Will federal unemployment be taxed?

Yes, unemployment checks are taxable income. If you received unemployment benefits in 2021, you will owe income taxes on that amount. Your benefits may even raise you into a higher income tax bracket, though you shouldn't worry too much about getting into a higher tax bracket.

Are taxes withheld from unemployment?

With voluntary withholding, a flat 10% can be withheld on unemployment benefits, but that might not be enough to cover tax liability, especially if someone had income at the front end of the year ...

Who pays unemployment tax?

Who Pays for Unemployment in New York State?

- Employers’ Duties. Once employers hire employees within the state, New York law requires them to contact the New York Department of Labor to determine their individual tax contribution rates and ...

- Covered Employment. ...

- Exceptions and Special Programs. ...

- Considerations. ...

When will you get the unemployment tax refund break?

You may have paid taxes on your unemployment benefits from 2020 if you filed your return before the American Rescue Plan was passed in March. If that's true, you could be eligible for a bigger refund than you expected. Here's why: The first $10,200 of ...

How much of the 600 will be taxed?

The second stimulus check from the $900 billion relief package is not taxable. The $600 stimulus payment is also considered an advance of a tax credit for the 2020 tax year and is not considered part of your taxable income.

Is the unemployment stimulus taxable?

By law, unemployment payments are taxable and must be reported on your federal tax return, according to the IRS. This includes the special unemployment compensation authorized under the COVID-19 relief bills.

Do you have to pay taxes on 600 stimulus?

The good news is that you don't have to pay income tax on the stimulus checks, also known as economic impact payments. The federal government issued two rounds of payments in 2020 — the first starting in early April and the second in late December.

How much taxes do they take out of a 900 dollar check?

You would be taxed 10 percent or $900, which averages out to $17.31 out of each weekly paycheck. Individuals who make up to $38,700 fall in the 12 percent tax bracket, while those making $82,500 per year have to pay 22 percent.

