Advantages of a Roth IRA

- Investments Grow Tax-Free. The greatest advantage over 401 (k)s is that since you contribute to your Roth IRA with taxed money, the growth isn’t subject to taxation, and you won’t ...

- More Freedom With Investment Options. ...

- Offers Spousal IRA. ...

Is 401k why better than IRA Roth?

While Roth IRAs do boast several key benefits, the 401 (k) does have its merits as well. For one, many 401 (k)s offer matching contributions from your employer. Matching contributions are basically...

Why is a Roth IRA better than a 401k?

With a traditional 401 (k), you don’t pay taxes on the income you’re funneling into your investments. But when you retire, you pay taxes when you withdraw money from that account. With a Roth IRA, you contribute the money after-taxes, so while you don’t get the immediate tax break, you don’t have to pay any taxes when you retire.

Which is better a 401k or a Roth IRA?

Key Takeaways

- Roth IRAs have been around since 1997. 1 Roth 401 (k)s came into existence in 2001. 2

- A Roth 401 (k) has higher contribution limits and allows employers to make matching contributions.

- A Roth IRA allows your investments to grow for a longer period, offers more investment options, and makes early withdrawals easier.

What's the difference between a Roth and a traditional 401k?

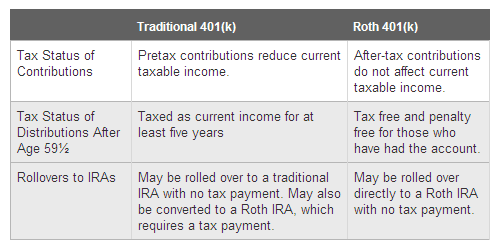

Traditional 401 (k)-Which Is Better? The difference between a traditional and a Roth 401 (k) comes down to when you pay the taxes. While Roth accounts have generally been advised for younger savers, a Roth 401 (k) can also give older savers a chance to benefit from tax-free distributions. If your employer offers both, you don't necessarily have to choose one or the other. ...

Is it better to use Roth IRA or 401k?

In many cases, a Roth IRA can be a better choice than a 401(k) retirement plan, as it offers a flexible investment vehicle with greater tax benefits—especially if you think you'll be in a higher tax bracket later on.

What is the downside of a Roth IRA?

Key Takeaways One key disadvantage: Roth IRA contributions are made with after-tax money, meaning that there's no tax deduction in the year of the contribution. Another drawback is that withdrawals of account earnings must not be made until at least five years have passed since the first contribution.

Why traditional 401k is better than Roth 401k?

For those with less familiarity, a “traditional“ 401(k) is funded with pretax money while a Roth 401(k) is funded with post-tax money. The only difference between these account types is when you decide to pay your taxes.

What are the pros and cons of a Roth 401k?

The Pros and Cons of a Roth 401(k)Pros:Withdrawals are tax-free. ... Special situations allow for penalty-free early distribution. ... There are no income limitations. ... Cons:Contributions are not tax-deductible. ... Minimum distributions are required.

At what age does a Roth IRA not make sense?

Unlike the traditional IRA, where contributions aren't allowed after age 70½, you're never too old to open a Roth IRA. As long as you're still drawing earned income and breath, the IRS is fine with you opening and funding a Roth.

What age should you open a Roth?

Minors cannot generally open brokerage accounts in their own name until they are 18, so a Roth IRA for Kids requires an adult to serve as custodian.

Should I convert my 401k to a Roth 401k?

Converting all or part of a traditional 401(k) to a Roth 401(k) can be a savvy move for some, especially younger people or those on an upward trajectory in their career. If you believe you will be in a higher tax bracket during retirement than you are now, a conversion will likely save you money.

What is the 5 year rule for Roth 401k?

The five-year rule after your first contribution The first five-year rule sounds simple enough: In order to avoid taxes on distributions from your Roth IRA, you must not take money out until five years after your first contribution.

Should I split my 401k between Roth and traditional?

In most cases, your tax situation should dictate which type of 401(k) to choose. If you're in a low tax bracket now and anticipate being in a higher one after you retire, a Roth 401(k) makes the most sense. If you're in a high tax bracket now, the traditional 401(k) might be the better option.

What is the downside of Roth 401k?

Tax bracket risk When you put money into a Roth account (whether a 401(k) or an IRA), you're taking a gamble -- namely, that your tax bracket will higher down the line than it is now. Your goal should be to pay taxes on your money when your marginal rate is lowest.

Is there a downside to Roth 401k?

