What is the MAX monthly SS benefit?

Many retirees get significantly more than the average benefit. In fact, the maximum possible Social Security benefit is $4,194 per month, or $50,328. This amount would certainly go much further toward creating financial stability in retirement. So ...

How do you calculate SS Benefits?

The following factors go into the formula:

- How long you work

- How much you make each year

- Inflation

- At what age you begin taking your benefits

What is the maximum Social Security retirement benefit payable?

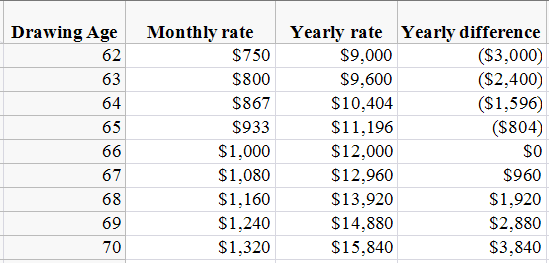

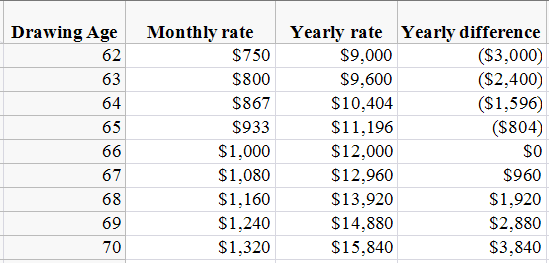

- $2,364 at age 62.

- $3,345 at age 66 and 4 months.

- $4,194 at age 70.

What is the maximum Social Security benefit at age 65?

Let’s say your full retirement age benefit is $3,000 per month and your age 65 benefit is $2,700. And we’ll say that your wife is currently getting $1,000 in her own retirement benefit. Subscribe to stay connected to Tucson. A subscription helps you access more of the local stories that keep you connected to the community.

How are Social Security benefits calculated?

How much is James Brown's FRA benefit?

What is the FRA age?

How to calculate AIME?

How much will Social Security decrease at age 62?

How much will Social Security pay in 2021?

What is the maximum Social Security benefit for 2021?

See more

About this website

How much do you have to earn to get maximum Social Security?

In 2022, if you're under full retirement age, the annual earnings limit is $19,560. If you will reach full retirement age in 2022, the limit on your earnings for the months before full retirement age is $51,960.

How much is the maximum SSS pension?

3. How much is the maximum SSS pension? In 2019, the highest amount of pension being paid by SSS for a retiree-pensioner was PHP 18,9457 while the minimum amount of pension was PHP 2,000. These already included the PHP 1,000 additional benefit.

How can I get 50000 pension per month?

Assume you or your spouse are 35 years old and wish to get a monthly pension of Rs 50,000 after reaching the age of 60. In this case, you will have to deposit Rs 15,000 in this scheme on a monthly basis. You must put this money aside until you reach the age of 60.

How long is SSS lump sum?

The retiree has the option to receive the first 18 months pension in lump sum, discounted at a preferential rate to be determined by the SSS. This option can be exercised only upon application of the first retirement claim, and the Dependent's Pension are excluded from the advanced 18 months pension.

Here Are the 2022 Social Security Earnings-Test Limits

What are the 2022 earnings test limits? Before we dive into next year's earnings test limits, let's do a refresher on the rules for claiming Social Security.

What is the maximum Social Security retirement benefit payable ...

The maximum benefit depends on the age you retire. For example, if you retire at full retirement age in 2022, your maximum benefit would be $3,345.

The Maximum Social Security Benefit Explained - AARP

The maximum Social Security benefit changes each year and you are eligible if you earned a maximum taxable income for at least 35 years. Learn more here.

How are Social Security benefits calculated?

Social Security benefits are calculated by combining your 35 highest-paid years (if you worked for more than 35 years). First, all wages are indexed to account for inflation. Wages from previous years are multiplied by a factor based on the years in which each salary was earned and the year in which the claimant reaches age 60. 5 .

How much is James Brown's FRA benefit?

By deferring his benefits, James permanently increased his $1,600 FRA benefit to $2,112.

What is the FRA age?

For example, if you were born in 1960 or later, your FRA is 67; if you were born between 1943 and 1954, it is 66. 3 You will receive 100% of your benefits if you wait until your FRA to claim them. If you claim earlier, you will receive less. If you claim at age 70, you get an 8% bonus for each year that you delayed claiming. 4

How to calculate AIME?

Once all wages have been indexed, the average indexed monthly earnings (AIME) is computed by dividing the sum of all indexed wages by 420 (35 years expressed as months). If you worked fewer than 35 years, a zero is entered for years you did not work. The benefit amount is then calculated based on factors that include the year in which collection begins , whether the claimant has reached FRA, and whether the claimant continues to work while collecting benefits. 5

How much will Social Security decrease at age 62?

