How do you calculate fringe benefits?

In just a few tenths of a second, you will see:

- Total Contribution Per Month into a Bona-Fide Plan

- Your Monthly Savings

- Your Annual Savings

How to calculate fringe benefits?

Fringe benefits for all students should be calculated at 7.65%. For graduate assistantships, calculate fringe benefits on wages only (not on the tuition support). Multiply the compensation to be paid with grant funds by 7.65%; EXAMPLE: A student will be hired to work 200 hours and paid $10/hour with grant funds ($2,000 total).

What qualifies as a fringe benefit?

Fringe benefits are the additional benefits offered to an employee, above the stated salary for the performance of a specific service. Some fringe benefits such as social security. Social Security Social Security is a US federal government program that provides social insurance and benefits to people with inadequate or no income. The first Social.

What is considered fringe benefit?

What Is a Fringe Benefit? A fringe benefit is a form of pay (including property, services, cash or cash equivalent) in addition to stated pay for the performance of services. Under Internal Revenue Code (IRC) Section 61, all income is taxable unless an exclusion applies. Some forms of additional compensation are

What is the Fringe percentage of a salary?

The rate is calculated by adding together the annual cost of all benefits and payroll taxes paid, and dividing by the annual wages paid. For example, if the total benefits paid were $25,000 and the wages paid were $100,000, then the fringe benefit rate would be 25%.

What is the average percentage of benefits to salary?

According to the latest data from the U.S. Bureau of Labor Statistics (BLS), the average total compensation for all civilian employees in 2020 is $37.73 per hour. Benefits make up 32 percent of an employee's total compensation.

What are legally required fringe benefits?

Vacation, health insurance, long-term disability coverage, tuition reimbursement, and retirement savings plans are just a few of the many benefits employers may offer employees.

How are fringe benefits granted calculated?

To determine the grossed-up value/tax base of the fringe benefit, the actual monetary value or the actual amount of benefit furnished, granted or paid shall be divided by sixty-five percent (65%) subject to 35% Fringe Benefit Tax (FBT) or the divisor shall be seventy-five percent (75%) subject to 25% FBT.

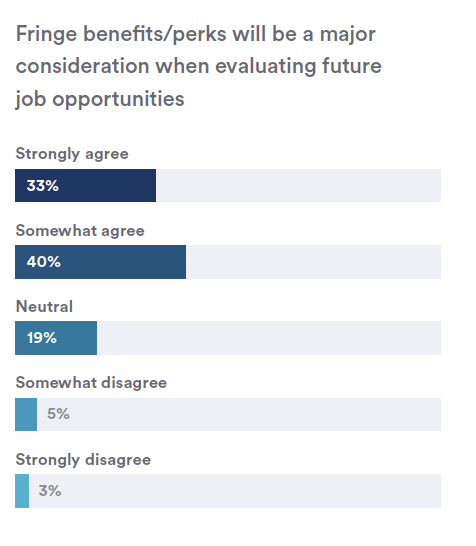

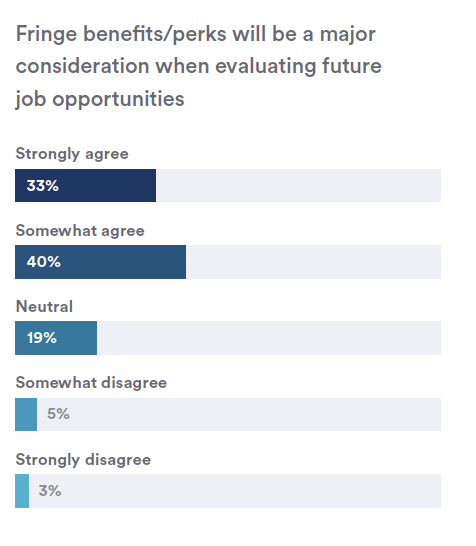

What is the most valued employee benefit?

It comes as no surprise that the number one most valued benefit by employees is health, dental, and vision insurance. Unfortunately, health insurance is also the most expensive benefit to offer, averaging around $6,435 per employee with individual coverage, and $18,142 for family coverage.

How much should I budget for employee benefits?

Experts suggest that you should expect to pay a range of 1.25 to 1.4 times each employee's base salary. That extra $10,000 might include things like $120 for life insurance—an average cost for your younger and older workers—$5,760 for family health coverage, $520 for dental insurance, and $200 for long-term disability.

What are the 7 fringe benefits?

These include health insurance, life insurance, tuition assistance, childcare reimbursement, cafeteria subsidies, below-market loans, employee discounts, employee stock options, and personal use of a company-owned vehicle.

How is monthly fringe benefit tax calculated?

To calculate an employee's fringe benefit rate, add up the cost of an employee's fringe benefits for the year (including payroll taxes paid) and divide it by the employee's annual wages or salary. Then, multiply the total by 100 to get the fringe benefit rate percentage.

