- Social Security is a federal program that provides retirement income and disability benefits.

- The Social Security program is funded by payroll taxes and is one of the largest areas of US federal spending.

- Starting to collect Social Security retirement benefits later rather than sooner can bring a significant financial bonus.

How to estimate your Social Security benefit?

Your Social Security benefit is decided based on your lifetime earnings and the age when you retire and begin taking payments. Your lifetime earnings are converted to a monthly average based on the 35 years in which you earned the most, adjusted for inflation.

How do you determine your Social Security benefit amount?

- For earnings that fall within the first band, you multiply by 90%. That is the first part of your benefit.

- For earnings that fall within the second band, you multiply by 32%. That is the second part of your benefit.

- For earnings that are greater than the maximum of the second band, you multiply by 15%. This is the third part of your benefit.

How much does social security really cover in retirement?

Key Points

- Your career has come to an unexpected end It's one thing to keep working until FRA and claim Social Security then. ...

- You're not super confident in your health Social Security is actually designed to pay you the same total lifetime benefit regardless of when you file. ...

- You've saved so much your benefits are really just bonus cash

How much you will get from Social Security?

The maximum possible Social Security benefit for someone who retires at full retirement age is $3,148 in 2021. However, a worker would need to earn the maximum taxable amount, currently $142,800 for 2021, over a 35-year career to get this Social Security payment.

What benefits do you get from Social Security?