Opting to receive benefits at age 62 will reduce their monthly benefit by 28.4% to $716 to account for the longer time they could receive benefits, according to the Social Security Administration. That decrease is usually permanent. 7 . If that same individual waits to get benefits until age 70, the monthly benefit increases to $1,266.

How much will Social Security pay in 2021?

According to the Social Security Administration (SSA), the maximum monthly Social Security benefit that an individual who files a claim for Social Security retirement benefits in 2021 can receive per month is as follows: $3,895 for someone who files at age 70. $3,113 for someone who files at full retirement age (FRA)

What is the maximum Social Security benefit for 2021?

The maximum monthly Social Security benefit that an individual can receive per month in 2021 is $3,895 for someone who files at age 70. For someone at full retirement age, the maximum amount is $3,113, and for someone aged 62, the maximum amount is $2,324.

Maximum Social Security Benefits For 2022

Many people wonder, “How much does Social Security pay?” You may already know that your Social Security benefits are calculated based on your earnings history. The more money you make during your working years, the more money you can expect from Social Security during retirement.

Calculating Your Monthly Social Security Benefit

Can you calculate your own Social Security retirement benefit amount? Absolutely! Though the calculation is quite cumbersome, you can manually calculate how much your Social Security check will be when you start your benefits. First, you will need to calculate your average indexed monthly earnings or AIME.

How To Maximize Your Social Security Payments

It should come as no surprise that most people want to maximize their retirement income, and many do this by maximizing their monthly payments from Social Security. With the average Social Security retirement benefit in 2022 being $1,657, you can quickly see that many people are not maximizing their benefits.

Spousal Benefits & Social Security Family Maximum

In addition to the primary earner, there are other Social Security beneficiaries who might be able to receive benefits from your earnings record. The first is your spouse. Eligible spouses may receive up to 50% of the benefit amount of the primary recipient.

Maximum Social Security Disability Benefit

Just like retirement benefits, SSDI benefits also have a maximum amount that will be paid each month. Calculating SSDI benefit amounts is a little more complicated than retirement benefits. Most SSDI recipients do not have 35 years of work history. However, they need at least ten years of work history to qualify for SSDI payments in most cases.

The Bottom Line

When it comes to Social Security retirement benefits, the sky is not the limit. In fact, the limit in 2022 is $3,345 if you start your benefits upon reaching full retirement age. Starting your benefits earlier than retirement age will reduce this amount, but delaying your benefits can cause this amount to go all the way up to $4,194.

How much do you have to earn to get maximum Social Security?

To get the max Social Security benefit, you need to earn the maximum taxable income each year. For 2022, this means that your taxable income needs to be at least $147,000. Almost every year, this limit is adjusted for inflation. In 2021, the maximum was $142,800, so you can see that the amount went up $4,200 in just one year.

How much does a spouse get if they receive Social Security?

So, if one spouse has a Social Security payment of $3,895 per month , the other spouse might qualify for a spousal payment of $1,947.50 monthly. And after you pass away, your spouse could receive a survivor's payment of the full $3,895 per month, which would also be adjusted annually for inflation.

What is the maximum wage for Social Security in 2021?

The maximum wage taxable by Social Security is $142,800 in 2021. However, the exact amount changes each year and has increased over time. It was $137,700 in 2020 and $106,800 in 2010. Back in 2000, the taxable maximum was just $76,200. Only $39,600 was taxed by Social Security in 1985.

How much will Social Security pay in 2021?

But many retirees receive over $3,000 per month from the Social Security Administration, and payments could be as much as $3,895 in 2021.

How much do you pay for Social Security?

Workers pay 6.2% of their earnings into the Social Security system, and employers match this amount until their salary exceeds the taxable maximum amount of income for that year. Those who have salaries larger than the taxable maximum do not pay Social Security taxes on that income or have those earnings factored into their future Social Security payments.

Do you have to pay Social Security if you make more than the maximum amount?

If you earn more than the taxable maximum amount in a single year, you won't have to pay Social Security taxes on that income . However, that income also won't be used to calculate your Social Security payments.

Can a divorced spouse claim disability?

The maximum family benefit all your family members can receive is usually about 150% to 180% of your full retirement benefit. A divorced spouse can additionally claim benefits based on your work record, but it will not impact the amount you and your current family members receive.

What is the maximum Social Security benefit for 2021?

The maximum possible Social Security benefit in 2021 depends on the age you begin to collect payments and is: -- $2,324 at age 62. -- $3,148 at age 66 and 2 months. -- $3,895 at age 70. However, qualifying for payments worth $3,000 or more requires some serious career planning throughout your life.

What is the maximum wage for Social Security in 2021?

