Advantages of Using a 529 Plan to Save for College

- Tax benefits. In most cases, states exclude qualified 529 plan distributions from taxable income, and many states offer a state income tax deduction or state income tax credit for 529 ...

- Low maintenance. ...

- High contribution limits. ...

- Favorable financial aid treatment. ...

- Flexibility. ...

What companies offer 529 college savings plans?

State tax incentives for employer 529 plan matching

- States promote saving for college. State-sponsored 529 plans are tax-advantaged accounts designed to help families save for college and avoid excessive student loan debt.

- State tax incentives for employers. ...

- 529 plans as an employee benefit. ...

- Employee 529 plan tax considerations. ...

What are the best 529 college savings plans available?

Here’s the list:

- Gold – Utah’s Utah Educational Savings Plan offers great passive investments from Vanguard, my favorite mutual fund company. ...

- Gold – The Vanguard 529 College Savings Plan of Nevada also offers Vanguard’s great low cost passive investments.

- Gold – Alaska’s T. ...

- Gold – Maryland’s Maryland College Investment Plan also offers investments from T. ...

How much should I contribute to a 529 plan?

How much can you contribute to a 529 plan in 2022?

- Annual 529 contribution limits. In 2022, many families are trying to make the most of their tax-advantaged savings accounts. ...

- Annual gift tax exclusion. ...

- The 5-year election. ...

- Lifetime gift tax exemption amount. ...

- 529 plan aggregate limits. ...

- 529 plan state income tax benefits. ...

- Next Steps. ...

What are the benefits of investing in a 529?

What Are the Pros and Cons of Using a 529 Plan?

- Pros and Cons of 529 Plans

- Advantages of Using a 529 Plan to Save for College. In most cases, states exclude qualified 529 plan distributions from taxable income, and many states offer a state income tax ...

- Disadvantages of Using a 529 Plan to Save for College. ...

- Follow us >> Facebook, Twitter, LinkedIn, Instagram <<

Is the 529 plan worth it?

How the Rich Benefit From 529 Plans. One of the biggest benefits of a 529 plan is you don't have to pay capital gains tax on any distributions used for education. The capital gains tax rate is based on income, and if your household makes less than $83,350, your capital gains tax rate is 0%.

What are the advantages of a 529 college savings plan?

529 plan investments grow on a tax-deferred basis and distributions are tax-free when used to pay for qualified education expenses, including college tuition and fees, books and supplies, some room and board costs, up to $10,000 in K-12 tuition per year and up to $10,000 in student loan repayment per beneficiary and ...

What is the downside to a 529 account?

The rules on 529 plans are strict. The most important one is this: you must use funds in a 529 account to pay for qualified educational expenses. Otherwise, you'll owe taxes on the investment gains at whatever the IRS would normally charge you plus an additional penalty rate of 10 percent.

Why you shouldn't use a 529?

The largest drawback to a 529 plan is that colleges consider it when deciding on financial aid. This means your child could receive less financial aid than you might otherwise need.

What is the average return on a 529 plan?

In 2011, people thought a rate of return around 3% for a 529 plan was amazing. Since 2011, the S&P's compounded annual growth rate (CAGR) is ~12% from June 2011 to June 2020. That is a lot more tax-free growth than the 3% account owners got back in 2011.

Does money in 529 grow tax-free?

Although contributions are not deductible, earnings in a 529 plan grow federal tax-free and will not be taxed when the money is taken out to pay for college.

What happens to my 529 if my child doesn't go to college?

If your child doesn't use all of their 529 funds, you'll be able to use up to $10,000 to pay off their student loans. If one child doesn't go to college at all, you can use their funds to pay up to $10,000 in student loans for each of their siblings.

How much should I put in 529 plan?

$529,000States with the highest aggregate limitsStateAggregate limitMissouri$550,000New Hampshire$542,000California$529,000New York, Rhode Island$520,0001 more row

What is the best way to save for a child's college?

8 Ways to Save for Your Child's College EducationOpen a 529 plan.Put money into eligible savings bonds.Try a Coverdell Education Savings Account.Start a Roth IRA.Put money into a custodial account.Invest in mutual funds.Take out a permanent life insurance policy.Take out a home equity loan.

What does Dave Ramsey say about 529 plans?

Dave warns against using a 529 Plan that would freeze your options or automatically change your investments based on the age of your child. Stay away from so-called “fixed” or “life phase” plans. You want to stay in control of the mutual funds at all times.

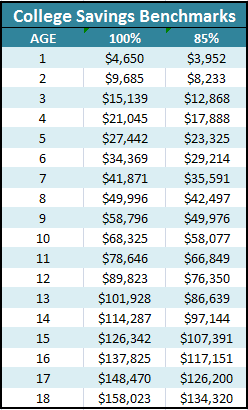

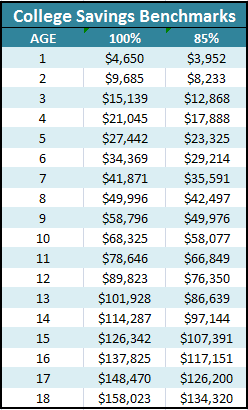

How much should you have in 529 by age?

