife to collect spousal benefits.

Can I collect ex spousal benefits and wait until I am 70 to collect my own Social Security?

You can only collect spousal benefits and wait until 70 to claim your retirement benefit if both of the following are true: You were born before Jan. 2, 1954. Your spouse is collecting his or her own Social Security retirement benefit.

How old do you have to be to get spousal benefits?

The spouse must be at least 62 years old or have a qualifying child – a child who is under age 16 or who receives Social Security disability benefits – in his or her care.

What is the maximum amount of benefits a spouse can receive?

Note that the maximum benefit for a spouse is 50% of their spouse’s benefit. That means that your spouse would have had to earn a substantial amount more over his or her working life to make that benefit higher ...

How long do you have to wait to apply for Social Security?

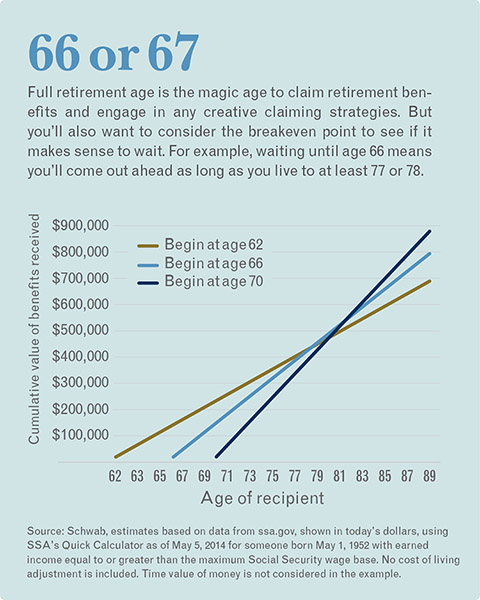

You can first apply for Social Security if you are no more than three months away from age 62. But your benefits increase significantly if you wait until you reach full retirement age, which can be 66 or 67, depending on your year of birth. To apply for spousal benefits, go to the Social Security Administration (SSA) website.

How much Social Security can a widow receive?

Widows and widowers may be able to receive up to 100% of the deceased spouse's Social Security benefit. Social Security uses a formula for families with more than one eligible dependent to calculate maximum benefits.

Can a spouse receive a survivor's benefit if they remarry?

If the surviving spouse remarries at age 60 or older, he or she can still receive the survivor benefit. However, remarrying before age 60 eliminates eligibility to collect the deceased spouse’s benefit.

Can same sex couples get Social Security?

Both opposite-sex and same-sex married couples are eligible for Social Security spousal and dependent benefits. So are some individuals in legal relationships such as civil unions and domestic partnerships. And those who were married for at least 10 years and have been divorced for at least two years also can apply.

Is Social Security complicated for married people?

Social security is complicated for individual filers, and being married can make it even more complicated. That’s because Social Security includes benefits for the spouse as well as the individual. When an individual files for retirement benefits, that person’s spouse may be eligible for a benefit based on the worker's earnings according to ...

How long do you have to be married to get spousal benefits?

You must have been married for over 10 years to get this income. 2. You also must be age 62 to file for or receive a spousal benefit. You can also wait longer. If you wait until you are at full retirement age (up to 67, depending on when you were born) to file, you will get a larger amount than if you file sooner. 3.

What happens to Social Security when a spouse dies?

When a person dies, their current or former spouse can often start getting their Social Security benefits. Whether this happens depends on several different factors.

How much life insurance can a married couple get?

In many cases, it can provide $50,000 to $250,000 of life insurance. Married couples should plan how to get the most out of both their spousal and survivor benefits.

How much life insurance can a married couple get if they delay Social Security?

In many cases, it can provide $50,000 to $250,000 of life insurance. Married couples should plan how to get the most out of both their spousal and survivor benefits.

How much of my spouse's Social Security is based on my work history?

If you take the benefits based on your spouse's work history and earnings, you will get 50% of the amount of your spouse’s Social Security benefit. This amount is calculated their full retirement age, or FRA. FRA depends on when you were born. You can check the Social Security website to find out how old you or your spouse need to be to reach FRA.

Do you lose Social Security if you retire early?

Social Security is based on your lifetime earnings. Anyone will lose part of their own benefit if they retire early. If you begin getting a spousal benefit before you reach your FRA, your benefit will be permanently lower. This is true unless you’re caring for a qualifying child.

Does spousal benefit reduce or change amount?

Taking a spousal benefit does not reduce or change the amount your current spouse, ex-spouse, or ex-spouse's current spouse may receive.

How much is spousal benefit?

