The cost of employee benefits (national average)

| Sector | Average pay cost | Average benefits cost | Average healthcare cost | Total hourly cost |

| 1 | Civilian workers | $26.85 | $12.06 | $3.09 |

| 2 | State and local workers | $33.09 | $20.50 | $6.10 |

| 3 | ||||

| 4 | Private industry | $25.89 | $10.76 | $2.63 |

How much should employers spend on benefits?

- Clearly identify what you want to learn. The key here is to be as specific as possible about what skill you want to build. ...

- Win — even if you lose. This is the ultimate way to make sure your 20% time doesn’t go to waste. ...

- Be flexible and committed. ...

- Look for ways to make it fun. ...

- Think in decades. ...

What factors influence the cost of employee benefits?

- Frozen Donor

- Frozen Non-donor

- Fresh Donor

- Fresh Non-donor

- Embryo Banking

What does the average employer spend on employee benefits?

What do employee benefits cost? Breaking down the numbers further, the study finds that benefits cost the average employer $21,726 annually per employee. With wages, the total cost is $71,334...

How much should employers contribute to employee benefits?

There are two HSA contribution levels for employers. For employers whose companies have fewer than 500 employees, the average contribution for a single employee is $750 and $1,200 for an employee with a family.

How do you calculate the cost of benefits for an employee?

Find the benefit load by adding the total annual costs of all employees' perks and divide it by all employees' annual salaries to determine a ratio — that ratio is your company's benefits load.

How much should I budget for employee benefits?

Experts suggest that you should expect to pay a range of 1.25 to 1.4 times each employee's base salary. That extra $10,000 might include things like $120 for life insurance—an average cost for your younger and older workers—$5,760 for family health coverage, $520 for dental insurance, and $200 for long-term disability.

How much do benefits typically cost?

Through December 2017 the average cost of employee benefits for employers per employee (including financial compensation and employee benefits) was $35.87 per hour. Of that amount, compensation accounted for an average of $24.49 (68.3%), with benefits accounting for the remaining $11.38 (31.7%).

How much does it cost per employee?

There's a rule of thumb that the cost is typically 1.25 to 1.4 times the salary, depending on certain variables. So, if you pay someone a salary of $35,000, your actual costs likely will range from $43,750 to $49,000.

What is fully loaded cost of employee?

The simplest way to derive the average loaded cost of an employee is to count up your total corporate expenses and divide it by the total number of productive hours worked.

How do you budget for salary and benefits?

Budgeting for salaried employees is pretty easy—just take their gross wages and divide by 12 months if you're doing a monthly budget. However, if you pay on a two-week schedule, some months will have three paychecks. Be sure to consider how often you pay your employees here. Hourly workers can get more complex.

What percent of salary goes to benefits?

According to the latest data from the U.S. Bureau of Labor Statistics (BLS), the average total compensation for all civilian employees in 2020 is $37.73 per hour. Benefits make up 32 percent of an employee's total compensation.

What is the most valued employee benefit?

It comes as no surprise that the number one most valued benefit by employees is health, dental, and vision insurance. Unfortunately, health insurance is also the most expensive benefit to offer, averaging around $6,435 per employee with individual coverage, and $18,142 for family coverage.

Do employees pay for benefits?

An employee benefits package typically includes healthcare insurance, retirement plans, vacation and paid time off. Generally, these packages will cover 80%, and in some cases 100%, of healthcare costs. Both the employer and employee pay the monthly premium on benefits.

What does an employer pay for an employee?

Employers must pay a flat rate of 6.2% of each employee's wages for Social Security tax. Employees pay a matching 6.2%. Stop paying the 6.2% Social Security tax rate if an employee earns above the Social Security wage base. For 2020, the SS wage base is $137,700.

How do you calculate overhead cost per employee?

Companies do often determine the average overhead cost per employee by simply taking the total expense for an item, such as a particular piece of machinery, and then dividing the cost per the total number of employees at the firm.

How much do benefits cost per employee Canada?

For most people, the benefit level is 55% of an employee's average insurable weekly earnings, up to a maximum amount. As of January 1, 2022, the maximum yearly insurable earnings amount is C$60,300, which means that an employee can receive a maximum amount of C$638 per week.

How much do employee benefits cost Canada?

Effective January 1, 2022, employees and employers contribute 5.70% up to the maximum (C$3,499.80).

What is the most valued employee benefit?

It comes as no surprise that the number one most valued benefit by employees is health, dental, and vision insurance. Unfortunately, health insurance is also the most expensive benefit to offer, averaging around $6,435 per employee with individual coverage, and $18,142 for family coverage.

How do you forecast employee benefits?

How To Forecast an Employee Benefits BudgetWhy Forecasting a Non-Salary Budget Is Important.Determine Full-Time Employee Classification.Calculate the Average Cost of Employee Benefits.Determine Costs of Benefits Versus Costs of Penalties.Update the Budget With Benefits Additions or Changes.Consult With an HR Advisor.More items...•

What is the average cost of fringe benefits?

