Key Takeaways

- Itemized deductions help some taxpayers lower their annual income tax bill more than the standard deduction would provide.

- The surviving itemized deductions include several categories like medical expenses, mortgage interest, and charitable donations.

- Itemizing most often makes sense for higher-income earners who also have a number of large expenses to deduct.

What are itemized deductions and how do they work?

- Itemized deductions are basically expenses allowed by the IRS that can decrease your taxable income. ...

- The standard deduction, which is the itemized deduction's counterpart, is basically a flat-dollar, no-questions-asked reduction in your adjusted gross income.

- You can take either the standard deduction or itemized deductions on your tax return. ...

What are itemized deductions and who claims them?

What are itemized deductions and who claims them? INDIVIDUAL INCOME TAX XXXX The most common itemized deductions are those for state and local taxes, mortgage interest, charitable contributions, and medical and dental expenses. The revenue cost of those four deductions was just under $240 billion in 2017 (table 1).

Is standard deduction better than itemized?

When you file your federal income tax return, you have two choices: take the standard deduction or itemize your deductions. According to the IRS, most taxpayers use the option that lowers their tax liability the most; however, changing tax laws mean that people who itemized in the past might want to switch to the standard deduction.

What counts as itemized deductions?

Types of itemized deductions. Itemized deductions include a range of expenses that are only deductible when you choose to itemize. Common expenses include: Mortgage interest you pay on up to two homes; Your state and local income or sales taxes; Property taxes; Medical and dental expenses that exceed 7.5% of your adjusted gross income; Charitable donations

Is it better to do standard deduction or itemize?

Add up your itemized deductions and compare the total to the standard deduction available for your filing status. If your itemized deductions are greater than the standard deduction, then itemizing makes sense for you. If you're below that threshold, then claiming the standard deduction makes more sense.

Who benefits the most from itemized deductions?

High-income taxpayersHigh-income taxpayers are much more likely to itemize. In 2017, more than 90 percent of tax returns reporting adjusted gross income (AGI) over $500,000 itemized deductions, compared with under half of those with AGI between $50,000 and $100,000 and less than 10 percent of those with AGI under $30,000 (figure 2).

How much do itemized deductions save you?

Remember, deductions are subtracted from your taxable income. So in this example, itemizing deductions reduced your taxable income by $1,000. If you're in the 22% tax bracket, that's a tax savings of $220. For every dollar you deduct from your taxable income, you lower your tax bill by 22 cents.

What is the biggest drawback of itemizing taxes?

Disadvantages of Itemized Deductions Here are a couple of reasons to avoid itemizing. It takes more paperwork and effort to itemize. Unlike standard deductions, itemizing is a manual process. You have to be able to document every itemized deduction.

When should you itemize your taxes?

You should itemize deductions if your allowable itemized deductions are greater than your standard deduction or if you must itemize deductions because you can't use the standard deduction. You may be able to reduce your tax by itemizing deductions on Schedule A (Form 1040), Itemized Deductions.

Is it worth it to itemize?

Generally speaking, itemizing is a good idea if the value of your itemized expenses is more than the value of the standard deduction.

When you shouldn't take the standard deduction?

Some people can't take the standard deduction If you are married filing separately and your spouse itemizes deductions, you can't take the standard deduction. You also cannot itemize when you file for a tax period of less than one year.

Why are itemized deductions important?

Itemized deductions help some taxpayers lower their annual income tax bill more than the standard deduction would provide.

What is itemized deduction?

Itemized deductions fall into a different category than above-the-line deductions, such as self-employment expenses and student loan interest. They are below-the-line deductions, or deductions from adjusted gross income (AGI). They are computed on the Internal Revenue Service’s Schedule A, and then the total is carried over to your 1040 form. 4

What are the deductions for taxes?

Tax deductions you can itemize 1 Mortgage interest of $750,000 or less 2 Mortgage interest of $1 million or less if incurred before Dec. 16, 2017 3 Charitable contributions 4 Medical and dental expenses (over 7.5% of AGI) 5 State and local income, sales, and personal property taxes up to $10,000 6 Gambling losses 18 7 Investment interest expenses 19 8 $2,500 in student loan interest (these do not need to be placed on Schedule A but can be taken above-the-line and subtracted from your taxable income); income phaseout limits apply 20 9 $250 (for educators buying classroom supplies)

How much can you deduct from your 2018 state tax return?

Starting in 2018 until the end of 2025, taxpayers can deduct only $10,000 of these combined taxes.

What is the choice when filing taxes?

When you file your taxes each year, you have the choice of taking the standard deduction or itemizing your deductions.

How much can you deduct out of pocket medical expenses?

