The cost of employee benefits (national average)

| Sector | Average pay cost | Average benefits cost | Average healthcare cost | Total hourly cost |

| 1 | Civilian workers | $26.85 | $12.06 | $3.09 |

| 2 | State and local workers | $33.09 | $20.50 | $6.10 |

| 3 | ||||

| 4 | Private industry | $25.89 | $10.76 | $2.63 |

What does the average employer spend on employee benefits?

What do employee benefits cost? Breaking down the numbers further, the study finds that benefits cost the average employer $21,726 annually per employee. With wages, the total cost is $71,334...

How do you calculate benefit cost per employee?

- Gross Earnings – Lets use an example here for our Sample Employee Fred Fredders. ...

- Employer Paid Taxes are also a big expense that must be added in. ...

- Employer Paid Insurance and Other % Based Costs – Insurance is always a large cost to the Employer and plays a large factor in the overall Hourly Costs. ...

How much should employers spend on benefits?

- Clearly identify what you want to learn. The key here is to be as specific as possible about what skill you want to build. ...

- Win — even if you lose. This is the ultimate way to make sure your 20% time doesn’t go to waste. ...

- Be flexible and committed. ...

- Look for ways to make it fun. ...

- Think in decades. ...

How much should employers contribute to employee benefits?

There are two HSA contribution levels for employers. For employers whose companies have fewer than 500 employees, the average contribution for a single employee is $750 and $1,200 for an employee with a family.

How much should I budget for employee benefits?

Experts suggest that you should expect to pay a range of 1.25 to 1.4 times each employee's base salary. That extra $10,000 might include things like $120 for life insurance—an average cost for your younger and older workers—$5,760 for family health coverage, $520 for dental insurance, and $200 for long-term disability.

How much do benefits typically cost per employee?

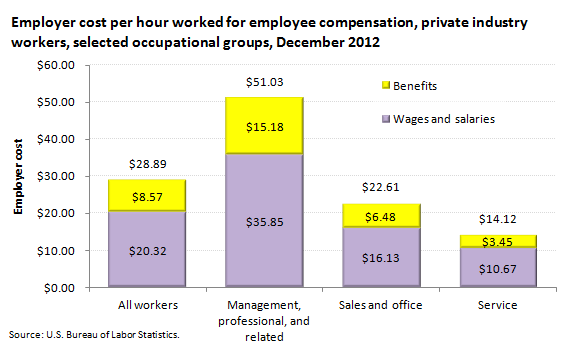

The national average of employee benefits cost Taken together, the average total compensation is $37.73 per hour. For state and government workers, the average cost for employers paying employee benefits equals $19.82 per hour, in addition to their average salary and wage which was $32.62 per hour.

How do you calculate the cost of benefits for an employee?

Find the benefit load by adding the total annual costs of all employees' perks and divide it by all employees' annual salaries to determine a ratio — that ratio is your company's benefits load.

What percentage of employee cost is benefits?

According to the latest data from the U.S. Bureau of Labor Statistics (BLS), the average total compensation for all civilian employees in 2020 is $37.73 per hour. Benefits make up 32 percent of an employee's total compensation.

What is the most valued employee benefit?

It comes as no surprise that the number one most valued benefit by employees is health, dental, and vision insurance. Unfortunately, health insurance is also the most expensive benefit to offer, averaging around $6,435 per employee with individual coverage, and $18,142 for family coverage.

What is fully loaded cost of employee?

The simplest way to derive the average loaded cost of an employee is to count up your total corporate expenses and divide it by the total number of productive hours worked.

How do you calculate average benefits?

A cost amount calculated by dividing the total cost by the units of production. Thus, if a firm produces 10,000 units of output for a total cost of $25,000, the average cost of each unit is $25,000/10,000 units, or $2.50 per unit.

What is the formula for calculating benefits?

In 2022, it is: 90 percent of the first $1,024 of your AIME; plus 32 percent of any amount over $1,024 up to $6,172; plus 15 percent of any amount over $6,172.

How are benefits calculated based on salary?

Calculate the average benefits load for all employees by taking the total annual amount spent by the company on benefits and dividing it by the total annual amount spent on salary.

What is the average cost of fringe benefits?

Although rates vary, according to the Bureau of Labor Statistics, the average fringe benefit rate (aka benefit costs) is 30%.

What is the employer's cost on a salary?

The binding costs you need to coverType of costPercentage of employee's base salaryBase salary $30,000FICA Medicare1.45%$435Unemployment insurance FUTA6% of first $7,000$420Unemployment insurance SUTA2.7%-3.4%$900Workers' Comp$0.12 for each $100 of wages$362 more rows•Nov 29, 2018