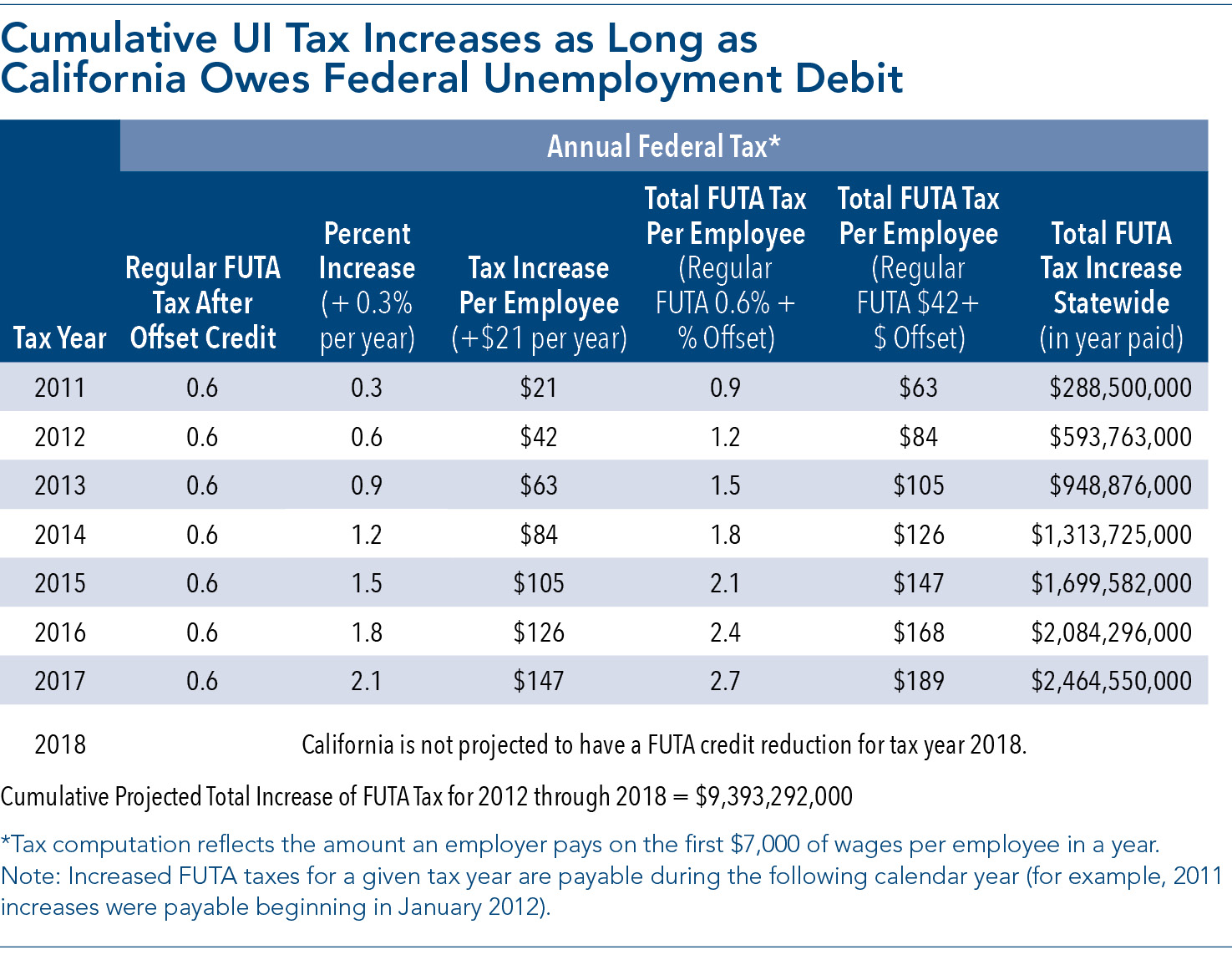

Department Of Labor Will List Those States Under Credit Reduction States

The employers under credit reduction state are usually not eligible for the full credit against the FUTA tax rate.

When Is Futa Tax Due

Usually, the FUTA tax payments are due by the end of the last month following the end of the quarter. The employer has to make the payments to the IRS on time.

When And How To File And Pay Futa Taxes

So, now that we know who has to pay unemployment taxes and what the FUTA tax rate looks like, lets talk about how your business will fulfill these tax obligations.

How To Get Your Suta Tax Rate

When you become an employer, you need to begin paying state unemployment tax. To do so, sign up for a SUTA tax account with your state.

I Filed My Taxes Before The Stimulus Bill Was Signed Do I Have To Do Anything

No. The IRS will automatically recalculate the amount of taxes due and give you a refund if you overpaid, so long as your overall tax situation stays the same.

What Is Futa Tax

FUTA, or the Federal Unemployment Tax Act, is a policy designed to help states pay unemployment benefits to those whose work contracts have been terminated. But this is only applicable if workers have not been dismissed for gross misconduct.

What Is The Futa Tax Rate

The FUTA tax rate for 2021 is 6% on the first $7,000 of employee wages . However, companies can qualify for a tax credit of up to 5.4% based on their timely payment of state unemployment taxes. So for these businesses, the rate would be as low as .6%. Just be aware that employers in a credit reduction state, listed here, cant claim the full credit.

How to get 10% withholding from unemployment?

To do that, fill out Form W-4V, Voluntary Withholding Request PDF, and give it to the agency paying the benefits. Don't send it to the IRS. If the payor has its own withholding request form, use it instead.

What are the types of unemployment benefits?

Here are some types of payments taxpayers should check their withholding on: 1 Benefits paid by a state or the District of Columbia from the Federal Unemployment Trust Fund 2 Railroad unemployment compensation benefits 3 Disability benefits paid as a substitute for unemployment compensation 4 Trade readjustment allowances under the Trade Act of 1974 5 Unemployment assistance under the Disaster Relief and Emergency Assistance Act of 1974, and 6 Unemployment assistance under the Airline Deregulation Act of 1978 Program

When are quarterly estimated taxes due?

The payment for the first two quarters of 2020 was due on July 15. Third and fourth quarter payments are due on September 15, 2020, and January 15, 2021, respectively.

Is unemployment taxable in 2020?

By law, unemployment compensation is taxable and must be reported on a 2020 federal income tax return. Taxable benefits include any of the special unemployment compensation authorized under the Coronavirus Aid, Relief, and Economic Security (CARES) Act, enacted this spring. Withholding is voluntary.

What is the federal unemployment tax?

The Federal Unemployment Tax Act (FUTA), with state unemployment systems, provides for payments of unemployment compensation to workers who have lost their jobs. Most employers pay both a Federal and a state unemployment tax.

Does the employer pay FUTA?

Only the employer pays FUTA tax; it is not deducted from the employee's wages. For more information, refer to the Instructions for Form 940. U.S. Citizens and Resident Aliens Employed Abroad - FUTA. Aliens Employed in the U.S. - FUTA. Persons Employed in U.S. Possessions - FUTA.

How are unemployment benefits taxable?

How Unemployment Benefits Are Usually Taxed. Unemployment benefits are usually taxable as income – and are still subject to federal income taxes above the exclusion, or if you earned more than $150,000 in 2020. Depending on the maximum benefit size in your state and the amount of time you were receiving unemployment benefits, ...

Is the stimulus payment taxable?

Those payments were considered a refundable income tax credit and were never taxable. The stimulus payments were technically an advanced payment of a special 2020 tax credit, based on your 2018 or 2019 income (your most recent tax return on file when they calculated the stimulus payments).

Do you have to pay taxes on unemployment in 2020?

Millions of people received unemployment benefits in 2020, and many are in tax limbo now. The federal government usually taxes unemployment benefits as ordinary income (like wages), although you don't have to pay Social Security and Medicare taxes on this income.

Can you file a W-4V with unemployment?

You can ask to have taxes withheld from your payments when you apply for benefits, or you can file IRS Form W-4V, Voluntary Withholding with your state unemployment office . You can only request that 10% of each payment be withheld from your unemployment benefits for federal income taxes.