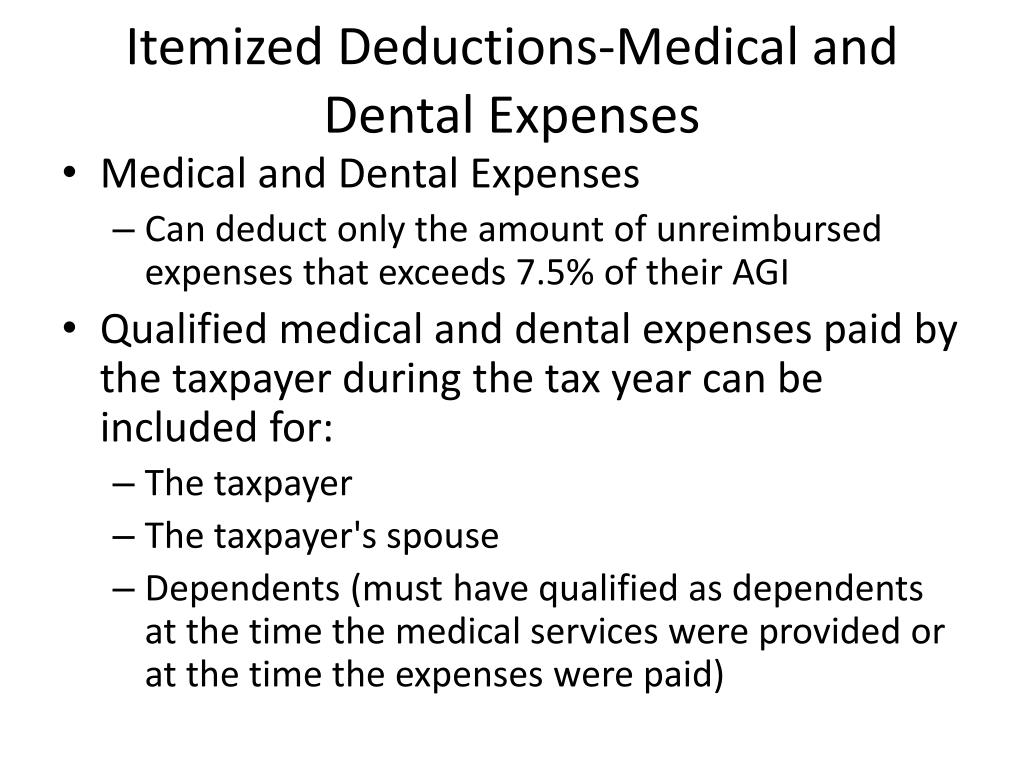

Taxpayers who incur qualified out-of-pocket medical and/or dental expenses that are not covered by insurance can deduct expenses that exceed 7.5% of their adjusted gross incomes.

What is the deduction for dental expenses?

Taxpayers who incur qualified out-of-pocket medical and/or dental expenses that are not covered by insurance can deduct expenses that exceed 7.5% of their adjusted gross incomes . This was originally scheduled to rise to 10% starting with the 2019 tax year (payable in April 2020). However, the 7.5% threshold will remain in place for the 2019 and 2020 tax years, thanks to an extension signed into law on Dec. 20, 2019. 6 7

What are the advantages of itemized deductions?

Advantages of itemized deductions. Itemized deductions might add up to more than the standard deduction. The more you can deduct, the less you’ll pay in taxes, which is why some people itemize — the total of their itemized deductions is more than the standard deduction. There are hundreds of possible deductions.

Why do you take the standard deduction instead of itemizing?

Because your itemized deductions add up to less than the standard deduction, you may be able to save money on taxes this year by taking the standard deduction instead of itemizing. That's because your standard deduction could reduce the amount of your income that's subject to tax more than itemizing might.

What is standard deduction?

The standard deduction is basically a flat-dollar, no-questions-asked reduction in your adjusted gross income. When you take the standard deduction, you basically opt to take a flat-dollar deduction instead of picking and choosing from the multitudes of individual tax deductions out there.

When you itemize on your tax return, do you pick and choose?

When you itemize on your tax return, you opt to pick and choose from the multitude of individual tax deductions out there instead of taking the flat-dollar standard deduction.

How often is the standard deduction adjusted?

It usually gets bigger every year. Congress sets the amount of the standard deduction, and it’s typically adjusted every year for inflation.

Is itemized deduction more than standard deduction?

Itemized deductions might add up to more than the standard deduction. The more you can deduct, the less you’ll pay in taxes, which is why some people itemize — the total of their itemized deductions is more than the standard deduction.

Do you need proof of standard deduction?