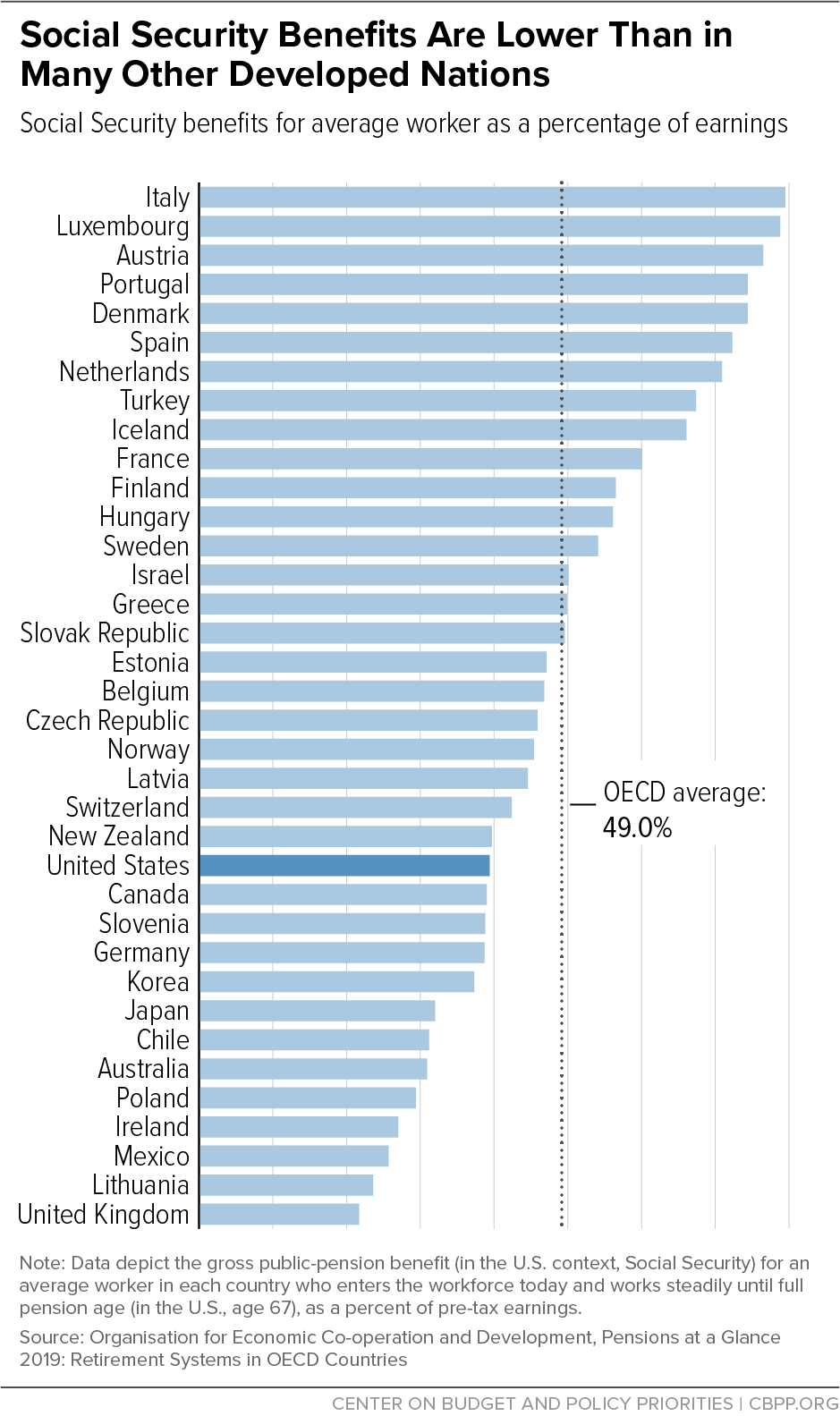

Social Security replaces a percentage of your pre-retirement income based on their lifetime earnings. The portion of your pre-retirement wages that Social Security replaces is based on your highest 35 years of earnings and varies depending on how much you earn and when you choose to start benefits.

Who benefits the most from Social Security?

Social Security provides more than just retirement benefits. ο Retired workers and their dependents accounted for 75.2% of total benefits paid in 2020. ο Disabled workers and their dependents accounted for 13.1% of total benefits paid in 2020.

How much Social Security will I get if I make 60000 a year?

That adds up to $2,096.48 as a monthly benefit if you retire at full retirement age. Put another way, Social Security will replace about 42% of your past $60,000 salary. That's a lot better than the roughly 26% figure for those making $120,000 per year.

How much does Social Security pay per month?

What Is the Average Social Security Benefit? The average Social Security retirement benefit is $1,563.82 per month, according to the Social Security Administration (SSA). The maximum is $3,240 per month for those who start collecting at FRA and were high earners for 35 years.

How is Social Security calculated?

Social Security benefits are typically computed using "average indexed monthly earnings.". This average summarizes up to 35 years of a worker's indexed earnings. We apply a formula to this average to compute the primary insurance amount ( PIA ). The PIA is the basis for the benefits that are paid to an individual.

Can disability benefits be reduced?

In such cases, disability benefits are redetermined triennially. Benefits to family members may be limited by a family maximum benefit.

Social Security Explained

Logan Allec is a licensed Certified Public Accountant (CPA) and a personal finance expert. He has more than a decade of experience consulting and writing about taxes, tax planning, credit cards, budgeting, and more. Logan also has a master's in taxation from the University of Southern California (USC).

Definition and Example of Social Security

Social Security is a federal benefits program that pays benefits to retirees and workers who are disabled, as well as their family members and survivors.

How Social Security Works

Social Security is financed through a 12.4% tax split among employers and employees; self-employed individuals pay the entire 12.4%. This tax money is deposited into the two Social Security trust funds: the Old-Age and Survivors Insurance (OASI) Trust Fund and the Disability Insurance (DI) Trust Fund. 2

Types of Social Security Benefits

Although Social Security is perhaps best-known as a retirement program for older Americans, it also pays benefits to individuals outside that demographic.

Social Security vs. Supplemental Security Income

Sometimes people confuse Social Security and Supplemental Security Income (SSI). While both programs are administered by the Social Security Administration, they are intended for different groups of people and are financed in different ways.

Criticism of Social Security

A primary criticism of Social Security is that at some point in the future—perhaps as early as the year 2034—the Social Security trust funds will no longer be able to pay full benefits scheduled under current law. 8

How Does the Social Security Program Work?

Collectively, the money paid into Social Security is delivered to qualified recipients, including retirees, those qualifying as disabled, a surviving spouse and dependents of beneficiaries. Unlike some retirement accounts such as a 401 (k), Social Security isn’t held in a personal account in your name.

Who Is Eligible for Social Security Benefits?

