How Does SSI and Social Security Benefits Differ?

- Don’t need to pay into the SSI program. Social Security benefits are connected to something like an “insurance” program. ...

- Source of funds. Social Security benefits come from a fund that is created by the taxes paid into the system. ...

- Additional help with medical costs with SSI. ...

- Food assistance. ...

Why is SSDI better than SSI?

Neither?

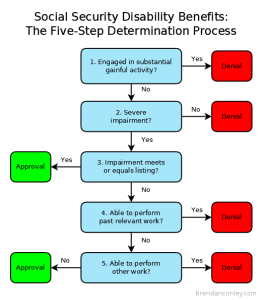

- STEP ONE: CHECK MEDICAL CRITERIA. SSI and SSDI have the exact same medical criteria. ...

- STEP TWO: CHECK SSDI. You can qualify for SSDI if you worked and paid taxes, but it depends how much you worked and how recently you worked.

- STEP THREE: DON’T GIVE UP TOO EASILY. ...

- STEP FOUR: CHECK SSI. ...

- STEP FIVE: OTHER OPTIONS. ...

Is SSI different from regular social security?

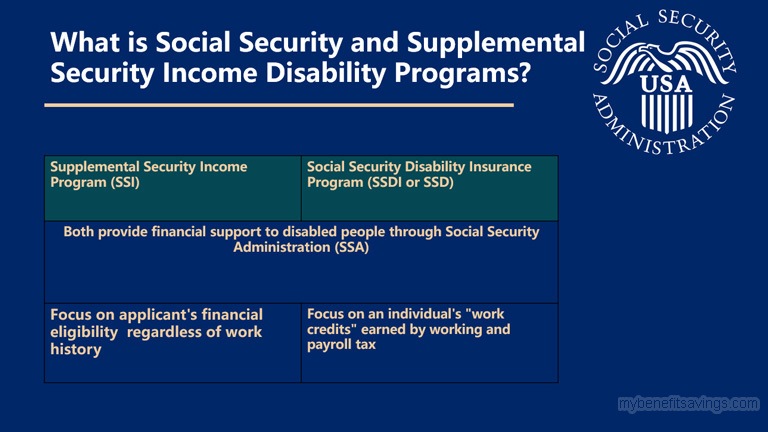

the key difference between social security and ssi is that social security is a program that provides a number of benefits for persons including retirement income, disability income, medicare, and death and survivorship benefits whereas ssi (supplemental security income) is a national income program designed to provide assistance to aged, blind, …

Is SSI and SSDI the same thing?

The main difference between SSDI (Social Security Disability Insurance) and SSI (Supplemental Security Income) is the fact that SSDI is available to workers who have collected a sufficient number of work credits over the years to be considered "insured" for the program. SSI disability benefits are available to low-income individuals who have either never worked or who haven't earned enough work credits to qualify for SSDI.

Is SSI the same as retirement income?

Social security benefits include monthly retirement, survivor and disability benefits. They don't include supplemental security income (SSI) payments, which aren't taxable. The net amount of social security benefits that you receive from the Social Security Administration is reported in Box 5 of Form SSA-1099, ...

What pays more Social Security or SSI?

In general, SSDI pays more than SSI. Based on data from 2020: The average SSDI payment is $1,258 per month. The average SSI payment is $575 per month.

What are the 3 types of Social Security?

Social Security Benefits: Retirement, Disability, Dependents, and Survivors (OASDI)

Can you get both SSI and Social Security retirement?

One of the requirements of continuing to receive SSI benefits is that you apply for any other cash benefits that are available, including retirement benefits. However, the good news is that you will be able to receive both retirement and SSI at the same time, so your overall monthly benefit amount will not decrease.

How do I know if I have SSI or Social Security?

If you have any questions about your benefits, or you are not sure if you receive Social Security or SSI, please call us toll-free at 1-800-772-1213. We will be happy to answer any questions you may have. You may also call or visit your local Social Security office.

Who qualifies for SSI?

To get SSI, you must meet one of these requirements: • Be age 65 or older. Be totally or partially blind. Have a medical condition that keeps you from working and is expected to last at least one year or result in death. There are different rules for children.

Is SSI the same as disability?

The Supplemental Security Income (SSI) program pays benefits to adults and children with disabilities who have limited income and resources. While these two programs are different, the medical requirements are the same.

At what age does SSI end?

65When you reach the age of 65, your Social Security disability benefits stop and you automatically begin receiving Social Security retirement benefits instead. The specific amount of money you receive each month generally remains the same.

At what age does SSI change to Social Security?

The age for collecting full Social Security retirement benefits will gradually increase from 65 to 67 over a 22-year period beginning in 2000 for those retiring at 62. The earliest a person can start receiving reduced Social Security retirement benefits will remain age 62.

What is the maximum Social Security benefit?

The maximum benefit depends on the age you retire. For example, if you retire at full retirement age in 2022, your maximum benefit would be $3,345. However, if you retire at age 62 in 2022, your maximum benefit would be $2,364. If you retire at age 70 in 2022, your maximum benefit would be $4,194.