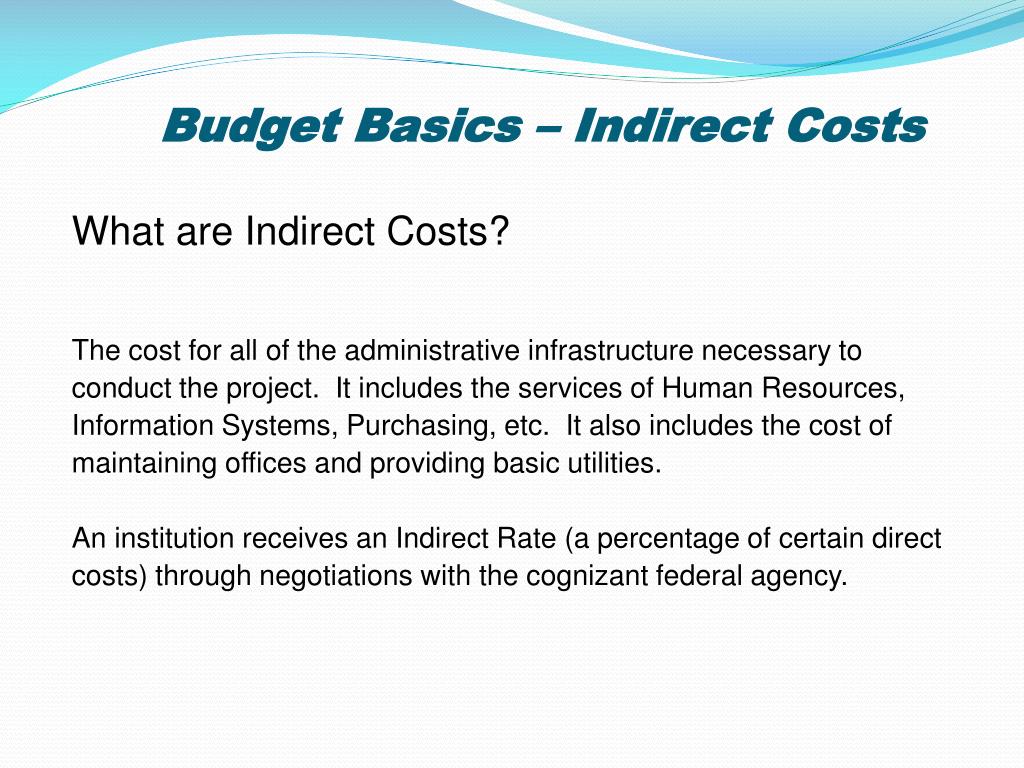

What is the standard computation rate for fringe benefits in a US federal grant?

Whenever grant funds are used to pay salaries and wages, associated fringe benefits must also be charged to the grant. VSU's negotiated indirect cost rate agreement has established a fringe benefit rate of 37% for full-time employees that should be used to calculate fringe benefits for grant proposals.

How do you calculate the average cost of benefits per employee?

Find the benefit load by adding the total annual costs of all employees' perks and divide it by all employees' annual salaries to determine a ratio — that ratio is your company's benefits load.

What are fringe benefits examples?

Some of the most common examples of fringe benefits are health insurance, workers' compensation, retirement plans, and family and medical leave. Less common fringe benefits might include paid vacation, meal subsidization, commuter benefits, and more.

How much is the monetary value of fringe benefit paid to managerial employee?

Fringe benefits provided to managerial and supervisory employees are subject to the 32% fringe benefit tax.

How many hours a year is fringe benefit?

Example of Fringe Benefit Rate. Let's assume that a company operates 5 days a week for 8 hours a day for 52 weeks a year resulting in a total of 2,080 hours per year.

What is fringe rate?

A fringe benefit rate is a percentage that results from dividing the cost of an employee's fringe benefits by the wages paid to the employee for the hours actually worked.

How much does an employer spend per hour?

That equates to $5,698 per worker, per year. Employers spend an average of $2.65 per employer, per hour, for payments required by law, like Social Security and Medicare. Retirement plans and investment benefits cost employers an average of $0.55 an hour for defined benefits and $0.78 per hour for defined contributions, per employee.

What are the benefits of an employer?

Though salary numbers are more frequently discussed, the health insurance, retirement, time off and legally required benefits, like Social Security contributions, offered by a company are equally , if not more, important. Many employees might not realize how costly these benefits are for an employer to provide.

How much does paid leave cost?

Paid leave benefits vary by employer, but cost on average about $5,000 per employee . This, of course, varies by industry and from company to company, and changes depending on whether a worker is entry-level, management, hourly or in an exempt position.

How much has health care increased since 2005?

Benefits Pro noted an increase of 368 percent since 2005 in the cost of employee benefits. During that time, health care alone has increased by 28 percent. This could be due in part to a spike in cases of chronic illness or to higher costs from health care providers.

Which cities have lower benefits?

Some cities, like Miami, enjoy lower benefit costs. Others, like the greater Phoenix area, have seen an increase in the recent past due to the influx of Fortune 500 companies that have set up shop there.

How much is compensation per hour in 2021?

Overall, compensation costs among private industry employers in the United States averaged $36.64 per hour worked in March 2021. Wages and salaries, at $25.80 per hour, accounted for 70.4 percent of these costs, while benefits, at $10.83, made up the remaining 29.6 percent. The June 2021 national release on Employer Costs for Employee Compensation ...

How much does an employer pay an hour in 2021?

Private industry employer costs for employee compensation among the four regions of the country ranged from $32.69 per hour in the South to $41.17 in the Northeast during March 2021, the U.S. Bureau of Labor Statistics reported today.

What is the total hourly pay for 2021?

In the Northeast, hourly total compensation costs in March 2021 were comprised of the following: wages and salaries ($28.36) made up 68.9 percent, while total benefits ($12.80) accounted for the remaining 31.1 percent of compensation costs.