A supplemental accident benefit covers many of the expenses that usually aren’t covered by a health plan. For example, a critical illness or cancer insurance plan pays out cash benefits in the event of a covered illness such as cancer, heart attack or stroke.

When should you get supplemental life insurance?

The younger and healthier you are, generally the less you’ll pay for premiums, but older people can still get life insurance. It may be wise to carry as much life insurance as you need to pay off your debts plus any interest, particularly if you have a mortgage or cosigned student loans with someone else.

Is accidental death insurance worth it?

Yes. Accidental Death Insurance is definitely worth buying in 2020. Not only this policy covers your family and relatives but it also gives you assurity that your family won’t become homeless or go in massive debt after your unexpected death.

What is accident insurance and is it worth it?

Is accident insurance worth it? Accident insurance is relatively inexpensive, but it also offers relatively small benefits. You might benefit from an accident insurance policy if your health insurance has high deductibles, because accident insurance offers a one-time payout that can help you afford medical care.

Should you buy supplemental life insurance through your employer?

There is no guarantee or limit on future cost increases. SUMMARY : Purchasing supplemental group life insurance through your employer is easy and convenient, but is only a good idea for employees who have severe health issues or not insurable.

What is a accident supplement?

An accident supplement (also known as accident insurance) is a policy that reimburses an insured in the event of a claim arising from an accident or injury. The policies typically have benefit amounts that range from $1,000 up to $10,000 or more. Most accident supplements have small deductibles.

Are supplemental benefits worth it?

With a supplemental health insurance plan, you get extra protection that helps pay for covered accidents and unexpected critical illnesses. This coverage also can help you pay for those other non-medical expenses that go along with an injury or serious illness.

What is the difference between accident insurance and disability insurance?

While disability insurance pays you benefits each month you remain disabled, an accident policy only pays out a preset number of times or over a specific range of time. Accident insurance also offers relatively low benefits compared to disability insurance.

Is accident and sickness insurance worth?

If an accident results in medical expenses your current health insurance doesn't cover, accident insurance can serve as a financial cushion should the unexpected happen. Accident insurance also helps complement disability insurance by allowing you to claim benefits even if your injuries don't keep you out of work.

Why is supplemental insurance not good?

For example, it may not cover all the expenses you expected; it may impose waiting periods before payments start; or it may contain limits based on how much you paid and for how long. It is important to understand that supplemental insurance is not regulated by the Affordable Care Act.

Who might benefit from supplemental insurance and why?

Supplemental health insurance can be an added layer of protection used to cover what a traditional health insurance plan does not. It can also help pay for nonmedical expenses that can go with illness or injury, such as lost income or childcare.

What does Dave Ramsey say about supplemental insurance?

QUESTION: Michelle on Twitter wants to know what Dave thinks about supplemental insurance like Aflac. ANSWER: Some supplemental insurance is good, but most of it is not. I don't believe in cancer insurance because your health insurance covers that. I don't believe in short-term disability insurance.

What is covered under accident insurance?

It covers accidental death, loss of limbs or sight, or other permanent disabilities resulting due to an accident.

Are accident plans necessary?

If you are the sole breadwinner of the family or have children and elderly parents relying on your income, you need an accident plan. In the scenarios above, we talked about how you can get income benefits from injuries that leave you temporarily unable to work.

What is considered an accidental injury?

Accidental injury means an injury that results accidentally or from any external, violent and anticipated causes. For instance, an unintentional bodily injury resulting from any external force and against the normal course of events can be categorized as an accidental injury.

Should you get accident forgiveness?

Based on the pros and cons listed above, accident forgiveness isn't worth it for everyone. It's only beneficial for drivers who have no history of accidents and meet all the other eligibility requirements. If you're already a very safe driver, you might end up paying for accident forgiveness coverage and never use it.

Is accidental insurance tax deductible?

No deduction in income tax is available for the portion paid towards accidental cover. Remember, there is much more to insurance than just the tax benefits. The primary function of insurance policies is to offer financial protection against unexpected incidents.