What is the minimum Social Security benefit?

DEFINITION: The special minimum benefit is a special minimum primary insurance amount ( PIA ) enacted in 1972 to provide adequate benefits to long-term low earners. The first full special minimum PIA in 1973 was $170 per month. Beginning in 1979, its value has increased with price growth and is $886 per month in 2020.

What is the monthly amount for Social Security disability?

SSDI payments range on average between $800 and $1,800 per month. The maximum benefit you could receive in 2020 is $3,011 per month. The SSA has an online benefits calculator that you can use to obtain an estimate of your monthly benefits.

What is the difference between Social Security and SSI?

Social security is mainly concerned with retirement benefits while SSI is designed to assist persons and children in fulfilling their basic needs. SSA provides a number of welfare and development programs to US citizens where social security and SSI takes priority. The organization has documented clear guidelines for eligibility criteria in order ...

What is the difference between Social Security and Supplemental Security Income?

The key difference between social security and SSI is that Social Security is a program that provides a number of benefits for persons including retirement income, disability income, Medicare, and death and survivorship benefits whereas SSI (Supplemental Security Income) is a national income program designed to provide assistance to aged, blind, and disabled persons and children who have little or no income to fulfil basic needs.

How is Social Security funded?

Social Security is primarily funded by tax acts of FICA and SECA. SSI is funded by the U.S. Treasury general funds.

What is a Social Security program?

What is Social Security? Social security program, officially termed as the Old-Age, Survivors, and Disability Insurance ( OASDI ), is a program that provides a number of benefits for persons including retirement income, disability income, Medicare, and death and survivorship benefits and is operated by the SSA.

How old do you have to be to receive Social Security?

A person may be eligible to receive retirement income between the ages of 62-70 years of age. The amount of funds received is based on the lifetime earnings. SSA adjusts the actual earnings of the individual to account for changes in average wages since the year the earnings were received. Then Social Security calculates ...

What is the definition of disabled?

Disabled. Those above the age of 18 years. Inability to do any substantial gainful activity; and. Can be expected to result in death; or. Have a medically determinable physical or mental impairment which is expected to last or has lasted at least 12 continuous months. Those below the age of 18 years.

Why is Social Security facing challenges?

Currently, the social security program is facing challenges in maintaining the social security program significantly due to longer life expectancies, an increasing population entering retirement age, and inflation.

What is the difference between Social Security and Dependents?

Dependents and Social Security. One key difference between the two programs is how dependents are treated. Dependent s may be eligible to collect Social Security after monthly benefits begin. Family members can receive a combined total equaling 150 to 180 percent of your Social Security benefit after you die. Child eligibility extends ...

How does Social Security work?

The Social Security Administration bases your SSI monthly benefit on the federal benefit rate that can change year to year to allow for cost of living increases. The amount you receive depends on your marital status, if you pay for housing or live rent-free, any state supplements you get and other income you have.

How much does Social Security pay if you retire early?

SSA sets an annual earnings limit and deducts $1 from your Social Security payment for each $2 you make when you retire early. It also reduces your payment by $1 for every $3 you earn during the year you reach full retirement age. According to the SSA, benefits equal approximately 40 percent of pre-retirement earnings.

What are the eligibility requirements for SSI?

Recipient Criteria. SSI recipients must meet income and asset ownership limits, be at least 65 and meet U.S. residency requirements or hold U.S. citizenship. Disabled or blind adults and children who meet the SSA's impairment standards also can qualify for SSI. Social Security recipients, however, must have paid Social Security taxes or be ...

Does SSI extend to dependents?

SSI Dependent Financial Assistance. Unlike Social Security, SSI benefits do not extend to dependents upon the recipient's death. However, a disabled or blind child whose parent has limited resources and income may qualify for SSI.

Do you have to pay Social Security taxes to get SSI?

Social Security recipients, however, must have paid Social Security taxes or be the dependent of a worker who paid them. People can get SSI and Social Security if they meet eligibility requirements for both programs.

Can you receive Social Security if you are disabled?

Those unable to work due to a disability and meet the SSA's strict definition of a disabling condition can receive Social Security payments based on their lifetime earnings, although any other financial assistance received from other governmental agencies reduces their monthly benefit.

How does SSI work?

SSI. How does it work. People who used to be in the workforce and have certain minimum credits can avail of this as a retirement or disability fund. This does not depend on any prior work or credit, rather on the present resources or income one might have. What is it.

What is Social Security?

That is where Social Security comes in, it provides a base income or pension for certain strata of society, especially old people, survivors, and people with disabilities. This is a federal pension system of sorts, where the current worker pays a certain amount which in turn helps the retired ones, who did the same when they were a part ...

What is SSI for blind people?

SSI is a Federal income supplement program wherein people with limited income or resources can draw benefits for it. It is targeted to help the ones in need like old citizens, people with disabilities, like blindness, and more.