Although rates vary, according to the Bureau of Labor Statistics, the average fringe benefit rate (aka benefit costs) is 30%.

What are the benefits of an employer?

Though salary numbers are more frequently discussed, the health insurance, retirement, time off and legally required benefits, like Social Security contributions, offered by a company are equally , if not more, important. Many employees might not realize how costly these benefits are for an employer to provide.

How much does an employer spend per hour?

That equates to $5,698 per worker, per year. Employers spend an average of $2.65 per employer, per hour, for payments required by law, like Social Security and Medicare. Retirement plans and investment benefits cost employers an average of $0.55 an hour for defined benefits and $0.78 per hour for defined contributions, per employee.

How much does paid leave cost?

Paid leave benefits vary by employer, but cost on average about $5,000 per employee . This, of course, varies by industry and from company to company, and changes depending on whether a worker is entry-level, management, hourly or in an exempt position.

How much has health care increased since 2005?

Benefits Pro noted an increase of 368 percent since 2005 in the cost of employee benefits. During that time, health care alone has increased by 28 percent. This could be due in part to a spike in cases of chronic illness or to higher costs from health care providers.

How much has unemployment increased since 2004?

Since 2004, unemployment insurance costs have risen by 106.8 percent .

Which cities have lower benefits?

Some cities, like Miami, enjoy lower benefit costs. Others, like the greater Phoenix area, have seen an increase in the recent past due to the influx of Fortune 500 companies that have set up shop there.

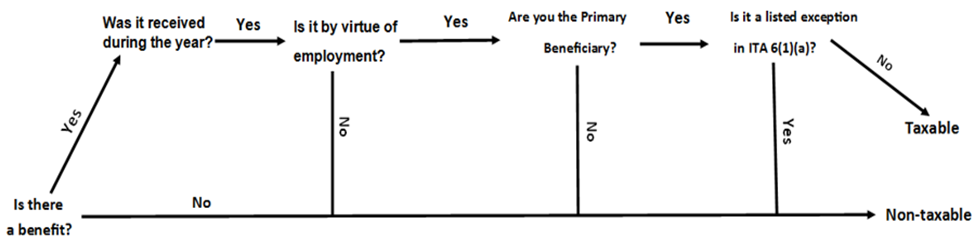

The cost of employee benefits (national average)

The average cost of benefits per employee was $12.06 per hour for civilian workers, $20.50 per hour for state and local workers, and $10.76 per hour in the private industry.

Top benefits and what they cost

Providing employee benefits is crucial for both attracting and retaining top talent, especially given the labor shortage that many companies are grappling with. Solid benefits can help increase productivity, and keep your employees happy.

Why are benefits important?

Benefits are anything your company can provide, on top of the compensation, to keep your workers happy, and feel valued. Providing benefits your employees will appreciate will keep them from leaving, reduce turnover and training costs, and attract the best possible talent.

An Employee Benefits Program: What Is It?

First, let’s define what an employee benefits program is before diving further into how much it will cost and how to get the most out of your budget. There are two types of benefits that go into a plan; mandatory and voluntary benefits.

What Affects the Cost of Your Employee Benefits Program?

It’s difficult to determine what your benefits program could cost without sitting down with an expert and discussing your unique needs. However, in general terms, the cost of your health and employee benefits program will depend on two prominent factors; the size of your business and the breadth of your plan.

How Much Do Employee Benefits Cost on Average?

We can use statistics gathered by the U.S. Bureau of Labor to get a good idea of what various employee benefits cost on average.

Why Offering Employee Benefits Is Worth It

Obviously, benefits packages cost a lot of money and take serious time and effort to put together. However, in today’s competitive job market, an employer cannot afford to not offer employee benefits coverage.

How to Reduce the Cost Of Employee Benefits Programs Without Sacrificing Quality

The first thing to consider when trying to keep costs down is what coverage you’ll want to include in your program. Be sure to analyze your program regularly and ask for employee feedback, because often, there are expensive perks that your employees don’t really want or use.

What percentage of an employee's total compensation is benefits?

What percentage of an employee’s total compensation is benefits? According to the Bureau of Labor and Statistics December 2020 report, about 30% of an employees’ total compensation is made up of benefits. Employer costs for employee compensation for civilian workers averaged $38.60 per hour worked.

How much does an employer contribute to health insurance?

That’s why most employers contribute (many significantly) to health insurance—covering anywhere from 50% to 100% of the total cost.

Why does an employee's status change over the course of a year?

Similarly, an employee’s status can change over the course of a year due to marriage, children, divorce, etc., which makes forecasting and identifying the actual costs for benefits more difficult. Employers have to manage and administer benefits each month. Deductions must be set up in payroll and carrier invoices must be paid each month.

What is total compensation?

The total in this section is the gross amount the employer paid to the employee in the paycheck before taxes.

Can employers determine yearly increases in benefits?

Employers can’t determine the yearly increase in benefits. Yearly increases are perhaps the most difficult aspect of calculating benefits spending; employers don’t know the upcoming increase in premiums year-over-year.