(You cannot withdraw earnings until retirement, just contributions.) Even though a Roth 401(k) is funded with the same kind of income (post-tax) as a Roth IRA it is still tied to the withdrawal rules of a regular 401(k). That means any early withdrawals before retirement are hit with a 10% early withdrawal penalty.

Who benefits from Roth 401k?

A Roth 401(k) may have the greatest benefit for employees currently in a low tax bracket who expect to move into a higher one after they retire. Contributions made to a Roth 401(k) are taxed at the lower tax rate. Distributions are tax-free in retirement, making it the greatest single advantage.

How much income can you contribute to a Roth IRA?

Your contributions would be reduced or phased out if your income was between $124,000 and $139,000. If you earned more than $139,000, you couldn't make any contributions to a Roth IRA. If you were married filing jointly, you could make a full contribution to a Roth if your income was less than $196,000.

What is a 401(k) plan?

401 (k) Plans. Named after section 401 (k) of the Internal Revenue Code, a 401 (k) is an employer-sponsored retirement plan. 1 To contribute to a 401 (k), you designate a portion of each paycheck to divert into the plan. These contributions occur before income taxes are deducted from your paycheck. 2 .

What is RMD in 401(k)?

Your RMD is the minimum amount that must be withdrawn each year from your 401 (k) account when you're in retirement. In other words, you can't leave all of your money in an 401 (k); otherwise, there'll be a 50% tax penalty on the amounts of the RMD that was not withdrawn.

What is the maximum amount you can contribute to a Roth IRA in 2021?

For 2020 and 2021, the maximum annual contribution for a Roth IRA is: $6,000 if you’re under age 50 3 . $7,000 if you’re age 50 or older, which includes a $1,000 catch-up contribution 8 .

What is the maximum 401(k) contribution for 2021?

For 2020 and 2021, the annual 401 (k) contribution limits are the same. 3. The contribution limits are as follows: $19,500 if you’re under age 50. $26,000, which includes an allowance for a catch-up contribution of an extra $6,500 if you’re age 50 or older 4.

Is a Roth IRA tax free?

Both 401 (k)s and Roth IRAs are popular tax-advantaged retirement savings accounts that differ in tax treatment, investment options, and employer contributions. Both accounts allow your savings to grow tax-free.

Is 401(k) pre-tax?

Contributions to a 401 (k) are pre-tax, meaning they are deposited before your income taxes are deducted from your paycheck. However, when in retirement, withdrawals are taxed at your then-current income tax rate. Conversely, there is no tax savings or deduction for contributions to a Roth IRA. However, the contributions can be withdrawn tax-free ...

Which is better, a Roth 401k or an IRA?

A Roth 401 (k) tends to be better for high-income earners, has higher contribution limits, and allows for employer matching funds. A Roth IRA lets your investments grow longer, tends to offer more investment options, and allows for easier early withdrawals.

What is a Roth 401(k)?

Roth 401 (k) Created by the Economic Growth and Tax Relief Reconciliation Act of 2001, Roth 401 (k)s are a hybrid, blending many of the best parts of traditional 401 (k)s and Roth IRAs to give employees a unique option when it comes to planning for retirement. Like traditional 401 (k)s, they allow for employer matches and contributions made ...

What are the disadvantages of Roth IRAs?

Disadvantages of Roth IRAs. Roth IRAs come with an income limit. As per the IRS, individual taxpayers who make $140,000 or more in 2021 ($139,000 for 2020), or married couples filing jointly who make up to $208,000 or more ($206,000 for 2020), are not eligible for Roth IRA contributions. 1 . Roth IRAs also have a lower contribution limit —$6,000 ...

What is Roth IRA?

Roth IRAs were established by the Taxpayer Relief Act of 1997 and named for Senator William Roth of Delaware. What sets them apart from traditional IRAs is that they are funded with after-tax dollars, making qualified distributions tax-free.

How long can you hold a Roth IRA?

However, under certain circumstances, such as buying a home for the first time or incurring childbirth costs, you can withdraw earnings from your Roth IRA free of penalty if you’ve held the account for under five years, and free of penalty and taxes if you have held it for more than five years.

How much can you borrow from a Roth 401(k)?

A third advantage is the ability to take a loan from a Roth 401 (k). You can borrow up to 50% of your account balance or $50,000, whichever is smaller.

When do you have to take RMDs with a Roth 401(k)?

With a Roth 401 (k), you must begin taking required minimum distributions (RMDs) once you reach the age of 72, as you must with 401 (k)s and traditional IRAs. If you don’t, you are subject to a financial penalty.