How long does disability last?

In order to get disability benefits, which might last for one year or more , or result in death, the person or even their family can apply for the same.

Is family included in SSI?

Families are not included under the SSI benefits, however, in the case of social security, there are spousal benefits as well as benefits for other family members even if the original worker might have been deceased.

Is Social Security limited?

Social Security payments are not limited and it depends on the income the individual had while they were in the workforce of any kind. SSI has a limited payment basis though it does not depend on any prior work one may or may not have had.

Does Social Security depend on income?

Social Security does not depend on the current income or family resources one might have if they are otherwise eligible. SSI on the other hand depends on both of these, as it is more about providing the basic necessities to the people in need.

How long does SSDI last?

The disability must be expected to last for at least 12 months or to end in death.

When did SSDI start?

SSDI dates to 1956 , when Social Security's rules were amended to permit benefit payments to disabled workers. Both workers and their employers primarily bear the cost of the program through payroll taxes. Benefits are paid out of Social Security's Disability Insurance Trust Fund.

How do I qualify for Social Security retirement?

As with Social Security retirement benefits, you qualify by working and paying Social Security taxes. How long you must have worked to be eligible varies based on your age when you become disabled. As it does for the spouses and children of retirees, Social Security can pay additional benefits to the spouses and children of disabled workers.

How long does it take to get a Social Security decision?

Getting a decision generally takes three to five months, according to Social Security officials, but the time can vary depending on how long Social Security needs to get medical records and other relevant evidence. Military veterans and people with particular severe medical issues may qualify for expedited processing.

What does SSI mean?

SSI stands for Supplemental Security Income. Social Security administers this program. We pay monthly benefits to people with limited income and resources who are disabled, blind, or age 65 or older. Blind or disabled children may also get SSI.

How is SSI financed?

SSI is financed by general funds of the U.S. Treasury--personal income taxes, corporate and other taxes. Social Security taxes collected under the Federal Insurance Contributions Act (FICA) or the Self-Employment Contributions Act (SECA) do not fund the SSI program. In most States, SSI recipients also can get medical assistance ...

When is SSI paid?

In some States, an application for SSI also serves as an application for food assistance. SSI benefits are paid on the first of the month.

How old do you have to be to get SSI?

To get SSI, you must be disabled, blind, or at least 65 years old and have "limited" income and resources. In addition, to get SSI, you must also: be either a U.S. citizen or national, or a qualified alien; reside in one of the 50 States, the District of Columbia or the Northern Mariana Islands; and.

Is disability the same as SSI?

Both programs pay monthly benefits. The medical standards for disability are generally the same in both programs for individuals age 18 or older. For children from birth to the attainment of age 18 there is a separate definition of disability under SSI.

Is Social Security based on prior work?

Unlike Social Security benefits, SSI benefits are not based on your prior work or a family member's prior work. ...

How much is Social Security?

SSI amounts vary by person and do have a maximum monthly amount, set by the Social Security Administration. For 2020, those amounts are: 1 $783 for an eligible individual 2 $1,175 for an eligible individual with an eligible spouse 3 $392 for an essential person.

What is Social Security tax?

The Social Security (SS) tax is part of a group of payroll taxes mandated by FICA ( the Federal Insurance Contributions Act). One component is the Social Security tax (or the Old-Age, Survivors, and Disability Insurance) and the other component is the Medicare tax. These FICA taxes fund your retirement and disability benefits.

What is the tax rate for Medicare?

While not a Social Security tax, the Additional Medicare Tax (AMT) is applicable to those who earn more than $200,000. AMT is taxed at a rate of 0.9%.

What is the maximum amount of Social Security benefits for 2020?

SSI amounts vary by person and do have a maximum monthly amount, set by the Social Security Administration. For 2020, those amounts are: $783 for an eligible individual. $1,175 for an eligible individual with an eligible spouse. $392 for an essential person.

When can I start taking Social Security?

You can begin taking your Social Security (SS) retirement benefits at age 62. But if you become disabled before you reach retirement age , you may qualify for SSDI benefits.

How old do you have to be to get SSI?

To be eligible for SSI, you generally must be 65 or older and have a disability. Children are also eligible to receive SSI. SSI is paid monthly through Medicaid. The amount is determined by need (i.e., "means-tested program”).

How does Social Security affect taxes?

How Social Security Benefits Affect Your Taxes. Once you start receiving Social Security benefits, depending on your total income and filing status, those payments may be taxable. Those filing single with a combined income under $25,000 will not have their SS benefits taxed.

Do you have to report changes to your living arrangements on Social Security?

Yes. If you receive SSI payments you must report changes in your living arrangements right away. The report must be made to Social Security and not your tribal social worker.

Do you have to report income to Social Security?

Yes. John is required to report ALL income he receives from ANY source. Social Security representatives will determine if the income will affect his SSI payments. Since per capita distributions vary by tribe, there are different rules for each type of distribution. When in doubt, report the income to Social Security.