Average college savings by ageAVERAGE AMOUNT SAVED FOR COLLEGEAge 0 – 6$7,929Age 7 – 12$15,359Age 13 – 17$27,559Age 18+$27,778

How much should I have saved for my child's college?

Our rule suggests a savings target of approximately $2,000 multiplied by your child's current age, assuming attendance at a 4-year public college (at $22,180/year), and your family aims to cover approximately 50% of college costs from savings.

What are the benefits of a 529 plan?

This will allow you to find the one that offers the options best suited to your needs. 529 plans offer several benefits, including: Federal tax breaks.

What are the drawbacks of a 529 plan?

There are pitfalls you should look out for when investing in a college savings plan, including: Tax penalties for certain withdrawals.

What are qualified higher education expenses?

Qualified higher education expenses include tuition and fees, room and board (as long as you are enrolled at least half-time), books and computers or computer equipment for the student’s use. State tax breaks. States may offer tax benefits such as tax credits or a tax deduction for contributions to 529 plans.

How much can you make from education savings account?

Now, they also can be used for some K-12 costs in certain states. You can now make up to $10,000 in tax-free withdrawals annually to pay for expenses at public, private or religious elementary and secondary schools.

How often can you change your 529 plan?

The ability to change investments. Federal tax law allows the account holder to change investments twice a year or when there’s a change in beneficiary. That means if you don’t like your plan’s performance, you aren’t stuck with your initial selection. “Check your investments in your 529 plan account quarterly to ensure you are invested in the right mix of options,” says Mary Anne Busse, a 529 plan expert and managing director at Great Disclosure, a consulting firm in Royal Oak, Michigan.

How many states offer guaranteed tuition?

About a dozen states offer guaranteed tuition plans that allow you to save for future tuition at today’s prices. This allows you to sidestep tuition price hikes and inflation. You can compare plans by state to see if your home state offers a prepaid tuition plan.

Do you have to be an investment expert to invest in a 529 plan?

Age-based options. You don’t have to be an investing expert to develop a successful 529 plan savings strategy. You can choose a package of investments based on the age of the student and how risk averse your family is.

What is the benefit of a 529 plan?

The biggest benefit of the 529 plan lies in raising money without taxes tax-deferred growth and tax-free withdrawals it can provide. 529 plans can be invested in a wide range of investment options. You can invest money in mutual funds and the stock market, it all depends on you.

Why is a 529 account good?

So, here are the top reasons a 529 college savings account is increasingly worthwhile. 1. The most known benefits of 529 plan – a tax break. The decision of using 529 college savings plan to fund college education costs will provide you with a variety of state and federal tax benefits.

Why is 529 plan different from other plans?

Why are plans so different? The reason is that almost every state sponsors its own 529 plan to pay costs at accredited schools in any state. Also, many offer deductions on state income tax to residents contributing to their home state’s plan.

Why is it important to set up a 529 plan for your child?

So it is important to set up a 529 plan for your child or beneficiary as early as possible to take full advantage of the growth and tax opportunities.

What is the best practice for investing in 529 plans?

The best practice is to consider this as an investment plan and you need to evaluate the particular 529 plans as you would any other investment. Check investment plan, plan performance and underlying fees and expenses before you invest.

What happens if you don't use your 529?

If you don’t use money from 529 plan for qualified higher education expenses, you will not lose it. But you will lose some of the preferential tax benefits. In this case, the earnings portion of your withdrawals will not be tax-free.

How much can you contribute to a 529 plan?

Contributions can be as much as $140,000 for couples or $70,000 for individuals — into one year by using the annual gift exemption.

Why is 529 so popular?

The reason why the 529 plan has become so popular isn’t just because college is getting so expensive, it’s also because it offers a ton of benefits for savers. From reducing taxes today and potentially creating a legacy for tomorrow to flexibility of use, the 529 plan really does have it all. In the end, the accounts are one of the best options for savers on a variety of fronts.

What is a 529 gift?

Contributions to a 529 plan are considered “completed gifts” that remove assets from a taxable estate. Thanks to a provision in the tax code, savers are able to contribute five times the annual gift tax exclusion – $150,000 for couples filing jointly, $75,000 for an individual – per beneficiary. While you should consult your own tax advisor, this huge sum can significantly reduce your taxable estate.

Can you switch beneficiaries of a 529 plan?

Because of this, account owners are allowed to switch beneficiaries of the plan at will. For example, if you’re saving for child A and they decide not to go to college or there’s left over money in the account after paying for school expenses, you can change the remainder to child B or even yourself.

Does a 529 plan qualify for FAFSA?

Currently, only 5.64% of the assets in a parent-owned 529 plan is factored into the Free Application for Federal Student Aid ( FAFSA ). This allows students to still qualify for grants, work study programs and low-cost student loans. This is unlike Uniform Gift to Minors Account ( UGMA) and Uniform Transfer to Minors Account ( UTMA) accounts, which are counted as the student’s assets and directly impact FAFSA calculations. The same can be said for regular brokerage accounts, which come with the added hassle of taxes.

