Following are the Benefits of having Life Insurance

- Life Risk Cover. Life insurance provides you with a high life risk cover that keeps you and your family protected in case of an unfortunate event.

- Death Benefit. Investing in term life insurance gives you and your family a secure future. ...

- Return on Investment. ...

- Tax Benefits. ...

- Loan Options. ...

- Life Stage Planning. ...

- Assured Income Benefits. ...

- Riders. ...

Full Answer

What are the advantages and disadvantages of life insurance?

Here are some of the most common disadvantages:

- Fear that money-driven insurance agents will scam you

- The inability to pay a monthly premium

- Lack of dependents who would need a death benefit

- The contestability period

- The cost of your insurance being contingent on your medical history

What are reasons to buy life insurance?

Which Type of Life Insurance Should You Buy?

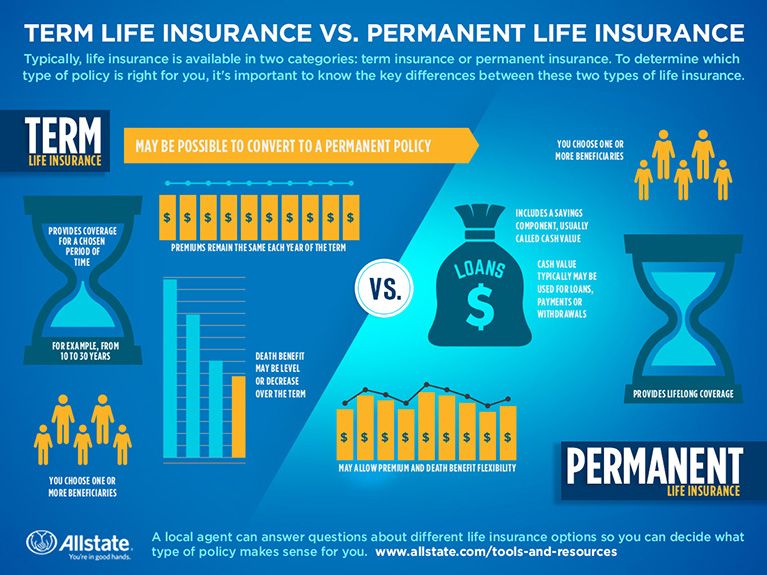

- Term Life Insurance. Term life insurance is often recommended for most common life insurance needs. ...

- Whole Life Insurance. Whole life insurance, on the other hand, lasts for your entire life, provided you current on your premiums.

- Other Types of Life Insurance. There are other types of life insurance, but many of them are overly complicated. ...

Why should I buy life insurance?

- Supplement retirement income

- Fund a child or grandchild’s education

- Pay off a mortgage

- Protect existing assets

- Establish an emergency fund

What kind of benefits does life insurance provide?

- The plan benefits at least 70 percent of all employees.

- At least 85 percent of all participating employees are not key employees.

- The plan benefits employees who qualify under a classification that is set up by the employer and found by the IRS not to discriminate in favor of key employees.

What are the benefits of life insurance?

The many benefits of having life insurance. All life insurance can give you financial confidence that your family will have financial stability in your absence. But generally, the more life insurance you have, the more benefits it will provide to your family when needed. For example, some people receive a nominal amount ...

Why is life insurance so expensive?

Life insurance generally gets more expensive with age, so many seniors get policies with just enough coverage to provide for funeral expenses to avoid burdening their family. Life insurance can also be used for estate planning strategies, where it can be a tax-advantaged way to leave assets to heirs.

Why do life insurance companies give younger customers lower rates?

Life insurance companies generally give younger customers lower rates for reasons that are easy to understand: They tend to have a longer life expectancy. They are less likely to have been diagnosed with a serious disease. They are likely to pay premiums over a longer number of years.

How to get life insurance at work?

Your employer may provide life insurance as a benefit, or you may opt to pay for additional life insurance through payroll deductions.

What happens to a whole life policy when you die?

A whole life policy is permanent life insurance that last your entire life.

What are the benefits of a home mortgage?

Paying off your home mortgage. Paying off other debts, such as car loans, credit cards, and student loans. Providing funds for your kids’ college education. Helping with other obligations, such as care for aging parents. Beyond your coverage amount, different kinds of policies can provide other benefits as well: ...

When do whole life policies pay dividends?

Some whole life polices do not have cash values in the first two years of the policy and don’t pay a dividend until the policy’s third year. Talk to your financial representative and refer to your individual whole life policy illustration for more information.

What is the purpose of life insurance?

The purpose of life insurance is to provide your loved ones with financial protection if you die. A tax-free payout is the main benefit, but the advantages of life insurance extend beyond extra cash. Life insurance provides cash to help your dependents replace your lost income when you die. This money goes to your beneficiaries ...

How long does term life insurance last?