Throughout your career, a portion of your total income is taxed for the Social Security program. As you work, you start to earn credits toward future Social Security benefits. While every working American is taxed, not everyone is eligible for Social Security due to the number of credits required.

At What Age Do Social Security Benefits Start?

Social Security benefits are paid out according to your retirement age. The full retirement age is 66 years old for those born between 1943 and 1954. If you were born after 1955, you have a full retirement age of 67. Those who choose to retire at that age receive the full retirement benefit amount.

How Does Social Security Affect My Retirement Plan?

According to the United States Social Security Administration, Social Security replaces about 40% of pre-retirement income, so it’s not meant to be the only source used. Having an accurate estimation of future benefits can greatly impact the way an individual’s retirement goals are achieved.

How are Social Security benefits calculated?

Social Security benefits are calculated by combining your 35 highest-paid years (if you worked for more than 35 years). First, all wages are indexed to account for inflation. Wages from previous years are multiplied by a factor based on the years in which each salary was earned and the year in which the claimant reaches age 60. 5 .

How much will Social Security decrease at age 62?

Opting to receive benefits at age 62 will reduce their monthly benefit by 28.4% to $716 to account for the longer time they could receive benefits, according to the Social Security Administration. That decrease is usually permanent. 7 . If that same individual waits to get benefits until age 70, the monthly benefit increases to $1,266.

How much will Social Security pay in 2021?

According to the Social Security Administration (SSA), the maximum monthly Social Security benefit that an individual who files a claim for Social Security retirement benefits in 2021 can receive per month is as follows: $3,895 for someone who files at age 70. $3,113 for someone who files at full retirement age (FRA)

What is the maximum Social Security benefit for 2021?

The maximum monthly Social Security benefit that an individual can receive per month in 2021 is $3,895 for someone who files at age 70. For someone at full retirement age, the maximum amount is $3,113, and for someone aged 62, the maximum amount is $2,324.

How is Social Security decided?

Your Social Security benefit is decided based on your lifetime earnings and the age you retire and begin taking payments. Your lifetime earnings are converted to a monthly average based on the 35 years in which you earned the most, adjusted for inflation. Those earnings are converted to a monthly insurance payment based on your full retirement age.

What is the formula for Social Security benefits?

The Social Security benefits formula is designed to replace a higher proportion of income for low-income earners than for high-income earners. To do this, the formula has what are called “bend points." These bend points are adjusted for inflation each year.

Is Social Security higher at age 70?

If you have already had most of your 35 years of earnings, and you are near 62 today, the age 70 benefit amount you see on your Social Security statement will likely be higher due to these cost of living adjustments .

Retirement Benefits

Retirement benefits are perhaps the most well-known Social Security program. When people work, a portion of the taxes they pay go toward the Social Security program. Additionally, working people earn Social Security credits, with a minimum of 40 credits being required for retirement benefits.

Survivors Benefits

Survivors benefits are meant to support spouses, children and parents who depended on deceased workers who paid into Social Security. Eligible individuals may receive monthly survivors benefits following the death of the worker who supported them.

Disability Insurance Benefits

The Social Security Disability Insurance program serves individuals up to age 65 who have a medical condition that meets the SSA’s definition of a disability. To qualify, a person must have paid Social Security taxes on their income and have earned a sufficient number of credits.

Supplemental Security Income

The Supplemental Security Income program is funded by general tax revenue rather than Social Security taxes. The program makes payments to disabled or blind people whose resources and income fall under certain financial limits. SSI also supports seniors 65 years of age and older who aren’t disabled but meet the program’s financial guidelines.

What happens if your spouse's retirement benefits are higher than your own?

If your benefits as a spouse are higher than your own retirement benefits, you will get a combination of benefits equaling the higher spouse benefit. Here is an example: Mary Ann qualifies for a retirement benefit of $250 and a spouse’s benefit of $400.

How old do you have to be to get spouse's Social Security?

To qualify for spouse’s benefits, you must be one of these: At least 62 years of age.

When will my spouse receive my full retirement?

You will receive your full spouse’s benefit amount if you wait until you reach full retirement age to begin receiving benefits. You will also receive the full amount if you are caring for a child entitled to receive benefits on your spouse’s record who is younger than age 16 or disabled.