What is a 529 plan?

A 529 plan is designed to encourage early and consistent savings efforts by offering an easy, affordable and convenient way for families to save for college. While the tax advantages are one of the primary benefits, states also offer a variety of features and benefits to help families reach their college savings ...

How much can you contribute to a 529 plan?

Many plans offer maximum contribution limits of $300,000 or more . Assets within 529 plans are protected from bankruptcy. Most states offers a low cost plan that can be opened by contacting the plan directly.

How much can you contribute to a charitable account?

Account owners can make a lump sum contribution of up to $75,000 per beneficiary or $150,000 if married filing jointly and avoid incurring a Gift Tax on this amount by electing to use five years of the annual gift tax exclusion all in one year. After utilizing this provision, the annual exclusion cannot be used again for the same beneficiary until the five year period has passed. Should a donor die within those five years, a pro-rata amount of the gift will revert back to their estate and be treated as a taxable gift.

Is a withdrawal from a college taxed?

All withdrawals are exempt from federal income tax when used for qualified higher education expenses.

What is a 529 plan?

A 529 plan account owner must select from a menu of investment options offered by the 529 plan. This typically includes static investment portfolios that aim to achieve a targeted level of risk, individual fund portfolios and age-based portfolios that automatically shift asset allocation as the beneficiary gets closer to college.

What is the maximum amount you can contribute to a 529 plan?

Maximum aggregate limits vary by state, ranging from $235,000 to $529,000.

When will 529 be available for 2021?

April 14, 2021. Paying for college is a major expense. If you’re thinking about opening a 529 plan for a child or grandchild, it’s important to understand 529 plan rules and how they work. This list of pros and cons of 529 plans will help you make the right choice for your child’s college savings.

Can a 529 plan be rolled over to another state?

State income tax recapture. If a 529 plan account owner does a rollover into another state’s 529 plan, any state income tax deductions and credits previously claimed may be subject to recapture, and the earnings portion of the outbound rollover may be added back to state taxable income.

Do 529 plans have to be taxable?

In most cases, states exclude qualified 529 plan distributions from taxable income, and many states offer a state income tax deduction or state income tax credit for 529 plan contributions. 529 plans are the only college savings plan to offer state tax benefits.

Is a 529 account considered a parent asset?

Favorable financial aid treatment. When a dependent student’s parent or a dependent student owns a 529 plan it is reported as a parental asset and has a relatively minimal effect on financial aid eligibility. Distributions from parent- and student-owned accounts are not counted as income on the Free Application for Federal Student Aid (FAFSA).

Is a 529 plan less expensive than a 529 plan?

The more families pay in 529 plan fees, the less they are able to save for college. Direct-sold 529 plans are less expensive than advisor-sold 529 plans, but expenses can also vary among 529 plan portfolios. It’s important to research your options and find a low-cost 529 plan option that meets your college savings needs.

What is a 529 account?

A 529 education savings plan is an investment account where you save funds over time to pay for tuition and other expenses at any college or university, as well as some primary or secondary school tuition costs.

What is the alternative to 529?

The two main alternatives to 529 plans include the Coverdell Education Savings Account (ESA) and custodial accounts governed by the Uniform Transfers to Minors Act (UTMA) and Uniform Gifts to Minors Act (UGMA).

What happens if you don't use your 529?

Penalty for certain withdrawals: If you end up not needing the funds in a 529 plan and you can’t transfer them to another beneficiary, you may need to pay taxes on your earnings along with a 10% withdrawal penalty.

What is a Coverdell account?

A Coverdell Education Savings Account is another option when it comes to saving for your child’s college education. Like a 529, it can be used for elementary and high school education, as well as higher education.

What does a beneficiary on a 529 plan get?

The beneficiary designated on the 529 plan receives a tax-free scholarship from the institution they choose to attend.

How much can you take out of K-12 tuition?

Remove up to $10,000 for K-12 tuition without that income-generating taxes or withdrawal penalties.

Can parents contribute to a 529 plan?

While the parents will remain in charge of the account, all related family members and even some friends have the right to contribute to this manner of account. As mentioned, parents must, at a minimum, contribute a base percentage to an existing 529 plan every month. From there, however, they have the opportunity to accept checks or cash payments from relatives designed to help their child afford a college degree.

Can you add more to a family retirement plan?

Regardless of which plan you pick, you’ll be expected to meet monthly minimal contributions to your plan in order to keep it open. You can, of course, add more to the plan than this minimal contribution, but how much you want to add is up to you. Note that other family members can contribute to these funds as long as you give them access and permission to do so.

Is a 529 plan FDIC insured?

FDIC-insured options within 529 plans are also a available for families who are risk-averse. Parents and grandparents who witnessed their retirement accounts get wiped out by the Great Recession may be hesitant to leave their child’s education fund at the mercy of volatile stock and fixed-income markets.