What Is a 401 (k)?

A 401 (k) is an employer-sponsored retirement savings plan. With a 401 (k), you can choose to contribute a percentage of your paycheck every month pre-tax. This means all the money you put toward your 401 (k) will be deducted before your income is taxed, creating less taxable income for you.

What Is a Roth IRA?

A Roth IRA is a special type of Individual Retirement Arrangement (IRA). An IRA is a type of retirement savings account that doesn’t require an employer to be opened. Any individual can open an IRA account directly with an investment firm.

How Whole Life Insurance Compares to the Roth IRA vs. 401 (k) Dilemma

While you may not automatically think this way, many people who are looking into Roth IRA vs. 401 (k) plans are often great candidates for building wealth with whole life insurance policies. Here are a few reasons why whole life insurance policies could be a great option as you save for the future:

What is the difference between a 401(k) and an IRA?

Both 401 (k)s and IRAs have valuable tax benefits, and you can contribute to both at the same time. The main difference between 401 (k)s and IRAs is that employers offer 401 (k)s, but individuals open IRAs (using brokers or banks). IRAs typically offer more investments; 401 (k)s allow higher annual contributions.

What is Roth IRA?

Roth IRA. Tax treatment of contributions. Contributions made with pre-tax dollars, which reduces your taxable income on a dollar-for-dollar basis. Some employers offer a Roth 401 (k) option, funded with after-tax dollars. Investments in the account grow tax-deferred. If Roth 401 (k), investments grow tax-free.

How to get free money from 401(k)?

Check your employee benefits handbook. If you see that your employer matches any portion of the money you contribute to the company 401 (k) plan, do not bypass this opportunity to collect your free money .

What is company matching in 401(k)?

It means that your employer contributes money to your account based on the amount of money you save, up to a limit. A common arrangement is for an employer to match a portion of the amount you save up to the first 6% of your earnings.

How to get a better retirement?

1. Contribute to a traditional or Roth IRA first. Not all companies match their employees' retirement account contributions. When that’s the case, choosing an IRA — and contributing up to the max — is generally a better first option.

How to get a match for 401(k)?

1. Contribute enough to earn the full match. Check your employee benefits handbook. If you see that your employer matches any portion of the money you contribute to the company 401 (k) plan, do not bypass this opportunity to collect your free money. A company matching program is one of the biggest benefits of a 401 (k).

What age can you withdraw from 401(k)?

Early withdrawal rules (before age 59 ½) Unless you meet an exception, early withdrawals of contributions and earnings are taxed and subject to a 10% penalty. See more on 401 (k) early withdrawal rules. Unless you meet an exception, early withdrawals of contributions and earnings are taxed and subject to a 10% penalty.

Pros Of A Brokerage Account

What is an IRA? Traditional IRA vs Roth IRA vs 401K – Pros and Cons and Tax Benefits

How Do You Invest

A Roth IRA will give you more flexibility to choose your own investments, but a 401 gets points for convenience.

The M1 Finance Investment Platform

The M1 Finance investment platform allows you to choosethe type of accounts that can help you to best meet your needs. The platformoffers a choice between individual, joint, retirement, and trust accounts.

Eligibility And Contribution Limits

There are no modified adjusted gross income limits for saving to a 401, so you can make use of this type of account, no matter how much or how little money you earn. You might not be able to save the full amount allowed each year to a Roth IRA, or you may not be able to contribute at all if you earn above certain MAGI limits.

Roth Ira Vs Brokerage Account: What Is Right For You

In general, Roth IRAs are the better option when you are just considering retirement goals. There is little use for Roth IRAs apart from retirement planning.

Benefits Of Roth Iras For Kids

Children, too, can benefit financially from Roth IRAs, for reasons similar to those given above and other reasons, too. An 18-year-old, for example, likely still has several milestones ahead including college, a first home purchase, and retirement.

Roth Ira Vs Brokerage Account

Brokerage accounts are not meant strictly for retirement savings, but they can be used for that purpose. A Roth IRA, however, offers you tremendous tax advantages intended to give you an edge in retirement savings.

What’s The Difference Between A Roth 401(k) and A Roth IRA?

Which Is Right For Me?

Other Information

The Bottom Line

- Here’s a rundown of the differences between 401(k)s and Roth IRAs. In many cases, a Roth IRA can be a better choice than a 401(k) retirement plan, as it offers a flexible investment vehicle with greater tax benefits—especially if you think you’ll be in a higher tax bracket later on. However, if your income is too high to contribute to a Roth, your ...