What is supplemental accident insurance?

Supplemental accident insurance, also called accident insurance or personal accident insurance, helps you handle out-of-pocket costs you may pay after an accidental injury.

What does supplemental accident insurance cover?

Coverage for supplemental accident insurance differs, depending on the injuries covered in your plan. However, take a look at some of the types of injuries that a supplemental accident insurance policy may cover due to accidents:

How does supplemental accident insurance work?

Let's walk through an example of how supplemental accident insurance might work.

How much does supplemental accident insurance cost?

Most types of supplemental insurance don't cost too much. The same is generally true for supplemental accident insurance.

Is supplemental accident insurance worth it?

Whether you get supplemental accident insurance depends on your family's needs. For example, you may want to get supplemental accident insurance if you have an active lifestyle or a limited budget for unexpected out-of-pocket medical expenses.

Deciding if you need supplemental accident insurance

You probably don't want to envision an accident happening to you or one of your family members. (Really — who does?) However, you may not realize truly how easy it can be to get supplemental accident insurance to prepare for a worst-case scenario.

What are insurance supplemental benefits?

Overview. Supplemental benefits products are insurance policies that provide financial protection against expenses associated with accidents or illnesses not covered by major medical insurance . These benefits supplement existing medical coverage to help pay unexpected out-of-pocket costs.

Why do I need accident insurance?

Accident insurance is supplemental to your primary health plan that helps you pay for out-of-pocket medical and non-medical costs from an accident or injury . Accident insurance provides lump-sum cash benefits that are paid directly to you, and not the doctors and hospitals, on an indemnity basis.

What is considered an accidental injury?

Accidental injury as the name suggest delineates all those types of injuries which are the outcome of an unforeseen and unfortunate mishap. Falls, cuts, burns, road accidents, bites, stings and drowning are examples of accidental injuries . Such injuries are covered under individual personal accident insurance.

What is accident plus coverage?

Accident Plus is a flexible plan that offers two levels of coverage . Accident Plus is supplemental accident insurance that provides employees with off-the-job coverage for accident -related expenses such as ambulance services, hospital confinement and medical treatment.

What supplemental insurance is best?

The Best Medicare Supplemental Insurance is: Best Overall for Medicare : Cigna . Most Affordable Medicare Supplemental Insurance: Humana . Best Customer Service: Blue Cross Blue Shield . Best for Claims: Aetna . Best for Quick Service: United Medicare Providers. Best for Drug Inclusion: UnitedHealthcare .

Is supplemental medical insurance worth it?

With a supplemental health insurance plan, you get extra protection that helps pay for covered accidents and unexpected critical illnesses. This coverage also can help you pay for those other non- medical expenses that go along with an injury or serious illness.

Should I get supplemental accident insurance?

Consider supplemental accident insurance if you: Are looking to fill a gap in health insurance . Have a major medical plan with significant deductibles or copayments. Are looking to experience fewer out-of-pocket medical expenses in case of an accident .

What is an accident supplement?

An accident supplement (also known as accident insurance) is a policy that reimburses an insured in the event of a claim arising from an accident or injury. The policies typically have benefit amounts that range from $1,000 up to $10,000 or more. Most accident supplements have small deductibles. ($100 or $250 are common amounts.) ...

Is Accident Supplement a stand alone plan?

Accident supplements are not regulated by the ACA, so they are available for purchase year-round. They are not suitable as stand-alone health coverage, but they can be a good option in conjunction with a major medical plan, especially one with a relatively high deductible.

What Does Supplemental Accident Expense Mean?

Supplemental accident expense is accident insurance that can be added to an existing health plan to cover expenses incurred from an accident or illness not ordinarily covered under a major medical plan.

Insuranceopedia Explains Supplemental Accident Expense

This insurance may benefit anyone who already has an existing health plan with a substantial deductible amount, whose access to health care providers is limited for some reason, and who wants to lower their out-of-pocket medical expenses. Certain insurance companies may offer this policy without health requirements or any evidence of insurability.