Is unemployment taxable in 2020?

Unemployment benefits are usually taxable, although a new law excludes some payments for 2020 – and complicates tax filing this year.

Does the $10,200 unemployment tax apply to 2020?

The $10,200 exclusion only applies to unemployment benefits paid in 2020, but the rules could change. "It does appear to be the type of provision that Congress may include in the next round of tax legislation later this year for 2021," says Luscombe. [.

Charges To Accounts Of Contributing Employers

A contributing employer’s account is charged with the unemployment benefits paid out based on the percentage of base period wages paid by the employer that were used to establish a claim.

Wait Unemployment Is Taxable

In most years, yes. The federal government considers unemployment benefits to be taxable ;income, although taxes are not automatically withheld from benefits payments, the way an employer might take taxes out of your paycheck.

How To Get Your Suta Tax Rate

When you become an employer, you need to begin paying state unemployment tax. To do so, sign up for a SUTA tax account with your state.;

How Do Unemployment Benefits Work

Unemployment is a benefit paid by state or federal governments to help people who have lost their jobs through no fault of their own. It doesn’t apply if you quit or were fired for cause.

Payments To Employees Exempt From Futa Tax

Some of the payments you make to employees are not included in the calculation for the federal unemployment tax. These payments include:

Where Can I Find Free Or Low

Spivey said one of the main questions shes getting lately is: “Who can still help me?”

Taxation Of Unemployment Benefits

Unemployment benefits are taxable income, and a preliminary tax of 20% is withheld on them.

How Are Unemployment Benefits Taxed?

Unemployment benefits are designed to replace a portion of your regular wages. As such, the IRS treats them like any other wages and taxes them at your ordinary income tax rate.

How to Pay Federal Income Taxes on Unemployment Benefits

Perhaps the easiest way to pay taxes on unemployment compensation is to have federal income taxes withheld from your weekly payments. To have federal income taxes withheld, file Form W-4V with your state’s unemployment office to instruct them to withhold taxes.

State Income Taxes on Unemployment Compensation

You may also need to pay state income taxes on your unemployment benefits. This is another tricky area because each state has different rules. Some states don’t have a state-level income tax, and others don’t tax unemployment benefits. Some tax unemployment benefits in full, and others impose taxes on only a portion of benefits.

How much tax do you pay on unemployment?

Typically, employers and employees each pay 6.2% in Social Security tax and 1.45% in Medicare tax, but you won't owe this on your unemployment income. As for state taxes on unemployment benefits, the rules vary depending on where you live.

Which states don't have income tax?

In the seven U.S. states with no income taxes (Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming) you won't have to worry about owing. And in some other states where income is ordinarily taxed, including Pennsylvania, New Jersey, California, and Montana, unemployment benefits are excluded. ...

What happens if you overpay federal taxes?

If you overpay federal taxes, that's not a big problem since you just get a refund. But if you underpay, you could end up getting hit with tax penalties.

Do you owe taxes on unemployment?

Unemployment benefits are subject to federal income tax -- but you won't owe payroll taxes on them . Unemployment benefits are subject to federal tax and, depending on where you live, you may owe state taxes as well. On the federal level, your benefits are taxed as ordinary income, so the amount you owe is based on your tax rate.

When are 2020 estimated taxes due?

15 for those who owe quarterly estimated taxes, but this year, the deadline for both the April and June payments has been extended by the IRS (and most states) to July 15, 2020.

Will the extra 600 unemployment be taxed in 2020?

Because the Coronavirus Aid, Relief, and Economic Security (CARES) Act provided an extra $600 a week in unemployment benefits, many Americans will find they're making more than they did when they were on the job.

Is unemployment tax free?

If you're one of them, it's important to realize these benefits are not tax-free. You need to know what your IRS obligations are so you're prepared to fulfill them and live on what's left over.

What is the extra 600 for unemployment?

That includes all state unemployment benefits, as well as all emergency federal benefits awarded under the CARES Act: the extra $600 under the Pandemic Unemployment Compensation (PUC) program and the two programs for self-employed and gig workers, Pandemic Unemployment Assistance (PUA) and Pandemic Emergency Unemployment Compensation (PEUC).

Which states do not levy state income tax?

In the above description, I talked about federal taxes. Then there’s the state tax bill that might be due. I say might, because there are some states that do not levy state income taxes on wages. They include Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming.

What to do if you received a 1099-G?

If you or someone you know has received an incorrect Form 1099-G for unemployment benefits you did not receive, immediately contact the issuing state agency to request a revised Form 1099-G showing you did not receive these benefits.

Do you have to pay taxes on unemployment?

It may seem unfair to those who have already suffered financial consequences of COVID-19, but you have to pay taxes on your unemployment benefits. According to the IRS, “unemployment compensation is taxable and must be reported on a 2020 federal income tax return.”

Is unemployment taxed?

Yes, Your Unemployment Benefits Are Taxable. Here’s How Much You’ll Owe