You need proof. You need to be able to substantiate your deductions. That means keeping records and being organized. If you normally take the standard deduction and are thinking of itemizing when preparing your return next year, start saving your receipts and other proof for your deductions now.

What are the disadvantages of itemized deductions?

Here are the disadvantages of itemized deductions: It takes more paperwork and effort to itemize. There are restrictions on some itemized deductions. It takes more paperwork and effort to itemize. Unlike standard deductions, itemizing is a manual process that requires gathering documentation and tallying expenses.

What is the difference between standard deduction and itemized deduction?

While the standard deduction is the government's built-in subtraction that you can take while preparing your taxes, itemizing is composed of individual deductions that , together, can help lower the amount of taxable income you pay.

Why do you get a bigger tax refund when you itemize?

You can save more money. Because you can include more deductions when itemizing, you might stand to earn a larger tax refund. The amount itemizing saves you will depend on your tax bracket. For instance, income taxed in the 24% tax bracket will see a 24 cent tax savings for every dollar itemized above the standard deduction.

How much can you deduct for blindness?

Taxpayers who are age 65 and older or blind are entitled to an additional deduction of $1,300 to $1,650, depending on their tax filing status. Anyone can claim it. You'll be allowed to take a standard tax deduction even if you don't have expenses that qualify you to make itemized deductions.

Why are deductions important?

Deductions shield a portion of your earnings from income tax, and they are especially important now that personal exemptions have been eliminated.

What are the benefits of standard deduction?

Here are the key benefits of the standard deduction: It's easy, convenient and saves time. Some taxpayers qualify for a bigger deduction. Anyone can claim it. It's easy, convenient and saves time. If you like to keep your taxes as easy as possible, opting for the standard deduction might be the wise way to go.

Is standard deduction easy?

While the standard deduction is quick and easy, itemizing could save you more money. (Getty Images)

Why do you itemize deductions?

When preparing your taxes, itemizing deductions is one way to lower your tax liability.

What qualifies as an itemized deduction?

Here’s a list from the IRS showing which expenses qualify as itemized deductions:

What happens if you exceed the standard deduction?

Therefore, if your itemized deductions exceed the amount of a standard deduction, you could lower your taxable income. In turn, you would have less tax liability. Conversely, while the standard deduction does not require any additional paperwork, itemized deductions do.

What is the best deduction for a tax return?

When you file your federal income tax return, you have your choice of deductions: standard or itemized. In some cases, a standard deduction is the best option if you do not have many charitable contributions or health care expenses.

Does standard deduction reduce balance?

Unless you have paid large amounts out of pocket for qualified deductions, your itemized deductions might not reduce your balance as much as the standard deduction will. Filing status. Standard deduction for 2020 tax year. Single.

Can you claim standard deduction if you are married?

However, some might not qualify for the standard deduction. For example, if you are legally married but both you and your spouse file as “married filing separately,” and they select itemized deductions, the other partner will not be able to claim a standard deduction.

Do you need to provide proof of itemized deductions?

You need to provide proof that you made these expenses. Taking itemized deductions is more difficult as there are some limitations you must consider, especially as it relates to healthcare costs . With this in mind, it can be a much more involved and time-consuming process.

What Are Above-the-Line Deductions?

These deductions are stand-alone adjustments that you can qualify for, whether you choose the standard deduction or to itemize.

Should You Itemize Your Deductions?

If you have itemized deductions that exceed the amount of your standard deduction, then you’re better off itemizing your expenses. However, you will need to fill out Schedule A and other forms when itemizing your deductions, depending on what you want to claim.

Can a nonresident alien take a standard deduction?

However, nonresident aliens who are married to a U.S. citizen or resident alien at the end of the year and who choose to be treated as U.S. residents for tax purposes can take the standard deduction. For additional information, refer to Publication 519, U.S. Tax Guide for Aliens.

Can you take deductions on your federal tax return?

There are two ways you can take deductions on your federal income tax return: you can itemize deductions or use the standard deduction. Deductions reduce the amount of your taxable income.

Should you itemize deductions?

You should itemize deductions if your allowable itemized deductions are greater than your standard deduction or if you must itemize deductions because you can't use the standard deduction.

Is the 1040 limited to individual deductions?

Individual itemized deductions may be limited. See the Instructions for Schedule A (Form 1040) to determine what limitations may apply. For more information on the difference between itemized deductions and the standard deduction, refer to Publication 17, Your Federal Income Tax for Individuals or the Instructions for Form 1040 and Form 1040-SR. You may also refer to Topic No. 551 and Publication 501, Dependents, Standard Deduction, and Filing Information.