Term life insurance is meant to last until your debts are paid off (generally a 20- to 30-year period while people depend on you most). The benefits of a term life plan include: Term life insurance is the cheapest life insurance you can buy. If you buy term life insurance when you’re young, you can lock in low rates.

Why do you have to pay monthly premiums for life insurance?

The biggest benefit of life insurance is financial protection for your loved ones if you die. However, you do have to pay monthly premiums for this peace of mind, which can be expensive if you’re in poor health or purchasing coverage when you’re older.

What is life insurance riders?

Benefits of life insurance riders. Life insurance provides cash to help your dependents replace your lost income when you die. This money goes to your beneficiaries and can be used for anything — funeral expenses, living expenses, college tuition, mortgage payments or donations to charity.

What happens if you cancel a term life insurance policy?

If you have a term life policy and can no longer afford it, you won’t lose anything more than the premiums you’ve paid if you decide to abandon the policy.

How long do you have to live to get death benefit?

Accelerated death benefit rider — If you’re diagnosed with a terminal illness (less than 12 to 24 months to live, depending on the state), you can get all or part of the death benefit paid out before you die. While this can support your end-of-life care, it could leave your survivors with a lower death benefit.

Can you use life insurance money for family?

Because a life insurance benefit is a tax-free lump sum of money, your family can use the cash however they wish.

What can life insurance help with?

Life insurance can help your loved ones pay for any debt you leave behind, including credit card debt, business debt, personal and/or educational loans and mortgage debt. At a time when your loved ones are already dealing with your loss, life insurance can help ease some of the financial burdens they may experience after your passing.

Why is life insurance important?

Here are five reasons why life insurance is important. 1. It Can Help to Financially Protect Your Family. Life insurance is meant to help protect your family's financial future. Even if you have savings, it's unlikely that it would be enough to cover your family's expenses for several years or even decades if something happens to you unexpectedly.

What are the expenses that are covered by life insurance?

Housing, food, utilities, clothing, car maintenance and health care premiums are likely all part of your monthly budget, and even without your income, your family will still need to cover these expenses. The death benefit from a life insurance policy can help provide the funds your family may need to help cover these expenses. When considering your options, you may want to think about using a life insurance calculator to help you determine how much life you insurance you may need.

What is universal life insurance?

This type of life insurance is similar to whole life because it also does not expire as long as you continue to pay the premium, and it also has a cash value component. With a universal life policy, you typically have the flexibility to adjust the premium and death benefit. However, there must be enough cash value in the policy to cover monthly charges if a lower premium is paid than the amount selected at issue or if a premium payment is skipped. Additional premium payments may need to be made to keep the policy in force. Increases in coverage are also subject to underwriting.

How long does term life insurance last?

Term Life Insurance. This type of life insurance offers coverage for a set period of time — generally 10, 15, 20 or 30 years. Coverage expires at the end of the term. However, most term life insurance policies also offer optional riders that could allow you to renew or convert your policy.

Can you use your life insurance to pay for funerals?

Dealing with this financial stress can add to the emotional stress your family might experience. Your family could use some of the death benefit from your life insurance policy to help pay for these costs. To do this, the beneficiary of the policy could direct some of the death benefit to the funeral home, or they can pay out-of-pocket and use the death benefit as a reimbursement for these expenses.

Does life insurance cover funeral expenses?

It Can Help to Pay for Future Education Expenses. Whether you're married with kids, or have a partner or other relatives who depend on you financially, having life insurance can be important. Life insurance provides money, or what's known as a death benefit, to your chosen beneficiary after you die.

What is the advantage of life insurance?

The main advantage of owning a life insurance policy is that if you die, your beneficiaries receive a payout called a death benefit that replaces any income you provided while you were alive. The disadvantage is that you have to pay monthly or annual premiums for this benefit.

What is life insurance?

Life insurance is the exchange of a relatively small payment each month — a premium — for a very large amount of money if you die — a death benefit. A high enough death benefit covers living expenses, such as a mortgage, and your kids’ college tuition. It can also provide a financial cushion for unforeseen expenses.

How much does life insurance cost?

Depending on how much coverage you need and your age when you apply, you may be paying as little as $20 per month in life insurance premiums for a term life insurance policy. You can lower your coverage amount and term length to get even lower premiums that fit into your budget.

How does term life insurance expire?

Term life insurance expires by the time you have fewer expenses. If you buy life insurance coverage early enough, you could save hundreds of dollars each year compared to buying coverage later in life. → Use our life insurance calculator ...

Why do life insurance companies charge more for coverage?

Your premiums are determined by your medical profile, family medical history, and age, so life insurance companies will charge you more for coverage if your profile flags anything that could potentially increase your risk of dying early.

How long does it take to get free life insurance quotes?

It’s easier than ever to apply for life insurance. Policygenius makes it easy to compare life insurance prices online. In just about 10 minutes, you can get free quotes from many different life insurance companies, and choose the one that fits your needs from there.

Why is whole life insurance so expensive?