Depending on how old you are when you file, the spousal benefit amount will range between 32.5% and 50% of the higher-earning spouse’s full retirement benefit. Check out the chart below to get an idea of how the benefit works and what your payment might be if you can take advantage ...

How many people receive Social Security benefits as a spouse?

A recent Social Security report found that 2.3 million individuals received at least part of their benefit as a spouse of an entitled worker. Some of these spouses had benefits of their own, but were eligible to receive higher benefit because the spousal benefit amount was greater than their own benefit. Others never worked outside the home ...

What is the most generous benefit available to retirees?

What’s one of the most generous benefits available to retirees? That’s easy. It’s Social Security spousal benefits ! These benefits are some of the most important, too.

What is the 1 year requirement for Social Security?

The 1-year requirement is also waived if you were entitled (or potentially entitled!) to Social Security benefits on someone else’s work record in the month before you were married. An example of these benefits would be spousal benefits, survivor benefits or parent’s benefits.

What is Julie's reduction to her own benefit?

This means that Julie’s reduction to her own benefit would be based on her age when she filed for her benefit. However, her reduction to the spousal benefit would be based on her age when Joe filed for his benefit. So, if Julie filed when she was 62, her own benefit would be reduced.

How long do you have to be married to qualify for spousal benefits?

You may also qualify for the spousal benefit If you’re divorced but the marriage lasted for at least 10 years and you’re not currently married.

How much of my spouse's Social Security is my full retirement?

Remember, in that case, it’s between 32.5% and 50% of the higher-earning spouse’s full retirement age benefit, depending on your filing age. However, it can seem a little more complicated if you have Social Security benefits from your work history.

How old do you have to be to get spouse's Social Security?

To qualify for spouse’s benefits, you must be one of these: At least 62 years of age.

When will my spouse receive my full retirement?

You will receive your full spouse’s benefit amount if you wait until you reach full retirement age to begin receiving benefits. You will also receive the full amount if you are caring for a child entitled to receive benefits on your spouse’s record who is younger than age 16 or disabled.

What happens if your spouse's retirement benefits are higher than your own?

If your benefits as a spouse are higher than your own retirement benefits, you will get a combination of benefits equaling the higher spouse benefit. Here is an example: Mary Ann qualifies for a retirement benefit of $250 and a spouse’s benefit of $400.

How much of my spouse's retirement is my full benefit?

Your full spouse’s benefit could be up to 50 percent of your spouse’s full retirement age amount if you are full retirement age when you take it. If you qualify for your own retirement benefit and a spouse’s benefit, we always pay your own benefit first. You cannot receive spouse’s benefits unless your spouse is receiving his or her retirement ...

What is the maximum survivor benefit?

The retirement insurance benefit limit is the maximum survivor benefit you may receive. Generally, the limit is the higher of: The reduced monthly retirement benefit to which the deceased spouse would have been entitled if they had lived, or.

What happens if you take your reduced retirement first?

If you took your reduced retirement first while waiting for your spouse to reach retirement age, when you add spouse’s benefits later, your own retirement portion remains reduced which causes the total retirement and spouses benefit together to total less than 50 percent of the worker’s amount. You can find out more on our website.

What does it mean to have a partner?

Having a partner means sharing many things including a home and other property. Understanding how your future retirement might affect your spouse is important. When you’re planning for your fun and vibrant golden years, here are a few things to remember:

Can my spouse's survivor benefit be reduced?

On the other hand, if your spouse’s retirement benefit is higher than your retirement benefit, and he or she chooses to take reduced benefits and dies first, your survivor benefit will be reduced, but may be higher than what your spouse received.

How much is spousal benefit reduced?

Specifically, your spousal benefit will be reduced by approximately 0.7% (25/36 of 1%) for each month before your FRA. If you file for benefits more than 36 months before your FRA, then your benefit will be reduced by approximately 0.4% (5/12 of 1%) for each month after 36 months.

How old do you have to be to file for spousal benefits?

Social Security spousal benefits are available to current spouses and widowed spouses. You must be at least 62 years old to file for a spousal benefit. Also, your spouse has to have filed for their Social Security Benefit first.

How much is my spouse's FRA benefit?

So, let’s say your spouse retires at his or her FRA and is eligible for a benefit of $1,600. Then, you would in turn be eligible at your FRA for $800. If you contributed to Social Security, you may wonder if your spousal benefit will be higher than your own benefit. Thankfully, you don’t need to worry.

Does Social Security determine spousal benefit?

Social Security will automatically determine which is higher between your benefit or your spousal benefit. Then, you will receive the higher amount. There are a couple specific details that can alter the amount of your spousal benefit.