FAST FACTS

A loss must occur within one year from the date of an accident to be covered under the Supplemental Occupational Accident Benefit.

What You Need To Do

You must provide satisfactory written proof of loss, usually in the form of a physician’s statement or death certificate, to the Fund Office within one year of the date of the loss. Contact the Fund Office at 301-731-1050 or at 1-800-929-3983 to begin receiving your benefit.

Individuals, Families and Small Business Health Insurance

Accidents happen and life can change in an instant. An accidental injury can leave you with large medical bills that your health insurance doesn’t fully cover. Our agents understand your needs and know how important it is to be supported when the unexpected happens.

What Is Supplemental Accident Insurance?

No matter how careful you are, accidents can happen. Your health insurance plan will only pay for so much, and the rest is your responsibility. This is where supplemental accident coverage can help. Supplemental insurance not only helps pay your out-of-pocket medical bills, but it can also be used for living expenses.

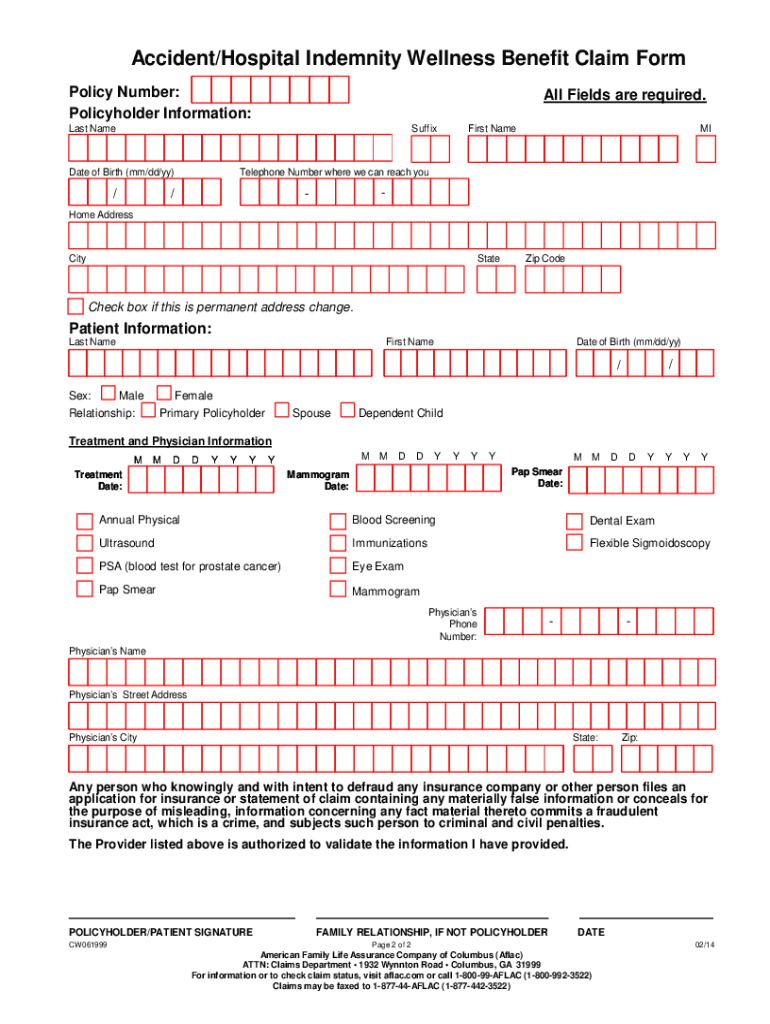

Filing Claims

Learn how to file a claim. File a Claim Organized Sports Benefit for Dependents Health Screening Benefit

Contact Info and Member Portal

Contact Aetna member services. Register on the member portal to file and track claims, sign up for direct deposit and view plan documents. Member Portal / Certificate of coverage Contact Information