Whole life insurance is much more expensive because it lasts your whole life; you’re guaranteed to die while it’s active as long as you’ve been paying your premiums. But most people don’t need as much life insurance after they retire, when they don’t have any dependents, their home is paid for, and they don’t have any outstanding loans. That means the extra years you spend paying whole life insurance premiums past retirement age don’t return as much bang for your buck.

What are the benefits of life insurance?

Here are a few of the many benefits of having life insurance. Family Protection. The most popular benefit of having life insurance is the death benefit. If someone dies while they have a life insurance policy in effect, the insurance company will pay a death benefit to the insured’s beneficiary.

Why do people use life insurance?

Financial Planning. As part of a robust financial plan, some use life insurance to cover financial expenses such as medical bills, debt or funeral costs. By using life insurance in this way, your family can avoid spending your savings that were intended for other uses.

What is life insurance medical exam?

The life insurance medical exam will evaluate a person’s smoking status, blood pressure and more. People trying to get a favorable rate on their life insurance may want to quit smoking and improve their fitness before applying for life insurance. Weak Investment Returns.

What are the disadvantages of life insurance?

While life insurance is generally an investment worth considering, you should consider the drawbacks before choosing to purchase a policy. Sales Commissions. It is not advised to purchase a life insurance policy on your own.

What is the cash value component of permanent life?

Additionally, the cash value component of permanent life can help you save for retirement. Depending on the type of policy you have, the cash value can grow tax-deferred and be reinvested. Some policies also prevent the cash value from declining with the market if there is a downturn.

Why is it important to understand your options?

That is why it is essential to understand your options and work with a financial advisor that you trust to find a suitable policy. Insurance Planning Tips. The life insurance insurance policy you select will have a lasting impact on your overall finances, especially once you reach retirement. If you’re unsure which policy is right ...

How long does term life insurance last?

Term life insurance only covers a person for a set amount of time, typically five years or more.

What is term life insurance?

Term life insurance covers you for a set amount of time, or term. It provides funds to your beneficiary (or beneficiaries) if you pass away during that time. Living benefit options for term life include: Accelerated death benefits. This living benefit pays out a portion of your term life policy if you ever face a terminal illness.

What is the benefit of adding a long term care policy to your life insurance?

Long-term care benefits. Adding a long-term care benefit to your permanent life policy lets you tap into the death benefit to cover long-term care expenses that your health insurance doesn’t cover . The death benefit is typically reduced by the amount of the long-term benefit that you use.

What is a withdrawal from a permanent life insurance policy?

A withdrawal lets you access a portion of the cash value of your permanent life policy . You won’t owe any taxes on this withdrawal if the amount you withdraw is less than or equal to your premium payments. ...

Does life insurance cover you after you die?

While life insurance generally benefits your loved ones after you pass away, it can also benefit them (and you) before that time comes through something known as living benefits.

Can you be charged interest on accelerated death benefit?

You may be charged interest on the portion of the accelerated death benefit that you use.

Do you have to have a credit check to take out a loan against a permanent life policy?

You’ll be charged interest if you take out a loan against your permanent life policy, but it’s usually lower than the interest charged by other lenders. You also won’t have to undergo a credit check or abide by a long list of restrictions.

Does permanent life insurance have accelerated death benefits?

Permanent life insurance has a death benefit like term life insurance, along with the ability to accumulate cash value on a tax-deferred basis, which a term policy does not. Some permanent life insurance policies give you the option of accelerated death benefits like term life insurance does.

What is life insurance?

Life insurance is there to protect your family financially after you’re gone. But what if you need the money sooner? Some life insurance policies allow you to accelerate the death benefit or access your cash value early, an option called “living benefits insurance.”. If you’re wondering “what is living benefits insurance,” here’s how term life ...

What is a living benefit rider?

A living benefit rider, which allows someone to get the payout from accelerated death benefits, can offer extra peace of mind, whether or not you end up needing it, just like regular term life policies.

What is accelerated death benefit?

A living benefits rider allows you to access a portion of your payout while you’re still alive if you’ve been diagnosed with a serious condition.

What is Fidelity Life?

At Fidelity Life, our goal is to make life insurance simple, affordable, and understandable for everyday families. This content is intended for educational purposes only. Each post is carefully fact-checked, reviewed and updated regularly to ensure the information is as relevant as possible.

Is a living benefits rider a good choice?

Consider your health history: Does Alzheimer’s, cancer, or another serious illness run in your family? If so, a living benefits rider may be a good choice.

Is cash value more expensive than term life insurance?

You can borrow against it or use it as collateral if you need extra money for expenses. While whole life policies are more expensive than term life insurance, they can provide permanent protection and extra support if the worst happens.

Can you add a rider to a life insurance policy?

You can add a rider to an existing policy or a new one, typically for an extra cost. One of the most common riders is a living benefits or terminal illness rider, also known as an accelerated death benefit rider.