Does Social Security make a difference in retirement?

However, there are some lesser known features of Social Security that can make a big difference for your retirement. Social Security spousal benefits are just one of these features. Intended for married couples with a sole or primary breadwinner, spousal benefits can significantly increase the amount of money you have coming in during retirement.

Do you get the most out of your spouse's Social Security?

Spousal benefits is like almost any Social Security discussion. You will get the most out of the program if you coordinate with your spouse. You’ll want to make sure the highest-earning spouse is waiting to maximize his or her benefits before filing.

How to ask your spouse to open their Social Security account?

Ask your spouse to create or open their my Social Security account, go to the ‘Plan for Retirement’ section, and note their retirement benefit estimate at their full retirement age or Primary Insurance Amount (PIA).

How long does it take to create a Social Security account?

Creating a free my Social Security account takes less than 10 minutes and you get access to many other online services. Plan for your future. Manage the present.

How to apply for spousal benefits?

You can expect the following when applying for Social Security spousal benefits: 1 You can receive up to 50% of your spouse’s Social Security benefit. 2 You can apply for benefits if you have been married for at least one year. 3 If you have been divorced for at least two years, you can apply if the marriage lasted 10 or more years. 4 Starting benefits early may lead to a reduction in payments. 5 If you have a work history, you’ll receive either your benefit or the spousal benefit, whichever is greater. 6 To be eligible, your working spouse will need to have already claimed benefits.

How long do you have to be married to receive spousal benefits?

You will still need to be married for at least one year before applying for benefits. Spousal benefits differ from personal benefits when it comes to delaying payments. If you delay personal benefits past full retirement age, the benefit increases over time. However, spousal benefits max out at full retirement age.

What happens if you remarry and your spouse passes away?

If your spouse passes away and you get remarried, the benefits could change. “The important thing to remember in receiving survivor benefits is that if you remarry before age 60, this will cut off your eligibility to collect on your deceased spouse’s or deceased ex-spouse’s record,” Barzideh says. “This could be a very expensive decision, because while a spousal benefit entitles you to 50% of the other spouse’s benefits, a survivor benefit would entitle you to 100% of those benefits.”

How long do you have to be married to get Social Security?

You should be married for at least one year before applying for Social Security benefits. “You are eligible for spousal benefits if your spouse has filed for Social Security benefits and you are at least age 62,” Moraif says.

What is the full retirement age?

The full retirement age varies by birth year and is usually age 66 or 67 . If you are married and your spouse begins collecting $2,000 per month at full retirement age, your spousal benefit will be $1,000 if you start payments at your full retirement age. How Much You Will Get From Social Security. ]

Do you get spousal benefits if you have a work history?

If you have a work history, you’ll receive either your benefit or the spousal benefit, whichever is greater.

How much does spousal benefit affect?

Depending on your age upon claiming, spousal benefits can range from 32.5 percent to 50 percent of your husband’s or wife’s primary insurance amount (the retirement benefit to which he or she is entitled at full retirement age, or FRA). Regardless of the amount of the spousal benefit, it does not affect the amount of your mate’s retirement payment.

How long do you have to be married to collect spousal benefits?

You qualify for spousal benefits if: Your spouse is already collecting retirement benefits. You have been married for at least a year. You are at least 62 (unless you are caring for a child who is under 16 or disabled, in which case the age rule does not apply).

How old do you have to be to receive survivor benefits?

You are at least age 60, unless you are disabled (then it’s 50) or caring for a child of the deceased who is under 16 or disabled (no age minimum). In most cases, survivor benefits are based on the benefit amount the late spouse was receiving, or was eligible to receive, when he or she died.

What percentage of survivor benefits are based on a child?

If the survivor benefit is based on your caring for a child, you receive 75 percent of the deceased’s benefit, ...

What is survivor benefit based on?

In most cases, survivor benefits are based on the benefit amount the late spouse was receiving, or was eligible to receive, when he or she died.

How much of a survivor's Social Security benefit do you get if you have a child?

If the survivor benefit is based on your caring for a child, you receive 75 percent of the deceased’s benefit, regardless of your own age when you file. Keep in mind. Your spousal benefit is not affected by the age at which your husband or wife claimed Social Security benefits.

Does Social Security increase if late spouse files for FRA?

With survivor benefits, if your late spouse boosted his or her Social Security payment by waiting past FRA to file, your survivor benefit would also increase. Your spousal or survivor benefits may be reduced if you are under full retirement age and continue to work. Social Security is phasing in the FRA increase differently for different types ...