The maximum wage taxable by Social Security is $142,800 in 2021. However, the exact amount changes each year and has increased over time. It was $137,700 in 2020 and $106,800 in 2010. Back in 2000, the taxable maximum was just $76,200. Only $39,600 was taxed by Social Security in 1985.

How much will Social Security pay in 2021?

But many retirees receive over $3,000 per month from the Social Security Administration, and payments could be as much as $3,895 in 2021.

How much do you pay for Social Security?

Workers pay 6.2% of their earnings into the Social Security system, and employers match this amount until their salary exceeds the taxable maximum amount of income for that year. Those who have salaries larger than the taxable maximum do not pay Social Security taxes on that income or have those earnings factored into their future Social Security payments.

How much can a child receive from a family member?

The maximum family benefit all your family members can receive is usually about 150% to 180% of your full retirement benefit.

Do you have to pay Social Security if you make more than the maximum amount?

If you earn more than the taxable maximum amount in a single year, you won't have to pay Social Security taxes on that income . However, that income also won't be used to calculate your Social Security payments.

How do Social Security benefits depend on earnings?

Social Security benefits depend on earnings. The amount of a person's retirement benefit depends primarily on his or her lifetime earnings. We index such earnings (that is, convert past earnings to approximately their equivalent values near the time of the person's retirement) using the national average wage index.

What is the retirement age for a person born in 1943?

c Retirement at age 66 is assumed to be at exact age 66 and 0 months. Age 66 is the normal retirement age for people born in 1943-54. People who retired at age 66 and who were born before 1943 received delayed retirement credits ; those born after 1954 will have their benefits reduced for early retirement.

What is the maximum amount of Social Security?

The Social Security Administration (SSA) sets maximum monthly benefit amounts based on your retirement age. This amount changes every year, but for people who retire in 2021, the maximum Social Security benefit they can claim is: 1 $2,324 for someone who files at age 62 2 $3,113 for someone who files at full retirement age — more on this below 3 $3,895 for someone who files at age 70

What is the maximum Social Security benefit for 2021?

This amount changes every year, but for people who retire in 2021, the maximum Social Security benefit they can claim is: $2,324 for someone who files at age 62.

What is the full retirement age?

Full retirement age is the age people can start receiving full retirement benefits once they've left the workforce. The SSA bases their definition of the full retirement age on the year you were born. For people born in 1960 or after, the full retirement age is 67. For people born between 1943 – 1954, the full retirement age is 66.

How much does Social Security increase after 70?

If you claim them after your full retirement age, it will increase them by approximately 8% annually until you reach your maximum Social Security benefit at age 70.

What is the retirement age for 2020?

In 2020, the full retirement age is currently 66 and two months for individuals born in 1955, and this age will gradually increase to 67 for people born in 1960 and after. Full retirement age also applies to employee-based pension plans.

What is the retirement age for a person born in 1943?

For people born between 1943 – 1954, the full retirement age is 66.

How are Social Security benefits calculated?

Social Security benefits are calculated by combining your 35 highest-paid years (if you worked for more than 35 years). First, all wages are indexed to account for inflation. Wages from previous years are multiplied by a factor based on the years in which each salary was earned and the year in which the claimant reaches age 60. 5 .

How much is James Brown's FRA benefit?

By deferring his benefits, James permanently increased his $1,600 FRA benefit to $2,112.

What is the FRA age?

For example, if you were born in 1960 or later, your FRA is 67; if you were born between 1943 and 1954, it is 66. 3 You will receive 100% of your benefits if you wait until your FRA to claim them. If you claim earlier, you will receive less. If you claim at age 70, you get an 8% bonus for each year that you delayed claiming. 4

How to calculate AIME?

Once all wages have been indexed, the average indexed monthly earnings (AIME) is computed by dividing the sum of all indexed wages by 420 (35 years expressed as months). If you worked fewer than 35 years, a zero is entered for years you did not work. The benefit amount is then calculated based on factors that include the year in which collection begins , whether the claimant has reached FRA, and whether the claimant continues to work while collecting benefits. 5

How much will Social Security decrease at age 62?

Opting to receive benefits at age 62 will reduce their monthly benefit by 28.4% to $716 to account for the longer time they could receive benefits, according to the Social Security Administration. That decrease is usually permanent. 7 . If that same individual waits to get benefits until age 70, the monthly benefit increases to $1,266.

How much will Social Security pay in 2021?

According to the Social Security Administration (SSA), the maximum monthly Social Security benefit that an individual who files a claim for Social Security retirement benefits in 2021 can receive per month is as follows: $3,895 for someone who files at age 70. $3,113 for someone who files at full retirement age (FRA)

What is the maximum Social Security benefit for 2021?

The maximum monthly Social Security benefit that an individual can receive per month in 2021 is $3,895 for someone who files at age 70. For someone at full retirement age, the maximum amount is $3,113, and for someone aged 62, the maximum amount is $2,324.