Is employee benefit expensive?

Employee benefits may be expensive, but their value goes beyond a simple dollar amount. When sizing up job offers, prospective employees will absolutely be comparing the benefits your company offers against those of your competitors. Of course you want to offer the best of the best—benefits that help you edge out the others—but practically, ...

Do deductions have to be paid each month?

Deductions must be set up in payroll and carrier invoices must be paid each month. Someone within your organization must review that invoice and make sure it’s accurate (because there’s almost always a carry-over in balance from the previous month for things like new hires, terminations, life events, etc.).

Why is it important to offer employee benefits?

You either have to do it because the law requires it, or you are highly encouraged to do so because 97% of workers say their benefits are important to how they feel about their job and workplace.

What is Supplemental Pay?

Supplemental pay. Supplemental pay includes any compensation awarded to workers outside of their normal wages, and is defined as a benefit by the BLS. This includes overtime pay, shift differential pay (compensation offered to employees that work outside of normal business hours), and any bonuses.

What is paid leave?

Paid leave comprises any time you’re paying an employee to not work. That includes allotted days for vacation or if someone gets sick, but also holidays. Check out this guide to find out if you live in a state that requires paid leave.

How much overtime do you have to pay for 40 hours a week?

Throwing a wrench in overtime pay budgeting is a new law passed in September of this year which raised the threshold under which salaried employees must be paid overtime for hours worked beyond 40/week from $23,660 to $35,568.

Do companies with 50 employees have to offer health insurance?

The employer mandate of the Affordable Care Act (ACA) says that companies with 50 or more FTE (full-time equivalent) employees must offer health insurance, but about one-third of businesses smaller than this offered health insurance last year anyway to attract job seekers and retain employees.

Is offering employee benefits expensive?

Offering employee benefits is an increasingly expensive proposition for businesses (benefits costs to employers have increased 368% over the last 14 years), and a complicated one. You can’t predict with absolute certainty who’s going to opt in and pay for voluntary benefits, or how much allotted PTO workers will actually use.

How much does health insurance cost per hour?

The total average cost for insurance benefits, including health, life, and disability insurance, comes to $2.73 per hour, or $5,698 annually per employee. Legally-required benefit contributions such as Social Security and Medicare add up to $2.65 per employee per hour.

Where are higher benefit costs found?

Higher benefit costs are found in companies that are centered in big, coastal cities such as San Francisco and New York . This finding isn’t too surprising, given the higher living costs in those cities. But there are some exceptions: parts of Florida such as Miami have relatively lower benefit costs for employers.

How much have benefits increased over time?

Benefits costs increase over time—but in different ways. The analysis finds that total costs of benefits to employers have increased 368 percent over 14 years. During that time, health benefits cost has increased by 28 percent, which the study attributes to chronic illness and rising costs from health care providers.

What percentage of compensation is health insurance?

Benefits account for approximately 29 percent of an employer’s compensation costs, the study finds. Health insurance made up 7.5 percent of compensation costs on average. Social Security and Medicare contributions, mandated by federal laws, came to 5.8 percent of employer contributions. The study notes that many industries are now adding benefits ...

How much has unemployment increased since 2004?

Despite the recent improvements in the U.S. economy, unemployment costs to employers have risen 106.8 percent since 2004—which the study attributes in part to the 2008 recession.

Why is Arizona's minimum wage higher?

Another reason may be a new law in the state that increased the minimum wage and required employers to offer sick time benefits to workers.

Do small companies have fewer workers?

The report notes that, “Ultimately, small companies have fewer workers to provide benefits for, while the largest companies may benefit from an economy of scale that many small or midsized companies lack.”. A more interesting finding may be the difference that location makes when it comes to benefits.

How much does it cost to pay someone a salary of $35,000?

So, if you pay someone a salary of $35,000, your actual costs likely will range from $43,750 to $49,000.

Why add up costs?

Add up the costs to see whether your business can afford to add an employee to your staff. If your business is growing and you need more help, you can’t afford to NOT hire more workers. But knowing the cost will help you budget accordingly.

What is mandatory added cost?

Mandatory added costs of an employee. Hiring an employee means considerable payroll tax costs, including: Employer share of FICA (7.65% on compensation up to the annual wage base, which is $132,900 in 2019, plus 1.45% on compensation over the annual wage base). Federal unemployment tax (FUTA) of $42 per employee.

What are fringe benefits?

In addition to fringe benefits, there is a slew of other employment-related costs that may be difficult to quantify. These include: 1 The cost of recruitment, including background checks and drug testing where applicable. 2 The cost of initial and ongoing training. 3 Miscellaneous items, such as uniforms and protective gear where needed.

Do employers have to offer health insurance?

Think about employee benefits you may want or need to offer an employee. Under federal law, only large employers (those with 50 or more full-time and full-time equivalent employees) must offer health insurance or pay a penalty. However, there is a federal tax credit for small employers that choose to provide at least 50% of the cost of health coverage.